Tag: money

11 Things That Will Destroy Your Wealth

Jason 0 Comments Retire Wealthy

Money has always been like a love affair, too

sweet if you're smart enough not to get caught. But if you also make one small mistake, it could

turn sour quickly when your partner discovers your infidelity. Just like money, if you're smart with

it, you'll enjoy the benefits of always being in a stable position in your life. Mistakes, no matter

how minor, could lead to the destruction of the wealth you worked so hard to create. Here are some

of the things you probably didn't know that are destroying your wealth.

11. Gambling The number one rule in gambling is that

the game is always in favor of the house. No matter how close you feel you are about to win,

please resist the urge because it is just a scheme to milk money from you. You might be playing on

the slot machines or card games, and you are on a winning streak. In the long term, the house will

win.

It’s a well-planned illusion while at the casino, as they want to have you there for as long

as they can. They will offer free refreshments and the environment itself will trick you with its

nonexistent natural light, making you unable to tell the time. Our addicted brothers and sisters

lose more in the gambling dens, ranging from about 55-90 thousand dollars each year. That’s enough to

start a business that will sustain your lifestyle! 10. Cars

These raving beasts are a sight to behold, and it's even better when you own one or two of

them. However, don't be too quick to spend your money on acquire such an asset.

This is because

it comes with a lot of baggage that will surely destroy your wealth. Why? Well, buying a new

car will have you paying extra monthly or yearly charges to maintain it. This ranges from

car insurance, car payments, finance charges, and down payments. And we haven't even included

the amount of fuel you need to run your errands daily and the parking fee.

This will add up to

roughly $450 a month on top of the 35,000 used to purchase the car if it was new. Maybe you

thought that it would be a smart move to buy a used car instead of a new one, which would have

cost 20,000 dollars. Sure, you saved a few bucks, but the fact is that you just bought yourself

a liability that depreciates every single day. The stats show that a new car depreciates 15%

in the first year of driving it. Thereafter, it decreases a further 15% each year. So, if you

wanted to sell the same car three years later, you'd only get $10,000-18,000 for it. Now that car

dealership isn't looking all that enticing, right? 9. Debt

Don't get me wrong. Debt isn't always the enemy, as it can help salvage a failing business, or even

create an outstanding income-generating stream if well thought through.

I'm talking about student

loan debt and credit card debt. These two are the most well-known American dream slayers, with up

to 1.6 trillion in student debt alone in the U.S. Stay away from the fascination of going to a more

prestigious university than you can afford. It forces you into debt that will take a good amount

of time to pay off, instead of opting for a local university that will take you in for a cheaper

price. You could also look into getting grants and student scholarships. Coupled with student

loans, a majority of students find themselves deep in credit card debt after spending their

entire college years purchasing on credit the things they can't afford with cash. These debts

are carried to adulthood, leaving many shackled to massive debt. Despite getting a handsome

paycheck at the end of the month, many end up broke because a large portion of that income is

spent on repaying all the debt they have accrued. 8.

Financial illiteracy

Alan Greenspan once said that the biggest problem in today's generation and

economy is the lack of financial literacy. It's no wonder many people are finding themselves deep

in debt and stagnant despite having well-paying jobs. No person is interested in learning about

money management. They'd rather just wing it when it comes to their finances, not knowing that

financial knowledge is powerful. We simply think that we can duplicate what other people

are doing, and our money bags will be fuller. Sorry to be the one to tell you this, but your

finances are as unique to you as your fingerprint. There is no ‘one shoe fits all’.

You have to learn

to balance what you spend on versus how much you earn. to come up with the most workable budget

for you. Learn about accounting and investing. This kind of knowledge will be beneficial in

the long run. Whereas a lack of it will destroy your wealth more than you acquired it.

7. Fashion Gucci bags, Louboutin shoes, a Rolex watch all

to try to make a good first impression. Stop it, please, you don't need to have the

most expensive suit in the room to make an impression. All you need is a

normal-looking one that's crisp and clean. Brush your teeth and maintain a good hygiene

season with some charisma and personality. You'll have everyone in the event looking

for an opportunity to interact with you.

We can all attest to doing all this clingy,

dressing just to keep up with the Jones. But we end up looking rich outside while

our bank accounts are screaming for help. It costs more to buy a 200$ bag that you carry

only once instead of buying one versatile one. 6. Eating out

Did you know that you probably spend around $3,000 a year just on

take-out? That's five times the amount you'd have spent if you'd cooked the food yourself.

Don't

get me started on the amount of time you wasted waiting for your delivery to get to you. Or how

long it takes to pick up the delivery yourself. You'd be saving a good amount of cash every month

by cooking your meals at home. You can stash this money away in your emergency fund for a rainy day.

Doing this not only saves you money, but allows you the opportunity to have a hot meal every day.

You can watch how many calories you're eating. You can even personalize your meals as much as you

want without the worry that the restaurant will forget to add extra gravy again.

Furthermore,

it's healthier to make that dinner yourself. Don't fall into this money trap and have your

wealth robbed from you as you sit by and watch. 5. Wrong relationship

Being in the wrong relationship might just cost you a fortune in your finances.

Up until today, you probably didn’t know, but statistics prove that the average man

spends close to 120,000 dollars on dates. A wedding costs about $34,000 to plan, with

an additional $6,000 for an engagement ring. Can you imagine spending this much only to

be hit with divorce papers? Quite expensive, don’t you think? A survey carried out has shown

that millennials getting into marriage secure themselves by signing a prenup in case things fall

apart.

In that case, they’ll walk out of someone’s life with something in their pocket. I don’t know

whom it might concern, but you better be keen when getting into relationships because the wrong

relationship will not only cost you emotional grief but will also dent your wealth. The

average marriage that works out in the US is 50%, so it’s important you know this before venturing

into it blindly. This means that if you flip a coin, you’ll be able to predict whether your

marriage will work out or not. In the case that things don’t work out for you, it costs an

average of 13,000 dollars to facilitate a divorce, not forgetting other expenses such as alimony

and child support that would be on your back. Without a doubt, we better invest smartly to

avoid these blunders that will destroy our wealth. 4.

Shopping

Shopping has turned into a famous trend all over the world where once someone makes

some small amount of money, all that runs through their mind is how they’ll swing by the mall and

shop till they drop. We should be very precise in our shopping and it would be better if we tagged

along with a shopping list to avoid the temptation of overspending. A close look at this will help

realize how much money is lost in thrift shops and shopping malls. All these shopping sprees

eventually lead to debt, and even more debt if you aren’t keen enough.

Can you believe that

the average credit card debt stands at $57,008? 3. No emergency fund

Living without an emergency fund is like going hiking and choosing not

to carry an extra bottle of water. because the instructor said that you'd be back

from the hike in 6 hours. Only for you to end up dehydrated because your only water bottle fell off

a cliff. The point here is, life is unpredictable, it's so important to have an emergency fund ready.

There isn't a standard amount of money you need to keep for any emergencies. Some say that you

need to have saved triple your monthly income while specifying a certain amount. However, we

are sure that not having an emergency fund will leave you broke in the event of an accident or

calamity. You'll be forced to pay out of pocket or max out your credit to shelter yourself.

This

will, in turn, lead to several financial strains unfolding in your life. You'll be left wondering

where your whole salary is disappearing to. 2. Alcohol

Some claim that a little wine every day does more good than harm. But have you ever

sat down to think about the financial implications that are associated with drinking? You're lucky

if you drink just a little, because heavy drinkers are suffering out there. In 2018 alone, people

have already downed more than 6.3 gallons of beer and 900 million gallons of wine. Do the math, and

you'll be stunned. Even more shocking is that the wealthy and those who are well educated are the

ones partaking in this joyous affair. Be smart to avoid this other money trap, because we've

all heard those stories. The ones who were once at the peak of their careers, both in title and

income, end up losing their jobs because they go out drinking way too much.

