Tag: stock market

This Is How To Become A Millionaire: Index Fund Investing for Beginners

Jason 0 Comments Retire Wealthy Retirement Planning

hi guys it's mark so did you know if you save two hundred dollars per month at an eight percent annual return then in 45 years you would have over wait for it one million dollars to be honest when someone first explained this was possible by investing in index funds i hardly understood a word they were saying it was like they would speak in a different language today i thought it was about time that i made the video that i wish i'd seen when i was younger and explain everything step by step and because i like people that actually practice what they preach i'm gonna be investing ten thousand dollars of my own money during this video so you can see exactly how it's done just a quick disclaimer though i'm not a financial advisor i'm a businessman and this is just some of the real life strategies that have worked for me personally i always thought of index funds as my backup plan if my businesses hadn't been successful then i would have become a millionaire anyway through these investments just remember if you like the video then smash the like button as it really helps push this video out to more people and also consider subscribing if you want to grow your wealth part one uncovering the lies so let's cut to the chase you've been put a major disadvantage people have been telling you lies about investing all of your life for instance at school when i was growing up i remember asking my teachers about investing and they always said it's just for rich people as they can afford to hire professionals to do it for them for the longest time i believed investing wasn't for me because i wasn't a pro and i didn't have much money and i thought i wouldn't stand a chance then we got friends one of mine said i'd have to look at all the financial newspapers learn how to read the charts and according to him it just wasn't worth my time and on top of this every time i mentioned investing to my family they seemed so scared because they thought it's the most risky thing in the world and not for normal people my dad even said if i started investing i'd lose all my money can you believe that these lies are exactly what the experts want you to believe as they know that index fund investing is extremely easy to do you don't need much money to start the risks are pretty low and on average it will make you more money in the long term the dark truth is that the average actively managed fund returns two percent less a year than the market in general this means that professionals on average are doing worse than index funds and even if they end up losing you money they still charge you fees no matter what now according to my favorite film the matrix you have now taken the red pill and you've woken up to the truth it's now time to move on to part two understanding the game i know when i first started investing i felt like i was going to make so many mistakes but once you understand their language it all becomes so much easier and that's what we're going to be talking about in this part so i've been banging on about index funds in many of my videos so i think it's about time i explained what they are and why they're so cool i'm a big football fan and if you have ever followed any sports you'll be familiar with a league table like this the better your team performs the higher up they'll be on the list but on the other hand if they do really badly they might be removed from the league entirely this is almost exactly the same as an index all you have to do is switch out the teams for companies let's take the s p 500 for example this is a list of the 500 best performing public companies in the usa the big dogs being amazon google apple and more recently tesla and just like a league table if a company doesn't perform well they're at risk of being removed from the list hasta la vista baby the idea of an index fund is to be a little bit sneaky as it allows you to invest in every single company on the list with just one click it's a bit like a friend of mine who picks a different football team each year he just wants to pick the winner every time so investing in index funds means that even if a few companies do terribly then it's balanced out by the companies that are doing extremely well the average return on the s p 500 over the last 10 years has been 13.6 now that is higher than usual but get this no one has ever lost any money if they've bought and held an s p 500 index fund for more than 20 years so if this is so foolproof then why do people still buy individual stocks well personally i like to do this just for a bit of fun i also think that some companies are currently working on awesome technology for the future but aren't making a lot of money at the moment so they won't make the cut into the popular index funds so now and again i like to invest some extra money into these up and coming companies so i don't miss out and that reminds me we bought currently giving away four free individual stocks if you want to pick them up i'll leave the link in the description and for everyone that's outside of the usa or china i'll leave a link where you can claim a free stock with trade in 212.

Hey that's pretty good you'll often hear people throwing around the terms roth ira in the usa stocks and shares isa in the uk tfsa in canada and supers in australia but what does it all mean well these are types of accounts that allow you to earn profits on your investments and you don't have to pay any taxes on them but they generally have limits because they're just so powerful these are kind of like captain america shield so let me explain if captain america just sat at home with his shield then he wouldn't ever get anything done but when he takes that shield into battle he has an advantage so these accounts are like your shield make sure to use them when you're investing a way you can do this is by using the money inside your shielded account to invest into index funds and all the profits will be yours because the government won't take a cut one of my biggest questions when i first started was should i invest all my money at the same time or do it gradually now this is something lots of investors argue about so i'm going to give you my view on things remember later i'm going to be investing this 10 000 in full so that kind of gives you an idea of what i believe investing all your money as a lump sum is certainly more risky however if i'm investing in something i know will increase over time like an s p 500 index fund then there is no point waiting the longer you wait the worse off on average you'll be however if you don't have the cash i wouldn't wait to save up the money i would just invest what i could every month as sometimes you're going to buy when the stocks high other times you're going to buy when the stock's low but overall this is going to balance out and this is known as dollar cost averaging when you log on to an investing website or app you'll see that there is something called etfs which are very similar to index funds and a lot of people get them confused both allow you to invest into a basket of stocks however the easy way to remember the difference is just to think of what etf stands for exchange traded fund if we break that down simply it just means that it can be traded on the stock market throughout the day whereas an index fund can only be bought and sold for a price that is set at the end of each trading day but let's cut to the chase you probably want to know which one's better on average if you're starting with little money then etfs may be a better option as they have lower minimum investment thresholds and many brokers don't charge a trading commission now if you're still watching this and you're younger than 18 then i am really impressed that you've been listening to a boomer like me for so long but seriously not many people learn this at such a young age as they don't teach it at school a way you can start investing under 18 is to open up a custodial account in the usa or a junior stocks and shares iso in the uk set up these accounts you just need to ask your parents the real secret ingredient to this millionaire formula is time and when you're younger you have so much of it that's because every year as you keep adding to your investments the interest starts to compound and grow at a rapid pace it's a snowball effect once you reach a certain tipping point the interest you're making is much more than the amount you're investing on a monthly basis it's a bit like when you see someone take ages to get to a hundred thousand subscribers on youtube and then within a few months they managed to hit the big million the sooner you get started the better as time will be on your side now i want to clear something up when people talk about index funds you will hear s p 500 again and again people just love it as i mentioned before this is a top 500 public companies in the usa but the cool thing is you don't actually have to be in the usa to invest in this i'm in the uk and it's one of my favorite investments i just love to think that i own a small part of all the biggest companies in the usa part three mastering the strategy so lots of people will teach you what to do but they won't actually say how to do it so i'm going to walk you through everything right now while i invest my own ten thousand dollars the first thing to really do is to work out your goals let's say you want to become a millionaire that was one of my goals i just had to work out how much i would actually need to invest per month to achieve this i love using these compound interest calculators you can find them online easily yourself if you want to have a go at this so if you're able to invest 250 dollars per month with an 8 annual return over 42 years you'll have over a million dollars in your account now if you're able to invest that for another 10 years you'll have over 2 million in your account of course if you wanted to invest even more then you're just going to speed up the whole process the next thing we need to do is pick the brokerage website we're using to set up our account and invest the ones that i love are charles swab fidelity and vanguard i call these the big three the founder of vanguard john bogle is often referred to as the father of index fund investing and if you think i'm a boomer he was even older than me his vanguard group gave birth to index funds so they're the oldest and most trusted let's jump onto their website to see what they have to offer so to get onto their full list of funds just go up to invest in and click on vanguard mutual funds at this point i'm going to have to ask you to strap in and brace yourself because if you haven't seen this page before it can look extremely overwhelming but in a minute you'll be able to impress all your friends when you know exactly how to read it see what i mean there are just so many options the main things to focus on are the expense ratio which is how much they're going to charge you per year you obviously want to keep these as low as possible and luckily with vanguard fees these are very low anyway the other thing to look at is the average returns and they break these down nicely on the right hand side of the screen but of course it's always good to remember that past performance doesn't always mean future returns my wife's a bit like vanguard she likes everything in order and nothing out of place so they have arranged all of their funds into different categories so everything is easy to find category one is bonds these are a type of contract that companies and governments sell when they need extra money if you invest in these they promise to pay you back in the future these are often seen as pretty low risk but also pretty low returns therefore the older you are the more bonds you should have in your portfolio number two is balance funds the idea of these is to pick the age at which you wish to retire and they'll do all the rest of the work for you and find the right mix of index funds as you can see these go up in five year intervals and you can pick whichever suits your plans best this could be a good option if you wanted to invest without thinking about it too much but personally i always prefer manually investing it's a bit like driving an automatic car that does all the work for you it just isn't as much fun as a stick shift number three is company location and size known as small medium and large cap here you can find v fix which tracks our old friend the s p 500 this little s means it's one of vanguard selected funds which they recommend if you click on it you're able to see exactly what companies you would be investing in and also the risk level vt sacs is another good one which is a total stock market index fund which has over 3586 different stocks this allows you to invest in the entire usa stock market in one click there is a minimum investment of three thousand dollars again but as before there's also an etf version with no minimum called vti then you have international stocks quite a cool one is emerging markets which invest in companies based in china taiwan india and many more but as you can see this is a five on the risk scale so i wouldn't personally invest a lot of money into this fund because look at me i'm a bit old to be taking too many risk and i need to sleep at night number four the last category is sector based so if you have a particular interest in energy healthcare or real estate you can invest into these sectors and there are also a lot more options for sector investing in the etf so now we've broken down what's on offer hopefully it all looks a bit more understandable now for the moment you've all been waiting for it's time to invest my ten thousand dollars i could split this between lots of different funds but personally i like to invest the majority of my money into american companies i would say probably about seventy percent american 20 in other countries including the uk and ten percent in some bonds i like to keep the bonds quite low as i don't mind this little extra bit of risk because i'm only 53 and i have a bit of time before i've got to rebalance my portfolio to secure my investments but that's a personal choice depending on your risk tolerance the funds that are available are different in every country but the indexes they track are very similar so you may need to invest in a different fund to me but obviously you can still use my percentages as a guide so i'm going to use the uk vanguard site to invest 5k straight into this etf that tracks the s p 500 so here we go all done two thousand dollars is going into an index fund that tracks the total american stock market so again we go on the screen click so far that's 70 invested in the biggest economy in the world which of course is the usa now i like to balance this out by investing in a different economy as i live back in my own country i'm going to be putting 2k into the ftse 100 index fund so looking good all done great now i've invested 90 of my 10k and i'd like a bit of security let's just put the remaining 1k into a global bonds index fund and let's just do that so just like that i've invested in the usa companies like apple amazon tesla and google i own a small piece of the biggest companies in the uk like hsbc bp and unilever and i have some bonds to balance out my portfolio it really is as easy as that so i'm going to leave the next video up here but don't click on it just yet remember to subscribe to the channel if you want to grow your wealth ring that notification bell and smash that like button okay i'll see you on the other side

