Tag: stock market for beginners

Why The 3 Fund Portfolio Is King

Jason 0 Comments Retire Wealthy Retirement Planning

– There's a very easy do it

yourself method to investing that not only out

performs the vast majority of retail and professional investors, but it also saves you a ton of time, energy and money along the way, and that investing method

is called, wait for it, the three fund portfolio. In this video I'll show you

what makes this way of investing so successful, the steps to properly create this portfolio in your account, which aren't always so obvious. I'll give you a list of the funds needed to create the portfolio, and then I'll show you the

actual historical returns based on a few back tested

three fund portfolios that I put together. If you get some value from this video, then please hit that thumbs up button. If not for me, then please

do it for my dog, Molly, because she's starring at me right now waiting for me to get done filming so that we can go outside and play. The three fund portfolio is made up of, you guessed it, three different funds. Nothing more and nothing less.

As with anything, you can

of course customize it beyond those three if you want, but the results may vary

based on how many shares of speculative investments that you decide to add beyond those three. The three types of funds consist of number one, a total U.S.

stock market index fund, which essentially holds every single stock traded on the stock market. We're talking small cap, mid cap, and large cap stocks, which makes up around

4,000 U.S.

Based companies. Number two, a total

international stock index fund that excludes stocks

that are headquartered within the United States. These are stocks that make up developed and emerging international economies, and are equal to roughly

7600 different stocks. And finally, a total U.S.

bond market index fund, which consists of a

mixture between maturities that are short,

intermediate and long term. In total, there's a little

over 10,000 of these.

When you own a total market index fund, you basically have money invested in essentially every single stock and bond traded on the stock market. Between these three funds, you'd hold a little more

than 21,500 different stocks and bonds across the world at the lowest cost possible. You're instantly diversifying your money by only having to worry about purchasing three different funds. As Jack Bogel, the guy

who introduced the first index fund to retail

investors like us once said "Why look for the needle," meaning those individual winning stocks, "when you can just buy

the whole haystack." By investing in these

three types of funds, there is zero overlap when it comes to stocks and bonds. Portfolio overlap happens when you invest in multiple funds that hold the exact same stocks, which in turn makes you less diversified than you might think you are. An easy way to remember this is when diversification decreases, your risk will increase.

Only having to own three

different investments sounds pretty simple, right? – Yep. – Like so simple that you

don't even need to pay one of those expensive

professional advisors- – What? – To pick your investments that will most likely underperform the market

in the long run, right? – Yep. – Did we just become best friends? – Do you wanna go do karate in the garage? – It's no secret that advisors

make money off of you, because that's how they get paid. And the amount that

they're paid comes directly from the returns of your investments. There's two main ways that

they make money off of you. Number one, by charging you

either an ongoing percentage based on your account balance, which I've seen on average is about 1%, or a flat fee no matter

the size of your account.

And/or number two, by

getting a cash kickback from the company that manages the fund they're having you invest in. I don't know if you caught that, but it sounds like there might be a little bit of a conflict of

interest for that one, right? Of course there is, but naturally they're gonna

try to hide that from you. If an investment advisor

told you to invest in the same three low cost

funds for the rest of your life, would you be willing to

pay them an ongoing 1% fee every single year? Would it be worth paying

them $20,000 in fees? Because if you invested $10,000 today, and paid them 1% per year for 30 years, then the total fees that you would pay from the annual fees plus

the opportunity cost, would add up to $19,800.

Now, let me put that in terms

that we can all understand. That equals $2,475 Chipotle burritos. Yes, you heard me correctly. You would pay more in fees

than that initial $10,000 that you invested. I don't know about you, but I wouldn't be willing to give up over 6.5 years worth of

daily Chipotle burritos for them to do something as simple as put me into a three fund portfolio. They wanna make it as

complicated as possible to make it appear like they're doing something

productive with your money by constantly fiddling with your portfolio to justify charging you 1%. If they knew that you knew that it was as easy as buying

three low cost index funds, then they'd be out of a job, which is why you most likely only hear this sort of good advice from a fiduciary financial advisor because they are legally obligated to act in your best interest. And the trust worthy ones

usually only charge a flat fee as opposed to an ongoing yearly fee. Not all non-fiduciary financial advisors are professional scumbags, but we do have to acknowledge the fact that their incentives aren't aligned with helping you make the

best investment decisions.

