Tag: stock market

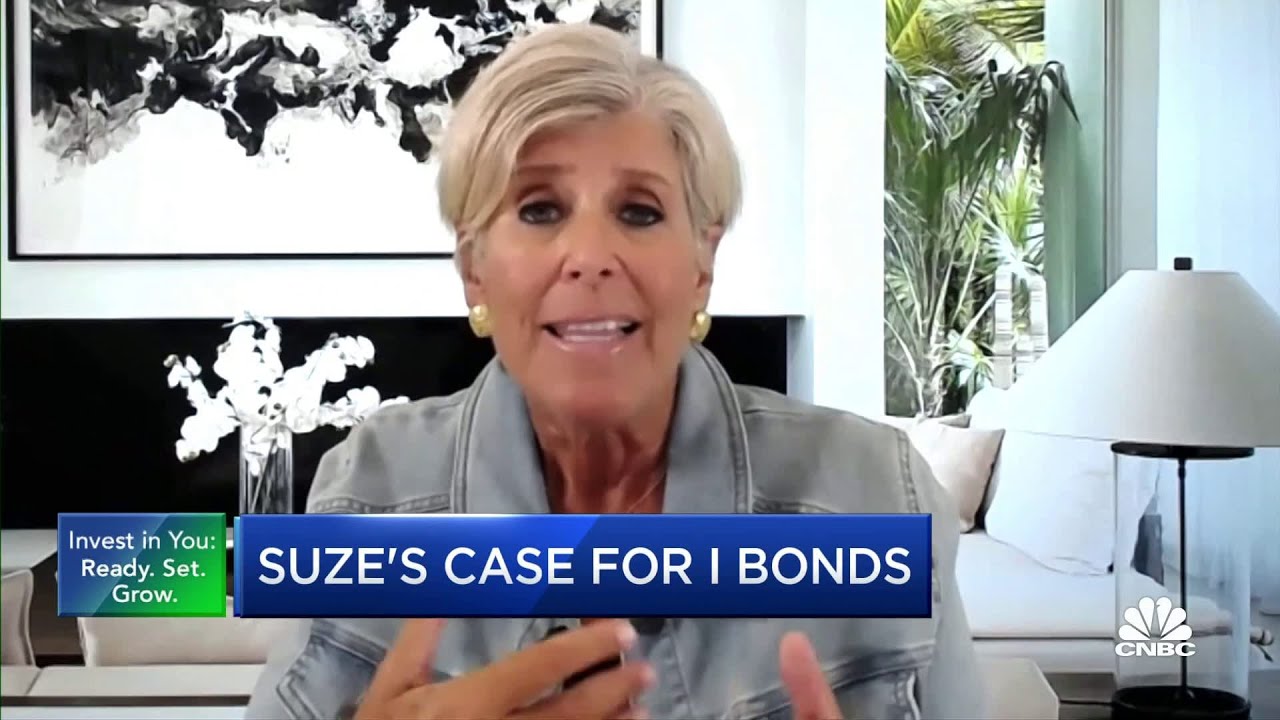

Personal finance expert Suze Orman’s number one investment right now

Jason 0 Comments Retire Wealthy Retirement Planning

SO THERE YOU SEE SUPPLY AND DEMAND AT WORK WITH INFLATION AT A HISTORIC HIGHS IN THE STOCK MARKET CHOPPY, OUR NEXT GUEST SAYS THE NUMBER ONE INVESTMENT RIGHT NOW IS I-BONDS HERE TO EXPLAIN IS A PERSONAL FINANCE POWER PLAYER AND OUR DEAR FRIEND SUZE ORMAN HOST OF THE WOMEN AND MONEY PODCAST. SHE IS ALSO CO-FOUNDER OF THE EMERGENCY SAVINGS FIRM SECURE SAVE SUZE, IT IS ALWAYS GREAT TO SEE YOU. WELCOME. GOOD TO HAVE YOU BACK WITH US. LET'S TALK ABOUT THE I-BONDS WHICH I DIDN'T EVEN KNOW ABOUT, BUTMY NEPHEW-IN-LAW SAID YOU HAVE TO GET THESE I-BONDS. EXPLAIN TO ME WHAT THEY ARE, HOW THEY WORK, HOW I BUY THEM AND FROM WHOM. >> NOW SO YOU BUY THEM FROM THE TREASURY, DIRECTLY FROM THEM SO YOU GO FROM TREASURYDIRECT.GOV IT IS THE ONLY PLACE THAT YOU CAN BUY THEM, NUMBER ONE THEY RANGE IN PRICE.

YOU CAN INVEST FROM $25 ALL OF THE WAY UP TO A MAXIMUM PER PERSON OF $10,000, ALTHOUGH THERE ARE WAYS TO DO IT WHERE YOU CAN PUT IN UP TO 30,000 IF YOU HAVE A TRUST AND/OR A BUSINESS WHEN YOU INVEST IN AN I-BOND, I STANDS FOR INFLATION, YOU HAVE GOT TO MAKE SURE THAT FOR ONE YEAR YOU DO NOT NEED YOUR MONEY AND THE REASON IS FROM THE TIME YOU PUT IT IN TO ONE YEAR YOU CANNOT TOUCH IT. FROM YEAR TWO TO FIVE THERE IS ONLY A THREE-MONTH INTEREST PENALTY. THAT IS HOW THEY WORK.

THEY ARE ATTACHED TO CPI SO RIGHT NOW WHEN THEY ANNOUNCED IN MAY, THE CPI THE YIELD ON THE SERIES I BONDS WERE GUARANTEED AND ANNUALIZED AND IT'S GUARANTEED TO YOU SO THEY CHANGE EVERY SIX MONTHS THE INTEREST RATE CHANGES EVERY MAY AND NOVEMBER SO FROM MAY UNTIL NOVEMBER EVERYBODY WHO BUYS ONE RIGHT NOW WILL BE GUARANTEED AN ANNUALIZED YIELD OF 9.62% STATE INCOME TAX-FREE OBVIOUSLY YOU'RE ONLY GOING TO GET THAT FOR SIX MONTH, BUT THAT'S STILL 4.81% ON YOUR MONEY. WHEN THEY RESET COME NOVEMBER, LET'S SAY THEY RESET EVEN LOWER. LET'S SAY THEY RESET AT 7.11 WHICH IS WHAT THEY WERE PAYING BEFORE THEY RAISED TO 9.62, YOU ARE GUARANTEED THAT FOR THE NEXT SIX MONTHS ON AN ANNUALIZED YIELD SO THAT'S, LIKE, 3.56%, HALF OF THAT FOR SIX MONTH BECAUSE THAT'S WHAT YOU'RE GUARANTEED SO FOR THE YEAR IT'S 8.37% THAT'S ESSENTIALLY HOW THEY WORK THEY'RE FABULOUS THEIR MATURITIES ARE FOR — GO ON >> I DON'T MEAN TO INTERRUPT YOU, BUT I WANTED TO ASK YOU THOSE NUMBERS THAT YOU JUST — AND I GET IT, YOU EXPLAINED IT PERFECTLY.

