Tag: money

Retirement Planning FACTORS | Age and Income

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

what to look for when selecting the right

retirement plan so age is a big factor when it comes to deciding which plan is right for you

if you're offered a pension that's fantastic not many companies do offer those nowadays however

if you have the benefit of getting one then yes take it but I also think you should also have a

retirement plan in addition to your pension just to diversify your savings another situation to

consider is your financial situation so someone with a higher income level is most likely going

to want to prefer choosing their own retirement plan because then they're going to be able to

not only write off those contributions but also distribute it later in life so it maximizes their

potential to not incur penalties or other taxable income kind of situations essentially the more

money you make you're looking for more write-offs you're looking to claim less you're looking to

you know have security but you got to be a little more deaf and clever in how you're taking your

distributions so to not trigger taxable events

How To Save For Retirement: Suze Orman Shares Her Best Money Advice | TODAY

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

>>> AND WE’RE BACK WITH OUR >>> AND WE’RE BACK WITH OUR SPECIAL SERIES LIVING LONGER SPECIAL SERIES LIVING LONGER TODAY, EXPLORING WAYS TO LIVER TODAY, EXPLORING WAYS TO LIVER NOT ONLY LONGER BUT BETTER. NOT ONLY LONGER BUT BETTER. >> THIS MORNING WE’RE FOCUSING >> THIS MORNING WE’RE FOCUSING ON YOUR FINANCES AND THE NEW ON YOUR FINANCES AND THE NEW ADVICE EXPERTS ARE GIVING TO ADVICE EXPERTS ARE GIVING TO MAKE YOUR MONEY REALLY LAST. MAKE YOUR MONEY REALLY LAST. >> THE GOOD NEWS AMERICANS ARE >> THE GOOD NEWS AMERICANS ARE LIVING LONGER, WHAT THAT MEANS, LIVING LONGER, WHAT THAT MEANS, A NEW FOCUS ON MAKING YOUR MONEY A NEW FOCUS ON MAKING YOUR MONEY LAST.

LAST. >> AS YOU’RE PLANNING FOR YOUR >> AS YOU’RE PLANNING FOR YOUR FUTURE, DON’T UNDERESTIMATE HOW FUTURE, DON’T UNDERESTIMATE HOW LONG YOU’RE GOING TO LIVE. LONG YOU’RE GOING TO LIVE. >> IN FACT, ABOUT ONE OUT OF >> IN FACT, ABOUT ONE OUT OF EVERY FOUR 65-YEAR-OLDS TODAY EVERY FOUR 65-YEAR-OLDS TODAY WILL LIVE PAST 90. WILL LIVE PAST 90. >> THE OLD ADVICE USED TO BE >> THE OLD ADVICE USED TO BE THAT AS YOU’RE PLANNING FOR THAT AS YOU’RE PLANNING FOR RETIREMENT EXPECT TO LIVE INTO RETIREMENT EXPECT TO LIVE INTO YOUR 80s. YOUR 80s. NOW THE EXPECTATION IS THAT NOW THE EXPECTATION IS THAT YOU’LL HAVE A GOOD CHANCE OF YOU’LL HAVE A GOOD CHANCE OF LIVING INTO YOUR 90s, MAYBE EVEN LIVING INTO YOUR 90s, MAYBE EVEN CELEBRATING YOUR 100th BIRTHDAY.

CELEBRATING YOUR 100th BIRTHDAY. >> WITH LONGEVITY CAN COME THE >> WITH LONGEVITY CAN COME THE ADDED STRESS TO SAVE MORE. ADDED STRESS TO SAVE MORE. >> PLANNING FOR THE FUTURE HAS >> PLANNING FOR THE FUTURE HAS BECOME A LOT MORE CHALLENGING BECOME A LOT MORE CHALLENGING AND REALLY THE ONUS IS NOW ON AND REALLY THE ONUS IS NOW ON THE INDIVIDUAL MORE THAN EVER.

THE INDIVIDUAL MORE THAN EVER. >> SO HOW DO WE MAKE SURE WE’RE >> SO HOW DO WE MAKE SURE WE’RE FINANCIALLY PREPARED FOR ALL FINANCIALLY PREPARED FOR ALL THOSE EXTRA YEARS? THOSE EXTRA YEARS? IT’S EASY. IT’S EASY. JUST CALL SUZE ORMAN, A PERSONAL JUST CALL SUZE ORMAN, A PERSONAL FINANCE EXPERT. FINANCE EXPERT. SHE HOSTS SUZE ORMAN’S WOMEN AND SHE HOSTS SUZE ORMAN’S WOMEN AND MANY PODCASTS. MANY PODCASTS. >> WE’RE LIVING LONGER. >> WE’RE LIVING LONGER.

THAT’S GREAT, BUT THE BAD NEWS THAT’S GREAT, BUT THE BAD NEWS IS, WE SURVEYED OUR TODAY.COM IS, WE SURVEYED OUR TODAY.COM AUDIENCE. AUDIENCE. THEY SAID 60% OF THEM FELT LIKE THEY SAID 60% OF THEM FELT LIKE THEY DON’T HAVE THE AMOUNT OF THEY DON’T HAVE THE AMOUNT OF MONEY THAT THEY’RE SAVING RIGHT MONEY THAT THEY’RE SAVING RIGHT NOW THAT, THAT IT WON’T LAST NOW THAT, THAT IT WON’T LAST THEM THROUGH THEIR RETIREMENT. THEM THROUGH THEIR RETIREMENT. >> IF YOU REALLY THINK ABOUT IT, >> IF YOU REALLY THINK ABOUT IT, YOU GUYS, MOST PEOPLE BARELY YOU GUYS, MOST PEOPLE BARELY HAVE THE MONEY TO PAY THEIR HAVE THE MONEY TO PAY THEIR BILLS TODAY LET ALONE SAVE IN BILLS TODAY LET ALONE SAVE IN THEIR MINDS FOR THE FUTURE. THEIR MINDS FOR THE FUTURE. >> PEOPLE FEEL LIKE THEY CAN’T >> PEOPLE FEEL LIKE THEY CAN’T SAVE. SAVE. >> THEY JUST FEEL THAT WAY, AND >> THEY JUST FEEL THAT WAY, AND THEY HAVE TO CHANGE THAT BECAUSE THEY HAVE TO CHANGE THAT BECAUSE THEY ARE GOING TO SPEND MORE THEY ARE GOING TO SPEND MORE YEARS IN RETIREMENT THAN THEY YEARS IN RETIREMENT THAN THEY EVER DID WORKING IF YOU THINK EVER DID WORKING IF YOU THINK ABOUT IT BECAUSE MOST PEOPLE ABOUT IT BECAUSE MOST PEOPLE THINK THEY’RE GOING TO RETIRE AT THINK THEY’RE GOING TO RETIRE AT 65, MAYBE THEY WORK 30 YEARS, 65, MAYBE THEY WORK 30 YEARS, THEY’RE GOING TO LIVE TO 100 THEY’RE GOING TO LIVE TO 100 POSSIBLY.

POSSIBLY. >> OENGWNING A HOUSE WAS ALWAYS >> OENGWNING A HOUSE WAS ALWAYS THE PLAN, BUT FOR THESE THE PLAN, BUT FOR THESE MILLENNIALS, THEY’RE OPEN ABOUT MILLENNIALS, THEY’RE OPEN ABOUT THE FACT THEY THINK THEY’LL THE FACT THEY THINK THEY’LL NEVER BE ABLE TO AFFORD A HOUSE, NEVER BE ABLE TO AFFORD A HOUSE, NEVER MIND SOME LONGEVITY OR NEVER MIND SOME LONGEVITY OR 401(k). 401(k). >> THAT’S NOT SUCH A HORRIBLE >> THAT’S NOT SUCH A HORRIBLE THING. THING. I DON’T THINK THAT THE KEY TO I DON’T THINK THAT THE KEY TO YOUR RETIREMENT IS OWNING A YOUR RETIREMENT IS OWNING A HOME. HOME. I THINK THE KEY TO YOUR I THINK THE KEY TO YOUR RETIREMENT IS HAVING ENOUGH RETIREMENT IS HAVING ENOUGH MONEY TO PAY WHATEVER YOUR MONEY TO PAY WHATEVER YOUR EXPENSES HAPPEN TO BE SO THE KEY EXPENSES HAPPEN TO BE SO THE KEY IS TO GET RID OF AS MUCH IS TO GET RID OF AS MUCH EXPENSES AS YOU CAN, DON’T HAVE EXPENSES AS YOU CAN, DON’T HAVE DEBT.

DEBT. IF YOU DO HAVE A HOME, MAKE SURE IF YOU DO HAVE A HOME, MAKE SURE YOUR MORTGAGE IS PAID OFF BY THE YOUR MORTGAGE IS PAID OFF BY THE TIME YOU RETIRE. TIME YOU RETIRE. THAT WOULD BE MY NUMBER ONE TIP THAT WOULD BE MY NUMBER ONE TIP TO TELL EVERYBODY THEY HAVE GOT TO TELL EVERYBODY THEY HAVE GOT TO DO IF THEY DO OWN A HOME.

