Tag: stock market investing

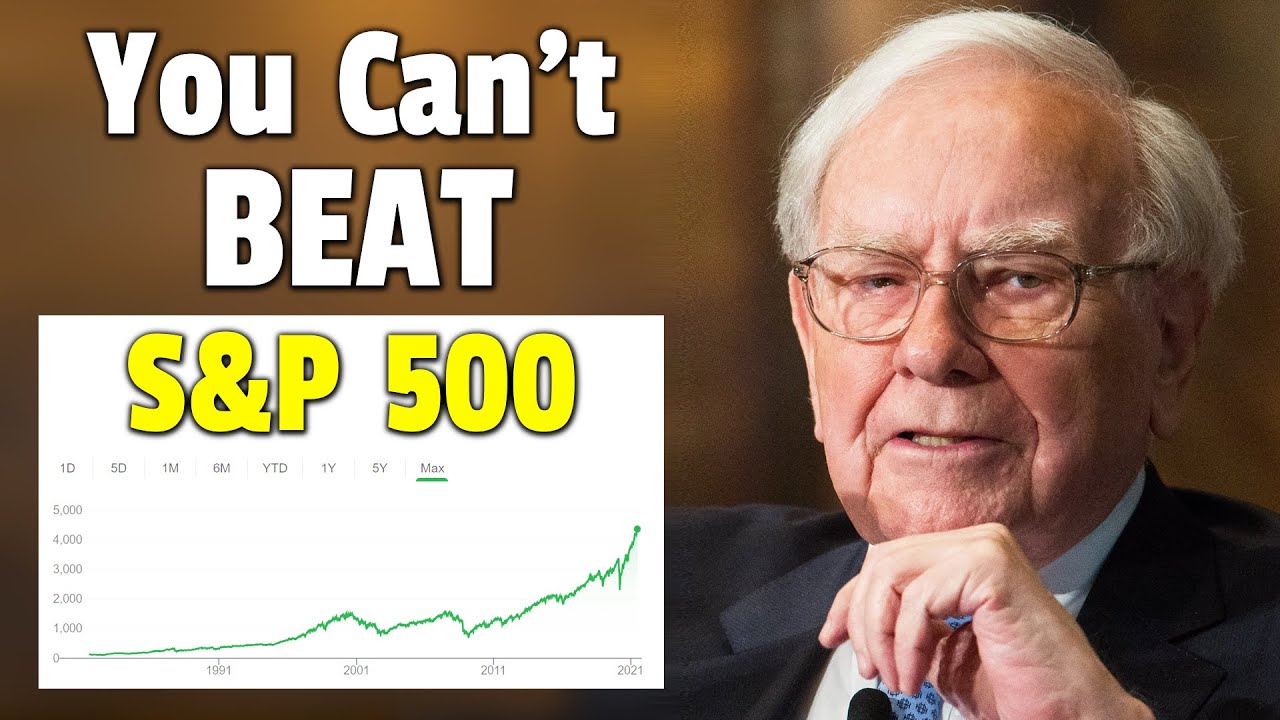

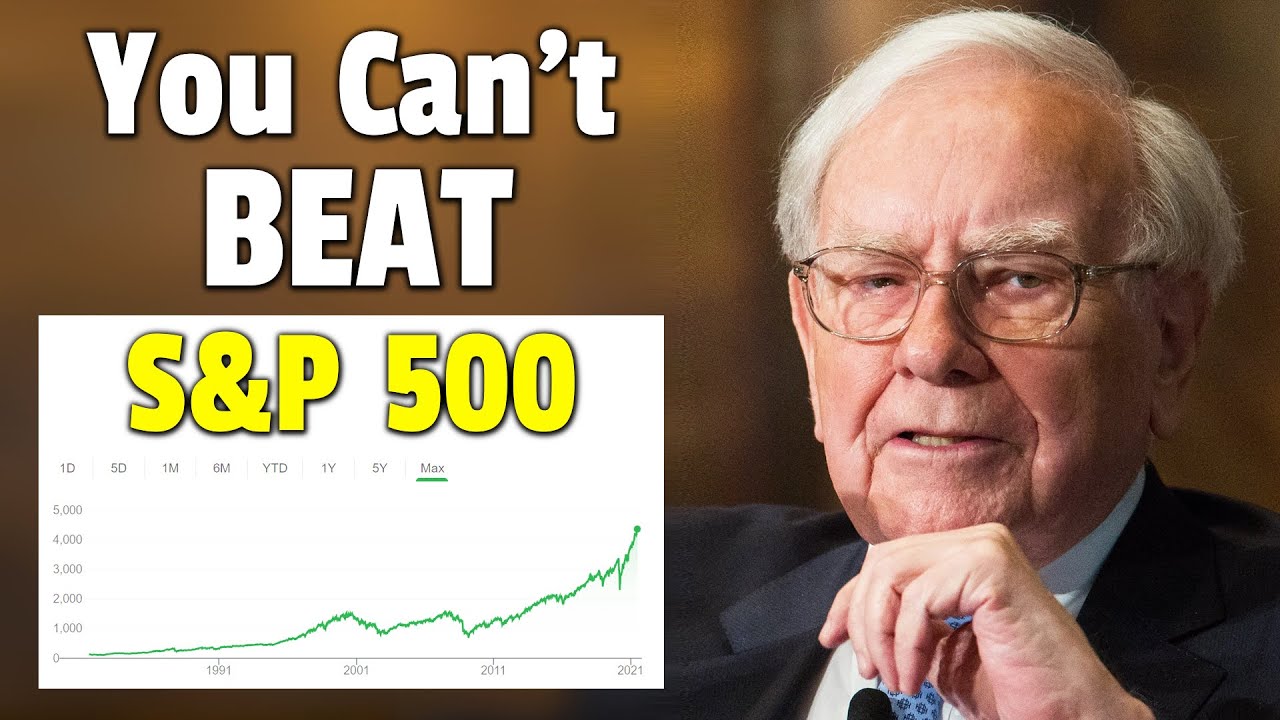

Warren Buffett: Why Most People Should Invest In S&P 500 Index

Jason 0 Comments Retire Wealthy Retirement Planning

why have you advised your wife to invest in index funds after your death rather than berkshire hathaway i believe munger has cancelled his offspring to quote not be so dumb as to sell she she won't be she won't be selling any berkshire to buy the index funds all all of my berkshire every single share will go to philanthropy so that i don't even regard myself as owning berkshire you know basically it's it's committed and i've i so far about 40 percent has already been distributed so the question is somebody who is not an investment professional will be i hope reasonably elderly by the time that the uh estate gets settled and what is the best investment meaning one that there would be less worry of any kind connected with and less people coming around and saying why don't you sell this and do something else and all those things she's going to have more money than she needs and the big thing then you want is money not to be a problem and there will be no way that if she holds the s p of virtually no way absent something happened with weapons of mass destruction but virtually no way that she will shall have all the money that she possibly can use to have a little liquid money so that if stocks are down tremendously at some point they close the stock exchange for a while anything like that she'll still feel that she's got plenty of money and the object is not to maximize it doesn't make any difference whether the amount she gets doubles or triples or anything of the sort the important thing is that she never worries about money the rest of her life and i had an aunt katie here in omaha charlie knew well and worked for her husband as did i and she worked very hard all her life and had lived in a house she paid i think i don't know eight thousand dollars for 45th and hickory all her life and uh because she was in berkshire uh she ended up she lived in 97.