THEY RESET EVERY SIX MONTHS AND ARE YOU GUARANTEED UNDER THIS PROGRAM TO MAKE A YIELD IF YOU HOLD THE BONDS THAT IS ABOVE THE THEN-PREVAILING RATE OF INFLATION? >> SO WHAT HAPPENS IS YOU ARE ABSOLUTELY GUARANTEED, AND WHAT'S SO GREAT IS THAT THE ONLY WAY A FINANCE PERSON CAN EVER USE THE WORD GUARANTEE SIDE USUALLY WITH A TREASURY INSTRUMENT BECAUSE IT'S GUARANTEED BY THE AUTHORITY OF THE UNITED STATES GOVERNMENT NO COMMISSIONS OR ANYTHING SO ONCE THEY DECLARE THAT RATE ON MAY 1st AND NOVEMBER 1st YOU ARE GUARANTEED FOR WHENEVER YOU BUY IT BETWEEN THOSE PERIODS, FOR SIX MONTHS YOU ARE GUARANTEE THE RATE THAT THEY DECLARED. AGAIN, THAT'S AN ANNUALIZED YIELD, SO IT'S ONLY REALLY GUARANTEED FOR SIX MONTHS UNTIL THEY RESET YOU KNOW, TYLER, I GAVE A MASTER CLASS ON THIS ON THE WOMEN AND MONEY PODCAST ON THE APRIL 17th EDITION OF IT. EVERYBODY SHOULD LISTEN TO IT BECAUSE IT TELLS YOU ALL THE INs AND OUTs, EVERYTHING YOU NEED TO KNOW THIS IS AN INVESTMENT. I'VE BEEN DOING THESE SINCE 2001 >> THIS DOES MAKE AN AWFUL LOT OF SENSE YOU EXPLAINED IT VERY WELL IN YOUR FIRST ANSWER IN TALKING ABOUT THE 9.6% RATE.

WE UNDERSTAND THAT THAT DOES CLEAR THE LEVEL OF INFLATION, BUT IF INFLATION IS SOMETHING LIKE 8.6%, AREN'T YOU MORE OR LESS JUST PROTECTING THE VALUE OF YOUR MONEY RATHER THAN REALLY GROWING IT EVEN IF INFLATION IS ONLY APERCENT LESS THAN WHAT YOU'RE MAKING. >> COURTNEY, YOU GOT THAT RIGHT, BUT DON'T YOU WANT IN MARKETS LIKE THIS TO HAVE A POSITION OF YOUR MONEY ABSOLUTELY RO TEKTED? WHERE ARE YOUGOING TO GO YOU CAN'T GO TO REGULAR BONDS, BECAUSE BONDS IF YOU ADOPTED IN BOND FUNDS FOR GROWTH, YOU'RE DOWN 10% OR 15%. YOU'RE DOWN SIGNIFICANTLY IN THE STOCK MARKET THERE HAS GOT TO BE A PORTION OF YOUR MONEY, WHATEVER THAT IS THAT YOU WANT PROTECTED, YOU WANT ESSENTIALLY IN CASH AT LEAST WHERE IT'S KEEPING UP WITH INFLATION WHICH IS EXACTLY WHAT THIS WILL DO VERSUS YOU'RE IN A MONEY MARKET ACCOUNT OR A CD OR WHATEVER IT IS AND YOU'RE GETTING 3% WHERE YOU'RE LOSING MONEY.

SO THIS IS A GREAT PLACE TO PUT YOUR — YOU MENTIONED AFTER FIVE YEARS, YOU MENTIONED 27 YEAR IS PUT FOR 30 YEARS >> I SEE, AND YOU CAN REDEEM THEM ANY TIME AFTER THE FIRST YEAR FROM THE YEAR TWO THROUGH FIVE THERE IS A THREE-MONTH INTEREST PENALTY AFTER THE FIFTH YEAR YOU CAN REDEEM ANY — YOU CAN REDEEM ANY TIME. >> WITHOUT ANY PEVNALTIES WHEN S EVER REALLY, ESSENTIALLY. SO YOU'RE IN THERE FOR A YEAR AND YOU REDEEM AFTER THAT, BIG DEAL. >> FINAL QUESTION WHICH COURTNEY TOUCHED ON AND THAT IS THAT THIS IS FOR A PORTION OF YOUR MONEY, IDEALLY MONEY YOU DON'T NEED TO TOUCH. IN SOME WAYS LIKE STOCKS, BUT YOU ACKNOWLEDGE THAT THERE IS WITH THIS KIND OF SAFETY MONEY AN OPPORTUNITY COST WHICH IS TO SAY IT'S NOT GOING TO BE YOUR GROWTH MONEY THE STOCK MARKET MIGHT RETURN YOU OVER THE FIVE YEARS OR THE TEN YEARS YOU HOLD THIS BOND MUCH MORE THAN 8%, 9%, A LITTLE ABOVE INFLATION, RIGHT YOUR GROWTH MONEY IS A DIFFERENT THING.

>> ABSOLUTELY. YOU HAVE GROWTH MONEY. YOU HAVE EMERGENCY SAVINGS ACCOUNT MONEY THAT WOULD NEVER GO INTO SOMETHING LIKE THIS BECAUSE YOU CAN'T AFFORD TO LOCK THAT UP FOR A YEAR, BUT YOU DO HAVE A PORTION OF YOUR MONEY THAT YOU WANT RIGHT NOW SAFE AND SOUTHBOUND BECAUSE EVERYBODY IS SO FREAKED, AND AT THESE INTEREST RATES, IF INFLATION CONTINUES THESE ARE A BIG WINNER BIG, BIG, BIG. >> WHAT'S THE PODCAST AGAIN, GO BACK.

Read MoreRetirement Planning Gone WRONG! (Don’t make these mistakes) – My Retirement Account is LOSING Money

