Tag: personal finance

Are 401(k)s a Financial Silver Bullet?

Jason 0 Comments Retire Wealthy Retirement Planning

It’s hard to find something everybody agrees

on. Crunchy or smooth? Smooth. Mac or PC? Fries or onion rings? Fries. But if there’s one financial instrument

that seems universally beloved, it’s got to be the 401(k). Everybody loves ‘em! People delay saving for a home, building an

emergency fund, or even paying off high-interest debt in pursuit of this conquering hero: the

tall, dark, and handsome 401(k). My hero… There’s a whole lot to love with the 401(k). So saddle up and take a ride to find out what

makes this cowboy the darling of investors everywhere! The year was 1980, and The Revenue Act of

1978 was finally going into effect.

And deep in the bill was a tiny provision;

Section 401, Subsection K. Largely overlooked, Section 401(k) allowed employees to defer

taxes on bonuses and stock options — basically a way for rich executives to make more and

pay less tax on it. But everything changed in 1981 when the IRS

ruled that employees could also contribute from their SALARY. This was music to employer’s ears! Managing all those employee pensions was expensive,

complicated, and downright risky! Maybe this new fella, 401(k), could replace

the dusty old pensions of our grandpappies. Before long, 401(k) fever was spreading like

wildfire! By 1996, 401(k) accounts held over a trillion

dollars! How does it work? Fundamentally, a 401(k) is an employer-sponsored

investment account.

It lets you invest part of your paycheck and

receive a tax benefit for doing so. Like company-provided insurance programs,

you have to opt-in to participate. The most attractive feature is the “employer

match”. Translation: if you save for your future,

the boss rewards you with “free” money, matching your contribution dollar for dollar,

up to a limit. Around half of 401(k)s offer an employer

match and this “free money” can come to thousands of extra dollars! Then there’s the sweet tax breaks.

Depending on the type of 401(k), your contributions

could be “pre-tax”, meaning it lowers your taxable income for the year. OR, you can pay the tax now, and allow that

money to grow tax-free. The more you save, the less taxes you pay. Looking pretty spiffy over there, Mr. 401(k)! Oh — and don’t forget that your contributions

are being invested in stock and bond funds. We have Two Cents episodes about those if

you’re not sure how they work. Now you can just sit back and watch compound

interest fatten your herd! Free money, big tax breaks, and investment

growth! What’s not to love?! Hold your horses there, partner. While the 401(k) has a lot going for it, there

are a couple burrs under the saddle.

Like the risks of managing your own investment

portfolios instead of leaving it to the professionals. As 401(k)s soared in popularity during the

80’s and 90’s, billions of dollars flowed into risky sectors like tech-stocks. And when things came crashing down — like

they did twice in the 2000’s — many working folks were left adrift like a tumbleweed in

the wind. And did you know that “Mr 401(k)” doesn’t

work for free? A study by TD Ameritrade found that 73% of

participants didn’t know how much their 401(k) costs, while 37% weren’t aware they

were paying fees at all! Investment firms regularly rack up hefty fees

since nobody’s paying attention — with the average being around 1.4%! And remember that juicy employer “match”

we mentioned earlier? Well, that might not end up being yours thanks

to “401(k) vesting”.

Even though funds might appear in your account,

they’re only yours once you become “vested” — often 3 to 5 years after you get hired! With the vast majority of millennials only

expecting to stay in a job for a few years at the most, that’s a lot of “free money”

that never gets collected. Despite their perks, and general popularity,

401(k)s have left a societal legacy that’s, well, ugly. See, 401(k)s were originally designed to be

a supplement to worker pensions. For most of the 20th century, it was common

for workers to stay with a single employer for most of their lives. And for that loyalty, their company offered

a defined benefit pension for the worker’s golden years.

These plans offered steadiness and security,

with the employer watching over everyone’s plans — from the janitor to the CEO. By their peak in 1980, 38% of all private

sector workers had an employer pension. Today, thanks to the 401(k), only 13% of private

sector workers have a pension. And while 401(k)s have their perks, they're just not as stable or reliable. 401(k)s are also “opt-in,” which means

you aren’t automatically enrolled. Left to their own devices, many employees simply aren’t saving enough — if they’re saving at all. Of the 79% of workers eligible to save into

a 401(k), only 41% opt to participate. The National Institute on Retirement Security

finds that the median retirement savings balance is just $3,000 for all working-age households

and a mere $12,000 for those near-retirement! Most financial experts recommend a personal

retirement savings rate between 10 – 15%.

The real rates are between 1 and 3%. The 401(k) was designed to be the side-dish,

not the main course. Saddling workers with the “opportunity”

to manage their own retirements has created a national crisis in retirement preparedness. But the good news is that if you know its

place, and use it wisely, a 401(k) can be a great part of your financial toolkit. Since pensions are going the way of the horse

and buggy, you’ll need your 401(k) to be galloping double-time to keep from being left

in the dust.

Take advantage of it and you’ll be riding

into the sunset instead of off a cliff. And that’s our two cents! If you've been transitioned from a pension to a 401(k) tell us about experience in the comments!.

Investment Finance Tips : ROTH IRA Retirement Tips

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

This is Patrick Munro, Financial Advisor,

and I'm asking the question today, "Do my ROTH contributions count if I have a retirement

plan at work"? Many of my clients will ask me that, and the more retirement plans you

can possibly have, the better. Many people do have a retirement plan at work which is

non-voluntary, meaning they didn't have any say in how it was set up, but, nevertheless

the employer is matching the contributions that you are payroll deducted, so you take

that. But you can also set up your own independent ROTH plan whereby the taxes are paid ahead

of time.

The more the better, I always say. If you have the money, by all means put that

in there and make sure that you don't put in too much money into a retirement plan to,

well, not have much of a lifestyle. You don't want to be IRA poor, you want to be remember

that you have to enjoy your life going forward. But by all means if you have an IRA plan at

work you can also set up an independent ROTH plan as well. So this is Patrick Munro talking

about that issue, "Do my ROTH's count if I have an IRA plan at work"?.

When can I retire? | How much Retirement Corpus is enough?

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

Hello friends welcome to

yadnya investment academy. Today is friday. So today we will talk about

a financial planning topic. Today's topic is Related to retirement planning A very common question of you all that come Obviously this all knows. Retirement is a very important goal. If we talk about financial goals. Mostly it should be. Mostly when i do financial planning So many persons financial

planning i have done personally Then in that comes. Retirement is a very important goal. In which we need a lot of money Nowadays early retirement is occurring.