Read More

Personal finance expert Suze Orman’s number one investment right now

Jason 0 Comments Retire Wealthy Retirement Planning

SO THERE YOU SEE SUPPLY AND DEMAND AT WORK WITH INFLATION AT A HISTORIC HIGHS IN THE STOCK MARKET CHOPPY, OUR NEXT GUEST SAYS THE NUMBER ONE INVESTMENT RIGHT NOW IS I-BONDS HERE TO EXPLAIN IS A PERSONAL FINANCE POWER PLAYER AND OUR DEAR FRIEND SUZE ORMAN HOST OF THE WOMEN AND MONEY PODCAST. SHE IS ALSO CO-FOUNDER OF THE EMERGENCY SAVINGS FIRM SECURE SAVE SUZE, IT IS ALWAYS GREAT TO SEE YOU. WELCOME. GOOD TO HAVE YOU BACK WITH US. LET'S TALK ABOUT THE I-BONDS WHICH I DIDN'T EVEN KNOW ABOUT, BUTMY NEPHEW-IN-LAW SAID YOU HAVE TO GET THESE I-BONDS. EXPLAIN TO ME WHAT THEY ARE, HOW THEY WORK, HOW I BUY THEM AND FROM WHOM.

>> NOW SO YOU BUY THEM FROM THE TREASURY, DIRECTLY FROM THEM SO YOU GO FROM TREASURYDIRECT.GOV IT IS THE ONLY PLACE THAT YOU CAN BUY THEM, NUMBER ONE THEY RANGE IN PRICE. YOU CAN INVEST FROM $25 ALL OF THE WAY UP TO A MAXIMUM PER PERSON OF $10,000, ALTHOUGH THERE ARE WAYS TO DO IT WHERE YOU CAN PUT IN UP TO 30,000 IF YOU HAVE A TRUST AND/OR A BUSINESS WHEN YOU INVEST IN AN I-BOND, I STANDS FOR INFLATION, YOU HAVE GOT TO MAKE SURE THAT FOR ONE YEAR YOU DO NOT NEED YOUR MONEY AND THE REASON IS FROM THE TIME YOU PUT IT IN TO ONE YEAR YOU CANNOT TOUCH IT.

FROM YEAR TWO TO FIVE THERE IS ONLY A THREE-MONTH INTEREST PENALTY. THAT IS HOW THEY WORK. THEY ARE ATTACHED TO CPI SO RIGHT NOW WHEN THEY ANNOUNCED IN MAY, THE CPI THE YIELD ON THE SERIES I BONDS WERE GUARANTEED AND ANNUALIZED AND IT'S GUARANTEED TO YOU SO THEY CHANGE EVERY SIX MONTHS THE INTEREST RATE CHANGES EVERY MAY AND NOVEMBER SO FROM MAY UNTIL NOVEMBER EVERYBODY WHO BUYS ONE RIGHT NOW WILL BE GUARANTEED AN ANNUALIZED YIELD OF 9.62% STATE INCOME TAX-FREE OBVIOUSLY YOU'RE ONLY GOING TO GET THAT FOR SIX MONTH, BUT THAT'S STILL 4.81% ON YOUR MONEY. WHEN THEY RESET COME NOVEMBER, LET'S SAY THEY RESET EVEN LOWER. LET'S SAY THEY RESET AT 7.11 WHICH IS WHAT THEY WERE PAYING BEFORE THEY RAISED TO 9.62, YOU ARE GUARANTEED THAT FOR THE NEXT SIX MONTHS ON AN ANNUALIZED YIELD SO THAT'S, LIKE, 3.56%, HALF OF THAT FOR SIX MONTH BECAUSE THAT'S WHAT YOU'RE GUARANTEED SO FOR THE YEAR IT'S 8.37% THAT'S ESSENTIALLY HOW THEY WORK THEY'RE FABULOUS THEIR MATURITIES ARE FOR — GO ON >> I DON'T MEAN TO INTERRUPT YOU, BUT I WANTED TO ASK YOU THOSE NUMBERS THAT YOU JUST — AND I GET IT, YOU EXPLAINED IT PERFECTLY.

THEY RESET EVERY SIX MONTHS AND ARE YOU GUARANTEED UNDER THIS PROGRAM TO MAKE A YIELD IF YOU HOLD THE BONDS THAT IS ABOVE THE THEN-PREVAILING RATE OF INFLATION? >> SO WHAT HAPPENS IS YOU ARE ABSOLUTELY GUARANTEED, AND WHAT'S SO GREAT IS THAT THE ONLY WAY A FINANCE PERSON CAN EVER USE THE WORD GUARANTEE SIDE USUALLY WITH A TREASURY INSTRUMENT BECAUSE IT'S GUARANTEED BY THE AUTHORITY OF THE UNITED STATES GOVERNMENT NO COMMISSIONS OR ANYTHING SO ONCE THEY DECLARE THAT RATE ON MAY 1st AND NOVEMBER 1st YOU ARE GUARANTEED FOR WHENEVER YOU BUY IT BETWEEN THOSE PERIODS, FOR SIX MONTHS YOU ARE GUARANTEE THE RATE THAT THEY DECLARED.