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

i have actually been obtaining this concern a great deal lately my pension is losing cash what do i do and also in this video i'' m going to show to you the response to that question for two different kinds of individuals one for those who are already retired and also for those ready to retire yet before we get there register for the network i have more than three decades in this business and i wish to share with you the conversations i have with my clients so you don'' t make the errors that numerous others might make so essentially i'' m mosting likely to deal with financial investments in the frame of mind concerning investments however i also want to show you a bonus offer topic if you will certainly a tax obligation preparation approach specific to times similar to this so see to it to remain tuned so i desire to show you right up front both worst things that you can do both for those that are already retired and for those regarding to retire the top point that i locate that many people do is panic is to overreact is to not recognize that there are traditionally ups and also downs in markets which is regular but behaviorally we have a tendency to respond a great deal much more when cash goes down after that we do take happiness when our portfolios increase we'' re concerned we may shed our cash and also as a result what is the effect on retirement as well as i am here to inform you the top worst point that you can do throughout times such as this is to over respond the second biggest error is to believe that you'' ve lost a number of cash and after that think perhaps you ' re back at the casino site and also maybe it'' s time to increase down as well as to try to get every one of that refund simultaneously do refrain that that really is betting not just your money yet your retired life future as well as please keep away from that believed procedure on the other side i wish to show you what we are telling our clients now because based on background precedent great deals of teleconference great deals of data great deals of analytics there is mosting likely to be a rebound of some sort it'' s took place each and every single time that the marketplace has actually come down it goes back up how much just how high when we wear'' t know that as well as i ' m not offering you financial investment suggestions'yet the advice that i ' m providing my clients the advice we are sharing with them is to start to prepare the profile for when we think the time is right to capitalize on some modifications so you can be in a placement that when as well as if the market does rebound that it does aid you and also you join that as you should so let me talk with those individuals who are about to retire yes your pension are probably down right now however my top piece of advice to you is this put on'' t allowed the worth of your profile determine when your retirement date is going to be as an example if you were going to retire within the following one two or three years as well as you'' ve seen your profile decrease over the previous 6 months approximately doesn'' t necessarily imply you still can'' t accomplish your retirement date because as i just claimed markets are rather predictable in this way they go up and after that they go down and afterwards they increase again and it duplicates itself rinse clean repeat so put on'' t take the snapshot now the polaroid picture yes i recognize that days me and also claim uh oh my portfolio was down consequently i need to defer my retired life a lot in the same vein incidentally as i saw a story a while ago that someone'' s 401k value was down and also therefore they chose not to take the holiday you ought to never allow the worth of your portfolio dictate for that brief time framework what you will or will certainly refrain from doing particularly when it involves your retired life the 2nd thing here for those about to retire is maybe we take this as a lesson to understand how much risk do you truly require to absorb order to accomplish your retired life number just how much do you need in your nest egg in the next one three 5 years so you can successfully pursue your retirement goals we call this in our organization the customized investment criteria you no more require to exceed the indexes if you will the s p the dao the e for whatever what you need to do is to recognize just how much threat you need to take in order to accomplish your retirement objectives and wear'' t take anymore threat than that in that method you might be able to reduce to lessen this volatility you may not lose as much money you might not have as much of a benefit either you might center it yet that may be much better off both for your profile as well as your sleep in the evening procedure as well now for those that are currently retired and this is a conversation i have a whole lot with my customers and i think it'' s extremely crucial for you to comprehend this it'' s significant absolutely nothing ' s changed what do i imply by that indeed i know your portfolio values are probably down now both the equity markets and also the set income markets bonds have actually had a disastrous year this year yet the fact is once more markets have a background they go up and they drop so if you recognize that markets rise as well as markets go down nothing'' s really altered in that way yet i understand due to the fact that i have these conversations with my clients a lot their expectation has actually changed so the most significant modification that has happened is that we'' re currently older and also we'' re really feeling a bit a lot more anxious we ' re no more working we ' re no more adding to the profile we might be depending on the portfolio for revenue over the future as well as we may be feeling that feeling of necessity absence of time if you will the reality that we wear'' t have as much margin for mistake as well as our perspectives have altered making this time feel a bit various than every other time and at a level you'' re right but from a financial market point of view that'' s wrong so i what i want you to do here is to see to it that you keep in mind what your long-lasting goals are make certain your profile is correctly alloted even during these times and have some confidence if you'' re collaborating with an advisor or if you'' re doing it on your own that the marketplaces will probably no guarantees for any future efficiency but the markets will possibly do what they'' ve done in the past which is go up and also down as well as up and to simply maintain in mind it'' s extra regarding exactly how we'' re seeing it than a per se modification out there so i assured you that sophisticated tax technique that is ideal for times such as this think it or otherwise when markets are down and several of your investments either stocks or shared funds or etfs or whatever it is you'' re investing in they may have lost some worth right what i want you to do is to talk with your expert as well as your tax obligation expert the expert being your economic advisor along with your tax obligation expert as well as to see if there'' s a means that you can market a few of those top quality holdings that you could have that may be down right now and also benefit from that loss if you have some resources gains that you are mosting likely to have to pay taxes on you may take this as a benefit to collect some losses to offset a few of those capital gains saving you in tax obligations for this year however it'' s going to be very crucial to coordinate your monetary preparation and also investment objectives with your tax obligation objectives too so this is a discussion you require to have with your group because this is what we'' re performing with our customers as well as you ought to be doing this as well you

Think Retirement = 🚫 Work? You may NEVER retire. Do THIS instead.

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

to make sure that'' s this one sort of command.

that maintains popping up in reaction to my video clips it'' s the whole oh you manage.

rentals ah you'' re still functioning you ' re not retired or oh you make YouTube videos.

you'' re still functioning no you ' re not retired it ' s not such as the retirement cops you understand I. imply plainly to these people out there retirement strictly indicates say goodbye to working say goodbye to need to.

make cash and for some remarkably it'' s even age bound apparently to be retired I obtained ta be 60.

plus [Music] I imply to be honest I assume this is just a silly debate over semantics right because.

well you can call it whatever you like we'' re happy living the way we live We'' re not gon na alter.

anything even if of YouTube remarks right but I additionally feel required to direct out that for.

these people thinking retirement purely suggests no much more functioning regular generating income they''

re. actually really incorrect it ' s a sight that ' s type of simply removed from fact entirely as well as.

the scariest thing is that if you stay with this belief you might never retire look I recognize the.

origins of the idea that retired life equals regular work I expanded up in that period also that era where.

you will certainly work 40 plus years in this one constant job retire at 65 and afterwards Tada Grand exit with.

this golden wall gold watch and your pension or you recognize Singaporean situation you recognize cpaf and afterwards.

off to the fairway you go now historically if you take a look at the context this was formed in the.

supposed golden years of the post-world War II full work now nowadays pretty.

apparent life job every little thing has substantially changed since not the very least root cause of Automation as well as.

digitalization jobs are no longer the secure point it made use of to be rather now it'' s very volatile.

I suggest consider what happened during the pandemic and afterwards since the pandemic is over it'' s the. tech layoffs as well as significantly fantastic news with the breakthroughs in AI drops are disappearing.

altogether the center class is vanishing they say the abundant are obtaining richer the bad are.

getting poorer so work nowadays already looks so different from what it used to be three decades earlier.

so why in the world would anyone anticipate retired life to stay the exact same as before I indicate the truth.

is that it doesn'' t for one it ' s obtained'a great deal more pricey we ' re living

so much longer these. days Treatment has actually also gotten progressively costly real estate expenses maintain Rising so pricey.

Climbing inflation not enough wage growth the quantity of money the experts maintain stating you need.

for a comfortable retired life continues Increasing however let'' s just take a reasonable number for the minimum.

suggested amount of financial savings for retirement in the US apparently that would certainly be about 555 000 US.

bucks or 10 times the U.S median income but after that another study shows that typically retired people have.

just somewhat over a hundred and also seventy thousand dollars conserved for retired life some retirees.

obviously simply have absolutely nothing zero as well as also in Singapore among the most affluent countries in the.

globe over 60 percent of pre-retired singaporeans are saying they'' re out track to retired life. either so after that what do you think all these individuals throughout the globe both pre-retirement and already.

retired are doing so this is what they'' re doing this is simply what pops right up if you do.

a quick Google on the Net by the method according to Wikipedia everyone'' s default Expert.

on all things in deep space if you take a look at Wiki'' s page on retirement in the US as you mature you.

have six way of life choices and also out of the six four entails some form of job full-time or part-time.

the truth seems to be that great deals of senior citizens are around side rushing or freelancing or setting.

up organizations or full-time Jobing at when more but it'' s not all as dismal as it might seem to. you obviously a whole lot'of individuals aren ' t planning on working after retirement simply only root cause of. monetary demand it ' s actually since they want to due to the fact that it'' s helpful for them it ' s

evidently around. healthy and balanced aging the feeling of social combination and also payment the entire seeing retired life not. as completion however as a brand-new phase of Life thingy which entirely makes good sense right because we'' re all. living longer and very early retirement is obtaining extra prominent so retirement isn'' t just that 5

to. 12 year duration any longer but possibly 20 to 40 plus years undoubtedly most senior citizens aren'' t back to the. full-time nine-to-five dissatisfied Daily Work there'' s so many varying levels of job after retired life. there'' s like semi-retirement you understand going back to work part-time that'' s freelancing Consulting.

what some individuals call opportunistic functioning occasionally they just do stuff like offering.

or adding in whatever ways they delight in however resembles it'' s a norm that numerous senior citizens are.

out there functioning or earning money or just getting this established regimen in their retired life sensation.

purposeful engaged and also quite pleased it'' s in fact a whole lot around simply advancing past that phase in life.

where your job is so consolidated paying the price of you and your household'' s existence that many.

individuals stick to doing crappy tasks they actually dislike just to endure I think that firmly insisting.