Reporting late

to work or even delivering inaccurate reports such a waste of good talent don’t you think?

1. Jewellery. Hip-hop has a firm grip on the dress code we

wear, as well as the bling and glamour that adorns our outfits. You’ll see little to none of

these celebrities without some dope iced-out chain or a gorgeous Rolex watch worth millions. Take a

look at Lil Wayne. For instance, he owns a pinkie ring worth two thousand dollars and Rick Ross’s

custom-made chain worth 1.5 million dollars! Practically speaking, owning such things may

destabilize your wealth. Did you know that jewellery is a depreciating asset? Probably not,

so next time you invest millions in jewellery, you better take a moment to critically assess

your decision. Even if you purchase top-shelf jewellery, it won’t bring back as much as you

invested, even if you resell it after a day. Jewellery is merely a status symbol that

you really won’t need to spend cash on. At the end of the day, the amount of wealth

you are worth is not calculated by the gold chain on your neck.

Be smart. One

last question before we wrap up: What will you do when you are given ten thousand

dollars in cash? Let us know down below. Well folks, thank you so much for watching.

If you enjoyed the video, give it a thumbs-up, and if you’re new here, welcome and

subscribe for more content like this. With that said, have a great

day, and see you in the next one..

Buffett on retirement

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

FOR PEOPLE RIGHT NOW WHEN IT COMES TO SAVING . >> I THINK IT'S THE SAME THING THAT MAKES MOST SENSE FRANKLY ALL OF THE TIME, AND THAT IS TO CONSISTENTLY BUY AN S&P 500 LOW COST INDEX FUND. KEEP BUYING IT THROUGH THICK AND THIN, AND ESPECIALLY THROUGH THIN. BECAUSE THE TEMPTATIONS GET — WHEN YOU SEE BAD HEADLINES IN NEWSPAPERS, MAYBE TO SAY WELL MAYBE I SHOULD SKIP A YEAR OR SOMETHING. JUST KEEP BUYING. AMERICAN BUSINESS IS GOING TO DO FINE OVER TIME. SO YOU KNOW THE INVESTMENT UNIVERSE IS GOING TO DO VERY WELL. THE DOW JONES INDUSTRIAL AVERAGE WENT FROM 66 1,497 IN ONE CENTURY, AND SINCE THAT CENTURY HAS ENDED, IT'S MORE OR LESS DOUBLED AGAIN. AMERICAN BUSINESS IS G. THE TRICK IS NOT TO PICK THE RIGHT COMPANY, IT'S TO BE — BECAUSE MOST PEOPLE AREN'T EQUIPPED TO DO THAT.

AND PLENTY OF TIMES I MAKE MISTAKES. THE TRICK IS TO ESSENTIALLY BUY ALL THE BIG COMPANIES THROUGH THE SFUND AND TO DO IT CONSISTENTLY, AND TO DO IT IN A VERY, VERY LOW COST WAY. BECAUSE COSTS REALLY MATTER. AND INVESTMENTS, IF RETURNS ARE GOING TO BE 7% OR 8% AND YOU ARE PAYING 1% THROUGH FEES, THAT MAKES AN ENORMOUS DIFFERENCE IN HOW MUCH MONEY YOU HAVE ON RETIREMENT. >> AT THE ANNUAL MEETING FOR BERKSHIRE HATHAWAY THIS YEAR, YOU INTRODUCED A SPECIAL GUEST TO THE AUDIENCE OF 40,000 SHAREHOLDERS WHO WERE WATCHING. IT WAS JACK VOGEL. WHY DID YOU WANT TO RECOGNIZE JACK VOGEL? >> I THINK JACK VOGEL HAS DONE MORE FOR AMERICAN INVESTORS THAN ANY OTHER PERSON CONNECTED WITH WALL STREET OR T BECAUSE WITH A NUMBER OF OTHER PEOPLE WE CAME UP WITH THE IDEA, HE WASN'T THE SOLE THINKER BEHIND IT BUT HE WAS THE GUY WHO IMPLEMENTED IT AND CRUSADED FOR NOW TRILLIONS OF DOLLARS IN LOW COST INDEX FUNDS. MOST PEOPLE ARE GOING TO HAVE BETTER LIVES, BETTER RETIREMENTS, THEIR KIDS ARE.

Read More

Personal finance expert Suze Orman’s number one investment right now

Jason 0 Comments Retire Wealthy Retirement Planning

SO THERE YOU SEE SUPPLY AND DEMAND AT WORK WITH INFLATION AT A HISTORIC HIGHS IN THE STOCK MARKET CHOPPY, OUR NEXT GUEST SAYS THE NUMBER ONE INVESTMENT RIGHT NOW IS I-BONDS HERE TO EXPLAIN IS A PERSONAL FINANCE POWER PLAYER AND OUR DEAR FRIEND SUZE ORMAN HOST OF THE WOMEN AND MONEY PODCAST. SHE IS ALSO CO-FOUNDER OF THE EMERGENCY SAVINGS FIRM SECURE SAVE SUZE, IT IS ALWAYS GREAT TO SEE YOU. WELCOME. GOOD TO HAVE YOU BACK WITH US. LET'S TALK ABOUT THE I-BONDS WHICH I DIDN'T EVEN KNOW ABOUT, BUTMY NEPHEW-IN-LAW SAID YOU HAVE TO GET THESE I-BONDS. EXPLAIN TO ME WHAT THEY ARE, HOW THEY WORK, HOW I BUY THEM AND FROM WHOM. >> NOW SO YOU BUY THEM FROM THE TREASURY, DIRECTLY FROM THEM SO YOU GO FROM TREASURYDIRECT.GOV IT IS THE ONLY PLACE THAT YOU CAN BUY THEM, NUMBER ONE THEY RANGE IN PRICE.

YOU CAN INVEST FROM $25 ALL OF THE WAY UP TO A MAXIMUM PER PERSON OF $10,000, ALTHOUGH THERE ARE WAYS TO DO IT WHERE YOU CAN PUT IN UP TO 30,000 IF YOU HAVE A TRUST AND/OR A BUSINESS WHEN YOU INVEST IN AN I-BOND, I STANDS FOR INFLATION, YOU HAVE GOT TO MAKE SURE THAT FOR ONE YEAR YOU DO NOT NEED YOUR MONEY AND THE REASON IS FROM THE TIME YOU PUT IT IN TO ONE YEAR YOU CANNOT TOUCH IT. FROM YEAR TWO TO FIVE THERE IS ONLY A THREE-MONTH INTEREST PENALTY. THAT IS HOW THEY WORK.

THEY ARE ATTACHED TO CPI SO RIGHT NOW WHEN THEY ANNOUNCED IN MAY, THE CPI THE YIELD ON THE SERIES I BONDS WERE GUARANTEED AND ANNUALIZED AND IT'S GUARANTEED TO YOU SO THEY CHANGE EVERY SIX MONTHS THE INTEREST RATE CHANGES EVERY MAY AND NOVEMBER SO FROM MAY UNTIL NOVEMBER EVERYBODY WHO BUYS ONE RIGHT NOW WILL BE GUARANTEED AN ANNUALIZED YIELD OF 9.62% STATE INCOME TAX-FREE OBVIOUSLY YOU'RE ONLY GOING TO GET THAT FOR SIX MONTH, BUT THAT'S STILL 4.81% ON YOUR MONEY. WHEN THEY RESET COME NOVEMBER, LET'S SAY THEY RESET EVEN LOWER. LET'S SAY THEY RESET AT 7.11 WHICH IS WHAT THEY WERE PAYING BEFORE THEY RAISED TO 9.62, YOU ARE GUARANTEED THAT FOR THE NEXT SIX MONTHS ON AN ANNUALIZED YIELD SO THAT'S, LIKE, 3.56%, HALF OF THAT FOR SIX MONTH BECAUSE THAT'S WHAT YOU'RE GUARANTEED SO FOR THE YEAR IT'S 8.37% THAT'S ESSENTIALLY HOW THEY WORK THEY'RE FABULOUS THEIR MATURITIES ARE FOR — GO ON >> I DON'T MEAN TO INTERRUPT YOU, BUT I WANTED TO ASK YOU THOSE NUMBERS THAT YOU JUST — AND I GET IT, YOU EXPLAINED IT PERFECTLY.