FIRE environment talks are occurring. Financial free retire early In such things When retirement comes in goal One important thing comes How much money do I need? Tell me this much money is enough. Then I can retire. That is a normal question. For this we have already

developed an interesting calculator but that was before pay wall. Now we have removed that from pay wall because it is very useful calculator. So a retirement calculator we have made. In that with so many

permutations combinations We can get an idea This much retire corps I need. If I reach here then I have done well. I am at least financially free. Now I have to retire. We have to work further or not. Then it is my decision. If above that. Now I am just sharing my screen. Now you will see here You will go on investyadnya website There is a section named

tracker and calculator. In this there is a retirement calculator.

Open this Now here we have to fill information. Suppose i am putting age of 30. You have to retire suppose on 60. Suppose we took an

example i have to retire on 60. Life expectancy we mostly suggest We should keep 90, 95, 100. With a conservative estimate If you keep 100 then it is very

good conservative estimate. If you want to take optimistic If you took practical then it should be 90. Suppose i am putting here 95. Fourth information is our Current annual expense When we do retirement calculation Obvious we took assumptions. One assumption is this the

expense i am doing today Suppose when i retire Then also my expenses should be like this. Means my lifestyle of now remain maintained Neither i increase nor decrease. Suppose I am spending 50k per month today. The expenses that are occurring. After retirement I will do the same expenses. After retirement expenses can reduce. It can be your house if

you are living now on rent. It can be so much rental expense. That can reduce.

Now your children's expenses are so much. They will reduce at that time. Sometimes after retirement

expenses increase. Like vacation expenses mostly increases. Sometimes medical expenses increase. Some expenses have increased. Mostly as an advisor If we took a general advice then we say. Keep the same expenses as they are now. Don't do much changes in that. Some increases some decreases. For example if we want

to do a simple calculation Then considering to current expenses Suppose my expense is 50,000 The profile we are taking has

expenses of 50,000 per month. Then it is 6 lakh rupees per year.

You have to put today's expenses. You don't have to put off retirement age. That's all it will insert. Inflation number How much inflation number we have to take? 7% inflation is mostly suggested by India. If you want to be conservative

then you can take 8%. If you want to be aggressive

then you can take 5-6%. Inflation you should calculate by your own. Every year how my expenses are increasing? If you know little bit idea about that These things are increasing

according to my expenses. Edcuation expenses children's fees It increases almost 8-10% every year. Rentals mostly 10%. Landlords mostly increases rent by 10%. My personal inflation is 8, 9-10%. You take according to your. So for calculation here

I am taking 7% inflation. Then return on investment. On the basis of return on investment. How much is my return on investment? Before retirement and after retirement. Now I am retiring at 60. At 30 I am starting investing. How much should I invest for that? How much retirement corpus I will get? The reason I am investing now. On that how much return should I expect? It depends where you are investing.

If you feel I will invest

mostly in equity markets. Retirement oriented because it is very long horizon. I am of 30 years and retiring at 60 years. Horizon is of 30 years. All that I am investing I will invest mostly on equity. Then we can take 11-12%

return on investment All that we will invest now. Or we kept in equity we can take that. If you feel This house is my retirement corpus This will increase according to that. Then on real estate the return

on expectations that remains. Basically there is round inflation of 7-8%. It depends on you if you have EPFO. That is a very big retirement corpus On EPF we get around 8%. According to that you have invested here. Overall that you are investing Or you are planning This is for retirement

and I am going to invest.

What are expected returns on that? Till 60. Pre retirement is retirement on investment. Suppose it is 12%. Whole the money I will put in equity. Then you took 12% return. Then post retirement my corpse will become. How much will it grow? Suppose I retire and I get corpus of 5 crores. Then 5 crore rupees Where will I invest? Again very difficult question If you are of 30 years then in 60 years. This is very difficult. This is a very big assumption. We have to think mostly at 60 our risk profile decreases. We will not take much equity allocation.

Suppose now we have 60-70 equity allocation That time it becomes 20-30% or 40%. I go a little bit on conservative. I say to most of the people Take percentage equal to inflation I get return same as inflation. If I want to take. Then 0.5-1% extra. We took here 8%. Means 8% of post retirement. My corpus will grow 8% after that. Inflation will remain 7%.

This is planning according to that. We will discuss these points later. Therefore I am doing all these zero. We inserted these things. What we say? Our retirement age, life expectancy. Our annual expense, inflation. These all are our compulsory fields. If I consider this now. Sorry some value needs to be inserted. Randomly value we are inserting. So that it can work. If I consider this now. Then I need retirement

corpus of 14.6 crores. If you are of 30 years and you have to do expense of 50k per month.

At today's value Today's 50k offcourse will not remain same at the time of retirement. They will increase with inflation. If you have to maintain today lifestyle The 50k expenses you are doing today Same you want to do at 60. After 30 years. This is the value after 30 years. Don't be so afraid. Today 14.5 crore is very much. After 30 years the value of 14.5 That should be arounf 70-80 lakh or 1 crore I am doing guess work. It will not be more than that. Think if I have 1 crore rupees today then I will be able to do for next 35 years. 60-95 years means 35 years 35k per month That to inflation to adjust it. I will get it consistently till 95 in 95 it will become zero. If i invest lumpsum then i can invest 50 lakhs. Considering I don't have anything. If I have 50 lakh rupees I will invest it. For 30 years they will grow by 12%. Expected pre-retirement. Then also my retirement money will be done. Monthly Sip that I have to do That is around 50,000 in this. 48,000 rupees sip i need in this. What is the meaning of step up? I will tell this in next.

If you have plan in 30 years 60 years. I have to do all these things. Then you have to do monthly sip of 48,000. To retire for next 30 years. Remember this is a monthly sip. It will not increase. Every year you have to do 48k consistently. Obviously our salary will increase in years Inflation increases salary increases. Now 48,000 will seem so big But after 3-5 years You will not feel big amount. That's what I am saying. In that our step up point comes. Now you will say I don't have 48,000 to invest.

It is a very big amount. From where 48,000 will come. If we are spending 50,000 Then by saving 50,000 we

can invest in retirement corpus. That is not possible. Then in that our second comes step up sip What is the meaning of step up sip? What is annual increase in our income? Can we increase sip every year? I cannot invest 48,000 now but from next year i can increase.