TO DO IF THEY DO OWN A HOME. >> WE’RE GOING TO GET INTO THAT. >> WE’RE GOING TO GET INTO THAT. WE HAVE THE THREE W’S. WE HAVE THE THREE W’S. THE FIRST IS WHERE. THE FIRST IS WHERE. WHERE IS THE BEST PLACE TO WHERE IS THE BEST PLACE TO INVEST YOUR MONEY SO IF YOU DO INVEST YOUR MONEY SO IF YOU DO HAVE 30ISH YEARS OF RETIREMENT HAVE 30ISH YEARS OF RETIREMENT YOU’RE SET? YOU’RE SET? >> I’VE SAID FOR A LONG TIME, >> I’VE SAID FOR A LONG TIME, JUST FORGET THE TAX WRITE OFFS JUST FORGET THE TAX WRITE OFFS OF YOUR PRETAX 401(k) OR IRA. OF YOUR PRETAX 401(k) OR IRA. FORGET THOSE NOW, AND IF YOUR FORGET THOSE NOW, AND IF YOUR CORPORATION OFFERS IT, CAN YOU CORPORATION OFFERS IT, CAN YOU CO CO DO A ROTH 401(k) OR A ROTH IRA DO A ROTH 401(k) OR A ROTH IRA WHICH ARE AFTER TAX WHICH ARE AFTER TAX CONTRIBUTIONS.

CONTRIBUTIONS. WHY? WHY? YOU DON’T HAVE TO WORRY WHAT THE YOU DON’T HAVE TO WORRY WHAT THE TAX BRACKETS ARE GOING TO BE 20, TAX BRACKETS ARE GOING TO BE 20, 30, AND 40 YEARS FROM NOW. 30, AND 40 YEARS FROM NOW. I PERSONALLY THINK THEY’RE GOING I PERSONALLY THINK THEY’RE GOING TO SKYROCKET OVER THE YEARS, SO TO SKYROCKET OVER THE YEARS, SO THEREFORE WHAT YOU SEE IS WHAT THEREFORE WHAT YOU SEE IS WHAT YOU GET IN A ROTH IRA OR A ROTH YOU GET IN A ROTH IRA OR A ROTH 401(k). 401(k). AGAIN, IT’S PRETAX VERSUS AFTER AGAIN, IT’S PRETAX VERSUS AFTER TAX, BUT AFTER THAT IT’S TAX TAX, BUT AFTER THAT IT’S TAX DEFERRED VERSUS TAX FREE. DEFERRED VERSUS TAX FREE. IT’S FOR YOUR BENEFICIARIES IN A IT’S FOR YOUR BENEFICIARIES IN A PRETAX ACCOUNT THEY’RE GOING TO PRETAX ACCOUNT THEY’RE GOING TO PAY TOTAL TAXES ON IT.

PAY TOTAL TAXES ON IT. >> LET’S GO BACK TO DEBT FOR A >> LET’S GO BACK TO DEBT FOR A SECOND. SECOND. FOR PEOPLE WHO HAVE STUDENT FOR PEOPLE WHO HAVE STUDENT LOANS, THEY’VE GOT CREDIT CARDS, LOANS, THEY’VE GOT CREDIT CARDS, THEY’VE GOT THAT MORTGAGE. THEY’VE GOT THAT MORTGAGE. HOW DO YOU PRIORITIZE THE DEBT? HOW DO YOU PRIORITIZE THE DEBT? WHAT DO YOU PAY AND WHEN? WHAT DO YOU PAY AND WHEN? >> STUDENT LOAN DEBT IS THE MOST >> STUDENT LOAN DEBT IS THE MOST DANGEROUS DEBT YOU CAN HAVE BAR DANGEROUS DEBT YOU CAN HAVE BAR NONE BECAUSE IN 90% OF THE NONE BECAUSE IN 90% OF THE CASES, 99%, IT IS NOT CASES, 99%, IT IS NOT DISCHARGEABLE IN BANKRUPTCY. DISCHARGEABLE IN BANKRUPTCY. SO THEY HAVE THE LEGAL AUTHORITY SO THEY HAVE THE LEGAL AUTHORITY TO GARNISH YOUR WAGES AND TO TO GARNISH YOUR WAGES AND TO REALLY THEN DECREASE YOUR INCOME REALLY THEN DECREASE YOUR INCOME SO STUDENT LOAN — SO STUDENT LOAN — >> TAKE CARE OF THAT FIRST.

>> TAKE CARE OF THAT FIRST. >> FIRST THAT. >> FIRST THAT. THEN IF YOU HAVE CREDIT CARD THEN IF YOU HAVE CREDIT CARD DEBT THAT NEEDS TO GO BECAUSE DEBT THAT NEEDS TO GO BECAUSE DEBT IS BONDAGE. DEBT IS BONDAGE. YOU GOT TO GET OUT OF THAT. YOU GOT TO GET OUT OF THAT. AND THEN YOU START WORKING, IF AND THEN YOU START WORKING, IF YOU’RE GOING TO STAY IN YOUR YOU’RE GOING TO STAY IN YOUR HOME FOR THE REST OF YOUR LIFE, HOME FOR THE REST OF YOUR LIFE, GET RID OF YOUR MORTGAGE GET RID OF YOUR MORTGAGE PAYMENT. PAYMENT. >> I WANT TO FOLLOW UP ON THAT. >> I WANT TO FOLLOW UP ON THAT. YOU DON’T WANT TO HAVE A YOU DON’T WANT TO HAVE A MORTGAGE, A LIVE MORTGAGE STILL MORTGAGE, A LIVE MORTGAGE STILL GOING BY THE TIME YOU RETIRE. GOING BY THE TIME YOU RETIRE. WHY? WHY? >> BECAUSE YOUR MORTGAGE PAYMENT >> BECAUSE YOUR MORTGAGE PAYMENT IS YOUR HIGHEST MONTHLY EXPENSE IS YOUR HIGHEST MONTHLY EXPENSE THAT YOU’RE GOING TO HAVE BAR THAT YOU’RE GOING TO HAVE BAR NONE.

NONE. >> WHEN YOU RETIRE. >> WHEN YOU RETIRE. >> IT’S FAR EASIER TO PAY OFF >> IT’S FAR EASIER TO PAY OFF YOUR MORTGAGE THAN TO SAVER THE YOUR MORTGAGE THAN TO SAVER THE MONEY TO GENERATE THE INCOME TO MONEY TO GENERATE THE INCOME TO PAY OFF YOUR MORTGAGE. PAY OFF YOUR MORTGAGE. YOUR GOAL IN RETIREMENT IS TO BE YOUR GOAL IN RETIREMENT IS TO BE TOTALLY DEBT FREE 100% IN TOTALLY DEBT FREE 100% IN RETIREMENT. RETIREMENT. IF YOU DON’T HAVE ENOUGH MONEY, IF YOU DON’T HAVE ENOUGH MONEY, DECREASE YOUR EXPENSES, AND THEN DECREASE YOUR EXPENSES, AND THEN YOUR MONEY WILL GO FURTHER. YOUR MONEY WILL GO FURTHER. >> GOT YOU. >> GOT YOU. >> WHAT ABOUT WHEN, WHEN DO YOU >> WHAT ABOUT WHEN, WHEN DO YOU START? START? I KNOW, WHEN WE’RE BORN WE I KNOW, WHEN WE’RE BORN WE SHOULD START SAVING. SHOULD START SAVING. >> YOU HAVE THE 200 BUCKS WHEN >> YOU HAVE THE 200 BUCKS WHEN YOU’RE 30. YOU’RE 30. >> PEOPLE ALWAYS THINK THEY HAVE >> PEOPLE ALWAYS THINK THEY HAVE TIME, TIME IS THE MOST IMPORTANT TIME, TIME IS THE MOST IMPORTANT INGREDIENT IN YOUR RETIREMENT INGREDIENT IN YOUR RETIREMENT RECIPE.

RECIPE. LET’S JUST SAY YOU HAVE 40 LET’S JUST SAY YOU HAVE 40 YEARS. YEARS. YOU’RE YOUNG. YOU’RE YOUNG. YOU HAVE 40 YEARS UNTIL YOU’RE YOU HAVE 40 YEARS UNTIL YOU’RE GOING TO BE 70. GOING TO BE 70. YOU PUT $200 A MONTH AWAY INTO A YOU PUT $200 A MONTH AWAY INTO A ROTH IRA OR ROTH 401(k). ROTH IRA OR ROTH 401(k). AVERAGE MARKET RETURNS, DO YOU AVERAGE MARKET RETURNS, DO YOU KNOW THAT YOU WOULD HAVE KNOW THAT YOU WOULD HAVE $1.1 MILLION AT 70, WHICH I $1.1 MILLION AT 70, WHICH I THINK SHOULD BE THE NEW THINK SHOULD BE THE NEW RETIREMENT AGE, BUT YOU WAIT TEN RETIREMENT AGE, BUT YOU WAIT TEN YEARS.