that retired life must be a Continuous vacation with no work or earning money whatsoever it'' s. truly simply fairly an ignorant idea that cherished Timeless vacation vision is not also a sustainable.

thing in truth I mean check out all the anecdotal evidence from all individuals out there you recognize.

they'' re claiming that that Eternal vacation stage of retirement it really lasts practically one.

two years generally Max prior to one obtains bored as well as depressed which feeling of loss and also being.

lost sets right in it'' s an entire cycle obviously you rest you get bored ultimately you discover.

brand-new Pursuits and also involvement money making or not and also then you get satisfied once more till the.

end to ensure that'' s the four phases of retired life so this person clarifies it in this video clip it makes.

overall sense you seem like you can examine that out however primarily ethical of the story at whatever age.

or phase of Life keeping hectic having function as well as engagement a great routine feeling included.

feeling monetarily secure it'' s healthy and also it makes individuals delighted on the other hand if you.

proceed to urge retirement you have to suggest no more job ever before since that'' s just how you'believe

you ' ll. more than happy until your end although the evidence factors or else then you understand that trashful.

quantity of retired life savings is just ever before going to maintain changing consistently higher and to hit it.

you'' re most likely mosting likely to end up working that added a lot more years it'' s already happening official.

old age across the world keeps enhancing and also say eventually happily you in fact handle to.

get there you retire you'' re sigh greatly loosen up right into your coastline chair which desire.

become a reality Perpetual getaway situation and after that one 2 years later on bam on routine.

it'' s lost catastrophe as well as your ball lonesome shed possibly questioning where everything went pear-shaped.

after that you pedal through some even more ears as well as let lost the bottom mode and afterwards you'' ll discover yourself. maybe aged 70 and also yet run out of financial savings since you didn'' t job right in between and after that you.

end up being one of those people around Googling how to discover a job at 70.

Sadly due to the fact that.

you in fact require to that'' s obtained ta suck so instead right here'' s my idea rather of clinging onto this.

outmoded suggestion of retired life I assume it'' s way extra productive to invest your time figuring out what'' s. possible currently for you as well as your ability sets you could hang around reasoning of exactly how you can perhaps take.

control and also redefine job as well as retired life in your life for yourself because if you wear'' t job as well as. retired life is being redefined for you by culture and federal government anyhow whether you like it or otherwise.

and after that you'' re just going to be adhering to along you can assume regarding just how you can potentially decouple.

the work you do from the cost of your existence as well as after that perhaps even better you can consider.

whether you can discover some means to decouple generating those existence calls from the straight.

input of your time as well as I think this is all truly important if you wear'' t want to be stuck on the.

grind up until you'' re regarding like I put on ' t know 120 years old since it'' s coming for everyone.

that time in your life where you can'' t make the exact same cash at your job as you could when you.

were younger or had even get a suitable paying task whatever that may be when you require one due to the fact that.

of like ageism as well as all those stuff you understand most Monetary guidance around they say that.

normally for any one of us to retire conveniently we need about 75 to 80 percent of our pre-retirement.

revenue to continue our existing criterion of living so below'' s the circumstance when I was still.

in the labor force myself running that business hamster wheel so I worked I was so done hectic.

simply working so I can hang on to that job it was my only resource of money so my entire presence.

was you recognize depending on that salary and as quickly as heck was not thinking to myself about exactly how I.

can redefine job for myself or if someday if I quit working how I might still generate 80 of.

that wage on a monthly basis so my presence wouldn'' t have to considerably alter I mean sure you can do.

like what we did now ideal you know downgrade your way of living probably move overseas to a less expensive place.

um come to be a lot less high upkeep in retired life so you don'' t need 80 of your pre-retirement revenue.

Possibly you'' ll still need what 30 40 percent as well as if right now your only income generation.

is through that task that salary you got no Investments no various other skills no side hustles.

no nothing when that work retires you at that compulsory age or as a result of a few other situations.

God forbid after that what are you mosting likely to do I think that'' s the sincere truth for a lot of working.

adults available still particularly more so if you in fact got married and started bulging.

children you understand time simply vaporizes very quickly at this phase of life already so I think all of us.

require this tip you know to look up from our service you understand to consider the larger image.

and try to regulate where we'' re all headed towards if you'' re still enjoying this video clip now.

after that I wish this works as that tip for you anyway if you'' re checking out your ability.

and maybe thinking of finding out brand-new ones you may be interested in what today'' s video. sponsor skillshare needs to supply skillshare is an on the internet knowing neighborhood with thousands.

of classes for anybody who enjoys finding out if 2023 is the year you promised on your own.

you'' re ultimately gon na explore new job or side hustle options or maybe deal with.

your individual growth skillshare is a excellent location to begin for the Italian me we.

take pleasure in being creative in our retirement so we create a great deal right we we prepare we do art we.

do pottery and we also make video clips on YouTube when we initially began skillshare was where.

we discovered so several Essentials like videography narration and a lot more so today among the.

best courses I ever rested through online anywhere is still that class by Sorel Amore YouTube success.

construct an authentic Channel that'' s worth to follow so her guidance concerning discovering your Specific niche valuing.

credibility over Beauty as well as producing purposeful messages and supplying worth to the target market it.

just actually leveled up the videos we were developing at that time it'' s always very easy to take whatever you.

discover on skillshare as well as apply it directly to your life Pursuits whatever those might be I very.

advise having a look at skillshare utilizing my web link in the summary below the very first 1000 people fail to remember.

one month of skillshare absolutely cost-free you can try it out discover something brand-new step a step closer.

to your 2023 objectives eventually no one actually recognizes anything so you require to develop your own process.

take care of danger and also after that stick to your plan via thick and also thin well also continually finding out.

from blunders and also improving most of us only live as soon as let'' s attempt to do it the finest that we can by this.

factor I'' m certain you ' ve obtained a whole lot to state in response whether you think what I'' ve simply stated is all.

bollocks or if you two are searching for a much better way of living layout after that this conventional retirement.

version which I'' ve constantly discovered so disappointing well you can leave me remarks below and also we.

can discuss I hope you enjoyed this video clip as common leave a like so hopefully more individuals will certainly.

see this as well as subscribe if you desire to maintain up with even more of this things thank you all once more.

and also let'' s chat once again following Saturday Cheerios.

Retirement Regrets: “I Wish I Would Have…”

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

One of the most effective means to plan for

retired life is to take a look at those who have already been via it. Today we'' re. discussing 3 of the most significant remorses that we speak with people that.

have actually currently retired and also maybe you can use several of those lessons to aid you.

improve your retirement. hi I'' m Chad Smith below with Alison Berger and.

welcome to the Financial Proportion channel where we'' re everything about assisting.

you find the balance of living today so that you can have an extra satisfied.

retired life later on when we think of is sorry for the important things that initially comes.

to mind for me is the flick “” We'' re the Millers” and also when the daughter'' s. partner comes in with a tattoo and he has “” no ragrets”” it'' s there as well as the father.

states really not also a single letter right, so it as well as it'' s amusing that there'' s. so numerous references to tattoos when it pertains to regrets and also that'' s due to the fact that we. think about them as being permanent and also it'' s really upsetting off or transform.

Only one in four retirees goes into retirement with a detailed financial.

house upkeep things like that that could otherwise gnaw at those.