THEY RESET EVERY SIX MONTHS AND ARE YOU GUARANTEED UNDER THIS PROGRAM TO MAKE A YIELD IF YOU HOLD THE BONDS THAT IS ABOVE THE THEN-PREVAILING RATE OF INFLATION? >> SO WHAT HAPPENS IS YOU ARE ABSOLUTELY GUARANTEED, AND WHAT'S SO GREAT IS THAT THE ONLY WAY A FINANCE PERSON CAN EVER USE THE WORD GUARANTEE SIDE USUALLY WITH A TREASURY INSTRUMENT BECAUSE IT'S GUARANTEED BY THE AUTHORITY OF THE UNITED STATES GOVERNMENT NO COMMISSIONS OR ANYTHING SO ONCE THEY DECLARE THAT RATE ON MAY 1st AND NOVEMBER 1st YOU ARE GUARANTEED FOR WHENEVER YOU BUY IT BETWEEN THOSE PERIODS, FOR SIX MONTHS YOU ARE GUARANTEE THE RATE THAT THEY DECLARED. AGAIN, THAT'S AN ANNUALIZED YIELD, SO IT'S ONLY REALLY GUARANTEED FOR SIX MONTHS UNTIL THEY RESET YOU KNOW, TYLER, I GAVE A MASTER CLASS ON THIS ON THE WOMEN AND MONEY PODCAST ON THE APRIL 17th EDITION OF IT. EVERYBODY SHOULD LISTEN TO IT BECAUSE IT TELLS YOU ALL THE INs AND OUTs, EVERYTHING YOU NEED TO KNOW THIS IS AN INVESTMENT. I'VE BEEN DOING THESE SINCE 2001 >> THIS DOES MAKE AN AWFUL LOT OF SENSE YOU EXPLAINED IT VERY WELL IN YOUR FIRST ANSWER IN TALKING ABOUT THE 9.6% RATE.

WE UNDERSTAND THAT THAT DOES CLEAR THE LEVEL OF INFLATION, BUT IF INFLATION IS SOMETHING LIKE 8.6%, AREN'T YOU MORE OR LESS JUST PROTECTING THE VALUE OF YOUR MONEY RATHER THAN REALLY GROWING IT EVEN IF INFLATION IS ONLY APERCENT LESS THAN WHAT YOU'RE MAKING. >> COURTNEY, YOU GOT THAT RIGHT, BUT DON'T YOU WANT IN MARKETS LIKE THIS TO HAVE A POSITION OF YOUR MONEY ABSOLUTELY RO TEKTED? WHERE ARE YOUGOING TO GO YOU CAN'T GO TO REGULAR BONDS, BECAUSE BONDS IF YOU ADOPTED IN BOND FUNDS FOR GROWTH, YOU'RE DOWN 10% OR 15%. YOU'RE DOWN SIGNIFICANTLY IN THE STOCK MARKET THERE HAS GOT TO BE A PORTION OF YOUR MONEY, WHATEVER THAT IS THAT YOU WANT PROTECTED, YOU WANT ESSENTIALLY IN CASH AT LEAST WHERE IT'S KEEPING UP WITH INFLATION WHICH IS EXACTLY WHAT THIS WILL DO VERSUS YOU'RE IN A MONEY MARKET ACCOUNT OR A CD OR WHATEVER IT IS AND YOU'RE GETTING 3% WHERE YOU'RE LOSING MONEY.

SO THIS IS A GREAT PLACE TO PUT YOUR — YOU MENTIONED AFTER FIVE YEARS, YOU MENTIONED 27 YEAR IS PUT FOR 30 YEARS >> I SEE, AND YOU CAN REDEEM THEM ANY TIME AFTER THE FIRST YEAR FROM THE YEAR TWO THROUGH FIVE THERE IS A THREE-MONTH INTEREST PENALTY AFTER THE FIFTH YEAR YOU CAN REDEEM ANY — YOU CAN REDEEM ANY TIME. >> WITHOUT ANY PEVNALTIES WHEN S EVER REALLY, ESSENTIALLY. SO YOU'RE IN THERE FOR A YEAR AND YOU REDEEM AFTER THAT, BIG DEAL. >> FINAL QUESTION WHICH COURTNEY TOUCHED ON AND THAT IS THAT THIS IS FOR A PORTION OF YOUR MONEY, IDEALLY MONEY YOU DON'T NEED TO TOUCH. IN SOME WAYS LIKE STOCKS, BUT YOU ACKNOWLEDGE THAT THERE IS WITH THIS KIND OF SAFETY MONEY AN OPPORTUNITY COST WHICH IS TO SAY IT'S NOT GOING TO BE YOUR GROWTH MONEY THE STOCK MARKET MIGHT RETURN YOU OVER THE FIVE YEARS OR THE TEN YEARS YOU HOLD THIS BOND MUCH MORE THAN 8%, 9%, A LITTLE ABOVE INFLATION, RIGHT YOUR GROWTH MONEY IS A DIFFERENT THING.

>> ABSOLUTELY. YOU HAVE GROWTH MONEY. YOU HAVE EMERGENCY SAVINGS ACCOUNT MONEY THAT WOULD NEVER GO INTO SOMETHING LIKE THIS BECAUSE YOU CAN'T AFFORD TO LOCK THAT UP FOR A YEAR, BUT YOU DO HAVE A PORTION OF YOUR MONEY THAT YOU WANT RIGHT NOW SAFE AND SOUTHBOUND BECAUSE EVERYBODY IS SO FREAKED, AND AT THESE INTEREST RATES, IF INFLATION CONTINUES THESE ARE A BIG WINNER BIG, BIG, BIG. >> WHAT'S THE PODCAST AGAIN, GO BACK.

Read More

THE WEALTH OF NATIONS | PART 2 (BY ADAM SMITH)