If you think my annual increase in income. If inflation is of 7%. With 7% income should increase If we take seven With 7% it is increasing. We considered 7% inflation. Salary is also increasing by 7%. In worst case salary is not changing. With 7% there is increase in salary. Existing investment Do you have any investment now? That you think this is my retirement income From that also it will reduce. Suppose if you have EPFO corpus Suppose of 5 lakh rupees. 5 lakh rupees i inserted here. This is my EPFO of 5 lakh rupees. I will use it for retirement. On that how much return I will get on EPFO? Return are 8% Then we consider we will get 8%. It is tax free means you will get 8% Suppose i have 5 lakh rupees On that i will get 8% more. Now let's do calculation again. Now since EPFO arrived. From 48 it became 46. Retirement corpus remained same. So now we have to do Sip of 46,000. We can do step up sip of 24,000. We invested 24,000 rupees this month. Every year we increase that by 7%. From annual increase in income we have to do this annual increase in sip.

Today you started sip of 24,300. Next year increased 7% on that. Then again in next year increase 7% on that Compounding 7%. Increase 7% every year Till the age of 60. Then also your goal will be achieved. Then you will have 14.6 crores rupees. Considering these were our rates of returns So it is very very good. You can apply so much

permutations and combinations on this. I have little more money than 24,000. I can do upto 35,000. Can I retire early? Then can I retire at 58? On 58 it will happen at 29,000. I have 35,000. Can I retire at 55? Now your interesting calculation will start No you need 37,000 For retirement at 55. Early retirement you can take at 37,000. If i do 37,000 per year. I invest in such investments

that give me 12% every year. 7% increase i put minimum. If you think 7% increase is less. Consider growth of salary minimum 8-10%. Why not? Consider 10%. Then in Rs 28,000 you can retire at 55. Retirement corpus also reduced. As early you retire that much less corpus you will want. Value of money comes less.

At that time its value will be more. At the age of 55 we need 11.6 crores. How much lump sum funding we need? How much monthly sip

and stepup sip we need? I considered 10% annual increase. Like this If you can do so many

permutations and combinations. You can plan yourself. When can I become financially free? I think this is very interesting calculator If you like as i am a conservative investor I am not taking 12% from whole equity. Suppose we take 9%. This we keep 10. The rate of return become 9% from 12%. Obviously both the sip's will increase. You can do calculation according to that. Which type of investor is I am? If you think here is also 9

then it will change again. These things you can do so many permutations and combinations

based on your profile. You will get so much support and understand If I invest this much money For this much time Then I can go towards a better retirement.

This is how you should work on these things. You can plan early retirement. You want to spend so much or not. 50,000 will not be sufficient. I want to increase my lifestyle. Now I am spending 50,000. But at that time I want to spend 75,000. Acc to that by using

permutation and combination What are my savings now? I can plan such investments or not.

Then in those things you will get

so much help from these calculator.. Do check that on our website. If you have any comment If there are complications

then visit our website. Below is our email address and

whats app number is given. All things are written below. You can email us there

if you have any query. Below there is comment section also. Must write in comment section.

Hit a like if you liked the video. If you think some knowledge is added Then hit a like Have a great time ahead friends Jai Hind.

Read More

The 4% Rule for Retirement: What You Need to Know!

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

one of the most common retirement planning

questions people have is how much money can I pull from my portfolio every year and live on

in retirement and that's where the four percent rule comes in handy and it basically says that

if you can pull four percent or less from your Diversified portfolio invested in things like

stocks and bonds and live off of that amount while keeping the rest invested then there's

a good chance that your money is going to last 20 30 years or more and as a frame of reference

if you had a million dollars then four percent would be forty thousand dollars if you had

five hundred thousand dollars it would be twenty thousand dollars per year and it's not

set in stone it is based off a study that was done many years ago and has held up well over

time but there are instances where people as they get older could pull more or if they retire

early maybe they want to consider even doing less than that but it's a really good way to get

a frame of reference on looking at how much you've saved and what that can translate

into in retirement as far as income goes

45+ and Have NOTHING Saved for Retirement?

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

The other day, I was catching up with an old

friend and I realized we'd been friends for 27 years. I never thought I would have a

friendship that long, but that's how life works. The older you get the faster time seems

to fly by. And when retirement is looming, well, boy, does it start to speed up! So, if

you haven't started saving for retirement, don't panic. It is possible to start saving

when you're 45, 50, even 60, and still be able to retire, but you have to treat it like

the house is burning down. So pay attention. I'm Britt Baker, co-founder of Dow Janes, and today I'm giving you seven steps

to catch up on saving for retirement. First step is to get real about your

current situation. How much have you saved for retirement so far? How much will you

get from Social Security? Plug those numbers into a retirement calculator to see how much more

you need to save each month to be able to retire.

The next step is to start saving dramatically.

If you're 50 and you haven't saved anything for retirement, and you wanna be able to retire,

you need to start saving and investing 50% of your income each month, which means that

you're probably gonna either need to reduce your cost of living or increase your income.

If neither of those options are possible, you need to get real about your alternative,

which we'll talk about later in this video. Okay. Third step is to pay off any high-interest

rate debt that you have and build an emergency fund. You wanna do these two things before you

actually start saving for retirement.

The reason for this is that the high-interest rate debt is

costing you more than you're gonna make by having your money invested or even sitting — definitely

sitting — in a savings account, so if you try to start saving for retirement

before you pay off your debt, it's a bad idea. So if you have any savings

sitting around in a savings account, use it to pay off your high-interest rate debt

ASAP. Then you'll wanna build up an emergency fund. But note, if you have a backup plan,

this emergency fund, doesn't have to be huge. You wanna start saving for retirement as soon

as possible, so don't let this step hold you back if you have family or your children who

will support you in case of an emergency. Four is max out your contributions. So, at this

point, saving for retirement should be your number one priority. So you wanna contribute as much as

you can to your retirement accounts. If you have an employer-sponsored retirement account, like

a 401(k )or a 403(b) and your company offers matching contributions, you wanna make sure that

you're contributing as much as your employer will match.