YEARS. >> YOU’RE TALKING ABOUT HAVING A >> YOU’RE TALKING ABOUT HAVING A SURPLUS OF 200 BUCK WHEN IS SURPLUS OF 200 BUCK WHEN IS YOU’RE 30. YOU’RE 30. SHOULD YOU TAKE THAT 200 AND SHOULD YOU TAKE THAT 200 AND APPLY IT TO ONE OF THESE OTHER APPLY IT TO ONE OF THESE OTHER THINGS. THINGS. >> YOU NEED TO BE SAVING >> YOU NEED TO BE SAVING ESPECIALLY IN A 401(k), ESPECIALLY IN A 401(k), ESPECIALLY IF THEY MATCH YOUR ESPECIALLY IF THEY MATCH YOUR CONTRIBUTION. CONTRIBUTION. YOU PUT IN A DOLLAR, THEY GIVE YOU PUT IN A DOLLAR, THEY GIVE YOU $0.50. YOU $0.50. I DON’T CARE IF YOU HAVE ANY I DON’T CARE IF YOU HAVE ANY MONEY. MONEY. YOU CAN’T PASS UP FREE MONEY. YOU CAN’T PASS UP FREE MONEY. IF YOU STARTED PUTTING, JUST IF YOU STARTED PUTTING, JUST LET’S SAY $200 A MONTH AWAY, AND LET’S SAY $200 A MONTH AWAY, AND YOU NOW ONLY HAVE 30 YEARS LEFT YOU NOW ONLY HAVE 30 YEARS LEFT VERSUS 40, YOU’D ONLY HAVE LIKE VERSUS 40, YOU’D ONLY HAVE LIKE $400,000.

$400,000. YOU JUST BLEW $700,000 BECAUSE YOU JUST BLEW $700,000 BECAUSE YOU WAITED TEN YEARS. YOU WAITED TEN YEARS. IT WAS ONLY A $24,000 DIFFERENCE IT WAS ONLY A $24,000 DIFFERENCE IN THOSE TEN YEARS. IN THOSE TEN YEARS. BUT THE TEN YEARS, THE SOONER BUT THE TEN YEARS, THE SOONER YOU BEGIN, THE BETTER YOU’LL BE. YOU BEGIN, THE BETTER YOU’LL BE. >> JUST TO CARSON’S POINT. >> JUST TO CARSON’S POINT. IF I HAVE 200 BUCKS TO SPARE,KY IF I HAVE 200 BUCKS TO SPARE,KY CAN EITHER PAY OFF MY CREDIT CAN EITHER PAY OFF MY CREDIT CARD DEBT AND START SAVING IN A CARD DEBT AND START SAVING IN A ROTH IRA, WHAT WOULD MY CHOICE ROTH IRA, WHAT WOULD MY CHOICE BE? BE? >> YOUR CHOICE THERE IS TO PAY >> YOUR CHOICE THERE IS TO PAY OFF YOUR CREDIT CARD DEBT.

OFF YOUR CREDIT CARD DEBT. >> IF YOU DON’T HAVE MUCH MONEY >> IF YOU DON’T HAVE MUCH MONEY YOU MAY BE BEHIND ON YOUR CREDIT YOU MAY BE BEHIND ON YOUR CREDIT CARD PAYMENTS, AND YOUR INTEREST CARD PAYMENTS, AND YOUR INTEREST RATES ARE 15, 18%. RATES ARE 15, 18%. THAT’S A GUARANTEED RETURN. THAT’S A GUARANTEED RETURN. WHEN YOU PAY OFF YOUR CREDIT WHEN YOU PAY OFF YOUR CREDIT CARD DEBT, YOU’RE GUARANTEEING A CARD DEBT, YOU’RE GUARANTEEING A FANTASTIC RETURN. FANTASTIC RETURN. >> WHAT IS THE ONE SMALL THING >> WHAT IS THE ONE SMALL THING YOU WOULD TELL OUR VIEWERS YOU WOULD TELL OUR VIEWERS BEFORE WE GO? BEFORE WE GO? >> HERE’S WHAT’S REALLY >> HERE’S WHAT’S REALLY IMPORTANT. IMPORTANT. MANY PEOPLE HAVE ADVICE FOR ALL MANY PEOPLE HAVE ADVICE FOR ALL OF YOU.

OF YOU. SOMETIMES THAT ADVICE IS GOOD SOMETIMES THAT ADVICE IS GOOD FOR THE PERSON GIVING THE FOR THE PERSON GIVING THE ADVICE, AND SOMETIMES IT’S GOOD ADVICE, AND SOMETIMES IT’S GOOD FOR THE PERSON RECEIVING IT. FOR THE PERSON RECEIVING IT. MY ADVICE IS THIS, PLEASE DON’T MY ADVICE IS THIS, PLEASE DON’T DO ANYTHING THAT YOU DON’T DO ANYTHING THAT YOU DON’T UNDERSTAND. UNDERSTAND. IT IS BETTER TO DO NOTHING THAN IT IS BETTER TO DO NOTHING THAN TO DO SOMETHING YOU DO NOT TO DO SOMETHING YOU DO NOT UNDERSTAND BECAUSE SOMETIMES YOU UNDERSTAND BECAUSE SOMETIMES YOU CAN DO SOMETHING AND IT BLOWS CAN DO SOMETHING AND IT BLOWS ALL YOUR MONEY, AND SO IF IT ALL YOUR MONEY, AND SO IF IT DOESN’T FEEL RIGHT TO YOU, YOU DOESN’T FEEL RIGHT TO YOU, YOU HAVE TO TRUST YOURSELF MORE THAN HAVE TO TRUST YOURSELF MORE THAN YOU TRUST OTHERS.

YOU TRUST OTHERS. IT’S YOUR MONEY, AND WHAT IT’S YOUR MONEY, AND WHAT HAPPENS TO YOUR MONEY IS GOING HAPPENS TO YOUR MONEY IS GOING TO DIRECTLY AFFECT THE QUALITY TO DIRECTLY AFFECT THE QUALITY OF YOUR LIFE, NOT MY LIFE. OF YOUR LIFE, NOT MY LIFE. NOT ANYBODY ELSE’S LIFE, SO IF NOT ANYBODY ELSE’S LIFE, SO IF YOU REALLY WANT TO BE POWERFUL YOU REALLY WANT TO BE POWERFUL IN LIFE, YOU HAVE TO BE POWERFUL IN LIFE, YOU HAVE TO BE POWERFUL OVER YOUR OWN MONEY.

OVER YOUR OWN MONEY. >> THAT’S GOOD ADVICE. >> THAT’S GOOD ADVICE. IN SOME CASES FINANCIALLY DOING IN SOME CASES FINANCIALLY DOING NOTHING IS BETTER THAN MAKING A NOTHING IS BETTER THAN MAKING A CHOICE TO YOUR DETRIMENT. CHOICE TO YOUR DETRIMENT. >> NEVER TALK YOURSELF INTO >> NEVER TALK YOURSELF INTO TRUSTING ANYONE. TRUSTING ANYONE. YOU WALK INTO A FINANCIAL YOU WALK INTO A FINANCIAL ADVISER’S OFFICE AND THEY FEEL ADVISER’S OFFICE AND THEY FEEL LIKE THEY KNOW WHAT YOU’RE LIKE THEY KNOW WHAT YOU’RE DOING. DOING. THEY MUST KNOW, YOU DON’T KNOW THEY MUST KNOW, YOU DON’T KNOW AND YOU BELIEVE THEM.

AND YOU BELIEVE THEM. SOMETIMES THEY GIVE GREAT AED SOMETIMES THEY GIVE GREAT AED VICE AND SOMETIMES THEY GIVE VICE AND SOMETIMES THEY GIVE ADVICE THAT’S NOT SO MUCH. ADVICE THAT’S NOT SO MUCH. >> THAT STUFF’S TRUE IN >> THAT STUFF’S TRUE IN ANYTHING, RIGHT? ANYTHING, RIGHT? >> WHEN YOU THINK ABOUT IT, >> WHEN YOU THINK ABOUT IT, SAVANNAH, YOUR MONEY AND YOUR SAVANNAH, YOUR MONEY AND YOUR LIFE ARE ONE. LIFE ARE ONE. WHO YOU ARE AND WHAT YOU HAVE IS WHO YOU ARE AND WHAT YOU HAVE IS ONE. ONE. IT’S YOU’RE THE ONE WHO EARNS IT’S YOU’RE THE ONE WHO EARNS IT. IT. YOU’RE THE ONE WHO INVESTS IT. YOU’RE THE ONE WHO INVESTS IT. YOU’RE THE ONE WHO SAVES IT, AND YOU’RE THE ONE WHO SAVES IT, AND YOU’RE THE ONE WHO’S GOING TO YOU’RE THE ONE WHO’S GOING TO LIVE. LIVE. >> WE’LL JUST GO TO YOU.