AGAIN, THAT'S AN ANNUALIZED YIELD, SO IT'S ONLY REALLY GUARANTEED FOR SIX MONTHS UNTIL THEY RESET YOU KNOW, TYLER, I GAVE A MASTER CLASS ON THIS ON THE WOMEN AND MONEY PODCAST ON THE APRIL 17th EDITION OF IT. EVERYBODY SHOULD LISTEN TO IT BECAUSE IT TELLS YOU ALL THE INs AND OUTs, EVERYTHING YOU NEED TO KNOW THIS IS AN INVESTMENT. I'VE BEEN DOING THESE SINCE 2001 >> THIS DOES MAKE AN AWFUL LOT OF SENSE YOU EXPLAINED IT VERY WELL IN YOUR FIRST ANSWER IN TALKING ABOUT THE 9.6% RATE. WE UNDERSTAND THAT THAT DOES CLEAR THE LEVEL OF INFLATION, BUT IF INFLATION IS SOMETHING LIKE 8.6%, AREN'T YOU MORE OR LESS JUST PROTECTING THE VALUE OF YOUR MONEY RATHER THAN REALLY GROWING IT EVEN IF INFLATION IS ONLY APERCENT LESS THAN WHAT YOU'RE MAKING. >> COURTNEY, YOU GOT THAT RIGHT, BUT DON'T YOU WANT IN MARKETS LIKE THIS TO HAVE A POSITION OF YOUR MONEY ABSOLUTELY RO TEKTED? WHERE ARE YOUGOING TO GO YOU CAN'T GO TO REGULAR BONDS, BECAUSE BONDS IF YOU ADOPTED IN BOND FUNDS FOR GROWTH, YOU'RE DOWN 10% OR 15%.

YOU'RE DOWN SIGNIFICANTLY IN THE STOCK MARKET THERE HAS GOT TO BE A PORTION OF YOUR MONEY, WHATEVER THAT IS THAT YOU WANT PROTECTED, YOU WANT ESSENTIALLY IN CASH AT LEAST WHERE IT'S KEEPING UP WITH INFLATION WHICH IS EXACTLY WHAT THIS WILL DO VERSUS YOU'RE IN A MONEY MARKET ACCOUNT OR A CD OR WHATEVER IT IS AND YOU'RE GETTING 3% WHERE YOU'RE LOSING MONEY. SO THIS IS A GREAT PLACE TO PUT YOUR — YOU MENTIONED AFTER FIVE YEARS, YOU MENTIONED 27 YEAR IS PUT FOR 30 YEARS >> I SEE, AND YOU CAN REDEEM THEM ANY TIME AFTER THE FIRST YEAR FROM THE YEAR TWO THROUGH FIVE THERE IS A THREE-MONTH INTEREST PENALTY AFTER THE FIFTH YEAR YOU CAN REDEEM ANY — YOU CAN REDEEM ANY TIME.

>> WITHOUT ANY PEVNALTIES WHEN S EVER REALLY, ESSENTIALLY. SO YOU'RE IN THERE FOR A YEAR AND YOU REDEEM AFTER THAT, BIG DEAL. >> FINAL QUESTION WHICH COURTNEY TOUCHED ON AND THAT IS THAT THIS IS FOR A PORTION OF YOUR MONEY, IDEALLY MONEY YOU DON'T NEED TO TOUCH. IN SOME WAYS LIKE STOCKS, BUT YOU ACKNOWLEDGE THAT THERE IS WITH THIS KIND OF SAFETY MONEY AN OPPORTUNITY COST WHICH IS TO SAY IT'S NOT GOING TO BE YOUR GROWTH MONEY THE STOCK MARKET MIGHT RETURN YOU OVER THE FIVE YEARS OR THE TEN YEARS YOU HOLD THIS BOND MUCH MORE THAN 8%, 9%, A LITTLE ABOVE INFLATION, RIGHT YOUR GROWTH MONEY IS A DIFFERENT THING.

>> ABSOLUTELY. YOU HAVE GROWTH MONEY. YOU HAVE EMERGENCY SAVINGS ACCOUNT MONEY THAT WOULD NEVER GO INTO SOMETHING LIKE THIS BECAUSE YOU CAN'T AFFORD TO LOCK THAT UP FOR A YEAR, BUT YOU DO HAVE A PORTION OF YOUR MONEY THAT YOU WANT RIGHT NOW SAFE AND SOUTHBOUND BECAUSE EVERYBODY IS SO FREAKED, AND AT THESE INTEREST RATES, IF INFLATION CONTINUES THESE ARE A BIG WINNER BIG, BIG, BIG. >> WHAT'S THE PODCAST AGAIN, GO BACK.

Read More

Buffett on retirement

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

FOR PEOPLE RIGHT NOW WHEN IT COMES TO SAVING . >> I THINK IT'S THE SAME THING THAT MAKES MOST SENSE FRANKLY ALL OF THE TIME, AND THAT IS TO CONSISTENTLY BUY AN S&P 500 LOW COST INDEX FUND. KEEP BUYING IT THROUGH THICK AND THIN, AND ESPECIALLY THROUGH THIN. BECAUSE THE TEMPTATIONS GET — WHEN YOU SEE BAD HEADLINES IN NEWSPAPERS, MAYBE TO SAY WELL MAYBE I SHOULD SKIP A YEAR OR SOMETHING.

JUST KEEP BUYING. AMERICAN BUSINESS IS GOING TO DO FINE OVER TIME. SO YOU KNOW THE INVESTMENT UNIVERSE IS GOING TO DO VERY WELL. THE DOW JONES INDUSTRIAL AVERAGE WENT FROM 66 1,497 IN ONE CENTURY, AND SINCE THAT CENTURY HAS ENDED, IT'S MORE OR LESS DOUBLED AGAIN. AMERICAN BUSINESS IS G. THE TRICK IS NOT TO PICK THE RIGHT COMPANY, IT'S TO BE — BECAUSE MOST PEOPLE AREN'T EQUIPPED TO DO THAT. AND PLENTY OF TIMES I MAKE MISTAKES. THE TRICK IS TO ESSENTIALLY BUY ALL THE BIG COMPANIES THROUGH THE SFUND AND TO DO IT CONSISTENTLY, AND TO DO IT IN A VERY, VERY LOW COST WAY. BECAUSE COSTS REALLY MATTER. AND INVESTMENTS, IF RETURNS ARE GOING TO BE 7% OR 8% AND YOU ARE PAYING 1% THROUGH FEES, THAT MAKES AN ENORMOUS DIFFERENCE IN HOW MUCH MONEY YOU HAVE ON RETIREMENT.