This is free money, so take full advantage

of it. If you don't already have an IRA, set one up and max out those contributions as well. And if

you're self-employed open a solo 401(k) or SEP IRA and max out those contributions too. If you're

getting the theme, the idea is maxing out your contributions. All of these ways that I'm talking

about also allow you to lower your tax rate, so it's especially helpful.

The final way to do

it is if you have a high-deductible health plan, you can open an HSA and max that out too.

Basically, you wanna save as much money as you can in your various tax-advantaged accounts. And

know that if you're 50 or over, you're allowed to contribute a bit more than the standard maximum.

So look up the maximum amount and contribute that. Fifth step is to invest your savings.

So, even though you're starting late, it's not too late to start investing.

I hear this a lot — is it too late for me? Is it too late to start

investing? But it's absolutely not. One thing that's really helpful to remember

is that you don't have to take all of your retirement money out when you turn 67, if that's

the age that you choose to retire. As soon as you choose to retire, you only need to take out enough

to live on each year, really, even each month, so that you still can let the rest of the money stay

invested in your accounts so that they will grow for as long as they can, which you know, could

end up being another 30 years after retirement.

Next is to plan for your realistic retirement.

So once you've done the exercises in step one to figure out the actual situation you're in,

find out if you're going to have to work longer than you planned, you might need to be making

income for longer than you expected and just know that. The sooner you know that, the more you

can prepare for it. The next thing to consider is will you have to move somewhere with a lower

cost of living? This might be why some people choose to retire in Mexico.

Cost of living

is really expensive in the United States, especially in some cities. So if it's gonna make

your retirement a lot easier and a lot happier, consider a change in lifestyle.

Speaking of changing lifestyle, you might also have to downgrade what you are

used to to be able to afford to stop working. So consider the trade-offs. Would you rather work and keep up your lifestyle

or would you rather retire spend time with your grandkids and maybe not

go on the lavish vacations that you're used to? Whether you wanna travel or take art classes

or spend time with family, you wanna be able to enjoy your retirement without stress.

If you

want some extra support on your journey towards saving money so you can actually retire, check

out our free class, Think Like an Investor. I'll put the link in the description below, and

remember it's never too late to start. So, even though you're getting a late start, it's

okay. There's absolutely hope. You have time. Just make sure you start saving, re-watch this

video, and remember the steps that you're supposed to do things in, and if you want some extra

support, feel free to join our member community, The Million Dollar Year.

We support tons of women

as they are just starting to save retirement in their forties and fifties, so we've

got you if you want the extra help..

6 Retirement Essentials (Most people only prepared 2 or 3)

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

I'm planning for retirement most people focus

mostly on marshaling together enough money you know Financial Resources so that they can last

the distance and then maybe at the back of their heads they have some vague plan right perhaps

two or three things to fill the time with a lot of the times this is stuff like travel family

well unfortunately I'm gonna say that's not quite nearly enough for Preparation we ourselves

have been retired for two years and going looking back on the past two years I kind of see like

six essential things that if you prep for it beforehand before your retirement starts I think

this can really make such a positive difference to your retirement so that's what I wanted

to bring up and discuss with you guys today number one first and foremost of course we have

to talk about money most people's concern is the amount of money that they have in retirement

whether it will last them till the end come comfortably and allow them to afford the Hobbies

like travel good food Etc but I actually think after going through the last two years building up

our financial Acumen is just as important if not more so what do I mean by Financial Acumen I mean

stuff like budgeting tracking projecting investing I mean if you think about it the money in your

bank account can always be squandered we all know that story I think more importantly what's

going to make your retirement more fireproof is having an ability to generate more money where

it came from in the first place so the second essential thing that you can prepare for so that

you have a wonderful retirement it's definitely the ability to be self-directing and disciplined

self-direction definitely helps so much with spending your retirement days meaningfully right

after all there are no more like work schedules or like demands from colleagues or bosses to help

shape your days anymore you have to be the person to take charge in retirement there's a study out

there actually that shows that for happily retired folks most of them actually have about 3.6 core

Pursuits that's what they say and the unheably retired folks tend to have less than 3.6 corporate

suits coming in at about 1.9 call Pursuits that's what the study reflected I guess it kind of just

shows in retirement you really need to fill your life to the brim and keep busy with activities

you love and that is a really great formula for happiness and self-direction will help you

to achieve that state as well as discipline because if you think about it like discipline

directly affects the state of your finances right it affects whether you stick with your retirement

planning whether you keep fit and active and you get to maintain your health in retirement even

whilst you're left up to your own devices even to find your cover suits if you don't have any

when you're starting or in your retirement so discipline and self-direction will be like

the building blocks for enjoying your life in retirement the third essential thing you might

want to work on and cultivate or happy retirement is people skills right so studies and research

have reflected very consistently that the main determining factor for happiness and Longevity

for most of us is actually relationships Human Relationships friendships relationship with

your spouse and with your family I guess if you look at most of us you know we all have

a little need of work on some social skills in some aspect I mean some of us are a bit shy

paper hats or graph or maybe socially anxious working on our people skills really will help us

to get along and live happily with our spouse and family members and also importantly to make

new friendships at whatever age we all know that making new friends gets a lot more difficult

as we get older I mean I haven't heard anyone say otherwise for me personally making new friends

as I get older is the biggest challenge there's this huge feeling that nothing can replace

friendships with people who have known you all your life but it is also a challenge as I

have chosen to exercise through Arbitrage in our retirement and we've moved away from home

so those friends aren't with us in our present I find that it takes a lot of intention I have

to consciously push myself to broaden my Social Circles and make the effort to get to know people

on a more intimate basis I am also very happy to be able to say that it has paid off in that for

the last two years in Bali I have actually made two or three new friends that I'm happy to say are

kindred spirits and not just social acquaintances so that's very nice and it's a huge Comfort to our

daily life here in a foreign land away from home now before we move on a big thank you to

Mumu Singapore for sponsoring this video Singapore is an online trading platform for

stocks ETFs and options I've been using the MooMoo mobile trading app myself for almost

a year now and I think it's awesome it's fast intuitive trading US Stocks is commission

free plus they give free level to data and many more perks now for a limited time when you open a