>> WE’LL JUST GO TO YOU. YOU’RE OUR TRUSTED SOURCE. YOU’RE OUR TRUSTED SOURCE. >> COME ON, EVERYBODY, COME JOIN.

Read More

Rethink Retirement – well-being beyond your bank account | Clare Davenport | TEDxBYU

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

Transcriber: Annet Johnson

Reviewer: gaith Takrity Do you ever dream of retirement? What’s your retirement dream? Is it pure bliss and relaxation? Can you almost feel that warm wind? Taste those fruity umbrella drinks? Lounging by the pool, endless games of golf,

walking on the beach? I’ve always loved vacations, haven’t you? So I think we’re really going to love

this constant vacation space in retirement too, right? It actually reminds me of a couple I know. Let’s call them, “Jeff and Jenny.” They’ve dreamt of retirement for years. Jeff had worked at the same company

for over 30 years. He knew everybody. He was the life of the place. And Jenny, she’d often worked two jobs

so they’d have enough. They finally did. They moved to sunny Florida, of course. But something strange started to happen. Jeff seemed lost, lonely. They started to nip at each other. They started to quarrel. And Jenny, although she was

beginning to make community, really didn’t like to golf. She’d never been that sporty. She missed her long-time book club. She missed her best friends, her kids, her soon-to-be grandchild.

What was going on? Had they not done everything right? They’d moved to sunny Florida. They’d worked with

a smart financial advisor. They’d saved enough. I ask you, if this is the dream vision

for retirement – You see it in the adverts. Why is it that so many are

dissatisfied at this age? Why is it that depression

increases by 40%? Why is it [that] substance abuse,

divorce rates are climbing? Why is everyone lonely? And people’s self-worth is low? Surely we can do better than this.

Look, I’ve spent many years consulting and coaching and researching

the ideas, tools, and frameworks that best support us

during times of transition, like retirement. Look, I’m not here to tell you

whether you should or shouldn’t retire, because maybe you should

or maybe you shouldn’t. It is up to you to design and discover. But I do want to share with you

what I know about these life changes, these life quakes, these life disruptors so we don’t end up

in a situation like Jeff and Jenny.

Look, we know that transitions

are a regular part of life. They can be trying and triumphant. They can be predictable and unpredictable because life often

doesn’t follow a straight line. But my research and others’ shows us

that if we bring our intention and attention to them,

we can improve our well-being. And we can improve our well-being

in retirement too. I like to think of it as an ROI,

a return on investment. But this time for our well-being. Think of it as the “ROI”

beyond our bank account, an investment portfolio

in human flourishing, your flourishing in retirement. Where “R” is where we reframe

our current definition of retirement. “O” is where we optimize

the well-being in retirement. And “I” is where we ignite

our way forward. So let’s “ROI,” Reframe, Optimize,

and Ignite, your retirement. Let’s start with “R”: reframe. Let’s reframe your current

definition of retirement. Look, even the word retirement

sends shivers down my spine. I really don’t like that word much. And when I look up the word “retire”

in a thesaurus, I see the strangest words: retreat, remove, exit, my personal favorite, “go to bed.” And, although I get it – It is very, very tempting

to go to bed sometimes, it does imply that we are

fading from life when in fact these years can be

some of our best years, some of our most flourishing years.

So then, how did it start? Well, historically, we never

abruptly retired. We gently moved from one stage

to another in life. And then rumor has it, this gentleman – I think he looks a bit scary, actually, German Chancellor, Otto Van Bismarck,

in 1889, created this idea, this invention of retirement

when he put in place disability insurance for those over 70. This idea was radical. But other countries followed suit,

making retirement age between 65 and 70. But what’s interesting about

this time period of 1889 was the life expectancy

was less than 44 years. A far cry from our 80′ish years today. So to be clear, this definition

or invention of retirement is over 100 years old and we have almost doubled our lifespan.

So surely, can we not all agree that

we need to reframe, rethink, redesign … our retirement definition? Next, let’s “O” of the ROI, let’s optimize. Let’s optimize our well-being

in retirement. And it’s here we can learn

from some great science and research. Edward Jones asked over 9,000 retirees, “What gives you fulfillment

in retirement?” Their answers: being authentic, spending

time with those they care for, they love, doing interesting things,

things that help them grow, and being generous, giving back.

Interestingly, money was

at the bottom of the list. And, look, we know that money can

bring us freedom and flexibility. But research consistently shows us

that above a base level, money is not the secret ingredient

to happiness in life or in retirement. It’s also interesting to examine

the disconnect between what retirees are thinking about – connection, contribution, community, and pre-retirees are thinking about, which is pretty much their bank accounts

and this vacation view of retirement.

And when we look at

this vacation view of retirement, we find that over time it becomes the norm and starts to lack the joy it once did. It’s probably why

Berkeley researchers found that we have a sugar rush

of well-being when we first retire and then a year or two later

a fairly sharp decline. Behavioral economists might call it

hedonic adaptation, where one more umbrella drink, one more golf game just loses its sparkle. We can also look into the world

of positive psychology as we continue to “O”, optimize. We can examine the science of

what makes for a good life, a happy life, a life better than fine. And it goes by the acronym, PERMAV. I like to think of it

as my well-being playbook where “P” is positive emotion,

feeling good, hopeful, inspired, loving. It’s like a micro moment of joy: a good laugh, a good meal. “E” is engagement. Having interests in pursuits that fully

captivate us and take us away: help us grow, our relationships, having loving and authentic relationships

with another, with groups, with communities. “M” is meaning, that sense of purpose,

something beyond ourselves.

“A” is accomplishment, having positive progress in life. And “V” is vitality, investing in our bodies, in our minds,

because they both matter and they work together. Look, these elements collectively

make up our well-being. They matter, they work together, and we have to bring our attention

and intention to them because they can change. So it’s super important

in retirement to focus on these. We can also learn from the

blue zones of the world, those zones where people

fully embrace the PERMAV elements. They live flourishing lives and they live

an extra 10 to 15 years than most of us. The word retirement doesn’t even exist. Take Marie, for example. She’s amazing. She's 101, has her own garden.

Walks over a mile a day,

volunteers five days a week, and spends a lot of time

with her great friends and her six great grandchildren. She is thriving. She is optimizing her retirement years. Next, “I” of the ROI. Let’s ignite our path forward. Let’s take action. Let’s explore ideas. Let's sneak up on the future. We know that life is not

a fixed destination but rather a continual design project. There’s not one best option for us. There's many great options

for us in retirement. We also know to break down

our ideas and our actions. We break them down small, so we feel comfortable taking action. We have a conversation, we explore an idea, we learn something new, but in a safe way. So we take some action. We adjust and edit and we take a little more action

as we ignite our way forward. So in closing, I invite you, all of you, to have a conversation

about your retirement. But maybe a little differently this time. It is never too early

and it’s never too late. Let’s create a retirement canvas full of the colors and

textures of well-being and ignited by our boundless

designs and imaginations, like Jeff and Jenny did.

They moved back from Florida. They still vacation there sometimes. They bought a smaller condo,

two doors down from their best friend. Jeff decided to go back to work part-time, and he’s taking improv

classes twice a week. And Jenny, she’s enrolled

in doing a Masters in English and still loving her long-time book club. They are prioritizing their friends, their family, and their new grandchild. They are thriving. So … what about you? Let’s begin to ROI

your retirement chapter. Let’s start with “R”, refrain. What does retirement now mean to you? And what beliefs are

no longer serving you? “O”, optimize. Who and what will you prioritize and how will you use your many,

many strengths and skills? And how does this compare

with those you care for? And “I”, ignite.

What is one small step

you could take today to better understand

your “retirement act,” knowing the best can be yet to come. Thank you. (Applause).