Investing in a three fund portfolio reduces the amount of time that you need to spend with

and pay a financial advisor whose goals aren't aligned with yours. But avoiding a shotty advisor isn't the only reason to

use a three fund portfolio. It's also a good way to avoid the risk that comes from an active fund manager that's handling how money's invested within a mutual fund that you invest in. Low cost total stock market index funds held within a three fund portfolio are passively managed funds, which means that they funds managers aren't choosing what

to buy, sell and hold.

Actively managed funds on the other hand, are run by people who

are choosing which stocks to buy, sell and hold. To successfully pick the right stock combo to outperform a basic total

stock market index fund, these fund managers need

to have some level of skill to achieve that out performance. But time after time the data shows that it's nearly impossible

to successfully do this over long periods of time. The hot fund manager

everyone talks about today turns out to be the loser of tomorrow that everyone eventually forgets about. In a paper published in

the journal of finance called luck versus skill in the cross section

of mutual fund returns, Fama and French found

that "On a practical level "our results on long term performance "say that true out performance "and net returns to investors "is negative for most if

not all active funds." In the paper they did admit that when returns are

measured before costs and expense ratios there

is stronger evidence of manager skill, but this is irrelevant though because you're not

getting into these funds without paying a fee.

It's like saying I have this

awesome new electric car but there's nowhere for

me to charge the thing so I can't really turn it on and drive it. All I can do is look at it. – Look at that, that's nice and shiny. – Which brings up another advantage that the three fund portfolio has. The three index funds

that make up the portfolio are extremely low cost. The price for each can

vary from fund to fund, which we'll cover in just a minute, but compared to most

other funds out there, they're the lowest since

they're passively managed. For example, the Vanguard ETF versions have an expense ratio of 0.03%, 0.08% and 0.035%.

That means for every $10,000 invested you're paying an expense of $3, $8 and $3.50 per year. A study from the Financial

Research Corporation called Predicting Mutual Fund Performance set out to determine

if there were any ways to predict the future

performance of a mutual fund. They tested 10 different predictors like past performance,

morning star ratings, expenses, turn over, manager tenure, asset size and a few more things. They came to the conclusion

that the best way to reliably predict the

future performance of funds was by looking at the expense ratio and nothing else.

They call a favorable expense ratio an exceptional predictor for bonds, and a good predictor for stock funds. Based on this research, if you wanna pick a successful fund, then ignore everything else, and just look for the one with the lowest expense ratio. And lucky for the three fund portfolio, those three total stock market index funds are about as low cost as they get. Hang tight because I did

all of the legwork for you by putting together a list of the exact tickers

that you might wanna use. I'll cover those in just a minute. It was cold in here, and now it's hot, so the jacket had to come off. When it's all said and done, the biggest selling point of a three fund portfolio

is that it's just easy.

Literally dummy proof. Contributing money to

your investment account on a regular basis, and spreading that money among

only three funds is easy. Rebalancing once per year

across only three funds is easy. When it comes to withdrawing

money when you're older, you only have to pick between

three funds to sell off, which is easy. When choosing what to invest in, you only have three funds to worry about, which is easy. Investing isn't complicated at all, but for some reason we

like to make it out to be more than it actually is. There is zero correlation between spending a bunch of time trying to pick stocks or mutual funds, or spending a bunch of

money on an advisor, and an increase in your

investment returns. Successful investing has more

to do with your psychology than anything. Stick with the three

fund portfolio process, and get on with living your life because the returns will

take care of themselves. The first step in building

your three fund portfolio will be to choose the three

funds that you'd wanna use. Here's a list of the exact

funds that you'd wanna hold deponing on which investing

platform that you use.

All you do is choose one

from the total U.S. funds, one of the total international funds, and one of the total U.S. bond funds. Side note, if you're

building this portfolio within a 401k, then you might not have access to a total

U.S. stock market fund. Now if that's the case, then you should have access to some sort of S&P 500 fund, which you can substitute in its place. You don't have to, but I'd suggest choosing

funds from the same row just to make things a lot easier for you.

As you can see, all

the funds are exclusive to their respective investing platforms except for the Vanguard ETF versions. Those Vanguard ETF's can be purchased on any investment platform, which is why they're my number one choice. To the far left, you can also see that I've ranked each three fund mix. I did that because the more

that I looked into each one, the more I realized that they

are not all created equally. Even though the expense

ratios for each fund within a category is

going to be different, they're not far off enough

to where I'd steer you away from any of them.