>> AT THE ANNUAL MEETING FOR BERKSHIRE HATHAWAY THIS YEAR, YOU INTRODUCED A SPECIAL GUEST TO THE AUDIENCE OF 40,000 SHAREHOLDERS WHO WERE WATCHING. IT WAS JACK VOGEL. WHY DID YOU WANT TO RECOGNIZE JACK VOGEL? >> I THINK JACK VOGEL HAS DONE MORE FOR AMERICAN INVESTORS THAN ANY OTHER PERSON CONNECTED WITH WALL STREET OR T BECAUSE WITH A NUMBER OF OTHER PEOPLE WE CAME UP WITH THE IDEA, HE WASN'T THE SOLE THINKER BEHIND IT BUT HE WAS THE GUY WHO IMPLEMENTED IT AND CRUSADED FOR NOW TRILLIONS OF DOLLARS IN LOW COST INDEX FUNDS. MOST PEOPLE ARE GOING TO HAVE BETTER LIVES, BETTER RETIREMENTS, THEIR KIDS ARE

Read More

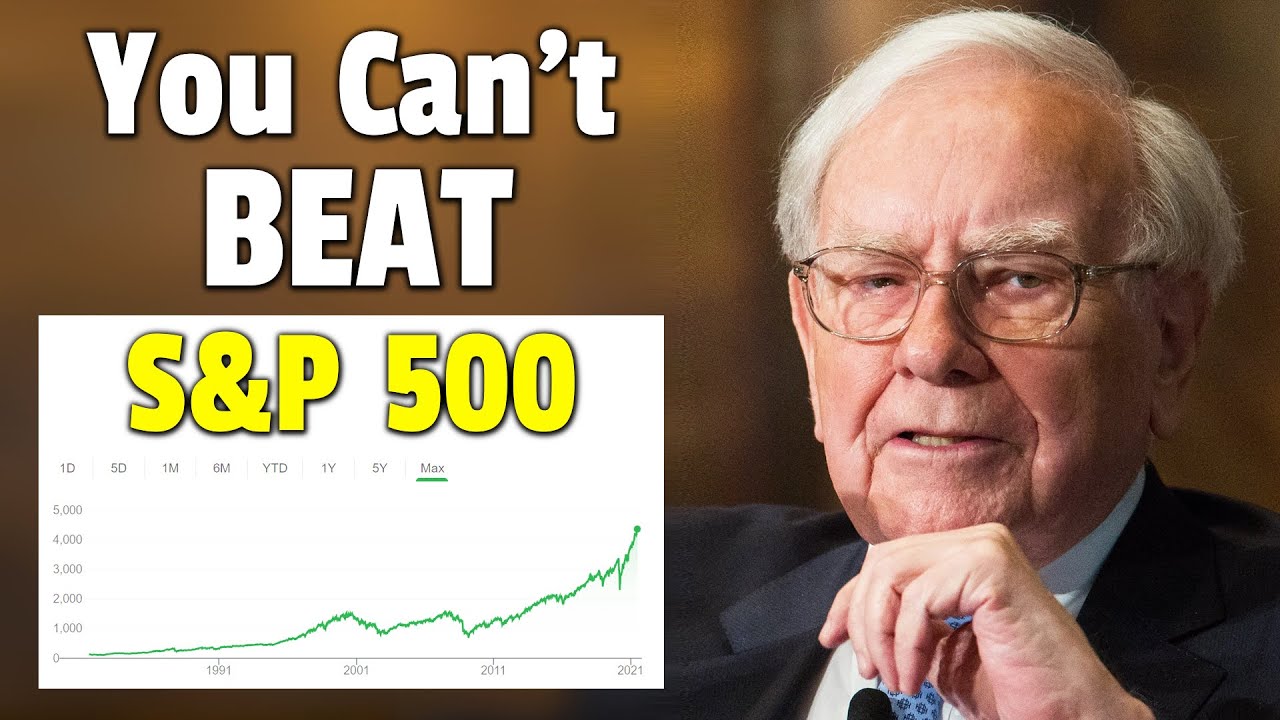

Warren Buffett: Why Most People Should Invest In S&P 500 Index

Jason 0 Comments Retire Wealthy Retirement Planning

why have you advised your wife to invest in index funds after your death rather than berkshire hathaway i believe munger has cancelled his offspring to quote not be so dumb as to sell she she won't be she won't be selling any berkshire to buy the index funds all all of my berkshire every single share will go to philanthropy so that i don't even regard myself as owning berkshire you know basically it's it's committed and i've i so far about 40 percent has already been distributed so the question is somebody who is not an investment professional will be i hope reasonably elderly by the time that the uh estate gets settled and what is the best investment meaning one that there would be less worry of any kind connected with and less people coming around and saying why don't you sell this and do something else and all those things she's going to have more money than she needs and the big thing then you want is money not to be a problem and there will be no way that if she holds the s p of virtually no way absent something happened with weapons of mass destruction but virtually no way that she will shall have all the money that she possibly can use to have a little liquid money so that if stocks are down tremendously at some point they close the stock exchange for a while anything like that she'll still feel that she's got plenty of money and the object is not to maximize it doesn't make any difference whether the amount she gets doubles or triples or anything of the sort the important thing is that she never worries about money the rest of her life and i had an aunt katie here in omaha charlie knew well and worked for her husband as did i and she worked very hard all her life and had lived in a house she paid i think i don't know eight thousand dollars for 45th and hickory all her life and uh because she was in berkshire uh she ended up she lived in 97.

she ended up with you know a few hundred million and she would write me a letter every four or five months and she said dear warren you know i hate to bother you but am i going to run out of money and and i would i would write her back and i'd say dear katie it's a good question because if you live 986 years you're going to run out of money and and then about four or five months later she'd write me the same winner again and i i have seen there's no way in the world if you've got plenty of money that it should become a a minus in your life and there will be people if you've got a lot of money that come around with various suggestions for you sometimes well-meaning sometimes not so well-meaning so if you've got something that's certain to deliver you know it was all in berkshire they'd say well if warren was alive today you know he would be telling him to do this i i just don't want anybody to go through that and the s p will be a i think actually what i'm suggesting is what but a very high percentage of people should do something like that and i don't think they will have us i think there's a chance they won't have as much peace of mind if they own one stock and they've got neighbors and friends and relatives that are trying to do some like i say sometimes well-intentioned sometimes otherwise to do something else and so i think it's a policy that'll get a good result and it's likely to stick charlie well as becky said the wonders are different i i want them to hold the berkshire well i want to hold the berkshire too no i bet i mean i i i don't like them i recognize the logic of the fact that that s p algorithm is very hard to beat in a diversified portfolio of big companies it's all but impossible for most people but you know it's i'm just more comfortable with the berkshire well it's the family business yeah yeah but but it uh i've just i've seen too many people as they get older particularly being susceptible just having to listen to the arguments of people coming well if you're going to protect your heirs from the stupidity of others you may have some good system but i'm not much interested in that subject [Laughter] okay you

Read More

6 Retirement Essentials (Most people only prepared 2 or 3)

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

I'm planning for retirement most people focus

mostly on marshaling together enough money you know Financial Resources so that they can last

the distance and then maybe at the back of their heads they have some vague plan right perhaps

two or three things to fill the time with a lot of the times this is stuff like travel family

well unfortunately I'm gonna say that's not quite nearly enough for Preparation we ourselves

have been retired for two years and going looking back on the past two years I kind of see like

six essential things that if you prep for it beforehand before your retirement starts I think

this can really make such a positive difference to your retirement so that's what I wanted

to bring up and discuss with you guys today number one first and foremost of course we have

to talk about money most people's concern is the amount of money that they have in retirement

whether it will last them till the end come comfortably and allow them to afford the Hobbies

like travel good food Etc but I actually think after going through the last two years building up

our financial Acumen is just as important if not more so what do I mean by Financial Acumen I mean

stuff like budgeting tracking projecting investing I mean if you think about it the money in your

bank account can always be squandered we all know that story I think more importantly what's

going to make your retirement more fireproof is having an ability to generate more money where

it came from in the first place so the second essential thing that you can prepare for so that

you have a wonderful retirement it's definitely the ability to be self-directing and disciplined

self-direction definitely helps so much with spending your retirement days meaningfully right

after all there are no more like work schedules or like demands from colleagues or bosses to help

shape your days anymore you have to be the person to take charge in retirement there's a study out

there actually that shows that for happily retired folks most of them actually have about 3.6 core