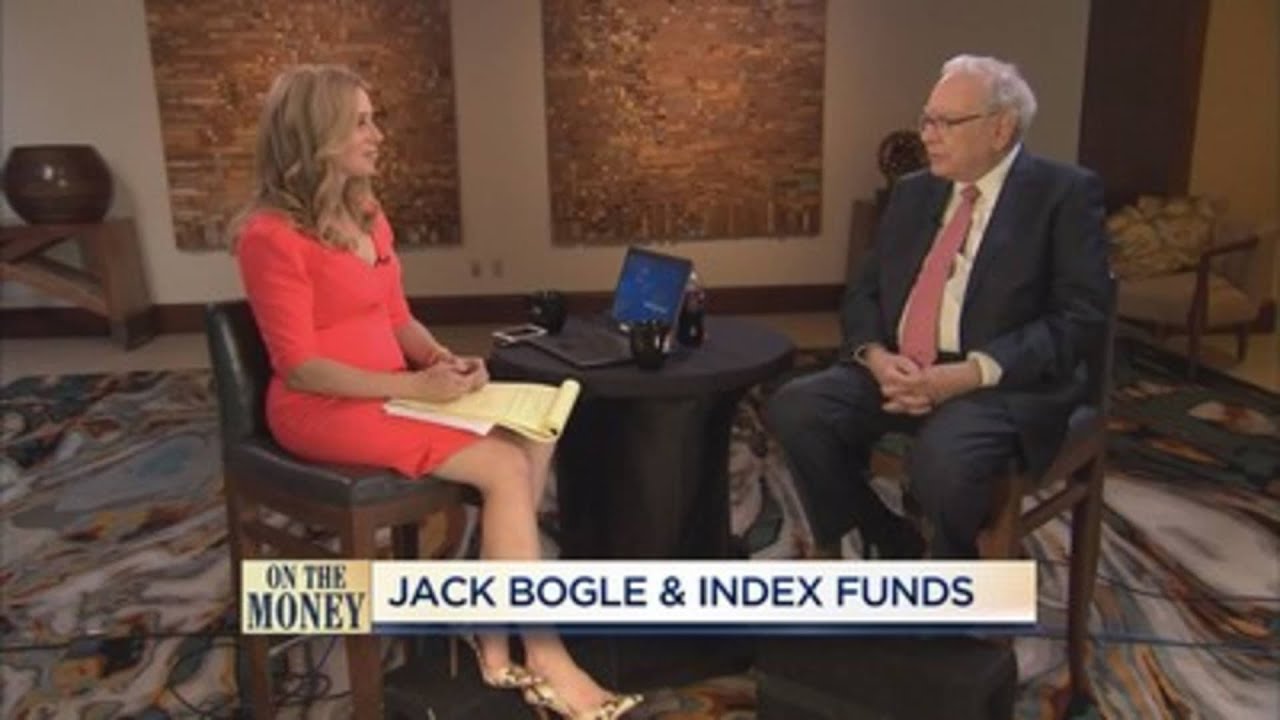

Buffett on retirement

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

FOR PEOPLE RIGHT NOW WHEN IT COMES TO SAVING . >> I THINK IT'S THE SAME THING THAT MAKES MOST SENSE FRANKLY ALL OF THE TIME, AND THAT IS TO CONSISTENTLY BUY AN S&P 500 LOW COST INDEX FUND. KEEP BUYING IT THROUGH THICK AND THIN, AND ESPECIALLY THROUGH THIN. BECAUSE THE TEMPTATIONS GET — WHEN YOU SEE BAD HEADLINES IN NEWSPAPERS, MAYBE TO SAY WELL MAYBE I SHOULD SKIP A YEAR OR SOMETHING.

JUST KEEP BUYING. AMERICAN BUSINESS IS GOING TO DO FINE OVER TIME. SO YOU KNOW THE INVESTMENT UNIVERSE IS GOING TO DO VERY WELL. THE DOW JONES INDUSTRIAL AVERAGE WENT FROM 66 1,497 IN ONE CENTURY, AND SINCE THAT CENTURY HAS ENDED, IT'S MORE OR LESS DOUBLED AGAIN. AMERICAN BUSINESS IS G. THE TRICK IS NOT TO PICK THE RIGHT COMPANY, IT'S TO BE — BECAUSE MOST PEOPLE AREN'T EQUIPPED TO DO THAT. AND PLENTY OF TIMES I MAKE MISTAKES. THE TRICK IS TO ESSENTIALLY BUY ALL THE BIG COMPANIES THROUGH THE SFUND AND TO DO IT CONSISTENTLY, AND TO DO IT IN A VERY, VERY LOW COST WAY. BECAUSE COSTS REALLY MATTER. AND INVESTMENTS, IF RETURNS ARE GOING TO BE 7% OR 8% AND YOU ARE PAYING 1% THROUGH FEES, THAT MAKES AN ENORMOUS DIFFERENCE IN HOW MUCH MONEY YOU HAVE ON RETIREMENT.

>> AT THE ANNUAL MEETING FOR BERKSHIRE HATHAWAY THIS YEAR, YOU INTRODUCED A SPECIAL GUEST TO THE AUDIENCE OF 40,000 SHAREHOLDERS WHO WERE WATCHING. IT WAS JACK VOGEL. WHY DID YOU WANT TO RECOGNIZE JACK VOGEL? >> I THINK JACK VOGEL HAS DONE MORE FOR AMERICAN INVESTORS THAN ANY OTHER PERSON CONNECTED WITH WALL STREET OR T BECAUSE WITH A NUMBER OF OTHER PEOPLE WE CAME UP WITH THE IDEA, HE WASN'T THE SOLE THINKER BEHIND IT BUT HE WAS THE GUY WHO IMPLEMENTED IT AND CRUSADED FOR NOW TRILLIONS OF DOLLARS IN LOW COST INDEX FUNDS. MOST PEOPLE ARE GOING TO HAVE BETTER LIVES, BETTER RETIREMENTS, THEIR KIDS ARE

Read More

Investment Finance Tips : ROTH IRA Retirement Tips

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

This is Patrick Munro, Financial Advisor,

and I'm asking the question today, "Do my ROTH contributions count if I have a retirement

plan at work"? Many of my clients will ask me that, and the more retirement plans you

can possibly have, the better. Many people do have a retirement plan at work which is

non-voluntary, meaning they didn't have any say in how it was set up, but, nevertheless

the employer is matching the contributions that you are payroll deducted, so you take

that. But you can also set up your own independent ROTH plan whereby the taxes are paid ahead

of time.

The more the better, I always say. If you have the money, by all means put that

in there and make sure that you don't put in too much money into a retirement plan to,

well, not have much of a lifestyle. You don't want to be IRA poor, you want to be remember

that you have to enjoy your life going forward. But by all means if you have an IRA plan at

work you can also set up an independent ROTH plan as well. So this is Patrick Munro talking

about that issue, "Do my ROTH's count if I have an IRA plan at work"?.

Generation Wealth – Official Trailer | Amazon Studios

Jason 0 Comments Retire Wealthy

– If I wanna work 100 hours a

week and never see my family and die at an early age

that's my prerogative. – I would have money as big as this room. And kiss it. – 33 pounds of gold and diamonds

given to me by superstars of the world. – I love money. Come to me. – I've been a photographer for 25 years. With my lens focused on wealth,

I noticed that no matter how much people had, they still want more. I wanna figure out why our

obsession with wealth has grown. It seemed to be a shift

in the American dream. – I know the name's of the

Kardashians better than I know the names of my neighbors. – This fictitious

lifestyle fuels this sense of inadequacy. – I have the classic Birkin

in almost every color. – The bags start $20,000 and go up. – I realized wealth was

much more than money. It was whatever gave us value. Fame, sex, even plastic surgery for dogs. – It's kind of like the end of Rome.

Society's accrue their greatest

wealth at the the moment that they face death. – If you look great and

you have a nice car, I'm all for it. But at the expense of what? – [Woman] You sell your soul to the devil. – You're so hungry for it you're blinded. – I am on the FBI most wanted list. – All of us are following the toxic dream. – If you think that money

will buy you anything and everything, you've

never ever had money. – Dollars, dinero, money is what it takes..

I Turned This Cash-Only Savings Hack Into An $850K Business

Jason 0 Comments Retire Wealthy Retirement Planning

I just remember, like,

wondering how I was going to make it through the

next month. Like had a degree, no

job, student loan debt hanging over my head,

credit card debt hanging over my head. And

January 1st came and I was like, I will never

be in this position again. And that's when I

started researching ways to budget and I found

cash budgeting. I started budgeting at

the beginning of the year and started throwing it

on social media to keep myself accountable. I started the business

after my tiktoks went viral. I was like, okay,

well, people are actually interested in this

because finances come off really boring to me and

for some reason people were engaging.

Our

internet will be receiving $20. My name is Jasmine

Taylor. I'm 31 from Amarillo, Texas, and my

business brought in over $800,000 last year. You implement cash

stuffing with it by budgeting the money

literally and physically with the cash. So that

means you start to budget with whatever your

paycheck number is and you give every dollar a

place down to zero. The first product we

sold was just a simple budget binder so you

could buy a binder, pick your cover, add your

name, and then choose six categories. And then we

moved on to adding in different savings

challenges. This one's pretty cute with the

piggies and the wallets, and I also like fries

before guys, we are out of stock a lot and out

of stock on our website doesn't mean that we're

out of stock in our warehouse. We stock enough items

that we can pack and ship out that same week. People are literally

waiting on the site at midnight on Saturday

night like waiting for the restock. Last week,

our $1,500 savings challenge sold out in

like six minutes.

I honestly didn't have

any expectations. I just went into it

hoping that I would make my money back. But I had

no idea. Even to this day,

sometimes I wake up and I'm like, What is

happening? I believe that my mindset changed in

December of 2020. I had just got through

Christmas and my sister died probably four years

previous, so I've been full time taking care of

my niece that works with me now. I was working at

the freestanding emergency room and then

I lost that job actually over the holidays. When you finally get

access to money, at least in my circumstance,

everything I wanted, I wanted to buy it. I have

bipolar disorder. So at the beginning of

my journey, I understood that a lot of my impulse

spending was tied to that.