Mumu Singapore Universal account they'll give you a year of commission free trading of Singapore

stocks ETFs and reads if you're trading us and Singapore stocks just switching to the MooMoo

app will save you so much money already when you deposit at least a hundred same dollars and

start using the mobile app to trade you stand to receive cash coupons up to 128 Sing dollars

and even a free Coca-Cola share worth around 87 subscribe two thousand Sing dollars or more into

funds on the MooMoo fun Hub and MooMoo will give you cash coupons up to 150 Sing dollars subscribe

at least 100 Sing dollar us to Momo cache plus and they'll throw in an additional tensing

dollars cashback altogether that's 368 Sing dollars worth of Welcome rewards absolutely free

just for using the Momo app so if you're actively investing anyhow I recommend checking out the

MooMoo ad using my link in the description below now back to the video the fourth essential

thing that you can definitely work on and that will benefit your retirement tremendously it's

actually courage you're definitely gonna need lots of courage in retirement and I guess this isn't

a skill exactly it's kind of more of a quality but in retirement you need a lot of courage

to even plunge into retirement you need the courage to you know take that leap of faith to

stop putting it off due to fear of the unknown feel or financial insecurities so then it's all

about courage at that stage not let fear and insecurity rule your life and your decisions it

is also the courage to recognize that in life at the start at the end in the middle the Domino's

you need are never all nicely lined up you know at some point you just got to jump into it and

then learn to cross the obstacles as they come so for retirement long term I guess the

biggest issue most commonly is always money but my perspective on this is that hey budgets

can always be reduced money can always be earned or recouped or whatever happens so I still

think that you know it is actually beneficial to Advocate an approach whereby you get to

a point where you feel that you have most of your Ducks lined up you've planned well you've

prepped for it grab hold of your courage with both hands and then take the plunge people tend

to think of retirement as the end but it's not it's the start of a new phase where you should be

trying so many new things new Pursuits new ways to live and for each of these new adventures

you're gonna need courage to take action and once you have taken the plunge you'll find the

next fifth thing very very useful and that would be a mentality of resilience especially in early

retirement there are a lot more decades ahead of you you know and therefore a lot more chances that

they things can go wrong whether it be down to bad financial planning or perhaps an unexpected Health

catastrophe or even sometimes natural disasters whatever comes I guess you will always need that

strength of Will and the resilience so that you can roll with the punches and then get back up

you want to know that you have the mental strength that even if things go pear-shaped you won't just

give up and lose hope and certain Corner you've got to Marshall what you've got inside you go out

there find Solutions perhaps if necessary you've got to go back to work but know that later on

you can return to retirement and try again so the sex essential thing that I believe will benefit

everyone in retirement is to cultivate an attitude of gratitude we all know life is a very long

journey hopefully at least and so much of what we Chase using most of our years actually doesn't

really matter in the big picture once you have taken a step back and then at that point is when

you start realizing the earlier you cultivate and attitude of gratitude and that appreciation for

the simple little things that are probably around you everywhere every day the happier you probably

will be and it sounds silly but it's not really automatic I mean we all live and grow up and

work and go to school in a society that kind of innovates us with messages that we need to reach

for more have more ambition gives us you know that High definitions of success in life that we

have to try to jump to reach and nobody sings the Praises of the pleasures of a simple cup of

tea you know the importance of family time with your loved ones or or just the pleasure of being

able to take an evening walk on the beach with your dog so I think that it's very important that

somebody reminds you that you know you can not overload what you already have what you're already

surrounded by growing that muscle of appreciation so that in each and every moment you are present

in your own life you see all the little Joys that you're surrounded with every day and if you

live life like that I think that will help you achieve contentment with just the small stuff

around you and that's what majority of your life in retirement may be about is just a small stuff

every day but in my own retirement here in Bali it is what makes me so grateful and so happy every

day that I am surrounded by my loving husband and very interesting and independent little dog

that's very very cute you know that we have very comfortable a bit simple house we have the ability

to enjoy good food even if it's simple stuff from the war rooms locally we have a garden and

beautiful things are growing around us every day the weather is great you know stuff is good yeah

I think this is one of the most essential simple things that's often overlooked simply because it's

a matter of mentality but I believe this essential quality or characteristic could make all the

difference for you so these are the six essential things that I believe are very very important for

you to cultivate and prepare for in the leader to actually taking the plunge into a return then I

think that if you have these six strong skills and qualities going for you you will be in a position

much more well placed to make the best out of your retirement however long that period may be let me

know what you think of my suggestions whether you agree or if you think they suck let me know why

but in any event I really appreciate you tuning in and sharing my thoughts for this week and

wherever you are in the world I'm wishing you a happy Saturday evening and let's speak again

next week till then you take care and bye for now

When can I retire? | How much Retirement Corpus is enough?

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

Hello friends welcome to

yadnya investment academy. Today is friday. So today we will talk about

a financial planning topic. Today's topic is Related to retirement planning A very common question of you all that come Obviously this all knows. Retirement is a very important goal. If we talk about financial goals. Mostly it should be. Mostly when i do financial planning So many persons financial

planning i have done personally Then in that comes. Retirement is a very important goal. In which we need a lot of money Nowadays early retirement is occurring. FIRE environment talks are occurring. Financial free retire early In such things When retirement comes in goal One important thing comes How much money do I need? Tell me this much money is enough.

Then I can retire. That is a normal question. For this we have already

developed an interesting calculator but that was before pay wall. Now we have removed that from pay wall because it is very useful calculator. So a retirement calculator we have made. In that with so many

permutations combinations We can get an idea This much retire corps I need. If I reach here then I have done well. I am at least financially free. Now I have to retire. We have to work further or not. Then it is my decision. If above that. Now I am just sharing my screen.

Now you will see here You will go on investyadnya website There is a section named

tracker and calculator. In this there is a retirement calculator. Open this Now here we have to fill information. Suppose i am putting age of 30. You have to retire suppose on 60. Suppose we took an

example i have to retire on 60. Life expectancy we mostly suggest We should keep 90, 95, 100. With a conservative estimate If you keep 100 then it is very

good conservative estimate. If you want to take optimistic If you took practical then it should be 90. Suppose i am putting here 95. Fourth information is our Current annual expense When we do retirement calculation Obvious we took assumptions.

One assumption is this the

expense i am doing today Suppose when i retire Then also my expenses should be like this. Means my lifestyle of now remain maintained Neither i increase nor decrease. Suppose I am spending 50k per month today. The expenses that are occurring. After retirement I will do the same expenses. After retirement expenses can reduce. It can be your house if

you are living now on rent. It can be so much rental expense. That can reduce. Now your children's expenses are so much.