she ended up with you know a few hundred million and she would write me a letter every four or five months and she said dear warren you know i hate to bother you but am i going to run out of money and and i would i would write her back and i'd say dear katie it's a good question because if you live 986 years you're going to run out of money and and then about four or five months later she'd write me the same winner again and i i have seen there's no way in the world if you've got plenty of money that it should become a a minus in your life and there will be people if you've got a lot of money that come around with various suggestions for you sometimes well-meaning sometimes not so well-meaning so if you've got something that's certain to deliver you know it was all in berkshire they'd say well if warren was alive today you know he would be telling him to do this i i just don't want anybody to go through that and the s p will be a i think actually what i'm suggesting is what but a very high percentage of people should do something like that and i don't think they will have us i think there's a chance they won't have as much peace of mind if they own one stock and they've got neighbors and friends and relatives that are trying to do some like i say sometimes well-intentioned sometimes otherwise to do something else and so i think it's a policy that'll get a good result and it's likely to stick charlie well as becky said the wonders are different i i want them to hold the berkshire well i want to hold the berkshire too no i bet i mean i i i don't like them i recognize the logic of the fact that that s p algorithm is very hard to beat in a diversified portfolio of big companies it's all but impossible for most people but you know it's i'm just more comfortable with the berkshire well it's the family business yeah yeah but but it uh i've just i've seen too many people as they get older particularly being susceptible just having to listen to the arguments of people coming well if you're going to protect your heirs from the stupidity of others you may have some good system but i'm not much interested in that subject [Laughter] okay you

Read More

Warren Buffett: How To Turn $10,000 Into Millions (Simple Investment Strategy)

Jason 0 Comments Retire Wealthy Retirement Planning

you can't really fail at it unless you buy the wrong stock or just get excited at the wrong time and i would like to just spend just a couple of minutes uh giving you a little perspective uh on how you might think about about uh investments as opposed to the uh tendency to focus on what's happening today or even this minute as you go through and to help me in doing that i'd like to go back through a little personal history and uh and we will start i have here up here in new york times of march 12 1942 and i'm a little behind on my reading and if you go back to that time it it was about what just about three months um since we got involved in a war which uh we were losing at that point uh the newspaper headlines were filled with bad news from the pacific and i've taken just a couple of the headlines from the days preceding march 11th which i'll explain it's kind of a momentous day for me and so you can see these headlines we've got slide 2 up there i believe and uh we were in trouble big trouble in the pacific uh it was only going to be a couple months later that the philippines fell but here we were getting bad news we might go to slide three for march 9th uh uh i hope you can read the headlines anyway the price of the paper is three cents incidentally um the uh and uh uh let's see we've got march 10th up there a slide i'm i want to get to where there's advanced technology of slides i want to make sure i'm showing you the same thing that i'm seeing in front of me so anyway on march 10th uh when again the news was bad full clearing path to australia and it was like it the stock market had been reflecting this and i'd been watching a stock called city service preferred stock which had sold at 84 dollars the previous year it had sold at 55 the year before early in the in january two months earlier and now it was down to forty dollars on march 10th so that night despite these headlines i said to my dad i said i think i'd like to pull the trigger and i'd like you to uh buy me three three shares of city certified the next day and that was all i had i mean that was my capital accumulated uh uh over the previous five years or thereabouts and so my dad the next morning um bought three shares well let's take a look at what happened the next day let's go to the next slide please and it was not a good day the stock market the dow jones industrials broke 100 on the downside now they were down 2.28 as you see but that was the equivalent of about a 500 point drop now so i'm in school wondering what is going on of course uh incidentally you'll see on the left side of the chart the new york times put the dow jones industrial average below all the averages they calculated they had their own averages which have since disappeared but the dow jones has continued so the next day uh we can go to the next slide and you will see what happened the stock that was in 39 my dad bought my stock right away in the morning because i'd asked him to my three shares and uh so i paid the high for the day that 38 and a quarter uh was my tick which is the high for day and by the end of the day it was down to 37 uh which was really kind of characteristic of my timing in stocks that was going to appear in future years uh um but uh uh it was on the what was then called the new york curb exchange then became the american stock exchange but things even though the war until the battle of midway looked very bad and if you'll turn to the next slide please you'll see that the stock did rather well you can see where i bought at 38 and a quarter and then the stock went on actually to eventually be called by the city service company for over 200 dollars a share but this is not a happy story because if you go to the next page you will see that i well as they always say it seemed like a good idea at the time you know uh so i sold those i made five dollars on it it was it was again typical of behavior but when you watch you go down to 27 uh you know it looked pretty good to get that profit well what's the point of all this well we can leave behind the city service story and i would like you to again imagine yourself back on march 11th of 1942 and as i say things were looking bad in the european theater as well as what was going on in in the pacific but everybody in this country knew uh america was going to win the war i mean it it was you know we'd gotten blindsided but but we were we were going to win the war and and we knew that the american system had been working well since 1776.

So if you'll turn to the next slide i'd like you to imagine that at that time uh you had invested ten thousand dollars and you put that money in an index fund we didn't have index funds then but but you in effect bought the s p 500 now i would like you to think a while and don't do not change the slide here for a minute i'd like you to think about how much that 10 000 would now be worth if you just had one basic premise just like in buying a farm you buy it to hold throughout your lifetime an independent and you look to the output of the farm to determine whether you made a wise investment you look to the output of the apartment house to decide whether you made a wise investment if you buy an apartment small apartment house to hold for your life and let's say instead you decided to put the ten thousand dollars in and hold a piece of american business uh and never look at another stock quote never listen to another person give you advice or anything of the sort i want you to think how much money you might have now and now that you've got a number in your head let's go to the next slide and we'll get the answer you'd have 51 million dollars and you wouldn't have had to do anything you wouldn't have to understand accounting you wouldn't have to look at your quotations every day like i did that first day i'd already lost 3.75 by the time i came home from school uh all you had to do was figure that america was going to do well over time that we would overcome the current difficulties and that if america did well american business would do well you didn't have to pick out winning stocks you didn't have to pick out a winning time or anything of the sort you basically just had to make one investment decision in your life and that wasn't the only time to do it i mean i could go back and pick other times that uh would work out even greater gains but as you listen to the questions and answers we give today just remember that the over the overriding question is how is american business going to do over your investing lifetime uh i would like to make one other comment because it's it's a little bit interesting let's let's say you're taking that ten thousand dollars and you listen to the profits of doom and gloom around you and and you'll get that constantly throughout your life and instead you use the ten thousand dollars to buy gold now for your ten thousand dollars you would have been able to buy about 300 ounces of gold and while the businesses were reinvesting uh in more plants and new inventions came along you would go down every year into your look in your safe deposit box and you'd have your three ounce 100 ounces of gold and you could look at it and you could fondle it and you could i mean whatever you wanted to do with it but it didn't produce anything it was never going to produce anything and what would you have today you would have 300 ounces of gold just like you had in march of 1942 and it would be worth approximately four hundred thousand dollars so if you decided to go with a non-productive asset goal instead of a productive asset which actually was earning more money and reinvesting and paying dividends and maybe purchasing stock whatever it might be you would now have over 100 times uh the value of what you would have had with a non-productive asset in other words for every dollar you have made in american business you'd have less than a penny by of gain by buying in the store value which people tell you to run to every time you get scared by the headlines or something disorder it's it's just remarkable uh to me that we have operated in this country with the greatest tailwind at our back that you can imagine it's an investor's i mean you can't really fail at it unless you buy the wrong stock or just get excited at the wrong time but if you if you owned a cross-section of america and you put your money in consistently over the years there's just there's no comparison against owning something that's going to produce nothing and there frankly there's no comparison with trying to jump in and out of stocks and and pay investment advisors if you'd followed my advice incidentally or this retrospective advice which is always so easy to give uh if you'd follow that of course you're there's one problem buddy your your friendly stock broker would have starved to death i mean you know and you could have gone to the funeral to atone for their fate but the truth is you would have been better off doing this than than a very very very high percentage of investment professionals have done or people have done that are active that it's it's very hard to move around successfully and beat really what can be done uh with a very relaxed philosophy and you do not have to be you do not have to be you do not have to know as much about accounting or stock market terminology or whatever else it may be or what the fed is going to do next time and whether it's going to raise rates three times or four times or two times none of that counts at all really in a lifetime of investing what what counts is is having a a philosophy that you've that you stick with that you understand why you're in it and then you forget about doing things that you don't know how to do