Mitch Anthony who it ' s another means of overcoming this there ' s these.

choices and thought procedures and really they imitate workbooks so you. can'type of analyze this procedure as well as I such as to quote because we both. just recently went to Disney we had a remarkable Disney experience Roy Disney. had a great quote around this suggestion and also it ' s, “It ' s not hard to make decisions. when you understand what your worths are “,” I'think that ' s a wonderful way to sum up this. concept of having a detail strategy taking time to'place it down on paper and understand. the decisions that you ' re walking through.So that 2nd regret that we. gone through it enters into much more information within that context of the.

thorough plan and also it ' s I want I would certainly have had more free of tax financial savings right no. one likes paying taxes so it ' s wonderful if you could recall and discover ways to do. more of that yeah and also especially in retired life if you ' re on a set income. taxes gnaw at even more of those cost savings that you may have so what we see a great deal. is'that individuals been available in and also they have a large account equilibrium in their 401k as well as. that ' s it they place ' t saved in any type of other accounts as well as I think that ' s an. simple'thing to do since it comes right out of your salary automatically. postponed which is terrific aids you develop up those savings but it doesn ' t offer you.

a whole lot of adaptability so in regards to retirement a great deal of times there ' s. surprises

as well as you may not have the ability to work as long as you had actually intended so early. retired life'tax-free cost savings make a huge difference offer you a lot.

much more adaptability to make sure that means we want to take a look at that our Roth IRA payments. if you ' re eligible, back-door Roth IRA contributions if you have high revenue,.

after tax 401k and also potentially also your HSA can be a wonderful retired life savings.

vehicle.And if you intend to discover more concerning those we have a longer podcast. episode that we did pertaining to this as well as it ' s in connected in the description. listed below where you can discover how to execute those so the third one is one. that you gain knowledge as you invest via the years right if you have a. lengthy investing life time and you ' re currently retired you have that comfort to. look back and state I wouldn ' t have stressed so much regarding. market drops buying the stock market is gon na raise your price of. return and your criterion'of living in retirement so it ' s crucial to have a. healthy allocation to the stock market throughout your functioning years in particular. and afterwards even into retirement so that you stay up to date with rising cost of living with time and also. maintain acquiring power yeah one of the stories as well as graphs that we stroll. with is that idea of missing out on the most effective days when you ' re investing and when. you ' re trying to time the marketplace it ' s easy to think that you can lose out on. the declines however remain in for the gains yet if

you'are it ' s hard since the gains the. big gains normally take place right following to the large losses and also it if you take a look at. this graph and also you see simply missing the best 5 days

it utilizes$ 1,000 as an instance. to show you however it takes a look at a period from 1990 to 2018 so a long period of time duration. however if you were just to miss out on the very best 5 days there and also you started with$ 10,000. you miss out on out on $44k of development which is an automobile that says new vehicle. tough pill to ingest I was going to state yet yeah I do auto is a far better instance. there so really it ' s concerning when you

' re in truth you ' re thinking of. planning you ' re trying to bring the future back to today to ensure that you'can. make far better choices in this aspect

among the manner ins which we have profiled that. in a previous video is discussing how do you spend at all-time highs as well as you. can watch that video clip below here we '

ve linked it for you and and we stroll. via thoroughly there is decision-making that you should utilize and. the historic instances that can help you do that and after that obviously if you. like these videos as well as intend to watch even more you can look into the subscribe button. next to Allison there as well as we eagerly anticipate signing up with

you following time.

Today we'' re. Only one in 4 retired people goes into retirement with a comprehensive financial. If you were simply to miss the ideal 5 days there as well as you started with$ 10,000.

Read More6 Retirement Essentials (Most people only prepared 2 or 3)

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

I'' m planning for retired life the majority of people concentrate.

mostly on aligning together enough money you understand Financial Resources so that they can last.

the range and afterwards possibly at the rear of their heads they have some vague strategy right perhaps.

2 or 3 points to fill up the time with a great deal of the times this is things like travel family.

well unfortunately I'' m gon na say that ' s not fairly virtually enough for Preparation we ourselves.

have been retired for 2 years and also going looking back on the past 2 years I type of see like.

6 necessary things that if you prep for it beforehand prior to your retirement begins I assume.

this can truly make such a positive difference to your retirement to ensure that'' s what I wanted.

to raise and also talk about with you guys today top firstly of program we have.

to talk regarding cash the majority of people'' s issue is the amount of money that they have in retired life.

whether it will certainly last them till completion come comfortably as well as allow them to pay for the Hobbies.

like traveling excellent food Etc however I in fact think after going via the last 2 years accumulating.

our monetary Acumen is equally as important if not a lot more so what do I imply by Financial Acumen I mean.

stuff like budgeting tracking predicting investing I suggest if you think of it the cash in your.

financial institution account can always be misused most of us understand that tale I think more significantly what'' s. mosting likely to make your retirement more fireproof is having a capacity to produce even more cash where.

it came from to begin with so the second vital thing that you can prepare for to make sure that.

you have a remarkable retired life it'' s certainly the capability to be self-directing as well as disciplined.

self-direction definitely helps a lot with investing your retired life days meaningfully right.

besides there are no much more like job routines or like demands from colleagues or employers to help.

shape your days anymore you need to be the individual to take cost in retired life there'' s a research study out.

there really that reveals that for gladly retired individuals the majority of them in fact have concerning 3.6 core.

Searches that'' s what they state as well as the unheably retired individuals have a tendency to have less than 3.6 company.

fits can be found in at about 1.9 call Searches that'' s what the research reflected I presume it type of just.

programs in retirement you truly need to load your life to the border as well as keep active with tasks.

you like which is a truly terrific formula for happiness as well as self-direction will certainly aid you.

to attain that state as well as self-control since if you think of it like technique.

directly impacts the state of your finances right it influences whether you stick with your retired life.

preparing whether you maintain fit and also active and also you reach keep your health in retired life also.

whilst you'' re left as much as your very own devices also to locate your cover matches if you wear'' t have any. when you ' re starting or in your retired life so discipline as well as self-direction will certainly be like.

the building obstructs for appreciating your life in retirement the 3rd vital point you might.

wish to service as well as grow or happy retired life is individuals skills right so research studies and also study.

have reflected very continually that the major determining factor for joy and Longevity.

for the majority of us is in fact partnerships Human Relationships friendships partnership with.

your spouse as well as with your family I guess if you take a look at the majority of us you recognize we all have.

a little need of work with some social abilities in some element I suggest a few of us are a bit shy.

paper hats or chart or perhaps socially anxious dealing with our individuals skills truly will aid us.

to manage as well as live gladly with our partner and also relative and additionally importantly to make.

brand-new relationships at whatever age we all understand that making brand-new good friends gets a whole lot a lot more tough.

as we obtain older I imply I place'' t listened to any individual say otherwise for me personally making new pals.

as I age is the largest obstacle there'' s this substantial sensation that nothing can replace.

friendships with people that have actually understood you all your life yet it is also an obstacle as I.

have actually picked to exercise via Arbitrage in our retirement and also we'' ve moved away from residence.

Those close friends aren'' t with us in our present I find that it takes a great deal of purpose I have.

to consciously press myself to expand my Social Circles and make the initiative to be familiar with people.

on a much more intimate basis I am additionally really happy to be able to state that it has actually settled because for.

the last two years in Bali I have actually made 2 or three new pals that I'' m happy to state are.

kindred spirits and also not simply social colleagues to make sure that'' s very great and it ' s a massive Comfort to our.

daily life here in a foreign land far from residence currently prior to we proceed a big thanks to.

Mumu Singapore for sponsoring this video Singapore is an on the internet trading system for.

supplies ETFs as well as alternatives I'' ve been utilizing the MooMoo mobile trading app myself for practically.

a year now and I assume it'' s outstanding it ' s quickly user-friendly trading United States Stocks is payment. free plus they give complimentary level to information and also lots of more benefits currently for a minimal time when you open up a.