I started tracking my

expenses and being really diligent about budgeting

and cash stuffing. I was not only able to

change my finances, but I was able to change my

mindset and my relationship with money. I have a bill checking

account. Right? So in that

checking account, there's already next month's

bills. So when you see me cash

stuffing on camera, that's for the next

month. So the first day of the

month, I go and deposit everything I've cashed

up into the bill account. And as the month goes

on, everything is direct deposited. The first

time I had been able to save $1,000, like I'd

never been able to hold on to $1,000. It really empowered me

more than anything else was. Okay, well, you did

that. What else can we do? It went crazy viral. And I was like, well,

I'll be back tomorrow with another one. I knew the stimulus

check was coming and I literally just went for

it. And so I went and bought

me a cricut and I bought the supplies for the

cricut, the mats and stuff like that.

And I

put the rest into inventory, into

purchasing my Shopify plan for the next couple

of months, some shipping supplies and that's it. It was pretty much gone. So in February of 2022,

I realized we needed help. We were working

like 18, 19 hour days trying to get custom

orders out, and we were burnt out. And it got to

the point where I couldn't hardly restock

the site because we couldn't keep up with

the orders. Right now I have three

contracted employees and they do crafting, so

they help me make envelopes. They help

make savings challenges as well as one of the

ladies comes here and she helps me pack orders

because we're now packing 700 – 800 orders a week

and it is pretty tedious. For example, our

customers can pick the cover that they want and

then they customize the envelopes inside to fit

their needs. So different people

choose different titles. You can pick the color,

the font on the envelopes. Monday

through Friday I pretty much come in admin,

catch up on anything that's happening that's

crazy that I need to fix.

We go to the back pack

orders, unbox inventory and we do that until 8

or 9 and then I come up here and if I'm going to

do lives or whatever, I do those if I need to

film YouTube content, I'll do that. Saturdays

and Sundays we all come in and we heavily pack

orders. A lot of the income that

I was making. I was very diligent

about throwing it towards debt. I invest some in

my future and the form of a 401K, pay my bills

with it, give myself spending money and put

some towards savings challenges.

So the same

stuff that I teach my audience I still use in

my daily life. We don't have an issue

bringing in customers. Our issue is honestly

that we can't fulfill more orders. We are shooting for $1

million at the end of 2023 and we are going to

get it. I'm believing that we're

going to get there. I've never had a problem

betting on myself.

You've got to be willing

to bet on yourself. If you don't how can you

expect anybody else to?.

11 Things That Will Destroy Your Wealth

Jason 0 Comments Retire Wealthy

Money has always been like a love affair, too

sweet if you're smart enough not to get caught. But if you also make one small mistake, it could

turn sour quickly when your partner discovers your infidelity. Just like money, if you're smart with

it, you'll enjoy the benefits of always being in a stable position in your life. Mistakes, no matter

how minor, could lead to the destruction of the wealth you worked so hard to create. Here are some

of the things you probably didn't know that are destroying your wealth.

11. Gambling The number one rule in gambling is that

the game is always in favor of the house. No matter how close you feel you are about to win,

please resist the urge because it is just a scheme to milk money from you. You might be playing on

the slot machines or card games, and you are on a winning streak. In the long term, the house will

win.

It’s a well-planned illusion while at the casino, as they want to have you there for as long

as they can. They will offer free refreshments and the environment itself will trick you with its

nonexistent natural light, making you unable to tell the time. Our addicted brothers and sisters

lose more in the gambling dens, ranging from about 55-90 thousand dollars each year. That’s enough to

start a business that will sustain your lifestyle! 10. Cars

These raving beasts are a sight to behold, and it's even better when you own one or two of

them. However, don't be too quick to spend your money on acquire such an asset.

This is because

it comes with a lot of baggage that will surely destroy your wealth. Why? Well, buying a new

car will have you paying extra monthly or yearly charges to maintain it. This ranges from

car insurance, car payments, finance charges, and down payments. And we haven't even included

the amount of fuel you need to run your errands daily and the parking fee.

This will add up to

roughly $450 a month on top of the 35,000 used to purchase the car if it was new. Maybe you

thought that it would be a smart move to buy a used car instead of a new one, which would have

cost 20,000 dollars. Sure, you saved a few bucks, but the fact is that you just bought yourself

a liability that depreciates every single day. The stats show that a new car depreciates 15%

in the first year of driving it. Thereafter, it decreases a further 15% each year. So, if you

wanted to sell the same car three years later, you'd only get $10,000-18,000 for it. Now that car

dealership isn't looking all that enticing, right? 9. Debt

Don't get me wrong. Debt isn't always the enemy, as it can help salvage a failing business, or even

create an outstanding income-generating stream if well thought through.

I'm talking about student

loan debt and credit card debt. These two are the most well-known American dream slayers, with up

to 1.6 trillion in student debt alone in the U.S. Stay away from the fascination of going to a more

prestigious university than you can afford. It forces you into debt that will take a good amount

of time to pay off, instead of opting for a local university that will take you in for a cheaper

price. You could also look into getting grants and student scholarships. Coupled with student

loans, a majority of students find themselves deep in credit card debt after spending their

entire college years purchasing on credit the things they can't afford with cash. These debts

are carried to adulthood, leaving many shackled to massive debt. Despite getting a handsome

paycheck at the end of the month, many end up broke because a large portion of that income is

spent on repaying all the debt they have accrued. 8.

Financial illiteracy

Alan Greenspan once said that the biggest problem in today's generation and

economy is the lack of financial literacy. It's no wonder many people are finding themselves deep

in debt and stagnant despite having well-paying jobs. No person is interested in learning about

money management. They'd rather just wing it when it comes to their finances, not knowing that

financial knowledge is powerful. We simply think that we can duplicate what other people

are doing, and our money bags will be fuller. Sorry to be the one to tell you this, but your

finances are as unique to you as your fingerprint. There is no ‘one shoe fits all’.

You have to learn

to balance what you spend on versus how much you earn. to come up with the most workable budget

for you. Learn about accounting and investing. This kind of knowledge will be beneficial in

the long run. Whereas a lack of it will destroy your wealth more than you acquired it.

7. Fashion Gucci bags, Louboutin shoes, a Rolex watch all

to try to make a good first impression. Stop it, please, you don't need to have the

most expensive suit in the room to make an impression. All you need is a

normal-looking one that's crisp and clean. Brush your teeth and maintain a good hygiene

season with some charisma and personality. You'll have everyone in the event looking

for an opportunity to interact with you.

We can all attest to doing all this clingy,

dressing just to keep up with the Jones. But we end up looking rich outside while

our bank accounts are screaming for help. It costs more to buy a 200$ bag that you carry

only once instead of buying one versatile one. 6. Eating out

Did you know that you probably spend around $3,000 a year just on

take-out? That's five times the amount you'd have spent if you'd cooked the food yourself.

Don't

get me started on the amount of time you wasted waiting for your delivery to get to you. Or how

long it takes to pick up the delivery yourself. You'd be saving a good amount of cash every month

by cooking your meals at home. You can stash this money away in your emergency fund for a rainy day.

Doing this not only saves you money, but allows you the opportunity to have a hot meal every day.

You can watch how many calories you're eating. You can even personalize your meals as much as you

want without the worry that the restaurant will forget to add extra gravy again.

Furthermore,

it's healthier to make that dinner yourself. Don't fall into this money trap and have your

wealth robbed from you as you sit by and watch. 5. Wrong relationship

Being in the wrong relationship might just cost you a fortune in your finances.

Up until today, you probably didn’t know, but statistics prove that the average man

spends close to 120,000 dollars on dates. A wedding costs about $34,000 to plan, with

an additional $6,000 for an engagement ring. Can you imagine spending this much only to

be hit with divorce papers? Quite expensive, don’t you think? A survey carried out has shown

that millennials getting into marriage secure themselves by signing a prenup in case things fall

apart.

In that case, they’ll walk out of someone’s life with something in their pocket. I don’t know

whom it might concern, but you better be keen when getting into relationships because the wrong

relationship will not only cost you emotional grief but will also dent your wealth. The

average marriage that works out in the US is 50%, so it’s important you know this before venturing

into it blindly. This means that if you flip a coin, you’ll be able to predict whether your

marriage will work out or not. In the case that things don’t work out for you, it costs an

average of 13,000 dollars to facilitate a divorce, not forgetting other expenses such as alimony

and child support that would be on your back. Without a doubt, we better invest smartly to

avoid these blunders that will destroy our wealth. 4.

Shopping

Shopping has turned into a famous trend all over the world where once someone makes

some small amount of money, all that runs through their mind is how they’ll swing by the mall and

shop till they drop. We should be very precise in our shopping and it would be better if we tagged

along with a shopping list to avoid the temptation of overspending. A close look at this will help

realize how much money is lost in thrift shops and shopping malls. All these shopping sprees

eventually lead to debt, and even more debt if you aren’t keen enough.

Can you believe that

the average credit card debt stands at $57,008? 3. No emergency fund

Living without an emergency fund is like going hiking and choosing not

to carry an extra bottle of water. because the instructor said that you'd be back

from the hike in 6 hours. Only for you to end up dehydrated because your only water bottle fell off

a cliff. The point here is, life is unpredictable, it's so important to have an emergency fund ready.