Read More

This Is How To Become A Millionaire: Index Fund Investing for Beginners

Jason 0 Comments Retire Wealthy Retirement Planning

hi guys it's mark so did you know if you save two hundred dollars per month at an eight percent annual return then in 45 years you would have over wait for it one million dollars to be honest when someone first explained this was possible by investing in index funds i hardly understood a word they were saying it was like they would speak in a different language today i thought it was about time that i made the video that i wish i'd seen when i was younger and explain everything step by step and because i like people that actually practice what they preach i'm gonna be investing ten thousand dollars of my own money during this video so you can see exactly how it's done just a quick disclaimer though i'm not a financial advisor i'm a businessman and this is just some of the real life strategies that have worked for me personally i always thought of index funds as my backup plan if my businesses hadn't been successful then i would have become a millionaire anyway through these investments just remember if you like the video then smash the like button as it really helps push this video out to more people and also consider subscribing if you want to grow your wealth part one uncovering the lies so let's cut to the chase you've been put a major disadvantage people have been telling you lies about investing all of your life for instance at school when i was growing up i remember asking my teachers about investing and they always said it's just for rich people as they can afford to hire professionals to do it for them for the longest time i believed investing wasn't for me because i wasn't a pro and i didn't have much money and i thought i wouldn't stand a chance then we got friends one of mine said i'd have to look at all the financial newspapers learn how to read the charts and according to him it just wasn't worth my time and on top of this every time i mentioned investing to my family they seemed so scared because they thought it's the most risky thing in the world and not for normal people my dad even said if i started investing i'd lose all my money can you believe that these lies are exactly what the experts want you to believe as they know that index fund investing is extremely easy to do you don't need much money to start the risks are pretty low and on average it will make you more money in the long term the dark truth is that the average actively managed fund returns two percent less a year than the market in general this means that professionals on average are doing worse than index funds and even if they end up losing you money they still charge you fees no matter what now according to my favorite film the matrix you have now taken the red pill and you've woken up to the truth it's now time to move on to part two understanding the game i know when i first started investing i felt like i was going to make so many mistakes but once you understand their language it all becomes so much easier and that's what we're going to be talking about in this part so i've been banging on about index funds in many of my videos so i think it's about time i explained what they are and why they're so cool i'm a big football fan and if you have ever followed any sports you'll be familiar with a league table like this the better your team performs the higher up they'll be on the list but on the other hand if they do really badly they might be removed from the league entirely this is almost exactly the same as an index all you have to do is switch out the teams for companies let's take the s p 500 for example this is a list of the 500 best performing public companies in the usa the big dogs being amazon google apple and more recently tesla and just like a league table if a company doesn't perform well they're at risk of being removed from the list hasta la vista baby the idea of an index fund is to be a little bit sneaky as it allows you to invest in every single company on the list with just one click it's a bit like a friend of mine who picks a different football team each year he just wants to pick the winner every time so investing in index funds means that even if a few companies do terribly then it's balanced out by the companies that are doing extremely well the average return on the s p 500 over the last 10 years has been 13.6 now that is higher than usual but get this no one has ever lost any money if they've bought and held an s p 500 index fund for more than 20 years so if this is so foolproof then why do people still buy individual stocks well personally i like to do this just for a bit of fun i also think that some companies are currently working on awesome technology for the future but aren't making a lot of money at the moment so they won't make the cut into the popular index funds so now and again i like to invest some extra money into these up and coming companies so i don't miss out and that reminds me we bought currently giving away four free individual stocks if you want to pick them up i'll leave the link in the description and for everyone that's outside of the usa or china i'll leave a link where you can claim a free stock with trade in 212.