Pursuits that's what they say and the unheably retired folks tend to have less than 3.6 corporate

suits coming in at about 1.9 call Pursuits that's what the study reflected I guess it kind of just

shows in retirement you really need to fill your life to the brim and keep busy with activities

you love and that is a really great formula for happiness and self-direction will help you

to achieve that state as well as discipline because if you think about it like discipline

directly affects the state of your finances right it affects whether you stick with your retirement

planning whether you keep fit and active and you get to maintain your health in retirement even

whilst you're left up to your own devices even to find your cover suits if you don't have any

when you're starting or in your retirement so discipline and self-direction will be like

the building blocks for enjoying your life in retirement the third essential thing you might

want to work on and cultivate or happy retirement is people skills right so studies and research

have reflected very consistently that the main determining factor for happiness and Longevity

for most of us is actually relationships Human Relationships friendships relationship with

your spouse and with your family I guess if you look at most of us you know we all have

a little need of work on some social skills in some aspect I mean some of us are a bit shy

paper hats or graph or maybe socially anxious working on our people skills really will help us

to get along and live happily with our spouse and family members and also importantly to make

new friendships at whatever age we all know that making new friends gets a lot more difficult

as we get older I mean I haven't heard anyone say otherwise for me personally making new friends

as I get older is the biggest challenge there's this huge feeling that nothing can replace

friendships with people who have known you all your life but it is also a challenge as I

have chosen to exercise through Arbitrage in our retirement and we've moved away from home

so those friends aren't with us in our present I find that it takes a lot of intention I have

to consciously push myself to broaden my Social Circles and make the effort to get to know people

on a more intimate basis I am also very happy to be able to say that it has paid off in that for

the last two years in Bali I have actually made two or three new friends that I'm happy to say are

kindred spirits and not just social acquaintances so that's very nice and it's a huge Comfort to our

daily life here in a foreign land away from home now before we move on a big thank you to

Mumu Singapore for sponsoring this video Singapore is an online trading platform for

stocks ETFs and options I've been using the MooMoo mobile trading app myself for almost

a year now and I think it's awesome it's fast intuitive trading US Stocks is commission

free plus they give free level to data and many more perks now for a limited time when you open a

Mumu Singapore Universal account they'll give you a year of commission free trading of Singapore

stocks ETFs and reads if you're trading us and Singapore stocks just switching to the MooMoo

app will save you so much money already when you deposit at least a hundred same dollars and

start using the mobile app to trade you stand to receive cash coupons up to 128 Sing dollars

and even a free Coca-Cola share worth around 87 subscribe two thousand Sing dollars or more into

funds on the MooMoo fun Hub and MooMoo will give you cash coupons up to 150 Sing dollars subscribe

at least 100 Sing dollar us to Momo cache plus and they'll throw in an additional tensing

dollars cashback altogether that's 368 Sing dollars worth of Welcome rewards absolutely free

just for using the Momo app so if you're actively investing anyhow I recommend checking out the

MooMoo ad using my link in the description below now back to the video the fourth essential

thing that you can definitely work on and that will benefit your retirement tremendously it's

actually courage you're definitely gonna need lots of courage in retirement and I guess this isn't

a skill exactly it's kind of more of a quality but in retirement you need a lot of courage

to even plunge into retirement you need the courage to you know take that leap of faith to

stop putting it off due to fear of the unknown feel or financial insecurities so then it's all

about courage at that stage not let fear and insecurity rule your life and your decisions it

is also the courage to recognize that in life at the start at the end in the middle the Domino's

you need are never all nicely lined up you know at some point you just got to jump into it and

then learn to cross the obstacles as they come so for retirement long term I guess the

biggest issue most commonly is always money but my perspective on this is that hey budgets

can always be reduced money can always be earned or recouped or whatever happens so I still

think that you know it is actually beneficial to Advocate an approach whereby you get to

a point where you feel that you have most of your Ducks lined up you've planned well you've

prepped for it grab hold of your courage with both hands and then take the plunge people tend

to think of retirement as the end but it's not it's the start of a new phase where you should be

trying so many new things new Pursuits new ways to live and for each of these new adventures

you're gonna need courage to take action and once you have taken the plunge you'll find the

next fifth thing very very useful and that would be a mentality of resilience especially in early

retirement there are a lot more decades ahead of you you know and therefore a lot more chances that

they things can go wrong whether it be down to bad financial planning or perhaps an unexpected Health

catastrophe or even sometimes natural disasters whatever comes I guess you will always need that

strength of Will and the resilience so that you can roll with the punches and then get back up

you want to know that you have the mental strength that even if things go pear-shaped you won't just

give up and lose hope and certain Corner you've got to Marshall what you've got inside you go out

there find Solutions perhaps if necessary you've got to go back to work but know that later on

you can return to retirement and try again so the sex essential thing that I believe will benefit

everyone in retirement is to cultivate an attitude of gratitude we all know life is a very long

journey hopefully at least and so much of what we Chase using most of our years actually doesn't

really matter in the big picture once you have taken a step back and then at that point is when

you start realizing the earlier you cultivate and attitude of gratitude and that appreciation for

the simple little things that are probably around you everywhere every day the happier you probably

will be and it sounds silly but it's not really automatic I mean we all live and grow up and

work and go to school in a society that kind of innovates us with messages that we need to reach

for more have more ambition gives us you know that High definitions of success in life that we

have to try to jump to reach and nobody sings the Praises of the pleasures of a simple cup of

tea you know the importance of family time with your loved ones or or just the pleasure of being

able to take an evening walk on the beach with your dog so I think that it's very important that

somebody reminds you that you know you can not overload what you already have what you're already

surrounded by growing that muscle of appreciation so that in each and every moment you are present

in your own life you see all the little Joys that you're surrounded with every day and if you

live life like that I think that will help you achieve contentment with just the small stuff

around you and that's what majority of your life in retirement may be about is just a small stuff

every day but in my own retirement here in Bali it is what makes me so grateful and so happy every

day that I am surrounded by my loving husband and very interesting and independent little dog

that's very very cute you know that we have very comfortable a bit simple house we have the ability

to enjoy good food even if it's simple stuff from the war rooms locally we have a garden and

beautiful things are growing around us every day the weather is great you know stuff is good yeah

I think this is one of the most essential simple things that's often overlooked simply because it's

a matter of mentality but I believe this essential quality or characteristic could make all the

difference for you so these are the six essential things that I believe are very very important for

you to cultivate and prepare for in the leader to actually taking the plunge into a return then I

think that if you have these six strong skills and qualities going for you you will be in a position

much more well placed to make the best out of your retirement however long that period may be let me

know what you think of my suggestions whether you agree or if you think they suck let me know why

but in any event I really appreciate you tuning in and sharing my thoughts for this week and

wherever you are in the world I'm wishing you a happy Saturday evening and let's speak again

next week till then you take care and bye for now

Buffett on retirement

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

FOR PEOPLE RIGHT NOW WHEN IT COMES TO SAVING . >> I THINK IT'S THE SAME THING THAT MAKES MOST SENSE FRANKLY ALL OF THE TIME, AND THAT IS TO CONSISTENTLY BUY AN S&P 500 LOW COST INDEX FUND. KEEP BUYING IT THROUGH THICK AND THIN, AND ESPECIALLY THROUGH THIN. BECAUSE THE TEMPTATIONS GET — WHEN YOU SEE BAD HEADLINES IN NEWSPAPERS, MAYBE TO SAY WELL MAYBE I SHOULD SKIP A YEAR OR SOMETHING. JUST KEEP BUYING. AMERICAN BUSINESS IS GOING TO DO FINE OVER TIME. SO YOU KNOW THE INVESTMENT UNIVERSE IS GOING TO DO VERY WELL. THE DOW JONES INDUSTRIAL AVERAGE WENT FROM 66 1,497 IN ONE CENTURY, AND SINCE THAT CENTURY HAS ENDED, IT'S MORE OR LESS DOUBLED AGAIN. AMERICAN BUSINESS IS G. THE TRICK IS NOT TO PICK THE RIGHT COMPANY, IT'S TO BE — BECAUSE MOST PEOPLE AREN'T EQUIPPED TO DO THAT.