There isn't a standard amount of money you need to keep for any emergencies. Some say that you

need to have saved triple your monthly income while specifying a certain amount. However, we

are sure that not having an emergency fund will leave you broke in the event of an accident or

calamity. You'll be forced to pay out of pocket or max out your credit to shelter yourself.

This

will, in turn, lead to several financial strains unfolding in your life. You'll be left wondering

where your whole salary is disappearing to. 2. Alcohol

Some claim that a little wine every day does more good than harm. But have you ever

sat down to think about the financial implications that are associated with drinking? You're lucky

if you drink just a little, because heavy drinkers are suffering out there. In 2018 alone, people

have already downed more than 6.3 gallons of beer and 900 million gallons of wine. Do the math, and

you'll be stunned. Even more shocking is that the wealthy and those who are well educated are the

ones partaking in this joyous affair. Be smart to avoid this other money trap, because we've

all heard those stories. The ones who were once at the peak of their careers, both in title and

income, end up losing their jobs because they go out drinking way too much.

Reporting late

to work or even delivering inaccurate reports such a waste of good talent don’t you think?

1. Jewellery. Hip-hop has a firm grip on the dress code we

wear, as well as the bling and glamour that adorns our outfits. You’ll see little to none of

these celebrities without some dope iced-out chain or a gorgeous Rolex watch worth millions. Take a

look at Lil Wayne. For instance, he owns a pinkie ring worth two thousand dollars and Rick Ross’s

custom-made chain worth 1.5 million dollars! Practically speaking, owning such things may

destabilize your wealth. Did you know that jewellery is a depreciating asset? Probably not,

so next time you invest millions in jewellery, you better take a moment to critically assess

your decision. Even if you purchase top-shelf jewellery, it won’t bring back as much as you

invested, even if you resell it after a day. Jewellery is merely a status symbol that

you really won’t need to spend cash on. At the end of the day, the amount of wealth

you are worth is not calculated by the gold chain on your neck.

Be smart. One

last question before we wrap up: What will you do when you are given ten thousand

dollars in cash? Let us know down below. Well folks, thank you so much for watching.

If you enjoyed the video, give it a thumbs-up, and if you’re new here, welcome and

subscribe for more content like this. With that said, have a great

day, and see you in the next one..

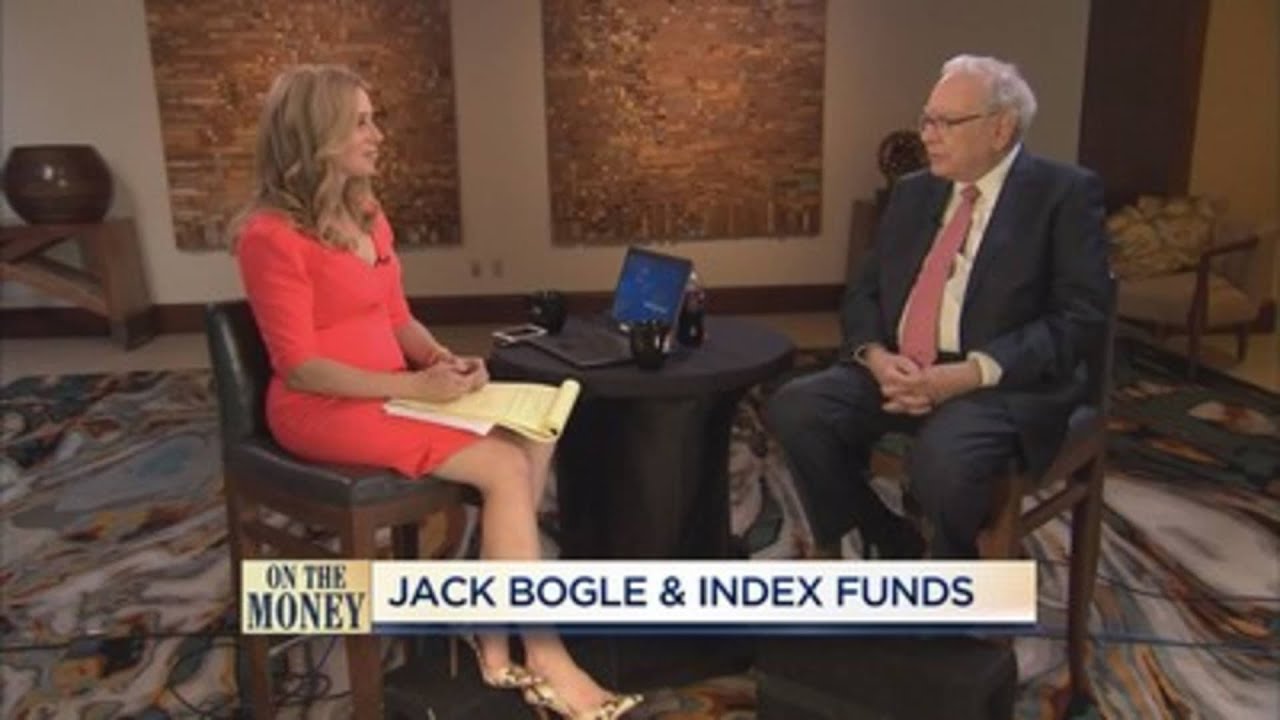

Buffett on retirement

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

FOR PEOPLE RIGHT NOW WHEN IT COMES TO SAVING . >> I THINK IT'S THE SAME THING THAT MAKES MOST SENSE FRANKLY ALL OF THE TIME, AND THAT IS TO CONSISTENTLY BUY AN S&P 500 LOW COST INDEX FUND. KEEP BUYING IT THROUGH THICK AND THIN, AND ESPECIALLY THROUGH THIN. BECAUSE THE TEMPTATIONS GET — WHEN YOU SEE BAD HEADLINES IN NEWSPAPERS, MAYBE TO SAY WELL MAYBE I SHOULD SKIP A YEAR OR SOMETHING. JUST KEEP BUYING. AMERICAN BUSINESS IS GOING TO DO FINE OVER TIME. SO YOU KNOW THE INVESTMENT UNIVERSE IS GOING TO DO VERY WELL. THE DOW JONES INDUSTRIAL AVERAGE WENT FROM 66 1,497 IN ONE CENTURY, AND SINCE THAT CENTURY HAS ENDED, IT'S MORE OR LESS DOUBLED AGAIN. AMERICAN BUSINESS IS G. THE TRICK IS NOT TO PICK THE RIGHT COMPANY, IT'S TO BE — BECAUSE MOST PEOPLE AREN'T EQUIPPED TO DO THAT.

AND PLENTY OF TIMES I MAKE MISTAKES. THE TRICK IS TO ESSENTIALLY BUY ALL THE BIG COMPANIES THROUGH THE SFUND AND TO DO IT CONSISTENTLY, AND TO DO IT IN A VERY, VERY LOW COST WAY. BECAUSE COSTS REALLY MATTER. AND INVESTMENTS, IF RETURNS ARE GOING TO BE 7% OR 8% AND YOU ARE PAYING 1% THROUGH FEES, THAT MAKES AN ENORMOUS DIFFERENCE IN HOW MUCH MONEY YOU HAVE ON RETIREMENT. >> AT THE ANNUAL MEETING FOR BERKSHIRE HATHAWAY THIS YEAR, YOU INTRODUCED A SPECIAL GUEST TO THE AUDIENCE OF 40,000 SHAREHOLDERS WHO WERE WATCHING. IT WAS JACK VOGEL. WHY DID YOU WANT TO RECOGNIZE JACK VOGEL? >> I THINK JACK VOGEL HAS DONE MORE FOR AMERICAN INVESTORS THAN ANY OTHER PERSON CONNECTED WITH WALL STREET OR T BECAUSE WITH A NUMBER OF OTHER PEOPLE WE CAME UP WITH THE IDEA, HE WASN'T THE SOLE THINKER BEHIND IT BUT HE WAS THE GUY WHO IMPLEMENTED IT AND CRUSADED FOR NOW TRILLIONS OF DOLLARS IN LOW COST INDEX FUNDS. MOST PEOPLE ARE GOING TO HAVE BETTER LIVES, BETTER RETIREMENTS, THEIR KIDS ARE.