Hey that's pretty good you'll often hear people throwing around the terms roth ira in the usa stocks and shares isa in the uk tfsa in canada and supers in australia but what does it all mean well these are types of accounts that allow you to earn profits on your investments and you don't have to pay any taxes on them but they generally have limits because they're just so powerful these are kind of like captain america shield so let me explain if captain america just sat at home with his shield then he wouldn't ever get anything done but when he takes that shield into battle he has an advantage so these accounts are like your shield make sure to use them when you're investing a way you can do this is by using the money inside your shielded account to invest into index funds and all the profits will be yours because the government won't take a cut one of my biggest questions when i first started was should i invest all my money at the same time or do it gradually now this is something lots of investors argue about so i'm going to give you my view on things remember later i'm going to be investing this 10 000 in full so that kind of gives you an idea of what i believe investing all your money as a lump sum is certainly more risky however if i'm investing in something i know will increase over time like an s p 500 index fund then there is no point waiting the longer you wait the worse off on average you'll be however if you don't have the cash i wouldn't wait to save up the money i would just invest what i could every month as sometimes you're going to buy when the stocks high other times you're going to buy when the stock's low but overall this is going to balance out and this is known as dollar cost averaging when you log on to an investing website or app you'll see that there is something called etfs which are very similar to index funds and a lot of people get them confused both allow you to invest into a basket of stocks however the easy way to remember the difference is just to think of what etf stands for exchange traded fund if we break that down simply it just means that it can be traded on the stock market throughout the day whereas an index fund can only be bought and sold for a price that is set at the end of each trading day but let's cut to the chase you probably want to know which one's better on average if you're starting with little money then etfs may be a better option as they have lower minimum investment thresholds and many brokers don't charge a trading commission now if you're still watching this and you're younger than 18 then i am really impressed that you've been listening to a boomer like me for so long but seriously not many people learn this at such a young age as they don't teach it at school a way you can start investing under 18 is to open up a custodial account in the usa or a junior stocks and shares iso in the uk set up these accounts you just need to ask your parents the real secret ingredient to this millionaire formula is time and when you're younger you have so much of it that's because every year as you keep adding to your investments the interest starts to compound and grow at a rapid pace it's a snowball effect once you reach a certain tipping point the interest you're making is much more than the amount you're investing on a monthly basis it's a bit like when you see someone take ages to get to a hundred thousand subscribers on youtube and then within a few months they managed to hit the big million the sooner you get started the better as time will be on your side now i want to clear something up when people talk about index funds you will hear s p 500 again and again people just love it as i mentioned before this is a top 500 public companies in the usa but the cool thing is you don't actually have to be in the usa to invest in this i'm in the uk and it's one of my favorite investments i just love to think that i own a small part of all the biggest companies in the usa part three mastering the strategy so lots of people will teach you what to do but they won't actually say how to do it so i'm going to walk you through everything right now while i invest my own ten thousand dollars the first thing to really do is to work out your goals let's say you want to become a millionaire that was one of my goals i just had to work out how much i would actually need to invest per month to achieve this i love using these compound interest calculators you can find them online easily yourself if you want to have a go at this so if you're able to invest 250 dollars per month with an 8 annual return over 42 years you'll have over a million dollars in your account now if you're able to invest that for another 10 years you'll have over 2 million in your account of course if you wanted to invest even more then you're just going to speed up the whole process the next thing we need to do is pick the brokerage website we're using to set up our account and invest the ones that i love are charles swab fidelity and vanguard i call these the big three the founder of vanguard john bogle is often referred to as the father of index fund investing and if you think i'm a boomer he was even older than me his vanguard group gave birth to index funds so they're the oldest and most trusted let's jump onto their website to see what they have to offer so to get onto their full list of funds just go up to invest in and click on vanguard mutual funds at this point i'm going to have to ask you to strap in and brace yourself because if you haven't seen this page before it can look extremely overwhelming but in a minute you'll be able to impress all your friends when you know exactly how to read it see what i mean there are just so many options the main things to focus on are the expense ratio which is how much they're going to charge you per year you obviously want to keep these as low as possible and luckily with vanguard fees these are very low anyway the other thing to look at is the average returns and they break these down nicely on the right hand side of the screen but of course it's always good to remember that past performance doesn't always mean future returns my wife's a bit like vanguard she likes everything in order and nothing out of place so they have arranged all of their funds into different categories so everything is easy to find category one is bonds these are a type of contract that companies and governments sell when they need extra money if you invest in these they promise to pay you back in the future these are often seen as pretty low risk but also pretty low returns therefore the older you are the more bonds you should have in your portfolio number two is balance funds the idea of these is to pick the age at which you wish to retire and they'll do all the rest of the work for you and find the right mix of index funds as you can see these go up in five year intervals and you can pick whichever suits your plans best this could be a good option if you wanted to invest without thinking about it too much but personally i always prefer manually investing it's a bit like driving an automatic car that does all the work for you it just isn't as much fun as a stick shift number three is company location and size known as small medium and large cap here you can find v fix which tracks our old friend the s p 500 this little s means it's one of vanguard selected funds which they recommend if you click on it you're able to see exactly what companies you would be investing in and also the risk level vt sacs is another good one which is a total stock market index fund which has over 3586 different stocks this allows you to invest in the entire usa stock market in one click there is a minimum investment of three thousand dollars again but as before there's also an etf version with no minimum called vti then you have international stocks quite a cool one is emerging markets which invest in companies based in china taiwan india and many more but as you can see this is a five on the risk scale so i wouldn't personally invest a lot of money into this fund because look at me i'm a bit old to be taking too many risk and i need to sleep at night number four the last category is sector based so if you have a particular interest in energy healthcare or real estate you can invest into these sectors and there are also a lot more options for sector investing in the etf so now we've broken down what's on offer hopefully it all looks a bit more understandable now for the moment you've all been waiting for it's time to invest my ten thousand dollars i could split this between lots of different funds but personally i like to invest the majority of my money into american companies i would say probably about seventy percent american 20 in other countries including the uk and ten percent in some bonds i like to keep the bonds quite low as i don't mind this little extra bit of risk because i'm only 53 and i have a bit of time before i've got to rebalance my portfolio to secure my investments but that's a personal choice depending on your risk tolerance the funds that are available are different in every country but the indexes they track are very similar so you may need to invest in a different fund to me but obviously you can still use my percentages as a guide so i'm going to use the uk vanguard site to invest 5k straight into this etf that tracks the s p 500 so here we go all done two thousand dollars is going into an index fund that tracks the total american stock market so again we go on the screen click so far that's 70 invested in the biggest economy in the world which of course is the usa now i like to balance this out by investing in a different economy as i live back in my own country i'm going to be putting 2k into the ftse 100 index fund so looking good all done great now i've invested 90 of my 10k and i'd like a bit of security let's just put the remaining 1k into a global bonds index fund and let's just do that so just like that i've invested in the usa companies like apple amazon tesla and google i own a small piece of the biggest companies in the uk like hsbc bp and unilever and i have some bonds to balance out my portfolio it really is as easy as that so i'm going to leave the next video up here but don't click on it just yet remember to subscribe to the channel if you want to grow your wealth ring that notification bell and smash that like button okay i'll see you on the other side

Read More

This Is How To Become A Millionaire: Index Fund Investing for Beginners

Jason 0 Comments Retire Wealthy Retirement Planning

hi guys it's mark so did you know if you save two hundred dollars per month at an eight percent annual return then in 45 years you would have over wait for it one million dollars to be honest when someone first explained this was possible by investing in index funds i hardly understood a word they were saying it was like they would speak in a different language today i thought it was about time that i made the video that i wish i'd seen when i was younger and explain everything step by step and because i like people that actually practice what they preach i'm gonna be investing ten thousand dollars of my own money during this video so you can see exactly how it's done just a quick disclaimer though i'm not a financial advisor i'm a businessman and this is just some of the real life strategies that have worked for me personally i always thought of index funds as my backup plan if my businesses hadn't been successful then i would have become a millionaire anyway through these investments just remember if you like the video then smash the like button as it really helps push this video out to more people and also consider subscribing if you want to grow your wealth part one uncovering the lies so let's cut to the chase you've been put a major disadvantage people have been telling you lies about investing all of your life for instance at school when i was growing up i remember asking my teachers about investing and they always said it's just for rich people as they can afford to hire professionals to do it for them for the longest time i believed investing wasn't for me because i wasn't a pro and i didn't have much money and i thought i wouldn't stand a chance then we got friends one of mine said i'd have to look at all the financial newspapers learn how to read the charts and according to him it just wasn't worth my time and on top of this every time i mentioned investing to my family they seemed so scared because they thought it's the most risky thing in the world and not for normal people my dad even said if i started investing i'd lose all my money can you believe that these lies are exactly what the experts want you to believe as they know that index fund investing is extremely easy to do you don't need much money to start the risks are pretty low and on average it will make you more money in the long term the dark truth is that the average actively managed fund returns two percent less a year than the market in general this means that professionals on average are doing worse than index funds and even if they end up losing you money they still charge you fees no matter what now according to my favorite film the matrix you have now taken the red pill and you've woken up to the truth it's now time to move on to part two understanding the game i know when i first started investing i felt like i was going to make so many mistakes but once you understand their language it all becomes so much easier and that's what we're going to be talking about in this part so i've been banging on about index funds in many of my videos so i think it's about time i explained what they are and why they're so cool i'm a big football fan and if you have ever followed any sports you'll be familiar with a league table like this the better your team performs the higher up they'll be on the list but on the other hand if they do really badly they might be removed from the league entirely this is almost exactly the same as an index all you have to do is switch out the teams for companies let's take the s p 500 for example this is a list of the 500 best performing public companies in the usa the big dogs being amazon google apple and more recently tesla and just like a league table if a company doesn't perform well they're at risk of being removed from the list hasta la vista baby the idea of an index fund is to be a little bit sneaky as it allows you to invest in every single company on the list with just one click it's a bit like a friend of mine who picks a different football team each year he just wants to pick the winner every time so investing in index funds means that even if a few companies do terribly then it's balanced out by the companies that are doing extremely well the average return on the s p 500 over the last 10 years has been 13.6 now that is higher than usual but get this no one has ever lost any money if they've bought and held an s p 500 index fund for more than 20 years so if this is so foolproof then why do people still buy individual stocks well personally i like to do this just for a bit of fun i also think that some companies are currently working on awesome technology for the future but aren't making a lot of money at the moment so they won't make the cut into the popular index funds so now and again i like to invest some extra money into these up and coming companies so i don't miss out and that reminds me we bought currently giving away four free individual stocks if you want to pick them up i'll leave the link in the description and for everyone that's outside of the usa or china i'll leave a link where you can claim a free stock with trade in 212.

