How 2024’s Record Retirement Numbers Could Spark a Recession | WSJ

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

– [Narrator] You're looking at

a chart of the US population, and these are the baby boomers. This year, a record number of them will reach

traditional retirement age. By 2030, they'll all be 65 or older. This is creating a fiscal problem because fewer taxable

workers means less money for social security. – If Congress does nothing,

we're gonna hit a major crisis.

– [Narrator] Here's how

this demographic shift threatens the future of one of the country's most

important government programs and what can be done to fix it. Baby boomers or those born between 1946 and 1964 have been propping

up the US economy for decades. – Their mere numbers

contributed for a long time to rapid economic growth and because every worker

contributed social security that made social security

look very healthy. – [Narrator] But as boomers

started exiting the workforce in 2008, the number of

retirees grew rapidly. – Not only do you have more

retirees collecting benefits for more years, you

have fewer young people entering the workforce

because birth rates were lower for their parents' generation, and that creates a squeeze

on both directions.

Higher expenses from all

those retirees living longer, lower payroll tax revenue from fewer people entering the labor force because of those declining birth rates. – [Narrator] This puts a lot

of pressure on social security and without policy change, projections show the trust

funds will be depleted in 2034. – There's a misconception out there that when the social security

trust fund is exhausted, the system is somehow

bankrupt and there's no money. Social security is an integral part of the federal government, and as long as the federal

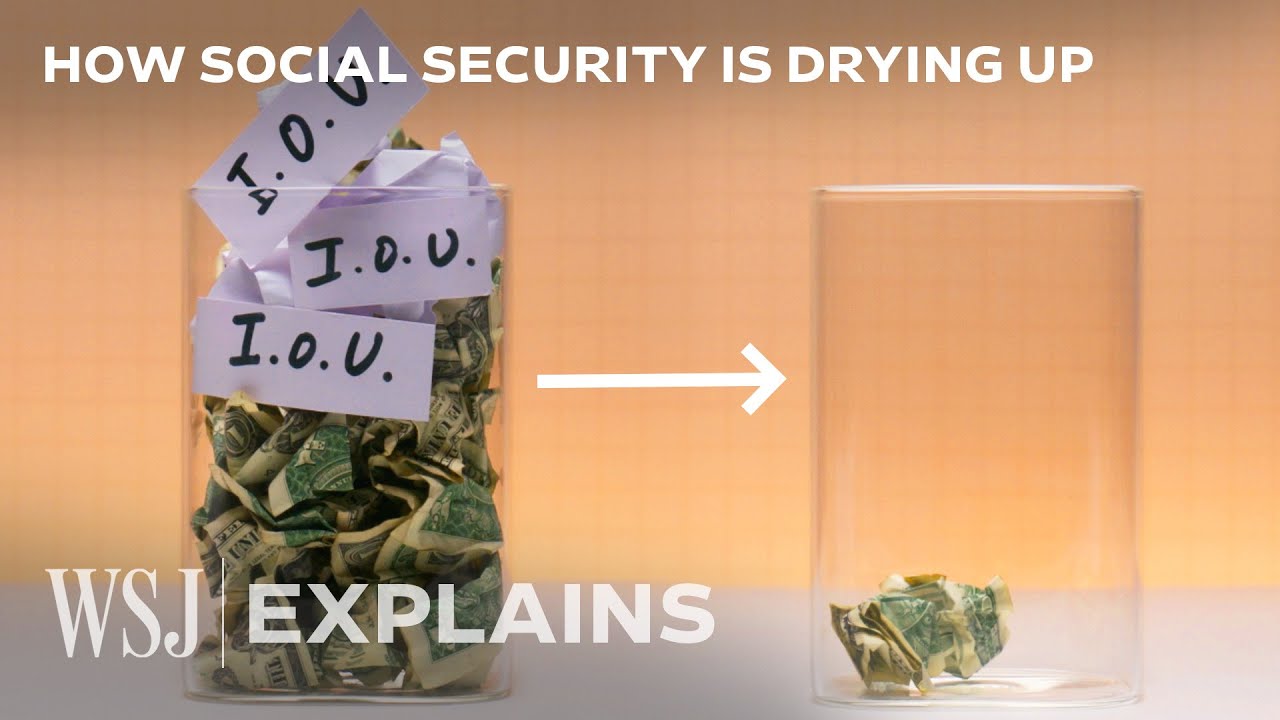

government is not bankrupt, social security is not bankrupt. – What's really happening is

the program is running out of treasury bonds, which are basically IOUs

from the government. For many years, social security

was taking in more money than it needed to pay out in

benefits, so it lent money to the government to

use for other programs, and it got IOUs in return. – Around 10 years ago though,

that situation flipped around.