Jason 0 Comments Retire Wealthy

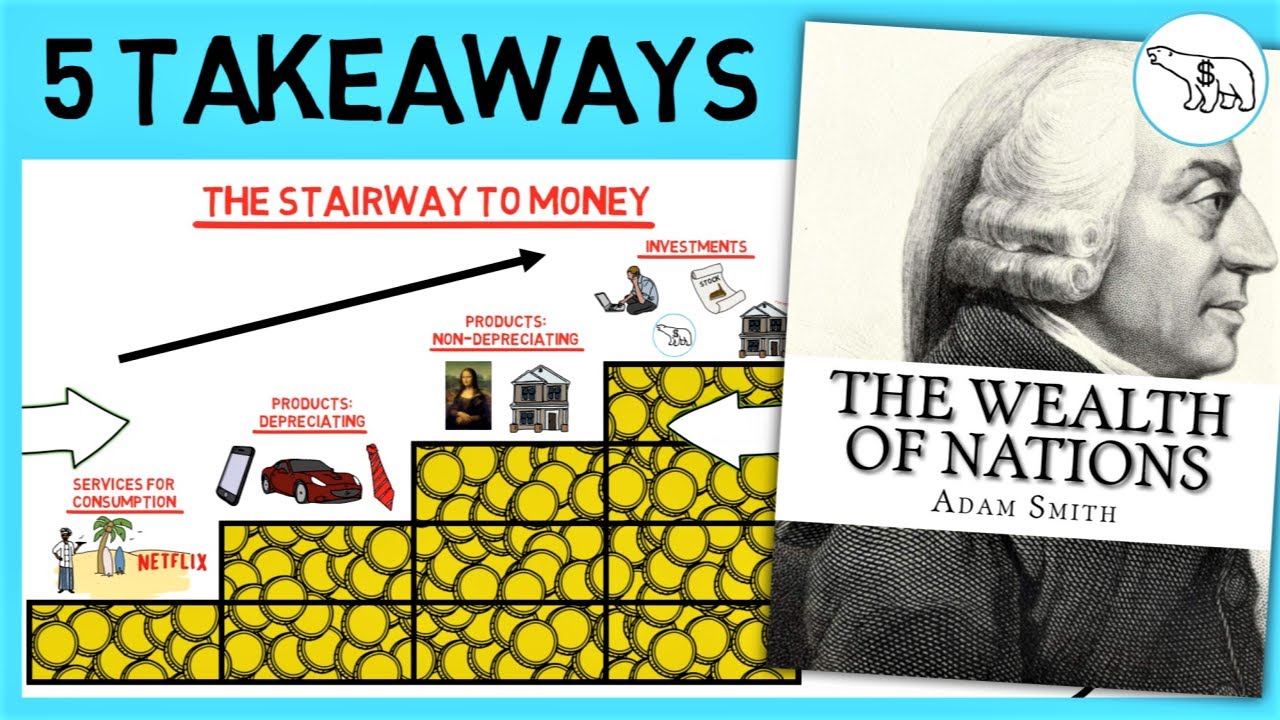

As promised, here is the second part of The Wealth of Nations, one of the most influential books ever written about economics If you haven't watched the first part yet I'd advise you to do that now, as some of the takeaways here build on those from the previous part Let's continue where we left last time … Takeaway number 6: Accumulation and employment of capital What's the similarity between Michael and a country like the US, China or Sweden? It is that they get wealthy in the same way Allow me to introduce The Swedish Investor's "Stairway to Money" All copyrighted and original content, of course Each different step represents a category that an individual can spend money on To become wealthy a person wants to spend money on the higher steps and not the lower ones At the bottom, we have services meant for consumption These are the worst things that you can spend your money on, as you'll consume them instantly Vacations, dinners and video on demand all belong to this category The next worst thing to direct your money towards is products meant for consumption Products depreciating value from the time of purchase, but at least they're not as bad as services because you will still be able to sell them at a later stage, even though it may only be at a fraction of their original value Cars, clothes and phones belong to this category Then we have products that do not depreciate in value and that often keep their value through inflation Important entries in this category are collectibles and a house to live in And at the top, we have investments This is a very broad category indeed, and anything which is expected to generate more cash in the future than the outlay of money is today, plus a reasonable return, belongs here Therefore – starting a business, educating yourself, investing in the stock market, or renting out properties all belong here It's the same with countries If a country buys services from another country, money flows right out from it without being replaced with something else that is valuable If a country buys products from another country, at least some of the value is still preserved as products can be sold again at a later stage It is similar with a third step in our Stairway to Money A country gets rich by increasing its own productivity by starting businesses there, by educating its people so that their skill and dexterity increases, or by buying productive assets from other countries BUT …

… and this is unimportant but Neither people nor nations should be afraid of having expenses just because of this Both people and nations, if they want to acquire wealth, should focus on what they are naturally good at and then outsource the rest This is what we shall focus on next Takeaway number 7: Globalization – the shortcut to increased wealth Here we have. Michael Lewis, a 32 years old engineer He's working at a job where he's paid a base monthly salary, but he's also compensated for overtime For overtime hours, he nets approximately $30 per hour Given this, here comes a few questions for you: Should michael cook his own food? Should michael clean his own house? And, sorry now i'm getting a bit silly just to prove a point here, should michael build his own phone instead of buying one from apple? From a wealth standpoint the answer is no to all of these questions It makes sense for Michael to do what he is best at, earning money from that and then hire other people to do what they are best at for everything else that he demands Perhaps Michael can cook his own food, but it takes him about an hour to prep a single meal, which means that he does so at a cost of $30, because he could have spent that time working as an engineer Therefore, it doesn't make sense for him to do it as he can just buy a meal outside for $15 Similarly, he can clean his own house, but it takes him 2 hours to do So that's $60 for Michael, while he can hire someone to do it for $40 And as an engineer, he is capable of building his own phone, but it might take him something like 200 hours plus $200 in materials That's a $6,200 phone! Why not just go buy the latest IPhone for $1,000? If it doesn't make sense to do something at 6 times the price it doesn't make sense to do so at 2 times the price, and probably not at 1.5 times the price either It is the same with nations For nations to increase their wealth, they should be focusing on the things that they are really good at, and then hire other nations to do what they are best at For example ..

The US is obviously a leader in many different businesses, but among others, in the fast food and entertainment industry China is incredible at producing most products at very low prices And in Sweden, we are quite good at producing furniture … … sorry, I mean at making everyone else produce furniture for themselves, of course Now, should Sweden try to produce the same products that China can produce much cheaper? No. Should China compete head-to-head with Hollywood? Probably not. Should the US have everyone produce furniture for themselves? Definitely not! All these countries can be more productive, and in that increase their wealth, by simply doing what they are best at, and then trade goods with each other Also, to make another comparison between individuals and countries in their quest for wealth: Both of them will earn more by having rich neighbors or acquaintances People know that if they want to be rich, they should move where other people are rich And probably even more importantly – they should acquire rich friends It's the same with nations A country should want their neighbors and trading partners to be wealthy, because eventually that wealth will spill over to them, too Just look at this map But we've been getting this backwards for centuries now In the 18th century, Great Britain and France, probably the two wealthiest countries in Europe at that time, did everything they could to make business miserable for each other instead of cooperating They even went to war with each other! Today, let's hope that the two most important economies of our time, the US and China, don't make that same mistake Takeaway number 8: Why free trade is superior, and why governments shouldn't interfere As we talked about in the previous video – in a capitalistic society, money will naturally flow where the returns are higher and disappear from where their returns are lower In a society where the government does not interfere, two rules will guide capital – Capital is naturally employed where it can produce the greatest returns This is actually a good thing, because businesses like these are more sustainable than anything else They will employ people where there is demand and a real competitive advantage – Capital is also naturally employed in the home market, as this comes with less risk This is also good, because it creates working opportunities in the own country For these two reasons, it is totally unproductive when governments interfere with the market Just as an imaginary example: Say that we, in Sweden, would do something as silly as setting up a ban on movies created in Hollywood What would happen when such a ban is introduced? Excluding potential retaliation, it will yield higher profits for the film industry in Sweden than what would naturally be the case Therefore, more capital will be incentivized to flow to this industry But this business still isn't competitive on a global scale.

Everywhere else than in Sweden, people will still watch movies from Hollywood! Moreover – the capital in Sweden which goes towards the creation of film is capital that could have been directed towards something where Sweden is competitive on a global scale, like the previously mentioned furniture Generally, politicians must have a small dose of God Complex if they think that they are smarter than the aggregated thinking of the market when it comes to capital allocation decisions in businesses There are two examples when it might be necessary to introduce duties, bans and tariffs though: – For goods that are important for the defense or survival of the country – And when a tax is imposed even on such domestically produced goods You don't want to shift the favor to the foreign goods, at the very least Apart from that, governments should probably stay away from using duties, bans and tariffs on foreign goods They should not incentivize certain industries or disincentivize others, because the market is likely to do this very well on its own, thanks to the before mention two There are a few areas where a government is absolutely necessary for the wealth of a nation though, and that is what we shall cover in the next takeaway Takeaway number 9: What is the purpose of a government? According to Adam Smith, there are some tasks in a society that the market and private people have little or no interest in solving The four that Smith discusses are: – The defense of a country – The justice system – Some type of infrastructure – And basic education The defense of a country is absolutely necessary for its wealth to increase Interestingly enough, a country is more and more likely to be invaded the richer it is Or so it was in the old days at least ..