Hey that's pretty good you'll often hear people throwing around the terms roth ira in the usa stocks and shares isa in the uk tfsa in canada and supers in australia but what does it all mean well these are types of accounts that allow you to earn profits on your investments and you don't have to pay any taxes on them but they generally have limits because they're just so powerful these are kind of like captain america shield so let me explain if captain america just sat at home with his shield then he wouldn't ever get anything done but when he takes that shield into battle he has an advantage so these accounts are like your shield make sure to use them when you're investing a way you can do this is by using the money inside your shielded account to invest into index funds and all the profits will be yours because the government won't take a cut one of my biggest questions when i first started was should i invest all my money at the same time or do it gradually now this is something lots of investors argue about so i'm going to give you my view on things remember later i'm going to be investing this 10 000 in full so that kind of gives you an idea of what i believe investing all your money as a lump sum is certainly more risky however if i'm investing in something i know will increase over time like an s p 500 index fund then there is no point waiting the longer you wait the worse off on average you'll be however if you don't have the cash i wouldn't wait to save up the money i would just invest what i could every month as sometimes you're going to buy when the stocks high other times you're going to buy when the stock's low but overall this is going to balance out and this is known as dollar cost averaging when you log on to an investing website or app you'll see that there is something called etfs which are very similar to index funds and a lot of people get them confused both allow you to invest into a basket of stocks however the easy way to remember the difference is just to think of what etf stands for exchange traded fund if we break that down simply it just means that it can be traded on the stock market throughout the day whereas an index fund can only be bought and sold for a price that is set at the end of each trading day but let's cut to the chase you probably want to know which one's better on average if you're starting with little money then etfs may be a better option as they have lower minimum investment thresholds and many brokers don't charge a trading commission now if you're still watching this and you're younger than 18 then i am really impressed that you've been listening to a boomer like me for so long but seriously not many people learn this at such a young age as they don't teach it at school a way you can start investing under 18 is to open up a custodial account in the usa or a junior stocks and shares iso in the uk set up these accounts you just need to ask your parents the real secret ingredient to this millionaire formula is time and when you're younger you have so much of it that's because every year as you keep adding to your investments the interest starts to compound and grow at a rapid pace it's a snowball effect once you reach a certain tipping point the interest you're making is much more than the amount you're investing on a monthly basis it's a bit like when you see someone take ages to get to a hundred thousand subscribers on youtube and then within a few months they managed to hit the big million the sooner you get started the better as time will be on your side now i want to clear something up when people talk about index funds you will hear s p 500 again and again people just love it as i mentioned before this is a top 500 public companies in the usa but the cool thing is you don't actually have to be in the usa to invest in this i'm in the uk and it's one of my favorite investments i just love to think that i own a small part of all the biggest companies in the usa part three mastering the strategy so lots of people will teach you what to do but they won't actually say how to do it so i'm going to walk you through everything right now while i invest my own ten thousand dollars the first thing to really do is to work out your goals let's say you want to become a millionaire that was one of my goals i just had to work out how much i would actually need to invest per month to achieve this i love using these compound interest calculators you can find them online easily yourself if you want to have a go at this so if you're able to invest 250 dollars per month with an 8 annual return over 42 years you'll have over a million dollars in your account now if you're able to invest that for another 10 years you'll have over 2 million in your account of course if you wanted to invest even more then you're just going to speed up the whole process the next thing we need to do is pick the brokerage website we're using to set up our account and invest the ones that i love are charles swab fidelity and vanguard i call these the big three the founder of vanguard john bogle is often referred to as the father of index fund investing and if you think i'm a boomer he was even older than me his vanguard group gave birth to index funds so they're the oldest and most trusted let's jump onto their website to see what they have to offer so to get onto their full list of funds just go up to invest in and click on vanguard mutual funds at this point i'm going to have to ask you to strap in and brace yourself because if you haven't seen this page before it can look extremely overwhelming but in a minute you'll be able to impress all your friends when you know exactly how to read it see what i mean there are just so many options the main things to focus on are the expense ratio which is how much they're going to charge you per year you obviously want to keep these as low as possible and luckily with vanguard fees these are very low anyway the other thing to look at is the average returns and they break these down nicely on the right hand side of the screen but of course it's always good to remember that past performance doesn't always mean future returns my wife's a bit like vanguard she likes everything in order and nothing out of place so they have arranged all of their funds into different categories so everything is easy to find category one is bonds these are a type of contract that companies and governments sell when they need extra money if you invest in these they promise to pay you back in the future these are often seen as pretty low risk but also pretty low returns therefore the older you are the more bonds you should have in your portfolio number two is balance funds the idea of these is to pick the age at which you wish to retire and they'll do all the rest of the work for you and find the right mix of index funds as you can see these go up in five year intervals and you can pick whichever suits your plans best this could be a good option if you wanted to invest without thinking about it too much but personally i always prefer manually investing it's a bit like driving an automatic car that does all the work for you it just isn't as much fun as a stick shift number three is company location and size known as small medium and large cap here you can find v fix which tracks our old friend the s p 500 this little s means it's one of vanguard selected funds which they recommend if you click on it you're able to see exactly what companies you would be investing in and also the risk level vt sacs is another good one which is a total stock market index fund which has over 3586 different stocks this allows you to invest in the entire usa stock market in one click there is a minimum investment of three thousand dollars again but as before there's also an etf version with no minimum called vti then you have international stocks quite a cool one is emerging markets which invest in companies based in china taiwan india and many more but as you can see this is a five on the risk scale so i wouldn't personally invest a lot of money into this fund because look at me i'm a bit old to be taking too many risk and i need to sleep at night number four the last category is sector based so if you have a particular interest in energy healthcare or real estate you can invest into these sectors and there are also a lot more options for sector investing in the etf so now we've broken down what's on offer hopefully it all looks a bit more understandable now for the moment you've all been waiting for it's time to invest my ten thousand dollars i could split this between lots of different funds but personally i like to invest the majority of my money into american companies i would say probably about seventy percent american 20 in other countries including the uk and ten percent in some bonds i like to keep the bonds quite low as i don't mind this little extra bit of risk because i'm only 53 and i have a bit of time before i've got to rebalance my portfolio to secure my investments but that's a personal choice depending on your risk tolerance the funds that are available are different in every country but the indexes they track are very similar so you may need to invest in a different fund to me but obviously you can still use my percentages as a guide so i'm going to use the uk vanguard site to invest 5k straight into this etf that tracks the s p 500 so here we go all done two thousand dollars is going into an index fund that tracks the total american stock market so again we go on the screen click so far that's 70 invested in the biggest economy in the world which of course is the usa now i like to balance this out by investing in a different economy as i live back in my own country i'm going to be putting 2k into the ftse 100 index fund so looking good all done great now i've invested 90 of my 10k and i'd like a bit of security let's just put the remaining 1k into a global bonds index fund and let's just do that so just like that i've invested in the usa companies like apple amazon tesla and google i own a small piece of the biggest companies in the uk like hsbc bp and unilever and i have some bonds to balance out my portfolio it really is as easy as that so i'm going to leave the next video up here but don't click on it just yet remember to subscribe to the channel if you want to grow your wealth ring that notification bell and smash that like button okay i'll see you on the other side