Mumu Singapore Universal account they'' ll offer you a year of compensation totally free trading of Singapore.

supplies ETFs as well as reviews if you'' re trading us and also Singapore stocks just switching to the MooMoo.

app will certainly save you a lot money already when you down payment at least a hundred same bucks and.

beginning utilizing the mobile app to trade you stand to receive cash discount coupons approximately 128 Sing bucks.

as well as also a free Coca-Cola share worth around 87 subscribe 2 thousand Sing dollars or more into.

funds on the MooMoo enjoyable Hub and also MooMoo will certainly offer you pay vouchers as much as 150 Sing bucks subscribe.

a minimum of 100 Sing dollar us to Momo cache plus and they'' ll throw in an additional contraction.

bucks cashback altogether that'' s 368 Sing dollars worth of Invite incentives absolutely totally free.

simply for utilizing the Momo application so if you'' re proactively spending anyhow I recommend looking into the.

MooMoo ad using my web link in the description below currently back to the video clip the 4th necessary.

point that you can certainly work with as well as that will certainly benefit your retirement significantly it'' s. in fact guts you'' re definitely gon na need whole lots of nerve in retirement as well as I guess this isn'' t. an ability specifically it ' s kind of more of a quality yet in retired life you need a great deal of guts.

to also dive right into retirement you need the guts to you recognize take that leap of confidence to.

quit placing it off as a result of fear of the unidentified feeling or monetary insecurities so after that it'' s

all. concerning nerve at that stage not allow worry as well as instability regulation your life as well as your choices it.

is also the nerve to recognize that in life at the start at the end in the center the Domino'' s. you need are never ever all perfectly aligned you understand eventually you just got to delve into it and.

after that learn to go across the barriers as they come so for retired life long-term I guess the.

most significant problem most frequently is constantly money but my perspective on this is that hi budget plans.

can always be lowered money can constantly be made or redeemed or whatever takes place so I still.

believe that you know it is really valuable to Advocate a strategy whereby you get to.

a factor where you really feel that you have many of your Ducks aligned you'' ve intended well you''

ve. prepped for it clinch your nerve with both hands and after that take the plunge individuals tend.

to consider retired life as the end but it'' s not it ' s the start of a brand-new phase where you must be. trying so numerous brand-new things brand-new Pursuits new methods to live as well as for each and every of these new journeys.

you'' re gon na require nerve to take action and when you have taken the dive you'' ll discover the. next fifth thing very really valuable which would certainly be a mentality of strength particularly in very early.

retired life there are a whole lot even more decades ahead of you you understand and also consequently a lot even more chances that.

they things can go wrong whether it be to bad monetary planning or possibly an unforeseen Health and wellness.

catastrophe or even occasionally natural calamities whatever comes I presume you will always require that.

stamina of Will as well as the durability to make sure that you can roll with the strikes and also then obtain back up.

you desire to recognize that you have the psychological toughness that also if points go pear-shaped you won'' t simply. offer up as well as shed hope as well as particular Edge you'' ve obtained to Marshall what you'' ve got in you head out.

there locate Solutions perhaps if essential you'' ve reached go back to function yet understand that later on.

you can go back to retirement and try once again so the sex necessary point that I think will certainly benefit.

every person in retired life is to cultivate a perspective of gratefulness most of us recognize life is a very long.

trip ideally a minimum of therefore much of what we Chase making use of a lot of our years in fact doesn'' t. really matter in the big photo when you have taken a step back and after that at that factor is when.

you start understanding the earlier you grow and mindset of appreciation which admiration for.

the straightforward little points that are most likely around you everywhere each day the better you possibly.

will be as well as it sounds silly yet it'' s not really automatic I suggest most of us live as well as grow up and also.

job as well as go to school in a culture that kind of innovates us with messages that we need to get to.

for even more have extra aspiration provides us you recognize that High meanings of success in life that we.

need to try to leap to get to and also no one sings the Praises of the satisfaction of an easy cup of.

tea you recognize the relevance of family time with your enjoyed ones or or just the enjoyment of being.

able to take a night walk on the beach with your canine so I assume that it'' s really important that

. somebody reminds you that you understand you can not overload what you already have what you'' re currently.

surrounded by growing that muscle mass of recognition so that in each as well as every moment you exist.

in your very own life you see all the little Joys that you'' re bordered with everyday and if you.

real-time life like that I believe that will help you achieve contentment with simply the tiny stuff.

around you which'' s what majority of your life in retirement might have to do with is just a little things.

each day however in my own retired life here in Bali it is what makes me so happy therefore pleased every.

day that I am surrounded by my loving partner as well as extremely fascinating and also independent little canine.

that'' s extremely really cute you understand that we have really comfortable a little bit easy house we have the capability.

to appreciate excellent food also if it'' s straightforward stuff from the war spaces locally we have a yard and.

attractive things are growing around us daily the climate is excellent you know things is great yeah.

I assume this is just one of one of the most necessary basic things that'' s often neglected just since it'' s. an issue of mindset but I believe this important high quality or characteristic might make all the.

difference for you so these are the six essential things that I believe are very very important for.

you to grow and also prepare for in the leader to in fact starting right into a return then I.

think that if you have these six strong abilities and also high qualities going with you you will certainly remain in a setting.

a lot a lot more well put to make the most effective out of your retirement nonetheless long that duration might be allow me.

know what you think about my tips whether you agree or if you believe they draw let me understand why.

but anyway I actually value you tuning in as well as sharing my thoughts for this week and also.

any place you are in the globe I'' m desiring you a delighted Saturday night and also let'' s talk again.

next week till after that you make sure and also bye in the meantime.

F.I.R.E – 6 Uncomfortable Truths we discovered about Early Retirement & how to mitigate them

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

international hello what are the awful sides to.

retiring very early aren'' t you burnt out every day simply lying around not doing anything put on'' t. you individuals fret about running out of cash hello guys welcome back to one more beautiful.

day right here in Paradise Bali a lot of you have been asking me so several concerns like the.

above so today I'' m gon na go through six awkward facts concerning layoff.

along with my pointers for alleviating them based on our very own experiences reaching fire and.

being retired right here in Bali Indonesia for the past two years so unpleasant fact number.

one retired life is a journey not a destination for the document lying around throughout the day doing nothing.

in retirement is a misconception it'' s always wonderful to have a couple of days of that right here as well as there but in reality.

you do that for lengthy stretches of time and you'' re most likely mosting likely to be struck extremely really hard with.

sensations of boredom lack of self-worth and you'' re gon na be missing out on a sense of satisfaction retirement.

isn'' t a location like Bali or Boracay it actually is the start of a New Trip in your life it'' s. that stretch of time where you lastly do those points you wished to do yet always couldn'' t. since you were so busy generating income to survive it can be anything taking a trip the world.

Creating that publication or researching that claim cross stitch side hustle if you never get past the.

myth you'' ll probably wind up getting bored and after that finish up returning to function and missing out on out on this.