The issue I have is that

when the name of a fund says total U.S. stock market index, I would assume that the fund would hold literally every

single stock on the U.S. market. The same goes for the total international and total bond index as well. But the more I started

to look into each one, the more I realized that

that's far from accurate. Most of these funds do not actually hold, quote, unquote, everything. Here's the same list, and next to each ticker symbol I have how many stocks or bonds are held within each one. Based on this info, the only true U.S.

Stock,

international stock, and bond funds are the

ones offered by Vanguard. That's not to say that you

should avoid any of the others, but it's something to be aware of. The returns will most likely be pretty close between all of them, but if you wanna get the closest return to the market as possible, then go with the Vanguard funds. Once again, the good news is

that with the Vanguard ETFs, they can be purchased on any

investment platform out there. The next step will be to

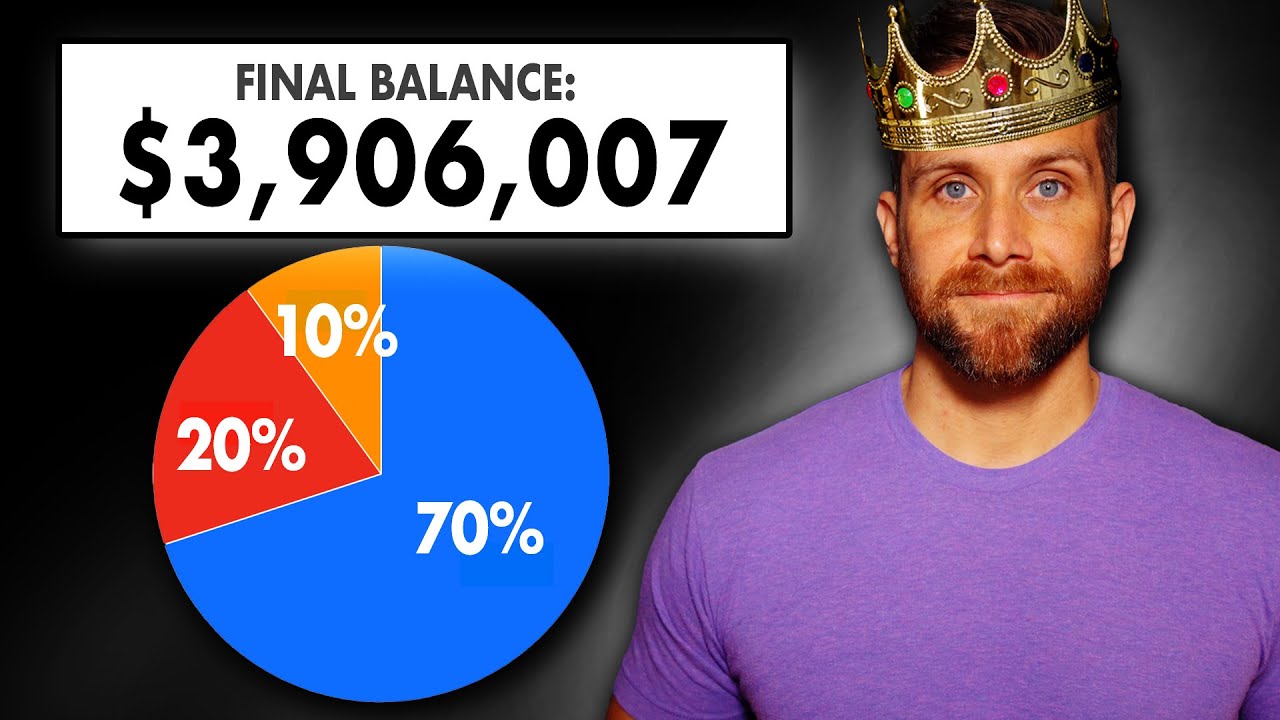

choose an asset allocation. Meaning out of 100%, how

much should go towards each of the three funds. This is quite possibly the

most important decision that you'll have to

make, so pay attention, because it's going to have a direct impact on your expected return and risk level. The more risk you wanna take, for example, the more stocks and less bonds that you wanna hold, the higher expected return. The inverse is also true. So the less risk that you wanna take, i.e., the more bonds and less stocks, the lower expected return. Here's a chart I put together showing you how different stock and bond allocations would have performed over the past 34 years.