They will reduce at that time. Sometimes after retirement

expenses increase. Like vacation expenses mostly increases. Sometimes medical expenses increase. Some expenses have increased. Mostly as an advisor If we took a general advice then we say. Keep the same expenses as they are now. Don't do much changes in that. Some increases some decreases. For example if we want

to do a simple calculation Then considering to current expenses Suppose my expense is 50,000 The profile we are taking has

expenses of 50,000 per month.

Then it is 6 lakh rupees per year. You have to put today's expenses. You don't have to put off retirement age. That's all it will insert. Inflation number How much inflation number we have to take? 7% inflation is mostly suggested by India. If you want to be conservative

then you can take 8%. If you want to be aggressive

then you can take 5-6%. Inflation you should calculate by your own. Every year how my expenses are increasing? If you know little bit idea about that These things are increasing

according to my expenses. Edcuation expenses children's fees It increases almost 8-10% every year. Rentals mostly 10%. Landlords mostly increases rent by 10%. My personal inflation is 8, 9-10%. You take according to your. So for calculation here

I am taking 7% inflation. Then return on investment. On the basis of return on investment. How much is my return on investment? Before retirement and after retirement.

Now I am retiring at 60. At 30 I am starting investing. How much should I invest for that? How much retirement corpus I will get? The reason I am investing now. On that how much return should I expect? It depends where you are investing. If you feel I will invest

mostly in equity markets. Retirement oriented because it is very long horizon. I am of 30 years and retiring at 60 years. Horizon is of 30 years. All that I am investing I will invest mostly on equity. Then we can take 11-12%

return on investment All that we will invest now. Or we kept in equity we can take that. If you feel This house is my retirement corpus This will increase according to that. Then on real estate the return

on expectations that remains. Basically there is round inflation of 7-8%.

It depends on you if you have EPFO. That is a very big retirement corpus On EPF we get around 8%. According to that you have invested here. Overall that you are investing Or you are planning This is for retirement

and I am going to invest. What are expected returns on that? Till 60. Pre retirement is retirement on investment. Suppose it is 12%. Whole the money I will put in equity. Then you took 12% return. Then post retirement my corpse will become. How much will it grow? Suppose I retire and I get corpus of 5 crores.

Then 5 crore rupees Where will I invest? Again very difficult question If you are of 30 years then in 60 years. This is very difficult. This is a very big assumption. We have to think mostly at 60 our risk profile decreases. We will not take much equity allocation. Suppose now we have 60-70 equity allocation That time it becomes 20-30% or 40%. I go a little bit on conservative. I say to most of the people Take percentage equal to inflation I get return same as inflation. If I want to take.

Then 0.5-1% extra. We took here 8%. Means 8% of post retirement. My corpus will grow 8% after that. Inflation will remain 7%. This is planning according to that. We will discuss these points later. Therefore I am doing all these zero. We inserted these things. What we say? Our retirement age, life expectancy. Our annual expense, inflation. These all are our compulsory fields. If I consider this now. Sorry some value needs to be inserted. Randomly value we are inserting. So that it can work.

If I consider this now. Then I need retirement

corpus of 14.6 crores. If you are of 30 years and you have to do expense of 50k per month. At today's value Today's 50k offcourse will not remain same at the time of retirement. They will increase with inflation. If you have to maintain today lifestyle The 50k expenses you are doing today Same you want to do at 60. After 30 years. This is the value after 30 years. Don't be so afraid. Today 14.5 crore is very much. After 30 years the value of 14.5 That should be arounf 70-80 lakh or 1 crore I am doing guess work. It will not be more than that. Think if I have 1 crore rupees today then I will be able to do for next 35 years. 60-95 years means 35 years 35k per month That to inflation to adjust it. I will get it consistently till 95 in 95 it will become zero. If i invest lumpsum then i can invest 50 lakhs.

Considering I don't have anything. If I have 50 lakh rupees I will invest it. For 30 years they will grow by 12%. Expected pre-retirement. Then also my retirement money will be done. Monthly Sip that I have to do That is around 50,000 in this. 48,000 rupees sip i need in this. What is the meaning of step up? I will tell this in next. If you have plan in 30 years 60 years.

I have to do all these things. Then you have to do monthly sip of 48,000. To retire for next 30 years. Remember this is a monthly sip. It will not increase. Every year you have to do 48k consistently. Obviously our salary will increase in years Inflation increases salary increases. Now 48,000 will seem so big But after 3-5 years You will not feel big amount. That's what I am saying. In that our step up point comes. Now you will say I don't have 48,000 to invest. It is a very big amount. From where 48,000 will come. If we are spending 50,000 Then by saving 50,000 we

can invest in retirement corpus. That is not possible. Then in that our second comes step up sip What is the meaning of step up sip? What is annual increase in our income? Can we increase sip every year? I cannot invest 48,000 now but from next year i can increase.

If you think my annual increase in income. If inflation is of 7%. With 7% income should increase If we take seven With 7% it is increasing. We considered 7% inflation. Salary is also increasing by 7%. In worst case salary is not changing. With 7% there is increase in salary. Existing investment Do you have any investment now? That you think this is my retirement income From that also it will reduce. Suppose if you have EPFO corpus Suppose of 5 lakh rupees. 5 lakh rupees i inserted here. This is my EPFO of 5 lakh rupees. I will use it for retirement. On that how much return I will get on EPFO? Return are 8% Then we consider we will get 8%. It is tax free means you will get 8% Suppose i have 5 lakh rupees On that i will get 8% more. Now let's do calculation again. Now since EPFO arrived. From 48 it became 46. Retirement corpus remained same.

So now we have to do Sip of 46,000. We can do step up sip of 24,000. We invested 24,000 rupees this month. Every year we increase that by 7%. From annual increase in income we have to do this annual increase in sip. Today you started sip of 24,300. Next year increased 7% on that. Then again in next year increase 7% on that Compounding 7%. Increase 7% every year Till the age of 60. Then also your goal will be achieved. Then you will have 14.6 crores rupees. Considering these were our rates of returns So it is very very good. You can apply so much

permutations and combinations on this.