Remarkable Life Experience so like every other journey start preparing what is this impressive experience you.

wish to invest your retired life time as well as cash on number 2 if you obtained burnt out during your.

retirement stuff maybe you'' re doing it wrong so for a great deal of people their retired life Jam.

has to do with traveling the world right that'' s an incredibly common one and also it'' s fantastic fun you never ever

. feel extra alive and also it'' s such a terrific obstacle because in fact you need so several various abilities.

to travel properly appropriate you require Street smarts to navigate the towns and scams as well as other concerns.

on the road you need to be able to prepare your travel plan book the most effective traveling deals know just how.

to haggle your costs in addition to things like riding a motorbike as well as diving as well as at the.

start it'' s always epic it ' s so unbelievable yet on exhilaration as well as feeling of achievement begins to.

plateau and afterwards you'' re gon na strike that factor of lessening returns and also it wasn'' t just. in traveling either it was likewise my paint my services my making it through The Wanderer life thingy I.

discover that when love to stay largely undirected most Quests in fact often tend to lose their taste.

with time another method of putting this is maybe you feel yourself coming under torpidity or.

that functioned really well for me one either I begin piercing deep down right into the details of.

what I'' m doing or 2 I make it into a service take my dad cooking is his terrific love in retired life.

yet he'' s not just asking in any case for the fun of it the last couple of years he'' s in quest of cooking.

a tastier sourdough bread any person has actually ever before come across out of 365 days in a year he is possibly.

baked about I'' m presuming possibly 400 sourdough loaves 2 loaves each bake he tweaks the dishes.

the starter the strategy the components he does some reverse engineering of sourdough bread that'' s. commercially marketed outside it'' s been maybe 3 years as well as he'' s still going solid so he established his.

own special sourdough bread objective and Target and also criteria rather of just offering as well as yogurting.

for fun I became professional teachers in both as well as at some point started both a yoga exercise service and also.

a browse school and you know I discovered a lot much more regarding both in the entire process whatever.

Search around if you begin truly piercing down there'' s constantly more Improvement to be had.

much more individual growth to seek please claim you enjoy Ceramic wear'' t simply do it aimlessly to pass time.

polish up your abilities go into competitions end up being an expert Potter do compensations as your.

retired life side rush or teach pottery classes when you keep pressing on your own to those higher.

requirements due to the fact that you'' re either actually drilling down right into the craft of it or you'' re running it.

as a Business you'' ll locate brand-new measures of efficiency therein and you will certainly be burnt out not to.

mention if you'' re actually like us on lean fire whatever website income you generate will help defray.

the expense of your passions and also leisure activities so you put on'' t need to touch on your long-term Investments.'isn ' t that a truly excellent bargain so two years ago at the age of 38 I retired with my spouse below.

in Bali it'' s quite early by a lot of standards and it'' s been a totally remarkable journey we''

ve. found out a whole lot and I hope the insights we are showing to you people are valuable if you'' re on. your own fire Trip or currently neck deep in retirement smack that like button show us in.

the remarks listed below what your retired life appears like up until now how you'' re maintaining active and also whether you.

concur or disagree with the points we made below currently on the 3rd uncomfortable reality it'' s. hard that you need to safeguard your time you possibly retired so you can spend your time doing however.

you please whenever you please many of us will certainly have invested the vast bulk of Our Lives.

thus much making a living which suggests generally another person is routing your time either your.

boss or your customers and also we obtain really made use of to that so then in retirement self-directing your.

time becomes something brand-new as well as type of foreign as well as if you take a look at retired individuals in Singapore.

after functioning jobs that whole lives the majority of them finish on in retired life working as complimentary.

day care solutions for their grandchildren if that'' s their utmost desire and for some.

Typical older individuals it certainly is after that it'' s wonderful I ' m really

happy pleased themHowever for some it might not actually be that yet they find themselves doing it anyhow type of like by.

default because they'' re so used to permitting another person to direct their time for them there'' s. always going to be individuals around that will attempt to make use of your leisure time asking you to.

run tasks for them maybe or like for us right here in Bali we obtain numerous requests from both individuals.

we recognize personally as well as full strangers of the net asking us to do things like strategy their.

vacations reveal them around Bali Etc obviously we like hosting friends and also household and we.

delight in aiding individuals typically yet smartly speaking our very own private lives would certainly simply disappear.

if we were to delight all the requests we obtain you'' ll need to discover how to say no to individuals and. exactly how to strike equilibrium retirement is as much regarding sharing your time with the people who matter.

to you as it has to do with having time for your own personal growth and advancement simply be mindful.

unpleasant truth number 4 it'' s most likely gon na be simply you as well as your considerable various other from.

now on out so upon retired life your social scene is going to alter significantly everyone else is at.

job or active with their very own things you'' re either gon na have to find out to appreciate your own company.

a whole lot or if you'' re fortunate adequate to have retired with your considerable other that'' s who you ' ll. most likely be spending bulk of your retirement with so best learn to manage companionably great.

interaction is crucial as it'' s simply generally being a considerate and respectful human being via.

the pandemic and on the road this past decade I'' ve seen a lot of individuals who appear truly shocked.

by the person the other fifty percent absolutely is when they start retired life and start taking a trip with each other.

24 7 a day but building that Convenience to do things on your own and also building that fantastic.

relationship with your other half can also potentially be one of the most rewarding part of your.

retired life journey and also your individual growth prior to I share with you the 5th awkward.

reality simply the fast word from our enroller of today'' s video clip MooMoo Singapore the stock.

market is historically among one of the most preferred ways to be invested I myself hold.

a choose number of U.S Blue Chip stocks and ETFs and also for over 10 months now I'' ve been making use of.

the MooMoo Singapore platform the mobile app is intuitive quickly very easy to utilize I break out real-time.

information and also also degree 2 quotes plus the super affordable commission costs consisting of trading U.S.

supplies with no commission saves me so much cash for a minimal time now brand-new customers of MooMoo.

Singapore obtain a Kickstart with the financier starting kit worth up to 2086 dollars when you.

register and down payment a hundred Sing dollars right into the moon Universal account will neutrals in 2.

Sing bucks cash get daily for the very first 10 days that'' s a present of 20 Sing dollars absolutely.

free on a deposit of a hundred bucks or more down payment 2 thousand Sing dollars as well as do.

to buy professions you'' ll obtain one totally free Coca-Cola show to about 80 Sing dollars if you down payment.

ten thousand Sing dollars as well as execute 7 purchase professions they'' ll provide you a 108 Sing buck Money.

discount coupon no inquiries asked I strongly believe that in today'' s day as well as age to be economically capable.

necessarily indicates one have to be putting the cash to function for them somehow so why not.

make the most of these deals now for even more info click the web link in the summary listed below.

uncomfortable truth number five your cash strategies are never as foolproof as you think all retired life.

whether it'' s the normal kind or fire actually all come down to the monetary preparation behind it.

right as well as one of the most unpleasant truth of all may be that your retired life funds are never.

as sure-fire as you prepare for specifically if your strategies are expected to spend 30 40 also 50.

years in the case of very early retirement expert forecasts and also assumptions go incorrect you made a.

mistake in your profile planning as a result of all the customers that we all carry Bearishnesses occur.

blacks on events gray Rhino events so lots of points no matter the plan regardless of exactly how much stress.

screening you did prior to you dove into it the unexpected typically takes place as well as the quicker you come.

to terms with this unpleasant reality the quicker you can proceed to hatching out versus the risks.