Read More

This Is How To Become A Millionaire: Index Fund Investing for Beginners

Jason 0 Comments Retire Wealthy Retirement Planning

hi guys it's mark so did you know if you save two hundred dollars per month at an eight percent annual return then in 45 years you would have over wait for it one million dollars to be honest when someone first explained this was possible by investing in index funds i hardly understood a word they were saying it was like they would speak in a different language today i thought it was about time that i made the video that i wish i'd seen when i was younger and explain everything step by step and because i like people that actually practice what they preach i'm gonna be investing ten thousand dollars of my own money during this video so you can see exactly how it's done just a quick disclaimer though i'm not a financial advisor i'm a businessman and this is just some of the real life strategies that have worked for me personally i always thought of index funds as my backup plan if my businesses hadn't been successful then i would have become a millionaire anyway through these investments just remember if you like the video then smash the like button as it really helps push this video out to more people and also consider subscribing if you want to grow your wealth part one uncovering the lies so let's cut to the chase you've been put a major disadvantage people have been telling you lies about investing all of your life for instance at school when i was growing up i remember asking my teachers about investing and they always said it's just for rich people as they can afford to hire professionals to do it for them for the longest time i believed investing wasn't for me because i wasn't a pro and i didn't have much money and i thought i wouldn't stand a chance then we got friends one of mine said i'd have to look at all the financial newspapers learn how to read the charts and according to him it just wasn't worth my time and on top of this every time i mentioned investing to my family they seemed so scared because they thought it's the most risky thing in the world and not for normal people my dad even said if i started investing i'd lose all my money can you believe that these lies are exactly what the experts want you to believe as they know that index fund investing is extremely easy to do you don't need much money to start the risks are pretty low and on average it will make you more money in the long term the dark truth is that the average actively managed fund returns two percent less a year than the market in general this means that professionals on average are doing worse than index funds and even if they end up losing you money they still charge you fees no matter what now according to my favorite film the matrix you have now taken the red pill and you've woken up to the truth it's now time to move on to part two understanding the game i know when i first started investing i felt like i was going to make so many mistakes but once you understand their language it all becomes so much easier and that's what we're going to be talking about in this part so i've been banging on about index funds in many of my videos so i think it's about time i explained what they are and why they're so cool i'm a big football fan and if you have ever followed any sports you'll be familiar with a league table like this the better your team performs the higher up they'll be on the list but on the other hand if they do really badly they might be removed from the league entirely this is almost exactly the same as an index all you have to do is switch out the teams for companies let's take the s p 500 for example this is a list of the 500 best performing public companies in the usa the big dogs being amazon google apple and more recently tesla and just like a league table if a company doesn't perform well they're at risk of being removed from the list hasta la vista baby the idea of an index fund is to be a little bit sneaky as it allows you to invest in every single company on the list with just one click it's a bit like a friend of mine who picks a different football team each year he just wants to pick the winner every time so investing in index funds means that even if a few companies do terribly then it's balanced out by the companies that are doing extremely well the average return on the s p 500 over the last 10 years has been 13.6 now that is higher than usual but get this no one has ever lost any money if they've bought and held an s p 500 index fund for more than 20 years so if this is so foolproof then why do people still buy individual stocks well personally i like to do this just for a bit of fun i also think that some companies are currently working on awesome technology for the future but aren't making a lot of money at the moment so they won't make the cut into the popular index funds so now and again i like to invest some extra money into these up and coming companies so i don't miss out and that reminds me we bought currently giving away four free individual stocks if you want to pick them up i'll leave the link in the description and for everyone that's outside of the usa or china i'll leave a link where you can claim a free stock with trade in 212.

Hey that's pretty good you'll often hear people throwing around the terms roth ira in the usa stocks and shares isa in the uk tfsa in canada and supers in australia but what does it all mean well these are types of accounts that allow you to earn profits on your investments and you don't have to pay any taxes on them but they generally have limits because they're just so powerful these are kind of like captain america shield so let me explain if captain america just sat at home with his shield then he wouldn't ever get anything done but when he takes that shield into battle he has an advantage so these accounts are like your shield make sure to use them when you're investing a way you can do this is by using the money inside your shielded account to invest into index funds and all the profits will be yours because the government won't take a cut one of my biggest questions when i first started was should i invest all my money at the same time or do it gradually now this is something lots of investors argue about so i'm going to give you my view on things remember later i'm going to be investing this 10 000 in full so that kind of gives you an idea of what i believe investing all your money as a lump sum is certainly more risky however if i'm investing in something i know will increase over time like an s p 500 index fund then there is no point waiting the longer you wait the worse off on average you'll be however if you don't have the cash i wouldn't wait to save up the money i would just invest what i could every month as sometimes you're going to buy when the stocks high other times you're going to buy when the stock's low but overall this is going to balance out and this is known as dollar cost averaging when you log on to an investing website or app you'll see that there is something called etfs which are very similar to index funds and a lot of people get them confused both allow you to invest into a basket of stocks however the easy way to remember the difference is just to think of what etf stands for exchange traded fund if we break that down simply it just means that it can be traded on the stock market throughout the day whereas an index fund can only be bought and sold for a price that is set at the end of each trading day but let's cut to the chase you probably want to know which one's better on average if you're starting with little money then etfs may be a better option as they have lower minimum investment thresholds and many brokers don't charge a trading commission now if you're still watching this and you're younger than 18 then i am really impressed that you've been listening to a boomer like me for so long but seriously not many people learn this at such a young age as they don't teach it at school a way you can start investing under 18 is to open up a custodial account in the usa or a junior stocks and shares iso in the uk set up these accounts you just need to ask your parents the real secret ingredient to this millionaire formula is time and when you're younger you have so much of it that's because every year as you keep adding to your investments the interest starts to compound and grow at a rapid pace it's a snowball effect once you reach a certain tipping point the interest you're making is much more than the amount you're investing on a monthly basis it's a bit like when you see someone take ages to get to a hundred thousand subscribers on youtube and then within a few months they managed to hit the big million the sooner you get started the better as time will be on your side now i want to clear something up when people talk about index funds you will hear s p 500 again and again people just love it as i mentioned before this is a top 500 public companies in the usa but the cool thing is you don't actually have to be in the usa to invest in this i'm in the uk and it's one of my favorite investments i just love to think that i own a small part of all the biggest companies in the usa part three mastering the strategy so lots of people will teach you what to do but they won't actually say how to do it so i'm going to walk you through everything right now while i invest my own ten thousand dollars the first thing to really do is to work out your goals let's say you want to become a millionaire that was one of my goals i just had to work out how much i would actually need to invest per month to achieve this i love using these compound interest calculators you can find them online easily yourself if you want to have a go at this so if you're able to invest 250 dollars per month with an 8 annual return over 42 years you'll have over a million dollars in your account now if you're able to invest that for another 10 years you'll have over 2 million in your account of course if you wanted to invest even more then you're just going to speed up the whole process the next thing we need to do is pick the brokerage website we're using to set up our account and invest the ones that i love are charles swab fidelity and vanguard i call these the big three the founder of vanguard john bogle is often referred to as the father of index fund investing and if you think i'm a boomer he was even older than me his vanguard group gave birth to index funds so they're the oldest and most trusted let's jump onto their website to see what they have to offer so to get onto their full list of funds just go up to invest in and click on vanguard mutual funds at this point i'm going to have to ask you to strap in and brace yourself because if you haven't seen this page before it can look extremely overwhelming but in a minute you'll be able to impress all your friends when you know exactly how to read it see what i mean there are just so many options the main things to focus on are the expense ratio which is how much they're going to charge you per year you obviously want to keep these as low as possible and luckily with vanguard fees these are very low anyway the other thing to look at is the average returns and they break these down nicely on the right hand side of the screen but of course it's always good to remember that past performance doesn't always mean future returns my wife's a bit like vanguard she likes everything in order and nothing out of place so they have arranged all of their funds into different categories so everything is easy to find category one is bonds these are a type of contract that companies and governments sell when they need extra money if you invest in these they promise to pay you back in the future these are often seen as pretty low risk but also pretty low returns therefore the older you are the more bonds you should have in your portfolio number two is balance funds the idea of these is to pick the age at which you wish to retire and they'll do all the rest of the work for you and find the right mix of index funds as you can see these go up in five year intervals and you can pick whichever suits your plans best this could be a good option if you wanted to invest without thinking about it too much but personally i always prefer manually investing it's a bit like driving an automatic car that does all the work for you it just isn't as much fun as a stick shift number three is company location and size known as small medium and large cap here you can find v fix which tracks our old friend the s p 500 this little s means it's one of vanguard selected funds which they recommend if you click on it you're able to see exactly what companies you would be investing in and also the risk level vt sacs is another good one which is a total stock market index fund which has over 3586 different stocks this allows you to invest in the entire usa stock market in one click there is a minimum investment of three thousand dollars again but as before there's also an etf version with no minimum called vti then you have international stocks quite a cool one is emerging markets which invest in companies based in china taiwan india and many more but as you can see this is a five on the risk scale so i wouldn't personally invest a lot of money into this fund because look at me i'm a bit old to be taking too many risk and i need to sleep at night number four the last category is sector based so if you have a particular interest in energy healthcare or real estate you can invest into these sectors and there are also a lot more options for sector investing in the etf so now we've broken down what's on offer hopefully it all looks a bit more understandable now for the moment you've all been waiting for it's time to invest my ten thousand dollars i could split this between lots of different funds but personally i like to invest the majority of my money into american companies i would say probably about seventy percent american 20 in other countries including the uk and ten percent in some bonds i like to keep the bonds quite low as i don't mind this little extra bit of risk because i'm only 53 and i have a bit of time before i've got to rebalance my portfolio to secure my investments but that's a personal choice depending on your risk tolerance the funds that are available are different in every country but the indexes they track are very similar so you may need to invest in a different fund to me but obviously you can still use my percentages as a guide so i'm going to use the uk vanguard site to invest 5k straight into this etf that tracks the s p 500 so here we go all done two thousand dollars is going into an index fund that tracks the total american stock market so again we go on the screen click so far that's 70 invested in the biggest economy in the world which of course is the usa now i like to balance this out by investing in a different economy as i live back in my own country i'm going to be putting 2k into the ftse 100 index fund so looking good all done great now i've invested 90 of my 10k and i'd like a bit of security let's just put the remaining 1k into a global bonds index fund and let's just do that so just like that i've invested in the usa companies like apple amazon tesla and google i own a small piece of the biggest companies in the uk like hsbc bp and unilever and i have some bonds to balance out my portfolio it really is as easy as that so i'm going to leave the next video up here but don't click on it just yet remember to subscribe to the channel if you want to grow your wealth ring that notification bell and smash that like button okay i'll see you on the other side