For the last decade, we've been

paying out more in benefits than we've been collecting

in social security revenue. – [Narrator] But because the program had so many IOUs stashed

away from previous years, it's been able to keep

paying benefits in full by cashing in on those IOUs. – Right now, there's

roughly $3 trillion in IOUs, but each year that $3 trillion stash gets a little bit smaller. By the year 2034, all of the

IOUs will have been cashed in. – That means retirees would see overnight about a 25% benefit cut. – [Narrator] This number will

likely increase as the number of workers per retiree continues to fall. – Simply because we're not about to go bankrupt doesn't

mean there's no problem.

There very much is a problem. – [Narrator] Studies

show that the majority of Americans rely on these

monthly benefits checks for retirement income. According to census bureau

data, about 50% of people between 55 and 66 years old

have no retirement savings. – Can you imagine right now if you had to take a 25% reduction

in your take home pay, you still have to pay rent. You gotta buy groceries,

you gotta pay utilities. – It's especially important for those who don't have college degrees, people on the lower end

of the income spectrum. – [Narrator] Fichtner says, when retirees have less retirement income, they also generally spend less money. – That means less economic activity. That means less employment because employers have to lay off people 'cause no longer is that money coming in. It's a ripple effect that could be basically a

senior induced recession. – But social security is only

meant to replace a percentage of a worker's pre-retirement income based on lifetime earnings. So as much as 78% for very

low earners to about 42% for medium earners and

28% for maximum earners. – This is three legged stool

we talk about all the time.

It's supposed to be social

security is one leg, your employer provided pension is a second leg and your

personal savings a third. Well, social security

is financial challenges. We don't have pensions really anymore. About 10% of the population has pensions and then it's hard to save on your own when you've gotta pay off student loans and housing costs are so high. – [Narrator] About half of Americans do have retirement accounts

like 401Ks and IRAs, but those are all subject to market risk. – I hear a lot, well,

those are 65 year olds.

Why do I have to worry

about the boomers today? Well, this impacts every

generation that's coming up behind. – They might not be asked to pay a slightly higher payroll tax. More important, they might be asked to work a little bit longer. – [Narrator] And like most

things in the economy, social security's funding

shortfall isn't an isolated issue. – It's one of the reasons

the federal budget deficits is as large as it is. It means that we have to borrow money, which means issuing bonds. That tends to put up

pressure on interest rates, which means it's harder to afford a house. It means that Congress might have to cut spending on other

programs like the military or the environment in order to make sure that there's enough money

for social security. – [Narrator] So what needs to

happen to put social security on more sound footing? Congress needs to pass a law. – Congress has stood still and not enhanced social

security since Richard Nixon.

– [Narrator] When and what kind of law, that we still don't know. There's been a number of proposed

solutions over the years. – This legislation demands that the wealthiest people in this country start paying their fair share of taxes, – But policymakers generally

disagree on whether to raise taxes or cut benefits. – You'll have two approaches

to how to solve this problem, and you're not gonna do it. – There's probably no single magic bullet, which will put social security

on a long-term footing. Instead, Congress is

probably going to have to look at a variety of steps which will collectively fix the problem.

– [Narrator] But economists

don't expect action to be taken anytime soon. – Everybody, including on Capitol Hill, knows that social security has a problem. Nobody, especially those in Capitol Hill, are prepared to do anything about it. – As we all apparently

agree, social security and Medicare is off the books now, right? They're not to be smart.

(clapping and cheering) – We all would wish that

politicians would show the political courage

necessary to tackle this now and not wait until the 11th hour. Benefits and changes to retirement programs

take a while to phase in. One of the last major reforms we had for social security were the 1983 reforms. – [Narrator] Those amendments

raised the retirement age to 67, but it took nearly

40 years to phase them in.

– There is a 10 year window, but we don't have 10 years to act. – There has to be some kind

of a legislative solution that comes along between now and then. By law, the program can't

borrow anywhere else. The program's too important,

too popular for it to basically be allowed

to run out of money..