You can predict most retired people they'' re functioning their monetary planning and also much less Help around.

the 4 percent drawdown policy right so the U.S stock exchange has had an incredible Run for the.

last 10 12 years or two now certainly points are looking a little various for the near.

future so those that have been traditional and also that have actually abstained from touching their long-lasting.

investments will have extra reproducing space currently to ride out this bearish market nonetheless long it may.

last buddies who have been following our journey for a while currently understand that a dominant portion of.

our retired life below in Bali consists of rental income from a variety of property Investments.

as well as however in the last two years considering that we started retirement Europe is a video game up in arms.

soaring Energy prices have increased the expense of living throughout the world and everywhere huge.

inflation is now a substantial concern fortunately we have so far taken care of to deal with whatever disturbances.

we'' ve experienced but primarily yet another unpleasant truth in retired life is that managing.

your money to make it last till the end takes up even more time than you assume wear'' t just go to rest on.

it continually look to expand the eggs in your basket and be open to adjusting your cash strategies.

like rebalancing your portfolio or changing how you invest your retirement Toolbox as different.

opportunities provide themselves for time you may not require to work for money any longer yet doing.

stuff that fuels your personal growth which produces some extra side revenue as a reward is.

never a Bad Point uncomfortable fact number six no factor sweating the tiny stuff y'' all understand I ' m. a big fan of simple frugal living as well as no pretenses whereas satisfied eating in an elegant restaurant.

as we are eating at the regional Battle areas right here sometimes extra pleased in fact yet a lot of us.

can additionally easily get carried away diving into with the itsy bitsy details of frugal living you.

recognize spending 2 hrs right here searching for offers as well as coupons that wind up conserving you 10 dollars three.

hours there finding out just how to maximize your air miles must you secure that 3.5 fixed.

deposit rate now or wait till next week where possibly it may be 3.7 I mean it can be fun.

and afterwards it can also be a poor use of your time you can do it if you delight in the obstacle.

feel in one’s bones that so long as you obtain the large stuff right your retirement is most likely mosting likely to function.

out just great so don'' t sweat the tiny stuff huge things include stuff like keeping top.

of your overall General expenditures you recognize doing your taxes right keeping a balance then.

Diversified profile so as lengthy as you keep in addition to every one of that I think that'' s regarding 95 of.

the huge picture truly alternatively what I'' m also saying is that if you explode your retired life.

funds by for example trying to go large or go residence on crypto no amount of voucher cutting is.

gon na save you from needing to go back to a task so yeah that'' s my take on not sweating the little.

things we'' re all retire at some factor of Our Lives whether early or late willingly or involuntarily.

all of it come down to choice as well as progressed preparation simply what I'' ve personally observed is that if.

you eliminated all the noise and distraction in life what do you believe are the genuine money we.

genuinely traded the means I see it is four points it'' s cash time Young people as well as health and wellness just consider it.

everything we do throughout our entire lives is actually us trading one of these for the other an.

layoff is that a person anomaly where you are in a position to invest all four money at the same time.

concurrently which maximizes your experience of life an actually clear image of this is.

traveling you can take a trip in your 60s and also 70s sure that'' s what a lot of individuals will certainly finish up doing and it'' s. wonderful you understand you see these folks really delighting in seeing brand-new points being very satisfied but it'' s usually.

in the kind of like great deals of cruise ship journeys around the globe and that'' s cool also but they'' ll never ever. experience what it'' s like to try finding out to browse or sail and getting all salted and burnt and also.

muscle mass achy but happily tired oh they'' ll never ever attempt anything even more vigorous and adventurous.

like say backpacking your method via Europe you understand crushing in brand-new hostels satisfying crazy individuals.

from Iceland or anywhere and also doing ridiculous points with each other all of us have 2 lives the life that we.

presently live and the life we could possibly live so then which life would certainly you choose inform me in.

the remarks below and put on'' t tell me you wouldn'' t retire early due to the fact that you simply wouldn'' t actually understand. what to do that'' s just a cop-out solution since yeah well you'' re too lazy to do the legwork.

and also try brand-new stuff as well as comprehend yourself thanks for seeing as constantly talk.

again following Saturday bye foreign.

Buffett on retirement

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

FOR INDIVIDUALS NOW WHEN IT INVOLVES CONSERVING. >> > > I THINK'IT ' S THE SAME POINT THAT MAKES A LOT OF SENSE FRANKLY ALL OF THE MOMENT, AS WELL AS THAT IS TO CONSISTENTLY PURCHASE AN S&P 500 AFFORDABLE INDEX FUND. KEEP BUYING IT THROUGH THICK AND THIN, AND ESPECIALLY THROUGH THIN. BECAUSE THE TEMPTATIONS OBTAIN– WHEN YOU SEE NEGATIVE HEADLINES IN PAPERS, POSSIBLY TO SAY WELL PERHAPS I MUST MISS A YEAR OR SOMETHING. SIMPLY KEEP PURCHASING. AMERICAN COMPANY IS GOING TO DO PENALTY GRADUALLY. SO YOU UNDERSTAND THE INVESTMENT UNIVERSE IS GOING TO DO EFFECTIVELY. THE DOW JONES INDUSTRIAL STANDARD WENT FROM 66 1,497 IN ONE CENTURY, AND GIVEN THAT THAT CENTURY HAS ACTUALLY FINISHED, IT'' S ESSENTIALLY DOUBLED ONCE AGAIN. AMERICAN COMPANY IS G. THE TECHNIQUE IS NOT TO PICK THE RIGHT BUSINESS, IT'' S TO BE– BECAUSE MOST INDIVIDUALS AREN ' T FURNISHED TO ACCOMPLISH THAT. AND A LOT OF TIMES I MAKE ERRORS. THE METHOD IS TO ESSENTIALLY BUY ALL THE BIG BUSINESS THROUGH THE SFUND AND TO PERFORM IT REGULARLY, AS WELL AS TO PERFORM IT IN A VERY, VERY AFFORDABLE WAY.BECAUSE COSTS REALLY ISSUE. AS WELL AS FINANCIAL INVESTMENTS, IF RETURNS ARE GOING TO BE 7% OR 8%AND YOU ARE PAYING 1% VIA CHARGES, THAT MAKES AN MASSIVE DISTINCTION IN HOW MUCH MONEY YOU CARRY RETIRED LIFE. > > AT THE YEARLY CONFERENCE FOR BERKSHIRE HATHAWAY THIS YEAR, YOU INTRODUCED A SPECIAL VISITOR TO THE AUDIENCE OF 40,000 SHAREHOLDERS THAT WERE WATCHING. IT WAS JACK VOGEL. WHY DID YOU WISH TO IDENTIFY JACK VOGEL? > > I THINK JACK VOGEL HAS DONE EVEN MORE FOR AMERICAN INVESTORS THAN ANY OTHER INDIVIDUAL GOTTEN IN TOUCH WITH WALL SURFACE ROAD OR T DUE TO THE FACT THAT WITH A NUMBER OF OTHER PEOPLE WE THOUGHT OF THE SUGGESTION, HE WASN ' T THE SOLE THINKER BEHIND IT BUT HE WAS THE GUY WHO EXECUTED IT AND CRUSADED FOR CURRENTLY TRILLIONS OF DOLLARS IN LOW COST INDEX FUNDS. THE MAJORITY OF PEOPLE ARE GOING TO HAVE BETTER LIVES, BETTER RETIRED LIVES, THEIR KIDS ARE.

DUE TO THE FACT THAT THE TEMPTATIONS GET– WHEN YOU SEE BAD HEADINGS IN NEWSPAPERS, PERHAPS TO SAY WELL MAYBE I NEED TO SKIP A YEAR OR SOMETHING. > > AT THE YEARLY MEETING FOR BERKSHIRE HATHAWAY THIS YEAR, YOU PRESENTED An UNIQUE GUEST TO THE AUDIENCE OF 40,000 SHAREHOLDERS WHO WERE WATCHING. > > I THINK JACK VOGEL HAS DONE EVEN MORE FOR AMERICAN INVESTORS THAN ANY OTHER PERSON CONNECTED WITH WALL SURFACE STREET OR T SINCE WITH A NUMBER OF OTHER PEOPLE WE CAME UP WITH THE CONCEPT, HE WASN ' T THE SOLE THINKER BEHIND IT BUT HE WAS THE MAN THAT EXECUTED IT AND CRUSADED FOR NOW TRILLIONS OF DOLLARS IN LOW COST INDEX FUNDS.

Recent Comments