AND PLENTY OF TIMES I MAKE MISTAKES. THE TRICK IS TO ESSENTIALLY BUY ALL THE BIG COMPANIES THROUGH THE SFUND AND TO DO IT CONSISTENTLY, AND TO DO IT IN A VERY, VERY LOW COST WAY. BECAUSE COSTS REALLY MATTER. AND INVESTMENTS, IF RETURNS ARE GOING TO BE 7% OR 8% AND YOU ARE PAYING 1% THROUGH FEES, THAT MAKES AN ENORMOUS DIFFERENCE IN HOW MUCH MONEY YOU HAVE ON RETIREMENT. >> AT THE ANNUAL MEETING FOR BERKSHIRE HATHAWAY THIS YEAR, YOU INTRODUCED A SPECIAL GUEST TO THE AUDIENCE OF 40,000 SHAREHOLDERS WHO WERE WATCHING. IT WAS JACK VOGEL. WHY DID YOU WANT TO RECOGNIZE JACK VOGEL? >> I THINK JACK VOGEL HAS DONE MORE FOR AMERICAN INVESTORS THAN ANY OTHER PERSON CONNECTED WITH WALL STREET OR T BECAUSE WITH A NUMBER OF OTHER PEOPLE WE CAME UP WITH THE IDEA, HE WASN'T THE SOLE THINKER BEHIND IT BUT HE WAS THE GUY WHO IMPLEMENTED IT AND CRUSADED FOR NOW TRILLIONS OF DOLLARS IN LOW COST INDEX FUNDS. MOST PEOPLE ARE GOING TO HAVE BETTER LIVES, BETTER RETIREMENTS, THEIR KIDS ARE.

Read More

5 Best Fidelity Index Funds To Buy and Hold Forever

Jason 0 Comments Retire Wealthy Retirement Planning

– In this video, I'm gonna go through the five best Fidelity funds to buy and hold forever. Now you're going to notice that all of the Fidelity zero index funds are missing from this top five, because they aren't really what they appear to be on the surface. Later in the video, I'll send you to another video I made uncovering their dirty little secret. First up is the Fidelity

500 Index Fund, FXIAX. There's only a few funds that I would consider foundational fund that most people should hold.

And if you prefer Fidelity funds, then this would be one of them. FXAIX tracks the S&P 500, which is made up of the

500 largest U.S. stocks, based on market cap. All a market cap is is the total number of outstanding shares multiplied by the price of the stock. These 500 stocks represent about 80% of the U.S. market cap. So these companies are what really moves the price of the overall stock market. To put it into perspective, there's about 4,300

publicly traded U.S. stocks. That means once we remove the largest 500, the remaining 3,800 only account for 20% of the total U.S. market cap. Everyone loves to talk

about the upside potential, and we'll cover that in just a minute. But I personally like to call out the downsides as well, because what you do during those times will have the biggest impact on your future returns.

Because the Fidelity 500 Fund has only been around since 2011, we'll be looking at the S&P 500 drawdowns to get a larger sample size. The largest drawdown started in 2007, due to the financial crisis. This fund would've seen a 51% drawdown, which means that if you

had $1 million invested, then at one point, it would've

been down to $490,000. This portion of your portfolio would've taken about three

and a half years to recover. The next largest drawdown was in 2000, where it had a drawdown of 45%, and took a little over

four years to recover. The third largest drawdown was in 2020, due to the health crisis, where that drawdown was 20%, and took four months to recover. A four-month recovery period is comical, so do not expect that

happening in the future, because they're not very common. Although past returns are irrelevant, because we are investing for the future, they're always good to be aware of. After taxes and sales, FXAIX has had a one-year return of 9.5%, three-year return of 15%, five-year return of 13%, and 10-year return of 12%. This is one of the lowest-cost

S&P 500 index funds, coming in at an expense

ration of .015% per year.

For everyone $1,000 invested, you're only paying 15 cents per year. These are everything with investing, because they eat into your returns, so keeping these as low as possible is extremely important. If you look at the sector breakdown, 28% of this fund is held in technology, followed by financial services, healthcare, and consumer cyclical. While some might say that

it's overweight in technology, that's only because those

companies are so dominant. This is the nice thing about a fund that tracks an index. There's no opinions about what should or shouldn't be added, because the market and

size of the business determines that for you. If the businesses in one sector start to shrink in size, then this fund will reflect that and replace those stocks

with what should be there.

The top 10 holdings are made

up of a ton of companies most of you recognize: Apple, Microsoft, Amazon, and Alphabet. These 10 make up about 30% of the total Fidelity 500 portfolio, which is perfectly fine because they're all solid companies. And when they eventually shrink in size, they'll automatically fall down this list and be replaced with

the next best company. The Fidelity 500 Index is for anyone who is looking to match the performance of those largest U.S. companies. Because they make up 80% of

the total U.S. market cap, they're what really moves the market. This index fund has a nice

mix of large cap stocks that are at the upper limit

between value and growth, with a leaning more towards growth stocks. This is good if you're looking to invest for portfolio growth with the safety that comes along with those larger, more stable companies. If we take a look at the stock weighting, 39% are large cap growth, 26% are large cap blend, and 19% are large cap value.

The downside of this fund is that you're missing out on those mid and smaller-cap stocks. While it's not a huge downside, it's still something to be aware of. If you are enjoying this video so far, then help support my dog

Mali and this channel by hitting that thumbs up button. If you're someone who

wants to take advantage of those 500 stocks, plus the additional thousands of stocks traded on the stock market, then you'd want to think about investing in the Fidelity Total

Market Index Fund, FSKAX.

Before we get too deep into it, I'll have to admit that I

am biased towards this fund and any other total U.S.

stock market index fund, so keep that in mind while I'm going through

this one specifically. FSKAX does exactly what the name says, invests in the total U.S. stock market. That means your money is invested among pretty much every

U.S.-based stock out there. At this point, it's made up of a little over 4,000 companies, and growing every year as more businesses go public. Since it holds that many stocks, your money is diversified among large-, mid, and small cap companies. When you invest in an

index fund like this, you're betting on the future

of the U.S. as a whole. I know there's a lot of

tinfoil hat people out there who are all doom and gloom

about the future of America. But as long as the businesses

behind these stocks are continuing to innovative,

make money, and grow, there's nothing to worry about. There are naturally going

to be a ton of losers among these 4,000 stocks, so that's why it can beneficial to place bets across the board by investing in this type of fund.

After taxes on distributions

and sale of fund shares, it's had a one-year return of 7%, three-year return of 14%, five-year return of 12%, and a 10-year return of almost 12%. This index fund is extremely low cost, coming in at an expense

ratio of .015% per year. That means for every $1,000 invested, you're only paying 15 cents per year. Looking at the sector breakdown of the Total Market Index Fund, technology is once again dominating at 27% of this fund. The rest of the breakdown is pretty similar to

the Fidelity 500 Fund, with healthcare at 13%, consumer discretionary at close to 12%, and financials at close to 12% as well. Within the top 10 of the Fidelity Total Market Index Fund, we see a ton of names that we recognize, the exact same companies

within this top 10 are in the top 10 of the

Fidelity 500 Fund as well.