Consider the raids of Genghis Khan and his Mongolian savages of the much wealthiest cities of China Or how the vikings invaded many much more established societies in Europe The savages actually had the advantage at this time, as they were much more skilled fighters But that all changed with the invention of the firearms Firearms were expensive to make, and no matter how skilled an army of spears and bows were, it couldn't beat one equipped with firearms And so, the odds changed in the favor of the wealthy nations, who could afford these supreme weapons Anyways … A nation must be able to defend itself to sustain its wealth And as this benefits everyone in a society, it does make sense that a government has the responsibility of this task Justice, is similarly an expense that benefits everyone in a society In the old days, justice was often exercised by those in power, but one can easily understand how such a system can be very corrupt It is essential that justice and power are separated.

Otherwise – who should bring justice to those in command? Similarly, a justice system that is based on profits tend to be very corrupt too, so it doesn't lend itself well to the free markets It used to be like this too, everyone that wanted justice had to bring a gift to the judges As you can probably imagine, the person who brought the greatest gift tended to get a little bit more "justice" than everyone else … So to speak. Therefore, the task of bringing justice to its people should be paid for by a government But those that use the justice system often should probably pay extra for that Infrastructure, such as the most important roads and docks used for commerce of a country, is something that benefits everyone too But it doesn't invite the same conflict of interest as the justice system does, and should thereby often be held privately Infrastructure should be financed with revenue from the commerce which can be carried by means of it. Because in this way, money will much more seldom be wasted on infrastructure projects Some infrastructure projects can be important without being profitable, but in that case they should often come with a local tax, not a national one Without some type of basic education being free and probably also mandatory, some of the country's inhabitants, those that are born into poverty, will most likely never learn how to read write or count Such inhabitants are unlikely to increase the productivity of a nation Therefore, we want to avoid that this happens A benefit such as learning to read, write and count benefits everyone and it should be one of the purposes of the government of making sure that this is done Takeaway number 10: How should a government be financed? So ..

With defense, justice, infrastructure and education, a publicly financed government seems to be the most fair and logical solution But there are many different options of financing something, and some are definitely better than others Here are 4 principles for creating good taxes: Equality Each person should contribute in proportion to his or her abilities and in proportion to the revenue which he earns under the protection of the state It is difficult to make sure that the wages, profits and rents (the three sources of income which we discussed in the previous video) are all taxed equally, but they should at the very least be taxed equally individually Certainty Time, quantity and manner of payment must always be clear This is probably the most important principle.

A little bit of uncertainty is worse than a great deal of inequality Uncertainty leads to the potential corruption of the tax gatherer Convenience Taxes should be due when the contributor is most likely to be able to pay The consumer pays whenever he consumes a service or product, and the wage earner should pay taxes as soon as he gets the wage, not at some other time when he might already have spent it all Efficiency A tax may never be more burdensome to the people than it is beneficial to the government For instance … – As few people as possible should be required for gathering the tax – A tax should never discourage industry – And the degree of visits and examinations of the people shouldn't make them feel oppressed With these 4 principles in mind, i'd like to ask you a question: Do you think that it is a good idea for a country to have a wealth tax? In other words, a tax which is in proportion to the total assets of private people. Please comment with your answer down below! Alright, that's it for Adam Smith's Wealth of Nations Here are two unusual recommendations for further watching from other channels: You can watch me doing the Navy Seal's screening test for eight hours, if you want to watch me in a lot of physical pain Or, you could watch this summary of 79 of my book summaries Cheers guys!

Read More

Maximizing your retirement contributions throughout your career

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

>>> IT IS NEVER TOO EARLY TO START PLANNING AND SAVING FOR RETIREMENT. HOW DO YOU KNOW IF YOU ARE ON THE RIGHT TRACK FOR YOUR FUTURE AND HOW SHOULD CONVERSATIONS EVOLVE AS YOU GET OLDER? JOIN US NOW TO EXPLAIN ALL OF THIS AND HOW TO MAXIMIZE YOUR SAVINGS IS CAMELIA ELLIOTT. THANK YOU SO MUCH FOR JOINING US . LET'S START RIGHT AFTER YOU GET YOUR FIRST REAL JOB AND YOU ARE IN YOUR 20s.

IF YOU LIKE YOU ARE NOT MAKING ENOUGH MONEY TO SEND ANYTHING ASIDE, BUT HOW SHOULD YOU BE INVESTING WHEN YOU ARE IN YOUR 20s? >> I KNOW THAT IT IS VERY DIFFICULT WHEN YOU'RE IN YOUR 20s AND TRANSITIONING FROM COLLEGE INTO SCHOOL. THE MOST IMPORTANT THING IS TO START EARLY. ONE THING YOU HAVE AS A BENEFIT IS CALLED COMPOUND INTEREST. IT CAN HELP YOU PREPARE FOR RETIREMENT MUCH EARLIER. IT WILL NOT FORCE YOU TO HAVE TO SAVE A LOT OF MONEY TOWARD THE END OF YOUR WORKING LIFE.

ONE OF THE MOST IMPORTANT THINGS IS TO ENROLL IN YOUR 401(K) PLAN. IF YOU NEED TO START SMALL, START SMALL. WHICH WE TYPICALLY RECOMMEND IS CONTRIBUTING THE EMPLOYER MATCH AND THE AVERAGE IS 4.5%. FOR THOSE WHO HAVE STUDENT LOANS, ONE OF THE GREAT THINGS BEEN OFFERED NOW IS IF YOU CANNOT CONTRIBUTE TO YOUR RETIREMENT PLAN, THEY COULD HELP YOU TO CONTRIBUTE MONEY TOWARD YOUR STUDENT LOAN. IT IS TAX-FREE MONEY TO HELP TO PAY DOWN STUDENT LOAN DEBT. THE LAST IS IT IS A GREAT TIME TO START A BUDGET AND GET ON THE RIGHT FOOT SAVING FOR RETIREMENT . ú>> I WISH THAT I TOOK THAT ADVICE IN MY 20s. LET'S TALK ABOUT LATER. IF YOU'RE IN YOUR 30s AND GOT RID OF YOUR CAR FROM COLLEGE AND ARE LOOKING TO SAVE FOR A HOUSE.

HOW DO YOU MODIFY YOUR CONTRIBUTIONS? >> AVOIDING LIFESTYLE CREEP IS ONE OF THE MAIN THINGS TO AVOID WHEN YOU'RE IN YOUR 30s. THINK ABOUT WHAT IS HAPPENING. YOU ARE BUYING A HOME AND HAVING CHILDREN. THERE'S SO MANY COMPETING PRIORITIES AT THAT TIME FOR YOU . ONE OF THE IMPORTANT THINGS TO DO IS CONTINUING TO SAVE. EVERY YEAR YOU MAKE MORE MONEY YOU COULD INCREASE YOUR CONTRIBUTIONS BY 1%. ALSO MAKING SURE THAT FAMILY MEANS DO NOT OVERSHADOW THE NEED TO SAVE FOR RETIREMENT. >> ONCE YOU SET IT UP AND THE MONEY COMES OUT, YOU DO NOT EVEN MISS IT. >> THANK YOU SO MUCH..

Read More

Rethink Retirement – well-being beyond your bank account | Clare Davenport | TEDxBYU

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

Transcriber: Annet Johnson

Reviewer: gaith Takrity Do you ever dream of retirement? What’s your retirement dream? Is it pure bliss and relaxation? Can you almost feel that warm wind? Taste those fruity umbrella drinks? Lounging by the pool, endless games of golf,

walking on the beach? I’ve always loved vacations, haven’t you? So I think we’re really going to love

this constant vacation space in retirement too, right? It actually reminds me of a couple I know. Let’s call them, “Jeff and Jenny.” They’ve dreamt of retirement for years. Jeff had worked at the same company

for over 30 years.