Read More

Warren Buffett: Why Most People Should Invest In S&P 500 Index

Jason 0 Comments Retire Wealthy Retirement Planning

why have you advised your wife to invest in index funds after your death rather than berkshire hathaway i believe munger has cancelled his offspring to quote not be so dumb as to sell she she won't be she won't be selling any berkshire to buy the index funds all all of my berkshire every single share will go to philanthropy so that i don't even regard myself as owning berkshire you know basically it's it's committed and i've i so far about 40 percent has already been distributed so the question is somebody who is not an investment professional will be i hope reasonably elderly by the time that the uh estate gets settled and what is the best investment meaning one that there would be less worry of any kind connected with and less people coming around and saying why don't you sell this and do something else and all those things she's going to have more money than she needs and the big thing then you want is money not to be a problem and there will be no way that if she holds the s p of virtually no way absent something happened with weapons of mass destruction but virtually no way that she will shall have all the money that she possibly can use to have a little liquid money so that if stocks are down tremendously at some point they close the stock exchange for a while anything like that she'll still feel that she's got plenty of money and the object is not to maximize it doesn't make any difference whether the amount she gets doubles or triples or anything of the sort the important thing is that she never worries about money the rest of her life and i had an aunt katie here in omaha charlie knew well and worked for her husband as did i and she worked very hard all her life and had lived in a house she paid i think i don't know eight thousand dollars for 45th and hickory all her life and uh because she was in berkshire uh she ended up she lived in 97.

she ended up with you know a few hundred million and she would write me a letter every four or five months and she said dear warren you know i hate to bother you but am i going to run out of money and and i would i would write her back and i'd say dear katie it's a good question because if you live 986 years you're going to run out of money and and then about four or five months later she'd write me the same winner again and i i have seen there's no way in the world if you've got plenty of money that it should become a a minus in your life and there will be people if you've got a lot of money that come around with various suggestions for you sometimes well-meaning sometimes not so well-meaning so if you've got something that's certain to deliver you know it was all in berkshire they'd say well if warren was alive today you know he would be telling him to do this i i just don't want anybody to go through that and the s p will be a i think actually what i'm suggesting is what but a very high percentage of people should do something like that and i don't think they will have us i think there's a chance they won't have as much peace of mind if they own one stock and they've got neighbors and friends and relatives that are trying to do some like i say sometimes well-intentioned sometimes otherwise to do something else and so i think it's a policy that'll get a good result and it's likely to stick charlie well as becky said the wonders are different i i want them to hold the berkshire well i want to hold the berkshire too no i bet i mean i i i don't like them i recognize the logic of the fact that that s p algorithm is very hard to beat in a diversified portfolio of big companies it's all but impossible for most people but you know it's i'm just more comfortable with the berkshire well it's the family business yeah yeah but but it uh i've just i've seen too many people as they get older particularly being susceptible just having to listen to the arguments of people coming well if you're going to protect your heirs from the stupidity of others you may have some good system but i'm not much interested in that subject [Laughter] okay you

Read MoreHow to Retire in 9 Years Starting With ZERO (A 5-Step Guide)

Jason 0 Comments Career after Retirement Retire Wealthy

are you over the age of 50 with no plan in sight for your retirement don't worry there's still hope it's never too late to get started hey guys welcome back to the channel in today's video we're going to teach you some tips on how to plan for your retirement even if you are starting late in life first of all you need to know that retirement is freedom which means that when you retire you should be able to do whatever you want whether to travel to your favorite destinations spend more time with your family or work on your own projects so let me take you through the steps of your journey to financial freedom first step is to cut your expenses write down all your monthly expenses think of your main fundamental expenses as your running cost as if you're running a company things like rent builds groceries internet so you can watch more of our videos and car payment remember that you could always find cheaper alternatives for some of your main expenses for example you could always move to a cheaper house and save on your rent or if you have a rental car you could rent a cheaper car that also matches your needs the key here is not to minimize your quality of life but to minimize the amount you spend on that quality now write down the other expenses that you could survive without this might differ from one person to another it could be your netflix or amazon prime subscription or it could be the designer clothes that you usually buy these are the items that you could totally scratch from your expenses the more you cut the more you save and in the fifth step i'm going to tell you how we are going to use all this extra money to get you even more money always remember that it's not about how much you earn is what you keep you could be earning much more than others but you're also spending much more than they do keep monitoring your expenses you can do this through a simple written list or even through apps such as zoho expense or expense point second step is to set your expectations remember when we said in the beginning of our video that retirement is freedom well you need to think of your freedom figure which is basically the amount of money you expect per year after your retirement now multiply this number by 25 i'm sure you will get a crazy seven figure number this is going to be your goal i bet you're thinking now that it's impossible but please don't close the video yet because in the last two steps i'm going to show you how you can make this possible you need to lower your expectations for the time being in order to get those results in the future it's a match a fight if you will wealth versus cash flow set your own goals for now and for the future not based on what you see around you or on social media it doesn't have to be a 25 million dollar mansion in beverly hills a huge yacht and a supercar but that doesn't mean you shouldn't be enjoying your retirement it's about being realistic and aware of your situation what you can achieve in the future third step is to consider working longer now i know what you must be thinking i'm watching this video to know how to retire early but bear with me you may retire by the age of 60 or even 65.