I have little more money than 24,000. I can do upto 35,000. Can I retire early? Then can I retire at 58? On 58 it will happen at 29,000. I have 35,000. Can I retire at 55? Now your interesting calculation will start No you need 37,000 For retirement at 55. Early retirement you can take at 37,000. If i do 37,000 per year. I invest in such investments

that give me 12% every year. 7% increase i put minimum. If you think 7% increase is less. Consider growth of salary minimum 8-10%. Why not? Consider 10%. Then in Rs 28,000 you can retire at 55. Retirement corpus also reduced. As early you retire that much less corpus you will want.

Value of money comes less. At that time its value will be more. At the age of 55 we need 11.6 crores. How much lump sum funding we need? How much monthly sip

and stepup sip we need? I considered 10% annual increase. Like this If you can do so many

permutations and combinations. You can plan yourself. When can I become financially free? I think this is very interesting calculator If you like as i am a conservative investor I am not taking 12% from whole equity. Suppose we take 9%. This we keep 10. The rate of return become 9% from 12%. Obviously both the sip's will increase. You can do calculation according to that. Which type of investor is I am? If you think here is also 9

then it will change again. These things you can do so many permutations and combinations

based on your profile. You will get so much support and understand If I invest this much money For this much time Then I can go towards a better retirement.

This is how you should work on these things. You can plan early retirement. You want to spend so much or not. 50,000 will not be sufficient. I want to increase my lifestyle. Now I am spending 50,000. But at that time I want to spend 75,000. Acc to that by using

permutation and combination What are my savings now? I can plan such investments or not. Then in those things you will get

so much help from these calculator..

Do check that on our website. If you have any comment If there are complications

then visit our website. Below is our email address and

whats app number is given. All things are written below. You can email us there

if you have any query. Below there is comment section also. Must write in comment section. Hit a like if you liked the video. If you think some knowledge is added Then hit a like Have a great time ahead friends Jai Hind.

Early Retirement Success Story – How He Saved 12 Crores in His 30s | Fix Your Finance Ep 36

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

If you want to retire early, then this video

is for you. Today we'll meet a man who has a corpus of

more than 10 crores and has managed to retire completely before

the age of 40. We will learn how to start planning, how to

do the calculations for early retirement and what all things to keep in mind before

leaving your job. So watch this video till the end and to support

our channel, like the video right now. FIX YOUR FINANCE Hello and welcome to a new episode of Fix

Your Finance. Today I have Ravi Handa with me. Welcome to the show Ravi. Glad to be here. How's early retirement treating you? It has its good parts obviously. What are the good parts? You can spend time on things which you were

not able to do earlier. And what are some of the bad parts of retiring

early? You lose a lot of value and a lot of validation

that you used to get from a job.

You have described your retired life in 2023. Let's take it back to like 15-16 years back. So, what did you study? I have done engineering in computer science. And what was your first job? Where did you start working? I started working in the education sector

itself. I joined IMS Calcutta which is a CAT coaching

company. Okay. And what was your first paycheck? 25,000 odd rupees. When you retired in 2022, what were you doing

back then? Actually, before that, I used to run a business

from 2012 to 2021. Which was in the education sector. My company was acquired by Unacademy. So, the last 1-1.5 years of my working career, I was with Unacademy as director content sales. So, how many years did you work? I worked from 2006 to 2010. Then I took a year break. 2011 is when I got married. 2011 is when I joined this IT company called

Mindtical. What was the trigger to start your own thing? When I was working for IMS, at that point of time itself, I started making educational videos on YouTube

around 2008.

Gradually, they became popular. Not very popular. And this was CAT coaching for MBA? CAT coaching. First, I started with math. Then I went to GK through math. Then to LRDI, then to English. I kept on expanding. And how was the business? How did it work? Business was profitable from day one. Because there was no expense. Yes. In today's date, the cost of videos or ads

in EdTech has gone astronomically.

In 2012, it was extremely simple. Because I don't think anyone was doing it. Or even if anyone was doing it, they were not such a big player that you cannot

really compete. On an average, what was the kind of profits

or salary that you guys were drawing? We had good years when we did revenues of

3 crores as well. We had bad years when we did revenues of 25

lakhs as well. There was massive fluctuation. In 2021, your company got acquired. Correct. It got acquired and then there was that vesting

period wherein you had to work. Correct. And after that, you got an exit. Correct. So, were you actively looking for an exit? Yes. Again, I am telling you the same. So, during the COVID period of 2020, my wife was pregnant at that point of time, So, my wife and I used to sit and chat about

what to do with life. And this is what emerged that we have to sell the business at whatever valuation possible, whatever sort

of deal you get. Because getting out of business is the priority. After selling the company, there will be a

vesting period wherein you were working with Unacademy.

Correct. What was your compensation then? Exact numbers I can't reveal because of the

NDA. But my salary was a little above 1 cr. And the ESOPs of the vesting, that was another additional 50 lakhs or a

little more than that. Wow! So, you have a lot of money in Edtech, I am

guessing. Yes. But I didn't get this for my skill or my talent. Okay. This I got primarily because they were acquiring

my company and this is a way for them to pay out the

money slowly rather than on day one. What is your background? Which college did you study in? IIT Kharagpur. Did that also help in your, you know, starting your entrepreneurial journey? Absolutely. I am telling you, there are a few things which have helped me a lot in life. To take risks, to experiment. One, my parents were always independent. I have never had to give a single rupee to

my parents. The second thing which has really helped me

is my wife was very well educated and in a very good

job which allowed me to take a lot of risks.

The third is that I went to a good college and through that college, you build a network. I have friends in senior positions in multiple

places. This is it. You are the sum of your privilege, your background and the people that you have interacted with over your life. Okay, so now we will talk about your expenses. Do you live in a rented apartment or is it

an owned? It's an owned flat. I shifted to Jaipur in 2015 to be closer to

my parents and at that point of time, I purchased the

flat that I still live in today.

Did you take it on loan or did you pay in

cash? No, it was entirely in cash because at that

point of time, I had been doing business for 2-3 years. The second thing is your travel. So, do you have a car or do you travel in

cabs? I have a car but I don't really like to drive

that much. So, how much fuel do you spend on a monthly

basis? I have no idea. So, you don't track expenses in general? That way, no. So, The way I track expenses is at the beginning

of the financial year, I check how much money was in the bank account. Throughout the year, I just find out how much

money went out of your bank account. So, that's how I determine how much I spent

this year. So, on an annual basis, how much did you spend

in the last 3 years? Around 2 lakh rupees goes into maintenance. Society, maintenance plus the other property

that I own.