He knew everybody. He was the life of the place. And Jenny, she’d often worked two jobs

so they’d have enough. They finally did. They moved to sunny Florida, of course. But something strange started to happen. Jeff seemed lost, lonely. They started to nip at each other. They started to quarrel. And Jenny, although she was

beginning to make community, really didn’t like to golf. She’d never been that sporty. She missed her long-time book club.

She missed her best friends, her kids, her soon-to-be grandchild. What was going on? Had they not done everything right? They’d moved to sunny Florida. They’d worked with

a smart financial advisor. They’d saved enough. I ask you, if this is the dream vision

for retirement – You see it in the adverts. Why is it that so many are

dissatisfied at this age? Why is it that depression

increases by 40%? Why is it [that] substance abuse,

divorce rates are climbing? Why is everyone lonely? And people’s self-worth is low? Surely we can do better than this. Look, I’ve spent many years consulting and coaching and researching

the ideas, tools, and frameworks that best support us

during times of transition, like retirement. Look, I’m not here to tell you

whether you should or shouldn’t retire, because maybe you should

or maybe you shouldn’t. It is up to you to design and discover. But I do want to share with you

what I know about these life changes, these life quakes, these life disruptors so we don’t end up

in a situation like Jeff and Jenny. Look, we know that transitions

are a regular part of life.

They can be trying and triumphant. They can be predictable and unpredictable because life often

doesn’t follow a straight line. But my research and others’ shows us

that if we bring our intention and attention to them,

we can improve our well-being. And we can improve our well-being

in retirement too. I like to think of it as an ROI,

a return on investment. But this time for our well-being. Think of it as the “ROI”

beyond our bank account, an investment portfolio

in human flourishing, your flourishing in retirement. Where “R” is where we reframe

our current definition of retirement. “O” is where we optimize

the well-being in retirement. And “I” is where we ignite

our way forward. So let’s “ROI,” Reframe, Optimize,

and Ignite, your retirement. Let’s start with “R”: reframe. Let’s reframe your current

definition of retirement. Look, even the word retirement

sends shivers down my spine. I really don’t like that word much. And when I look up the word “retire”

in a thesaurus, I see the strangest words: retreat, remove, exit, my personal favorite, “go to bed.” And, although I get it – It is very, very tempting

to go to bed sometimes, it does imply that we are

fading from life when in fact these years can be

some of our best years, some of our most flourishing years.

So then, how did it start? Well, historically, we never

abruptly retired. We gently moved from one stage

to another in life. And then rumor has it, this gentleman – I think he looks a bit scary, actually, German Chancellor, Otto Van Bismarck,

in 1889, created this idea, this invention of retirement

when he put in place disability insurance for those over 70. This idea was radical. But other countries followed suit,

making retirement age between 65 and 70. But what’s interesting about

this time period of 1889 was the life expectancy

was less than 44 years. A far cry from our 80′ish years today. So to be clear, this definition

or invention of retirement is over 100 years old and we have almost doubled our lifespan. So surely, can we not all agree that

we need to reframe, rethink, redesign … our retirement definition? Next, let’s “O” of the ROI, let’s optimize. Let’s optimize our well-being

in retirement. And it’s here we can learn

from some great science and research. Edward Jones asked over 9,000 retirees, “What gives you fulfillment

in retirement?” Their answers: being authentic, spending

time with those they care for, they love, doing interesting things,

things that help them grow, and being generous, giving back.

Interestingly, money was

at the bottom of the list. And, look, we know that money can

bring us freedom and flexibility. But research consistently shows us

that above a base level, money is not the secret ingredient

to happiness in life or in retirement. It’s also interesting to examine

the disconnect between what retirees are thinking about – connection, contribution, community, and pre-retirees are thinking about, which is pretty much their bank accounts

and this vacation view of retirement.

And when we look at

this vacation view of retirement, we find that over time it becomes the norm and starts to lack the joy it once did. It’s probably why

Berkeley researchers found that we have a sugar rush

of well-being when we first retire and then a year or two later

a fairly sharp decline. Behavioral economists might call it

hedonic adaptation, where one more umbrella drink, one more golf game just loses its sparkle. We can also look into the world

of positive psychology as we continue to “O”, optimize. We can examine the science of

what makes for a good life, a happy life, a life better than fine. And it goes by the acronym, PERMAV. I like to think of it

as my well-being playbook where “P” is positive emotion,

feeling good, hopeful, inspired, loving. It’s like a micro moment of joy: a good laugh, a good meal. “E” is engagement. Having interests in pursuits that fully

captivate us and take us away: help us grow, our relationships, having loving and authentic relationships

with another, with groups, with communities.

“M” is meaning, that sense of purpose,

something beyond ourselves. “A” is accomplishment, having positive progress in life. And “V” is vitality, investing in our bodies, in our minds,

because they both matter and they work together. Look, these elements collectively

make up our well-being. They matter, they work together, and we have to bring our attention

and intention to them because they can change. So it’s super important

in retirement to focus on these. We can also learn from the

blue zones of the world, those zones where people

fully embrace the PERMAV elements. They live flourishing lives and they live

an extra 10 to 15 years than most of us. The word retirement doesn’t even exist. Take Marie, for example. She’s amazing. She's 101, has her own garden. walks over a mile a day,

volunteers five days a week, and spends a lot of time

with her great friends and her six great grandchildren. She is thriving. She is optimizing her retirement years. Next, “I” of the ROI. Let’s ignite our path forward. Let’s take action. Let’s explore ideas. Let's sneak up on the future. We know that life is not

a fixed destination but rather a continual design project.

There’s not one best option for us. There's many great options

for us in retirement. We also know to break down

our ideas and our actions. We break them down small, so we feel comfortable taking action. We have a conversation, we explore an idea, we learn something new, but in a safe way. So we take some action. We adjust and edit and we take a little more action

as we ignite our way forward. So in closing, I invite you, all of you, to have a conversation

about your retirement.

But maybe a little differently this time. It is never too early

and it’s never too late. Let’s create a retirement canvas full of the colors and

textures of well-being and ignited by our boundless

designs and imaginations, like Jeff and Jenny did. They moved back from Florida. They still vacation there sometimes. They bought a smaller condo,

two doors down from their best friend. Jeff decided to go back to work part-time, and he’s taking improv

classes twice a week. And Jenny, she’s enrolled

in doing a Masters in English and still loving her long-time book club. They are prioritizing their friends, their family, and their new grandchild. They are thriving. So … what about you? Let’s begin to ROI

your retirement chapter. Let’s start with “R”, refrain. What does retirement now mean to you? And what beliefs are

no longer serving you? “O”, optimize. Who and what will you prioritize and how will you use your many,

many strengths and skills? And how does this compare

with those you care for? And “I”, ignite. What is one small step

you could take today to better understand

your “retirement act,” knowing the best can be yet to come.

Thank you. (Applause).

Read More

Finance Cheat Code Only The Wealth Know 🤫 #shorts

Jason 0 Comments Retire Wealthy

this is a financial cheat code that the wealthy are not sharing with you and if you want to become rich you have to re-watch this video let's say you take out a loan which you don't have to pay any taxes on it the rich would use this debt to go and buy assets that appreciate your value they then use appreciated assets value as it grows to borrow even more money from the asset which is also tax-free and have the assets cash flow okay to the impassive income subscribe for more financial breakdowns.

Rethink Retirement – well-being beyond your bank account | Clare Davenport | TEDxBYU

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

Transcriber: Annet Johnson

Reviewer: gaith Takrity Do you ever dream of retirement? What’s your retirement dream? Is it pure bliss and relaxation? Can you almost feel that warm wind? Taste those fruity umbrella drinks? Lounging by the pool, endless games of golf,

walking on the beach? I’ve always loved vacations, haven’t you? So I think we’re really going to love

this constant vacation space in retirement too, right? It actually reminds me of a couple I know. Let’s call them, “Jeff and Jenny.” They’ve dreamt of retirement for years. Jeff had worked at the same company

for over 30 years. He knew everybody. He was the life of the place.