The only difference is how much money is allocated to each company. With the Fidelity 500 Fund, 29% was in the top 10. Within the Fidelity

Total Market Index Fund, there's only about 25%

allocated to those top 10. A lot of this has to do with the fact that FSKAX has over 4,000 companies to spread your money across, while the 500 fund only

has to spread your money across, of course, 500 companies. The Fidelity Total Market Index Fund is for the person who wants this ability that comes with investing in

those biggest 500 companies while still gaining exposure

to those up-and-coming, mid, and small cap stocks as well. As you can see, this index fund is considered a blend between

value and growth stocks, with a tilt more towards growth.

While most of the weighting

is in the large cap area, we see that about 18% is in mid caps, and 9% is in small cap stocks. Just like the Fidelity 500 Index Fund, the Total Market Fund is one

of the foundational funds that should be a part

of everyone's portfolio in some form. I personally don't think it makes sense to hold both of them at the same time, because there is some portfolio overlap. Once you have your U.S.

investments covered, the next best fund is the Fidelity Total

International Index Fund, FTIHX. And this fund is currently made up of over 5,000 stocks.

The Fidelity Total

International Index Fund is just like the Total U.S. Index Fund, except the International fund holds stocks that exist

outside of the United States. This fund seeks to

provide investment results that match the total return of foreign developed and

emerging stock markets. FTIHX specifically tracks the MSCI All Country World Index ex U.S., which covers about 85% of global equities outside of the United States. By investing in FTIHX, your money is diversified among different countries, regions, sectors, and even currencies. Since this fund has only

been around since 2016, I looked at the drawdowns from a global ex U.S. stock portfolio. The largest drawdown started in 2007, of course, due to the financial crisis, and ended up down 58%. It took a little over

eight years to recovery. The next largest drawdown started in 2000 due to the dot com crash, where it dropped by 47%, and it took about two and

a half years to recover. The third largest drawdown was in 1990, where it saw a max drawdown of 31%, and took three years and

four months to recover. One-year returns are negative 1%, three-year returns are 6%, and five-year returns are 5%.

Since this is a newer fund, we don't have enough data to

get out to the 10-year returns. The expense for this

Total International Fund is one of the lowest in the industry, coming in at .06%. That means for every $1,000 invested, you'll only pay 60 cents per year. The sector breakdown is a lot different when we compare it to

those first two U.S. funds that we looked at. For this international fund, we can see that the

majority of the holdings are in financials at an

almost 19% allocation, followed by industrials, tech, then consumer discretionary. The top 10 holdings only

make up less than 10% of the overall holdings, which is night and day compared to the first two

U.S. funds that we looked at. For those U.S. funds,

if you don't remember, the top 10 made up about

30% of the holdings. I don't see an issue with this, because there's a little more risk when investing in companies outside of the United States. A lot of these companies

you probably recognize, but once we get out of these top 10, you probably don't recognize

a lot of the companies within this index fund.

When we look at region breakdown, about 70% of the money is diversified among European and

emerging market companies. The Fidelity Total International Index is perfect for someone who

wants to get that broad exposure to anything outside of the U.S. As with any stock-based index funds, there are many risks to be aware of. Those can range from political, economical, regulations, currency, and interest rate risk. The good news is that FTIHX is more concentrated in

stocks that are larger, with a blended mix

between value and growth. The Fidelity U.S. Bond Index Fund, FXNAX, is perfect for the conservative

side of your portfolio. At this point, it has about 8,400 holdings from 593 issuers. It tracks the Bloomberg

U.S. Aggregate Bond Index, which holds a mixture of U.S. treasuries, corporate bonds, and

mortgage-backed securities. Max drawdowns for bond index funds look drastically different

from stock-based index funds, which is exactly how things should look.

The largest drawdown

started at the end of 2020, where it was down 7.77%, and it still hasn't recovered. The second largest was in 2013, where it went down 3.87%, and took nine months to recover. The third largest was in 2016, where it was down 3.5%, and it took nine months to recover. For a one-year period, this fund is down 2.74%. Three-year returns are at .87%, five-returns are at 1.08%, and the 10-year return is at 1.21%. The Fidelity Total U.S. Bond Fund is extremely low cost at .025% per year. That means for every $1,000 invested, you're paying 25 cents. This bond index is mainly diversified among three different types of bonds. 39% is in U.S. treasuries, 27% are in mortgage-backed

security pass-through bonds, and 24% are in corporate bonds. If you are someone who is building a three-fund portfolio, then you're going to need a bond fund. Now this is a great index fund to fill the gap in that type of strategy.

Don't sleep on bonds, because they still serve the same purpose as they always have, to reduce volatility

within your portfolio. Now this is especially needed when you are getting closer to retirement. I'll have my three-fund portfolio video linked up down in the

description, above my head, and at the end of this video as well. Real estate has had great

returns over the years, so if you're looking to gain more exposure to that asset class on the

Fidelity investment platform, then the Fidelity Real

Estate Index Fund, FSRNX, is the one that I prefer. Time out real quick, because after reviewing

my notes on this one, I am calling an audible in

the middle of this recording to pull this one off of my top five list.

This fund isn't tracking

the underlying index as well as I thought it was. On top of that, the fund manager is trading the underlying stocks like it's an actively managed fund, which could result in higher trading costs for investors like you. The turnover rate is 53% for this fund. This basically means that

they're buying and selling off 53% of the holdings

within a 12-month period. Compare that to the Vanguard

Real Estate Index ATF, where the turnover is only 7%, and I cannot, with good conscience, recommend the Fidelity

Real Estate Index Fund. If you want a real estate

fund on the Fidelity platform, then go with the Vanguard version, VNQ. Be honest, I don't like any of the other Fidelity funds, either, so I don't have a replacement

for the Real Estate Fund. Don't forget to hit that

thumbs up button before you go. My video on why you should avoid the Fidelity zero fee index funds will be linked to your left and in the description of this video a couple of days after

this one's released.

If you prefer Vanguard funds that you can purchase on the

Fidelity investment platform, then, to your left, I'll also have my top five video on those..

Personal finance expert Suze Orman’s number one investment right now

Jason 0 Comments Retire Wealthy Retirement Planning

SO THERE YOU SEE SUPPLY AND DEMAND AT WORK WITH INFLATION AT A HISTORIC HIGHS IN THE STOCK MARKET CHOPPY, OUR NEXT GUEST SAYS THE NUMBER ONE INVESTMENT RIGHT NOW IS I-BONDS HERE TO EXPLAIN IS A PERSONAL FINANCE POWER PLAYER AND OUR DEAR FRIEND SUZE ORMAN HOST OF THE WOMEN AND MONEY PODCAST. SHE IS ALSO CO-FOUNDER OF THE EMERGENCY SAVINGS FIRM SECURE SAVE SUZE, IT IS ALWAYS GREAT TO SEE YOU. WELCOME. GOOD TO HAVE YOU BACK WITH US. LET'S TALK ABOUT THE I-BONDS WHICH I DIDN'T EVEN KNOW ABOUT, BUTMY NEPHEW-IN-LAW SAID YOU HAVE TO GET THESE I-BONDS. EXPLAIN TO ME WHAT THEY ARE, HOW THEY WORK, HOW I BUY THEM AND FROM WHOM. >> NOW SO YOU BUY THEM FROM THE TREASURY, DIRECTLY FROM THEM SO YOU GO FROM TREASURYDIRECT.GOV IT IS THE ONLY PLACE THAT YOU CAN BUY THEM, NUMBER ONE THEY RANGE IN PRICE.

YOU CAN INVEST FROM $25 ALL OF THE WAY UP TO A MAXIMUM PER PERSON OF $10,000, ALTHOUGH THERE ARE WAYS TO DO IT WHERE YOU CAN PUT IN UP TO 30,000 IF YOU HAVE A TRUST AND/OR A BUSINESS WHEN YOU INVEST IN AN I-BOND, I STANDS FOR INFLATION, YOU HAVE GOT TO MAKE SURE THAT FOR ONE YEAR YOU DO NOT NEED YOUR MONEY AND THE REASON IS FROM THE TIME YOU PUT IT IN TO ONE YEAR YOU CANNOT TOUCH IT. FROM YEAR TWO TO FIVE THERE IS ONLY A THREE-MONTH INTEREST PENALTY. THAT IS HOW THEY WORK.