On the first line, the 0% stock and 100% bond allocation would have only netted you an average of 5.73% annual return. During the worst year, you would have only lost 2.66%, with a max draw down of 5.96%. On the last line, I tested a 100% stock and 0% bond allocation for 34 years. It gave us an average annual return of basically 10%. But, and this is a big but, you would have had to been able to handle a worst year

return of negative 38%, and a max draw down of negative 52%. That means that if you had

a million dollar portfolio, and you were 100% in stocks, that at one point you would have been down $520,000, and your three fund portfolio

would be worth $480,000. Yes, of course your investments

eventually recovered, but you need to ask yourself if you could handle that kind

of draw down on your portfolio and not panic sell. That point when the portfolio was down 52% was the housing market crash, which started towards the end of 2007. There were a lot of

unknowns during that time. And looking back on it now, we know how things played out. But if you were in the middle of it, then you had zero clue if the whole financial

system was going to crash.

To make things even worse, your portfolio during that time would have been under water for a little over five

years and two months. Let me say that again in a different way. It would have taken your portfolio 1,885 days to fully recover from that $520,000 loss. So you need to ask yourself

could you handle not selling and continuing to invest during that time if you were invested in 100% stocks, because to get that 10%

average annual return over those 34 years, you would have had to of not sold, and continued to invest

money every single month, even when it looked like

there wasn't any light at the end of that tunnel.

That's one of the prices

that you have to pay for that higher average annual return. Always keep that in mind. And I didn't even put in here data of other times it crashed too because that wasn't the only time. There was another time

where I think it was down 43% or 48% as well. Based on the odds and history, we know that it's likely

your portfolio will tank, potentially like that, at some point between now and when you disappear from this earth.

If you want your money to

grow in a meaningful way, then you have to have a decent amount of your money invested into stocks, which means that times like these are going to hurt no matter what. If you don't think that you can handle huge swings like that, but still wanna give your money a fighting chance to grow, then start with a five,

10 or 20% bond allocation within your three fund portfolio. You're also going to

wanna continue investing even when times look really, really ugly in the economy and the stock market. When it comes to how much to put towards international stocks, this is a tricky one that's been debated so many times. And because of that I

refer back to Jack Bogel, the founder of Vanguard on this one. For a long time he was completely against allocating any money towards

international stocks. His thought process was

that if you already own a total U.S. stock market index, then you naturally have exposure

to international markets because a lot of those corporations do a ton of business overseas. But as time went on he changed

his stance a little bit.

He ended up saying that he would be fine if someone held anywhere between 0% and 20% of their portfolio in international stocks. So do what you want with that info. If you're really not sure, then start out with something

like 10% in international, and then adjust it up or down from there. When it comes to

rebalancing your portfolio to get your allocations back

to where they should be, I would only plan on

doing that once per year. Don't worry about doing

it any more than that. One of my favorite investing

platforms that I use, and I love that makes the whole three fund portfolio investing a lot easier is M1 Finance.

I'll have a link in the description of this video to check them out, and also get a free $30 from them. Now it's time to implement

this strategy for yourself. If you have any additional questions beyond what I've covered so far, please leave them down

in the comments below, and I will try to answer every

single one of them for you. But there's two things that I really need to

stress to you though.

Number one, it is extremely important to invest money into

this type of portfolio on a regular basis. Consistency is key. The returns I showed you, are all what happened in the past, and do not give us any indication of how things will play out in the future. For all we know, the returns for everything going forward might be lower. Now if that's the case, then the best thing that you can do is to shove as much money as possible into those investments on a regular basis.

The returns on a 100% stock portfolio might only net you an annual return of 5% as opposed to that 10% that we saw. But I would rather be

earning 5% on a portfolio of $800,000 than one

that's only worth $400,000 because I wasn't investing

on a consistent basis. And number two, there's

going to come a time, most likely multiple times, when things look very dark

and grim within the world, the economy and the stock market. I am talking really, really ugly. Kind of like when we were in the middle of the housing market crash of 2008.

I need you to ignore all of that noise, continue to invest, stay optimistic, don't

fiddle with this portfolio, and stay the course. Corrections and bear

markets will come and go. But I can promise you one thing, if your three fund portfolio is crashing, then everyone else's

most likely are as well. But the only people

who actually lose money are the ones who sell or start messing with their

portfolios during that time because they're the ones who

are locking in their losses by doing those things.

I've met a few people who

sold their investments at the bottom of the housing market crash, and still haven't fully put their money back into the market. Now those people had to push

out their retirement dates another 10 and 15 years because

of that panicked decision. Be sure to hit that thumbs up button before you go. Check out the description

for more resources and playlists to help

with all of your personal finance and investing needs. I'll see you in the next one friends. Done..

Recent Comments