And Jenny, she’d often worked two jobs

so they’d have enough. They finally did. They moved to sunny Florida, of course. But something strange started to happen. Jeff seemed lost, lonely. They started to nip at each other. They started to quarrel. And Jenny, although she was

beginning to make community, really didn’t like to golf. She’d never been that sporty. She missed her long-time book club. She missed her best friends, her kids, her soon-to-be grandchild. What was going on? Had they not done everything right? They’d moved to sunny Florida. They’d worked with

a smart financial advisor. They’d saved enough. I ask you, if this is the dream vision

for retirement – You see it in the adverts.

Why is it that so many are

dissatisfied at this age? Why is it that depression

increases by 40%? Why is it [that] substance abuse,

divorce rates are climbing? Why is everyone lonely? And people’s self-worth is low? Surely we can do better than this. Look, I’ve spent many years consulting and coaching and researching

the ideas, tools, and frameworks that best support us

during times of transition, like retirement.

Look, I’m not here to tell you

whether you should or shouldn’t retire, because maybe you should

or maybe you shouldn’t. It is up to you to design and discover. But I do want to share with you

what I know about these life changes, these life quakes, these life disruptors so we don’t end up

in a situation like Jeff and Jenny. Look, we know that transitions

are a regular part of life. They can be trying and triumphant. They can be predictable and unpredictable because life often

doesn’t follow a straight line. But my research and others’ shows us

that if we bring our intention and attention to them,

we can improve our well-being.

And we can improve our well-being

in retirement too. I like to think of it as an ROI,

a return on investment. But this time for our well-being. Think of it as the “ROI”

beyond our bank account, an investment portfolio

in human flourishing, your flourishing in retirement. Where “R” is where we reframe

our current definition of retirement. “O” is where we optimize

the well-being in retirement. And “I” is where we ignite

our way forward. So let’s “ROI,” Reframe, Optimize,

and Ignite, your retirement. Let’s start with “R”: reframe. Let’s reframe your current

definition of retirement. Look, even the word retirement

sends shivers down my spine. I really don’t like that word much. And when I look up the word “retire”

in a thesaurus, I see the strangest words: retreat, remove, exit, my personal favorite, “go to bed.” And, although I get it – It is very, very tempting

to go to bed sometimes, it does imply that we are

fading from life when in fact these years can be

some of our best years, some of our most flourishing years. So then, how did it start? Well, historically, we never

abruptly retired.

We gently moved from one stage

to another in life. And then rumor has it, this gentleman – I think he looks a bit scary, actually, German Chancellor, Otto Van Bismarck,

in 1889, created this idea, this invention of retirement

when he put in place disability insurance for those over 70. This idea was radical. But other countries followed suit,

making retirement age between 65 and 70. But what’s interesting about

this time period of 1889 was the life expectancy

was less than 44 years. A far cry from our 80′ish years today. So to be clear, this definition

or invention of retirement is over 100 years old and we have almost doubled our lifespan. So surely, can we not all agree that

we need to reframe, rethink, redesign … our retirement definition? Next, let’s “O” of the ROI, let’s optimize. Let’s optimize our well-being

in retirement. And it’s here we can learn

from some great science and research. Edward Jones asked over 9,000 retirees, “What gives you fulfillment

in retirement?” Their answers: being authentic, spending

time with those they care for, they love, doing interesting things,

things that help them grow, and being generous, giving back. Interestingly, money was

at the bottom of the list.

And, look, we know that money can

bring us freedom and flexibility. But research consistently shows us

that above a base level, money is not the secret ingredient

to happiness in life or in retirement. It’s also interesting to examine

the disconnect between what retirees are thinking about – connection, contribution, community, and pre-retirees are thinking about, which is pretty much their bank accounts

and this vacation view of retirement. And when we look at

this vacation view of retirement, we find that over time it becomes the norm and starts to lack the joy it once did. It’s probably why

Berkeley researchers found that we have a sugar rush

of well-being when we first retire and then a year or two later

a fairly sharp decline. Behavioral economists might call it

hedonic adaptation, where one more umbrella drink, one more golf game just loses its sparkle. We can also look into the world

of positive psychology as we continue to “O”, optimize. We can examine the science of

what makes for a good life, a happy life, a life better than fine.

And it goes by the acronym, PERMAV. I like to think of it

as my well-being playbook where “P” is positive emotion,

feeling good, hopeful, inspired, loving. It’s like a micro moment of joy: a good laugh, a good meal. “E” is engagement. Having interests in pursuits that fully

captivate us and take us away: help us grow, our relationships, having loving and authentic relationships

with another, with groups, with communities. “M” is meaning, that sense of purpose,

something beyond ourselves. “A” is accomplishment, having positive progress in life. And “V” is vitality, investing in our bodies, in our minds,

because they both matter and they work together. Look, these elements collectively

make up our well-being. They matter, they work together, and we have to bring our attention

and intention to them because they can change. So it’s super important

in retirement to focus on these.

We can also learn from the

blue zones of the world, those zones where people

fully embrace the PERMAV elements. They live flourishing lives and they live

an extra 10 to 15 years than most of us. The word retirement doesn’t even exist. Take Marie, for example. She’s amazing. She's 101, has her own garden. walks over a mile a day,

volunteers five days a week, and spends a lot of time

with her great friends and her six great grandchildren. She is thriving. She is optimizing her retirement years. Next, “I” of the ROI. Let’s ignite our path forward. Let’s take action. Let’s explore ideas. Let's sneak up on the future. We know that life is not

a fixed destination but rather a continual design project.

There’s not one best option for us. There's many great options

for us in retirement. We also know to break down

our ideas and our actions. We break them down small, so we feel comfortable taking action. We have a conversation, we explore an idea, we learn something new, but in a safe way. So we take some action. We adjust and edit and we take a little more action

as we ignite our way forward. So in closing, I invite you, all of you, to have a conversation

about your retirement. But maybe a little differently this time. It is never too early

and it’s never too late. Let’s create a retirement canvas full of the colors and

textures of well-being and ignited by our boundless

designs and imaginations, like Jeff and Jenny did. They moved back from Florida. They still vacation there sometimes. They bought a smaller condo,

two doors down from their best friend. Jeff decided to go back to work part-time, and he’s taking improv

classes twice a week.

And Jenny, she’s enrolled

in doing a Masters in English and still loving her long-time book club. They are prioritizing their friends, their family, and their new grandchild. They are thriving. So … what about you? Let’s begin to ROI

your retirement chapter. Let’s start with “R”, refrain. What does retirement now mean to you? And what beliefs are

no longer serving you? “O”, optimize. Who and what will you prioritize and how will you use your many,

many strengths and skills? And how does this compare

with those you care for? And “I”, ignite.

What is one small step

you could take today to better understand

your “retirement act,” knowing the best can be yet to come. Thank you. (Applause).

Why You Shouldn’t Chase Money – Millionaire Mindset Wealth Principle #2 – Millionaire Mindset Ep. 4

Jason 0 Comments Retire Wealthy

– Millionaire attitude wide range principle second: Believe demands, not money. Please claim it together. Believe requirements not cash. If you chase after money, it'' s. really hard to obtain money. Chase requires. It ' s very easy to generate income. Believe needs, not cash. Below'' s a little fascinating cartoon. The hundred dollar bill having a conversation with a $1 bill. The hundred buck bill stated, “” You recognize, I had a great life. Wonderful house, fast cars and trucks, fantastic trips, and expensive dining establishments. The $1 costs said, “” All I ever did was to go to church, most likely to.

church, and most likely to church.”” A hundred buck expense.