Read More

Personal finance expert Suze Orman’s number one investment right now

Jason 0 Comments Retire Wealthy Retirement Planning

SO THERE YOU SEE SUPPLY AND DEMAND AT WORK WITH INFLATION AT A HISTORIC HIGHS IN THE STOCK MARKET CHOPPY, OUR NEXT GUEST SAYS THE NUMBER ONE INVESTMENT RIGHT NOW IS I-BONDS HERE TO EXPLAIN IS A PERSONAL FINANCE POWER PLAYER AND OUR DEAR FRIEND SUZE ORMAN HOST OF THE WOMEN AND MONEY PODCAST. SHE IS ALSO CO-FOUNDER OF THE EMERGENCY SAVINGS FIRM SECURE SAVE SUZE, IT IS ALWAYS GREAT TO SEE YOU. WELCOME. GOOD TO HAVE YOU BACK WITH US. LET'S TALK ABOUT THE I-BONDS WHICH I DIDN'T EVEN KNOW ABOUT, BUTMY NEPHEW-IN-LAW SAID YOU HAVE TO GET THESE I-BONDS. EXPLAIN TO ME WHAT THEY ARE, HOW THEY WORK, HOW I BUY THEM AND FROM WHOM. >> NOW SO YOU BUY THEM FROM THE TREASURY, DIRECTLY FROM THEM SO YOU GO FROM TREASURYDIRECT.GOV IT IS THE ONLY PLACE THAT YOU CAN BUY THEM, NUMBER ONE THEY RANGE IN PRICE.

YOU CAN INVEST FROM $25 ALL OF THE WAY UP TO A MAXIMUM PER PERSON OF $10,000, ALTHOUGH THERE ARE WAYS TO DO IT WHERE YOU CAN PUT IN UP TO 30,000 IF YOU HAVE A TRUST AND/OR A BUSINESS WHEN YOU INVEST IN AN I-BOND, I STANDS FOR INFLATION, YOU HAVE GOT TO MAKE SURE THAT FOR ONE YEAR YOU DO NOT NEED YOUR MONEY AND THE REASON IS FROM THE TIME YOU PUT IT IN TO ONE YEAR YOU CANNOT TOUCH IT. FROM YEAR TWO TO FIVE THERE IS ONLY A THREE-MONTH INTEREST PENALTY. THAT IS HOW THEY WORK.

THEY ARE ATTACHED TO CPI SO RIGHT NOW WHEN THEY ANNOUNCED IN MAY, THE CPI THE YIELD ON THE SERIES I BONDS WERE GUARANTEED AND ANNUALIZED AND IT'S GUARANTEED TO YOU SO THEY CHANGE EVERY SIX MONTHS THE INTEREST RATE CHANGES EVERY MAY AND NOVEMBER SO FROM MAY UNTIL NOVEMBER EVERYBODY WHO BUYS ONE RIGHT NOW WILL BE GUARANTEED AN ANNUALIZED YIELD OF 9.62% STATE INCOME TAX-FREE OBVIOUSLY YOU'RE ONLY GOING TO GET THAT FOR SIX MONTH, BUT THAT'S STILL 4.81% ON YOUR MONEY. WHEN THEY RESET COME NOVEMBER, LET'S SAY THEY RESET EVEN LOWER. LET'S SAY THEY RESET AT 7.11 WHICH IS WHAT THEY WERE PAYING BEFORE THEY RAISED TO 9.62, YOU ARE GUARANTEED THAT FOR THE NEXT SIX MONTHS ON AN ANNUALIZED YIELD SO THAT'S, LIKE, 3.56%, HALF OF THAT FOR SIX MONTH BECAUSE THAT'S WHAT YOU'RE GUARANTEED SO FOR THE YEAR IT'S 8.37% THAT'S ESSENTIALLY HOW THEY WORK THEY'RE FABULOUS THEIR MATURITIES ARE FOR — GO ON >> I DON'T MEAN TO INTERRUPT YOU, BUT I WANTED TO ASK YOU THOSE NUMBERS THAT YOU JUST — AND I GET IT, YOU EXPLAINED IT PERFECTLY.

THEY RESET EVERY SIX MONTHS AND ARE YOU GUARANTEED UNDER THIS PROGRAM TO MAKE A YIELD IF YOU HOLD THE BONDS THAT IS ABOVE THE THEN-PREVAILING RATE OF INFLATION? >> SO WHAT HAPPENS IS YOU ARE ABSOLUTELY GUARANTEED, AND WHAT'S SO GREAT IS THAT THE ONLY WAY A FINANCE PERSON CAN EVER USE THE WORD GUARANTEE SIDE USUALLY WITH A TREASURY INSTRUMENT BECAUSE IT'S GUARANTEED BY THE AUTHORITY OF THE UNITED STATES GOVERNMENT NO COMMISSIONS OR ANYTHING SO ONCE THEY DECLARE THAT RATE ON MAY 1st AND NOVEMBER 1st YOU ARE GUARANTEED FOR WHENEVER YOU BUY IT BETWEEN THOSE PERIODS, FOR SIX MONTHS YOU ARE GUARANTEE THE RATE THAT THEY DECLARED. AGAIN, THAT'S AN ANNUALIZED YIELD, SO IT'S ONLY REALLY GUARANTEED FOR SIX MONTHS UNTIL THEY RESET YOU KNOW, TYLER, I GAVE A MASTER CLASS ON THIS ON THE WOMEN AND MONEY PODCAST ON THE APRIL 17th EDITION OF IT. EVERYBODY SHOULD LISTEN TO IT BECAUSE IT TELLS YOU ALL THE INs AND OUTs, EVERYTHING YOU NEED TO KNOW THIS IS AN INVESTMENT. I'VE BEEN DOING THESE SINCE 2001 >> THIS DOES MAKE AN AWFUL LOT OF SENSE YOU EXPLAINED IT VERY WELL IN YOUR FIRST ANSWER IN TALKING ABOUT THE 9.6% RATE.

WE UNDERSTAND THAT THAT DOES CLEAR THE LEVEL OF INFLATION, BUT IF INFLATION IS SOMETHING LIKE 8.6%, AREN'T YOU MORE OR LESS JUST PROTECTING THE VALUE OF YOUR MONEY RATHER THAN REALLY GROWING IT EVEN IF INFLATION IS ONLY APERCENT LESS THAN WHAT YOU'RE MAKING. >> COURTNEY, YOU GOT THAT RIGHT, BUT DON'T YOU WANT IN MARKETS LIKE THIS TO HAVE A POSITION OF YOUR MONEY ABSOLUTELY RO TEKTED? WHERE ARE YOUGOING TO GO YOU CAN'T GO TO REGULAR BONDS, BECAUSE BONDS IF YOU ADOPTED IN BOND FUNDS FOR GROWTH, YOU'RE DOWN 10% OR 15%. YOU'RE DOWN SIGNIFICANTLY IN THE STOCK MARKET THERE HAS GOT TO BE A PORTION OF YOUR MONEY, WHATEVER THAT IS THAT YOU WANT PROTECTED, YOU WANT ESSENTIALLY IN CASH AT LEAST WHERE IT'S KEEPING UP WITH INFLATION WHICH IS EXACTLY WHAT THIS WILL DO VERSUS YOU'RE IN A MONEY MARKET ACCOUNT OR A CD OR WHATEVER IT IS AND YOU'RE GETTING 3% WHERE YOU'RE LOSING MONEY.

SO THIS IS A GREAT PLACE TO PUT YOUR — YOU MENTIONED AFTER FIVE YEARS, YOU MENTIONED 27 YEAR IS PUT FOR 30 YEARS >> I SEE, AND YOU CAN REDEEM THEM ANY TIME AFTER THE FIRST YEAR FROM THE YEAR TWO THROUGH FIVE THERE IS A THREE-MONTH INTEREST PENALTY AFTER THE FIFTH YEAR YOU CAN REDEEM ANY — YOU CAN REDEEM ANY TIME. >> WITHOUT ANY PEVNALTIES WHEN S EVER REALLY, ESSENTIALLY. SO YOU'RE IN THERE FOR A YEAR AND YOU REDEEM AFTER THAT, BIG DEAL. >> FINAL QUESTION WHICH COURTNEY TOUCHED ON AND THAT IS THAT THIS IS FOR A PORTION OF YOUR MONEY, IDEALLY MONEY YOU DON'T NEED TO TOUCH. IN SOME WAYS LIKE STOCKS, BUT YOU ACKNOWLEDGE THAT THERE IS WITH THIS KIND OF SAFETY MONEY AN OPPORTUNITY COST WHICH IS TO SAY IT'S NOT GOING TO BE YOUR GROWTH MONEY THE STOCK MARKET MIGHT RETURN YOU OVER THE FIVE YEARS OR THE TEN YEARS YOU HOLD THIS BOND MUCH MORE THAN 8%, 9%, A LITTLE ABOVE INFLATION, RIGHT YOUR GROWTH MONEY IS A DIFFERENT THING.

>> ABSOLUTELY. YOU HAVE GROWTH MONEY. YOU HAVE EMERGENCY SAVINGS ACCOUNT MONEY THAT WOULD NEVER GO INTO SOMETHING LIKE THIS BECAUSE YOU CAN'T AFFORD TO LOCK THAT UP FOR A YEAR, BUT YOU DO HAVE A PORTION OF YOUR MONEY THAT YOU WANT RIGHT NOW SAFE AND SOUTHBOUND BECAUSE EVERYBODY IS SO FREAKED, AND AT THESE INTEREST RATES, IF INFLATION CONTINUES THESE ARE A BIG WINNER BIG, BIG, BIG. >> WHAT'S THE PODCAST AGAIN, GO BACK.

Read More

Recent Comments