THEY ARE ATTACHED TO CPI SO RIGHT NOW WHEN THEY ANNOUNCED IN MAY, THE CPI THE YIELD ON THE SERIES I BONDS WERE GUARANTEED AND ANNUALIZED AND IT'S GUARANTEED TO YOU SO THEY CHANGE EVERY SIX MONTHS THE INTEREST RATE CHANGES EVERY MAY AND NOVEMBER SO FROM MAY UNTIL NOVEMBER EVERYBODY WHO BUYS ONE RIGHT NOW WILL BE GUARANTEED AN ANNUALIZED YIELD OF 9.62% STATE INCOME TAX-FREE OBVIOUSLY YOU'RE ONLY GOING TO GET THAT FOR SIX MONTH, BUT THAT'S STILL 4.81% ON YOUR MONEY. WHEN THEY RESET COME NOVEMBER, LET'S SAY THEY RESET EVEN LOWER. LET'S SAY THEY RESET AT 7.11 WHICH IS WHAT THEY WERE PAYING BEFORE THEY RAISED TO 9.62, YOU ARE GUARANTEED THAT FOR THE NEXT SIX MONTHS ON AN ANNUALIZED YIELD SO THAT'S, LIKE, 3.56%, HALF OF THAT FOR SIX MONTH BECAUSE THAT'S WHAT YOU'RE GUARANTEED SO FOR THE YEAR IT'S 8.37% THAT'S ESSENTIALLY HOW THEY WORK THEY'RE FABULOUS THEIR MATURITIES ARE FOR — GO ON >> I DON'T MEAN TO INTERRUPT YOU, BUT I WANTED TO ASK YOU THOSE NUMBERS THAT YOU JUST — AND I GET IT, YOU EXPLAINED IT PERFECTLY.

THEY RESET EVERY SIX MONTHS AND ARE YOU GUARANTEED UNDER THIS PROGRAM TO MAKE A YIELD IF YOU HOLD THE BONDS THAT IS ABOVE THE THEN-PREVAILING RATE OF INFLATION? >> SO WHAT HAPPENS IS YOU ARE ABSOLUTELY GUARANTEED, AND WHAT'S SO GREAT IS THAT THE ONLY WAY A FINANCE PERSON CAN EVER USE THE WORD GUARANTEE SIDE USUALLY WITH A TREASURY INSTRUMENT BECAUSE IT'S GUARANTEED BY THE AUTHORITY OF THE UNITED STATES GOVERNMENT NO COMMISSIONS OR ANYTHING SO ONCE THEY DECLARE THAT RATE ON MAY 1st AND NOVEMBER 1st YOU ARE GUARANTEED FOR WHENEVER YOU BUY IT BETWEEN THOSE PERIODS, FOR SIX MONTHS YOU ARE GUARANTEE THE RATE THAT THEY DECLARED. AGAIN, THAT'S AN ANNUALIZED YIELD, SO IT'S ONLY REALLY GUARANTEED FOR SIX MONTHS UNTIL THEY RESET YOU KNOW, TYLER, I GAVE A MASTER CLASS ON THIS ON THE WOMEN AND MONEY PODCAST ON THE APRIL 17th EDITION OF IT. EVERYBODY SHOULD LISTEN TO IT BECAUSE IT TELLS YOU ALL THE INs AND OUTs, EVERYTHING YOU NEED TO KNOW THIS IS AN INVESTMENT. I'VE BEEN DOING THESE SINCE 2001 >> THIS DOES MAKE AN AWFUL LOT OF SENSE YOU EXPLAINED IT VERY WELL IN YOUR FIRST ANSWER IN TALKING ABOUT THE 9.6% RATE.

WE UNDERSTAND THAT THAT DOES CLEAR THE LEVEL OF INFLATION, BUT IF INFLATION IS SOMETHING LIKE 8.6%, AREN'T YOU MORE OR LESS JUST PROTECTING THE VALUE OF YOUR MONEY RATHER THAN REALLY GROWING IT EVEN IF INFLATION IS ONLY APERCENT LESS THAN WHAT YOU'RE MAKING. >> COURTNEY, YOU GOT THAT RIGHT, BUT DON'T YOU WANT IN MARKETS LIKE THIS TO HAVE A POSITION OF YOUR MONEY ABSOLUTELY RO TEKTED? WHERE ARE YOUGOING TO GO YOU CAN'T GO TO REGULAR BONDS, BECAUSE BONDS IF YOU ADOPTED IN BOND FUNDS FOR GROWTH, YOU'RE DOWN 10% OR 15%. YOU'RE DOWN SIGNIFICANTLY IN THE STOCK MARKET THERE HAS GOT TO BE A PORTION OF YOUR MONEY, WHATEVER THAT IS THAT YOU WANT PROTECTED, YOU WANT ESSENTIALLY IN CASH AT LEAST WHERE IT'S KEEPING UP WITH INFLATION WHICH IS EXACTLY WHAT THIS WILL DO VERSUS YOU'RE IN A MONEY MARKET ACCOUNT OR A CD OR WHATEVER IT IS AND YOU'RE GETTING 3% WHERE YOU'RE LOSING MONEY.

SO THIS IS A GREAT PLACE TO PUT YOUR — YOU MENTIONED AFTER FIVE YEARS, YOU MENTIONED 27 YEAR IS PUT FOR 30 YEARS >> I SEE, AND YOU CAN REDEEM THEM ANY TIME AFTER THE FIRST YEAR FROM THE YEAR TWO THROUGH FIVE THERE IS A THREE-MONTH INTEREST PENALTY AFTER THE FIFTH YEAR YOU CAN REDEEM ANY — YOU CAN REDEEM ANY TIME. >> WITHOUT ANY PEVNALTIES WHEN S EVER REALLY, ESSENTIALLY. SO YOU'RE IN THERE FOR A YEAR AND YOU REDEEM AFTER THAT, BIG DEAL. >> FINAL QUESTION WHICH COURTNEY TOUCHED ON AND THAT IS THAT THIS IS FOR A PORTION OF YOUR MONEY, IDEALLY MONEY YOU DON'T NEED TO TOUCH. IN SOME WAYS LIKE STOCKS, BUT YOU ACKNOWLEDGE THAT THERE IS WITH THIS KIND OF SAFETY MONEY AN OPPORTUNITY COST WHICH IS TO SAY IT'S NOT GOING TO BE YOUR GROWTH MONEY THE STOCK MARKET MIGHT RETURN YOU OVER THE FIVE YEARS OR THE TEN YEARS YOU HOLD THIS BOND MUCH MORE THAN 8%, 9%, A LITTLE ABOVE INFLATION, RIGHT YOUR GROWTH MONEY IS A DIFFERENT THING.

>> ABSOLUTELY. YOU HAVE GROWTH MONEY. YOU HAVE EMERGENCY SAVINGS ACCOUNT MONEY THAT WOULD NEVER GO INTO SOMETHING LIKE THIS BECAUSE YOU CAN'T AFFORD TO LOCK THAT UP FOR A YEAR, BUT YOU DO HAVE A PORTION OF YOUR MONEY THAT YOU WANT RIGHT NOW SAFE AND SOUTHBOUND BECAUSE EVERYBODY IS SO FREAKED, AND AT THESE INTEREST RATES, IF INFLATION CONTINUES THESE ARE A BIG WINNER BIG, BIG, BIG. >> WHAT'S THE PODCAST AGAIN, GO BACK.

Read More

Recent Comments