But if you retire by the age of 70 you are increasing your social security check to nearly double plus there's also more money going into your 401k what's 401k oh you didn't know well i will explain this in the next step if you can't bear the thought of staying at your current job any longer than you need to then you should look into quitting your current job and finding another one something that you will enjoy more you you'll be surprised at the amount of companies that are currently looking for workers with experience be aware of your physical health keep up with your regular medical check-ups eat healthfully do any form of physical exercise could be something as small as taking a relaxing walk every day all this keeps you energetic so that you may continue working at the top of your game fourth step is to open an investment account this account could be funded by the money you save as a result of cutting expenses remember step one or you could open a 401k account if you don't already have one a 401k plan is a company sponsored retirement account where employers can contribute their income and employers usually match contributions up to a certain amount there are two basic types of 401ks traditionally and roth which differ primarily in how they're taxed with a traditional 401k employee contributions are pre-tax meaning they've reduced taxable income ban withdrawals are taxed during retirement employee contributions to rough 401ks are made with after tax income there's no tax deduction in the contribution year but withdrawals are tax-free so if you don't have a 401k yet what are you waiting for start one and make use of all this non-taxable income now it's time to invest your money which takes us to the last step the fifth and last step is to increase your income well you can always ask for a raise in your current job if the thought of asking for more pay sounds daunting then you can try looking for a new job with a better salary which may not be as challenging as you think there are many ways to promote your skills and experience to other companies you can upload your resume to sites such as indeed.com or linkedin.com let the companies come to you but there is an even easier way to increase your income through a side hustle one of the easiest ways to do so is through creating an amazon individual seller account it's free to create but you need to pay a commission of 99 cents for every sale that you make on amazon not intrigued yet hear this according to a recent survey of amazon sellers twenty percent make between one thousand dollars and five thousand dollars per month which i believe is great for a side hustle or even a decent second income you can even sell your own private label products on amazon around 67 percent of all amazon sellers run their business using the private label method private labeling is a process of manufacturing a pre-existing item preferably with product improvements putting your branding and logos on it and selling it to consumers sometimes it is referred to as wide labeling or brand creation the process has been around for years and is common in countless retail stores targets mainstays brand and walmart's great value are two examples of private label brands your site hustle could also be building websites or content writing there are millions of ways to start a site hustle it's all based on the set of tools that you possess be sure to check out my videos covering this topic and i'll post a link in the description below and remember you can always learn a new skill and this skill could be your next source of income so never stop learning another way to increase your income is by creating a passive income stream passive means you don't actually need to actively trade your time for money you are basically making money while you sleep there are three ways to earn passive income stock markets you don't need to call a local broker anymore there are plenty of applications that you can use to trade stocks that's what makes it the easiest way to gain passive income i'll post some links in the description below for some of my favorite exchanges that i use to trade stocks and crypto cryptocurrency is part of the new modern era with many ways for you to earn passively if you are willing to accept its high risk prices of cryptocurrencies including bitcoin have been falling in 2022 amid a worldwide crypto price crash this could also mark a perfect opportunity to buy with prices being so low check out this video i made where i go over the top five cryptos that billionaire kevin o'leary from shark tank is currently investing in but remember be wise when investing in crypto never put in more than you are willing to lose other options include real estate it's harder to get into it as you need to save up enough to pay for a down payment once purchase you can then get a tenant to rent out the house which will cover payments on the mortgage and hopefully a bit more use any cash flow to pay down the principal faster after a few years you will have paid off the house and can now enjoy some free cash flow from your rental property the earlier you start doing this the sooner you can pay off the mortgage debt now that we have been through each of the five steps of your journey to freedom keep this in mind your life is not going to change unless you take the initiative a nine to five job alone is not enough to build wealth have faith in yourself have faith in your abilities you're not alone in this situation and if other people can do it so can you improve your physical and mental health this will keep you more focused and energetic to work on your goals and it saves you from spending a lot of money down the road on treatment and medications this is it for me today i hope this video has given you as much hope as it did to me don't forget to hit the like button and subscribe to our channel watch our previous videos you never know what piece of information could change your life

Read MoreTop 5 Wealth Killers Only 1% of Rich People Know

Jason 0 Comments Retire Wealthy

Virtually 6 in 10 Americans don'' t have. sufficient cost savings to cover a $500 or $1,000 unplanned expense. That’s definitely.

horrible because if something fails, you will certainly need to take unneeded lendings.

or, god forbid, pay a bank card passion. They might rise 20 and even 30 percent..

You have to be a moron to pay that much rate of interest. What else can you.

do if you have nothing else option.

Even those who actually.

conserve some cash apparently said they don'' t have much in their financial savings account. Certainly, cost savings went considerably higher during the pandemic age because we were compelled.

to remain at home and also collect stimulation checks yet that’s currently hunting us down with the greatest.

Regardless of the fed'' s best efforts to keep increasing prices, that hasn'' t helped.

never ever recognize that considering that we don'' t have a machine that can take us to a different truth. When virtually 60 percent of the population says that they have less than a thousand.

dollars in their interest-bearing account, you recognize that we have a problem because a thousand.

bucks is probably not enough to cover the rent. What occurs if you get ill, enter into an.

mishap, or obtain discharged? What do you do? I obtain, its hard to save when.

we are bordered by so many things pushing us to spend.Even before

the video clip.

begun, you probably saw an ad that called you to visit their website and also spend some cash. Let me make clear something, spending cash isn'' t bad. There is absolutely nothing wrong with getting things you.

requirement or want. At the end of the day, what’s the point of generating income at the end of the day. On.

top of that, spending is what drives the economic situation forward. Without enough costs, we will certainly have.

depreciation that will reduce economic growth. What I see often takes place is that People typically.

grumble that they can'' t conserve due to the fact that they need to cover their standard costs yet wind up acquiring.

5-dollar coffee as well as avocado salute every early morning. Once again, there is absolutely nothing poor keeping that, as long.

as you are saving an excellent dimension of your paycheck.I don’t truly support the suggestion of saving every. penny feasible since life isn ' t practically conserving money. It'' s concerning experiences. And also component. of that is having a good time with friends and spending cash. If you are at the start.

of your journey, you can'' t manage to spend every cent you gain. You need to construct that.

funding that will certainly deal with your part of you. The issue is that there are few riches.

awesomes that drain your budget plan one of the most. If you can get rid of them, you will certainly be able.

to conserve a ton of money as well as develop that lot of money. If you prepare, give this video a thumbs.

up, as well as let'' s start with the initial one. Vehicle. If you have actually ever possessed an auto, you most likely recognize just how expensive it is to.

have a car.In truth, a lot of people that drive don'' t recognize exactly just how much their cars and truck costs. The average monthly payment on a brand-new car was $575 in 2020. That'' s much from the real cost of.

possessing a cars and truck. Which’s back in 2020. It’s far more than that given that there is a lack of.

chips and also high rising cost of living. Which’s simply your regular monthly repayments without taking into account.

insurance, gas, and particularly upkeep. What I also realized when I got my very first auto was.

how commonly I started to drive.I began driving anywhere, also when it wasn ' t essential. Gas is not inexpensive, specifically now, and also being embeded traffic daily can.

cost a lot of money. However if you have a household, certainly owning a car makes good sense, specifically.

when public transportation is not a choice. But if you are solitary, for god'' s purpose, save that.

You will thank me later on.

as an example. A fortune! 20 bucks here or 30 bucks there don’t appear like a lot, yet if you include it.

up throughout a month, it will add up. According to the Bureau of Labor Data,.

Americans invest regarding 1 percent of their gross yearly revenue on alcohol.For the average. household, that’s$ 565 a year, $5,650 in one decade, or a whopping $22,600 over a 40-year duration. That.

doesn’t appear much. However do not be tricked by this number. It takes right into account all Americans,.

consisting of those who don’t drink and those who consume once to twice a year. If you just.