What ' s a church. Make a lot more so you can offer much more, versus everyone placing a.

couple pair bucks the damn hat.What if you could make enough adequateCash you could donate give away even more cash the whole damn church together? Believe about it.

if I put effort right into it. Can I come to be a millionaire as well? I actually wish to become,.

no, a billionaire. She stated: Can I end up being a billionaire if I strive enough and put my initiative and strive for it? As well as right here'' s what she responded, she supplied some guidance: Change your focus far from what you desire, a billion bucks, and also.

obtain deeply, intensely curious concerning what the.

world wants as well as needs. Ask on your own what you have.

the prospective to supply that is so unique and also.

engaging as well as helpful that no computer can change you, nobody might outsource you, no one can take your product and make it much better and afterwards club you into.

oblivion, not actually, after that create that.

One thing. When you come to be a master.

of two globes say, engineering and also organization,.

you can bring them with each other in such a way that will certainly present hot ideas to every other, so they can have suggestion sex and make idea.

babies that no one else has actually seen prior to. And B,.

create a competitive advantage because you can move between the worlds, speak both languages, attach the people, mash the aspects to stimulate.

fresh, innovative understanding till you awaken with the.

revelation that transforms your life. The globe doesn'' t throw a.

billion dollars at a person since the individual desires.

The globe does not care. What'' s the word? The globe provides you money in exchange for something it views to be.

of equal or better value. Something that transforms.

an aspect of the culture, remodels a familiar tale.

or introduce a new one, alters the way people.

consider the category as well as use it in daily life.There '

s no road map,.

no blueprint for this. A whole lot of individuals will.

give you a great deal of guidance and the majority of it will certainly be bad.

as well as a great deal of it will be great as well as audio, yet you will.

need to figure out exactly how it doesn'' t put on you.

because you are coming from an unanticipated angle and.

you will be doing it alone up until to you develop the.

charisma and also reliability to bring in the skill you.

require to find with you. Have guts, you will certainly require it. As well as excellent luck, you will certainly require that also.”” A round of applause. (crowd claps) That'' s one smart spouse. That basically sums all of it. That just virtually – When I read that post, I'' m like, like– It is so good. It is like, wow. Like, charm! My benefits. Envision if that ' s just how clever the other half is, Elon Musk, my goodness. There'' s a claiming behind.

Love'' s the secret. – Legislation of tourist attraction, yes? Below'' s what

the.

make your reality.”” Right? You become what you assume about. That'' s what the legislation

of. attraction speak about. – [Male] I had a roommate.

that read this publication. – Yes. – [Male] And also she thought that you simply claimed to believe as well as not do anything.

– Yes. – [Guy] As well as advantages will certainly come for her. – Yes, you just need to think.

And also not have to do anything as well as excellent things will certainly come to you. – [Guy] That'' s exactly how she discusses it. – That'' s it. You see, the number of of you have. come across Believe and also Grow Rich? The amount of have not listened to. of Believe and also Grow Rich? Go read it.

– [Man] Okay.

– Okay, by Napoleon Hillside. Notification that the title, state it with each other– Think–.

Not visualize and expand rich. Not kick back as well as do.

Not hope and expand abundant. It'' s assume. That'' s not what the publication is around.

And also there'' s a fantastic publication that I likewise like, The Millionaire Fastlane by MJ DeMarco. And there'' s so many. Assuming alone never made.

anybody rich unless their assuming materializes itself.

right into constant activity. What are the two keywords? [target market together] -.

Consistent action.What are the 2 essential words? 2 word application of. Range develops millionaires,.

size develops millionaires. What is scale? Volume. Quantity. You intend to make millions? Market millions of something. Magnitude, deepness, transection size. Market a 2 million buck thing,.

five million dollar thing, 10 million dollar point. You can likewise be a millionaire. Scale and also magnitude together.

develops billionaires. You backtrack the resource.

of millionaire cash and you will discover numerous something. To make it straightforward and short, you intend to make.

It'' s very straightforward. You'' re not making the money that you want? Look at exactly how lots of people you'' re affecting.

you deliver in a marketplace.Tough to be a millionaire doing that, yes? As a business owner, if. you ' re giving a solution, you ' re only dealing with– Unless you have a great deal of. magnitude, bill a lot of cash, then it ' s difficult to be a millionaire. You believe in regards to you offer something, you sell to countless people. Yes, that ' s just how you arrive. Retrace the source of millionaire money as well as you'' ll locate millions of something. Fail to remember the legislation of tourist attraction,.

the law of love. The regulation of what? Affection. The amount of individuals do you influence states the more lives.

you influence in an entity that you regulate in range or in size, the richer you will end up being. The law of affection. See if you have something that are influencing numerous people. You can have a lack of confidence. You will make millions. Are there individuals making millions.

that'' s an absolute jerk.Anybody solution concern. Are there individuals making. millions they ' re the nicest people you have ever met? Money does not care. Money doesn'' t have a principles. It doesn'' t have an ethical. You'' re an evildoer, I'' m. not gon na let you'have me. Or you ' re

a great person, I ' m. gon na let you have some even more.

There are some of the nicest,. kindest individuals that I understand, entirely broke. There are also individuals.

It'' s nothing to do with each other, mmkay? Prior to I go right into that, take 2 mins. The first one, as well as the.

Go.

( Calle Ocho)”” by Pitbull Shake their hand and also say.

“” thanks for sharing”” please. (Audience murmuring) So show me, simply shout out the answer a-ha minutes, what it indicates to you simply the very first 2 concepts. What it suggests for you.

[Man] I think for me, comprehending that money is a circulation- – Blood circulation [Guy] – It'' s like flow. It helps with my financial investment purchasing, say the only.

way I'' m mosting likely to generate income is if I offer it, as well as, yeah, that'' s just exactly how I recognize it.- Sometimes you assume.

concerning it with economic situation what causes economic situation recession,.

it'' s a lack of -what? A lack of circulation. You.

hear it from the government. If you wish to help the.

economic climate from the U.S. You intend to assist the economic situation,.

Currently am I saying you wear'' t. desire to save any cash? You got ta go through that stage. When you save enough, you want to spend, you want to increase, yet.

you got ta master making it. You'' re efficient it. Perhaps for some of you it'' s tough to think. Making it is actually pretty damn very easy. If you'' re really great- simply take my word, making it.

You'' re. Money comes.

Way, method harder. Go to the mike guy,.

Give Earl a round of applause. (audience applauds) Give like a one min version of it- what the heck occurred. – Hi Earl.

you desire the longer variation, I'' m doing a longer variation on the 23rd.

I inform the story of exactly how.

I made a number of money so I made a 40 million dollar realm. And afterwards I screwed up and also I lost it all. 2008 struck me even more than it.

And also really, it'' s amusing. One of those things you talked concerning- number 3, right, not worthy- it'' s amusing, I sent you an email.

as well as I was in that stage not feeling, not worthwhile- right, I mean I made a million dollars, it'' s very easy to do. In fact the funny point.

is, Dan picked me up. He stated, you don'' t have. to strike a particular level to deal with me once again. It wasn'' t a question of merit. You'' re my friend, I wish to.

assist you anyway, let'' s do this. As well as, the amusing point is.

when I ultimately chose to leave my butt, 60 days, 6 figures. Six months, 7 numbers. I report back to Dan each week.

“” hey this is what I'' m doing” and the initial pair updates were attractive, “” hey check out this, appearance.

at this, look at this”” the last pair updates, not.

You can make it. Making it is stupid simple.

as well as I'' m making a lot more sales now than I was when I was marketing. So, the sales and also advertising and marketing.

fuction? Yeah, 100 percent. But keeping it is a bitch. – [Dan] I such as that quote, “” Making it is very easy,.

maintaining it is a bitch.”” that'' s truly, you ' re writing. this down? That ' s great. [Audience Praises] Place that on Facebook. I.

like that. Tweet that. – [Announcer] Ten times your financial resources. Ten times your organization. Ten times your advertising. Ten times your life. Hit the subscribe switch now.

Recent Comments