5-7 lakh rupees is the vacation. Another 2-3 lakhs would be eating out, drinking,

parties. Parties, not the pub parties. Parents' 50th anniversary, the first birthday

of the child. So, all these parties add up. 3 lakhs or a little more than that would go

towards the house help staff. These are the big hits. Now, it is time for the main thing, which is talking about your financial independence

and retirement plans. The first and main thing is figuring out your

FIRE number. How much money would I need to not work and can retire comfortably. So, in which year did you seriously start

thinking about FIRE? Which year? Covid, 2020. 2020 is when I actually sat down and did the

numbers.

Where I have this much money, I will put this

money here and there. So, it took me around 3 months, maybe 6 months to figure out how much money I exactly need,

how do I need to invest it. And then it took me a couple of years, 3 years

to execute that. So, if your annual expense is 25 lakhs, if you take a multiple of 30, it is 7.5 cr. Right? So, what are some of the milestones that you

took into account? There are two major chunks that I have kept.

One of them is nearly everyone likes and accepts

that you have to save money for your child's higher

education. So, I have earmarked 50 lakh rupees for that. Wow! I will give it to him at 18 or whatever appropriate

age. 7.5 Cr plus 50L. For this? Yes. 8 cr. Another 50L is what I wanted to keep as a

sort of play money for experiments that I would want to do. Angel investing is one of them. Crypto investments is one of them. I am doing a podcast right now, so it has

its own expenses. Yeah. You should check out his YouTube channel,

okay? Every month, two videos come up specifically

talking about how to achieve FIRE. Okay? There is a link in the description.

Definitely subscribe. That is 50 lakhs, your play money. How is that going by the way? Angel investments and other investments? I have lost a lot of money in angel investments. I have lost a little bit of money in crypto

as well. But the biggest problem in angel investments

is that it is extremely illiquid. There is no honesty. So, I had put 3 lakh rupees in a company in

2019. In 2021, it became 45 lakh rupees. Ravi Handa is happy that it is done. Did you get an exit? Exit? The company closed in 2023. It became zero. Oh shit. So, that is the problem with angel investment. That's why you have allocated an amount which you yourself have called play money. Correct. Any other milestones that you have covered? No, these two. 8.5 cr was your FIRE number. You said that you started investing a huge

amount since 2015. You started investing or saving more.

From 2006 to 2015, did you manage to save any portion of your

salary? Yes, we were always saving more than 50-60%. We used to save this much. So, it was business, revenue was high, that's

why you didn't save. It was something which was there. Your expenses were always lower than what

you were earning. So, have you accumulated the 8.5 cr ? A little bit more than that. Very nice. How much percentage of that, if you are comfortable

sharing, how much percentage has come from selling

your company and how much percentage of the proportion

has come from your savings? I would say that selling the company probably

gave me 20-25%. Which basically means that this was not a

result of a certain event. No, no. So, this was because my business was successful. The second factor was that my expenses were

very low. The third factor was that I always had substantial

investment in equity. The fourth factor is where I would say the

selling of the company comes in. The main money that was made was made by business. And let's say if you were doing your software

job, you would have been in the top positions, In that case, do you think this much wealth

accumulation would have been possible? If I was in India, then no.

If I had gone abroad, then I would have been

way ahead of this. Is that one of those things that you would,

you know, you look back and want to change? I regret it every week. If I had been a good student, if I had studied

in college, then I wouldn't have been in the coaching

line. I would have moved to the US or Canada or

Europe or somewhere after college. I can't believe that you are saying that you are not content with what you have achieved

financially. I am absolutely content with what I have achieved.

Because I have bounced back from the mistakes

of not studying in college. Yeah. The 8.5 cr that you have accumulated, that too, what are the percentages where you

have invested? My current net worth would be somewhere between

12-13 cr. Out of this, 1-1.5 crore rupees, which is

my 4-5 years of expenses, I keep it in absolutely liquid low risk investments. So, this is my cash bucket. In the medium term bucket, I have taken a

balance advantage fund. I have long term bonds, gilt funds, which is another 4-5 years of expenses. So, a mix of equity and debt. Third bucket, which is my long term bucket, another, I believe, 6-7 crores would be in

that and then there is a piece of land that I own

which is around 2 cr. Tell me one thing, how to go about it? Primarily if you are young you need to save,

develop as a habit sort of a thing but your focus should be on making money.

Where will you earn money from? Either you will grow in a job or you will

join risky jobs like startups to get ESOPs or you leave the country, you go abroad you

earn a lot more there, you save a lot more there and you come

back and you know you can be in a very good situation or what you do is you get a higher

degree. Suppose you have done engineering, MBA, Masters

in Engineering, there are plenty of avenues. Your main focus should be on making more and

more and more money. Because after one point your expenses can't

get less. So if you want to increase the alpha, the

difference in income and expenses that will only happen if you are constantly focusing on increasing

the top line. Let's say I have decided that I want to retire

early. What was the framework? What were some of the thought processes? One according to me even hoping for planning

for early retirement is sort of accepting a failure that you couldn't make your career

in your life better that's why you are going towards retirement.

Yes financial independence is important, early

retirement is not. If you are in a job that you like, that you

enjoy or I will say if you are in a job or in a career that you don't hate, do not think

about early retirement. Early retirement became important for me because

I wasn't liking what I was doing. So this is our quick finance round. You have to answer the questions as soon as

possible. If you had an unlimited budget, what would

you gift your wife? Vacation, luxury vacation. If money was out of consideration which in

your case holds true, what would you do for a living? I don't know I will keep experimenting with

it which is what I am doing right now.

And the last question is for people who want

to achieve financial independence and you know are seeking early retirement, what are

2-3 nuggets of advice that you would share with them? For financial independence, increasing your

income as much as possible that should be your priority. The second priority should be that bulk of

your savings should go into equity. If you are chasing early retirement, I think

that is a bad chase to have. That should be, that is like surgery, that

should be the last option. Try changing your job, try changing the city

you work in, try changing the country you work in, try changing your careers. If there is no avenue, that is when you think

about early retirement. Alright, that brings us to the end of the

episode. Thank you so much for sharing your journey. I am sure that a lot of people have learnt

a lot from today's episode and video.

Make sure to check out his YouTube channel. Every month at least 2-3 videos are made on

this topic. Subscribe to his channel and if you liked

anything in this video, subscribe to my channel as well. Goodbye..

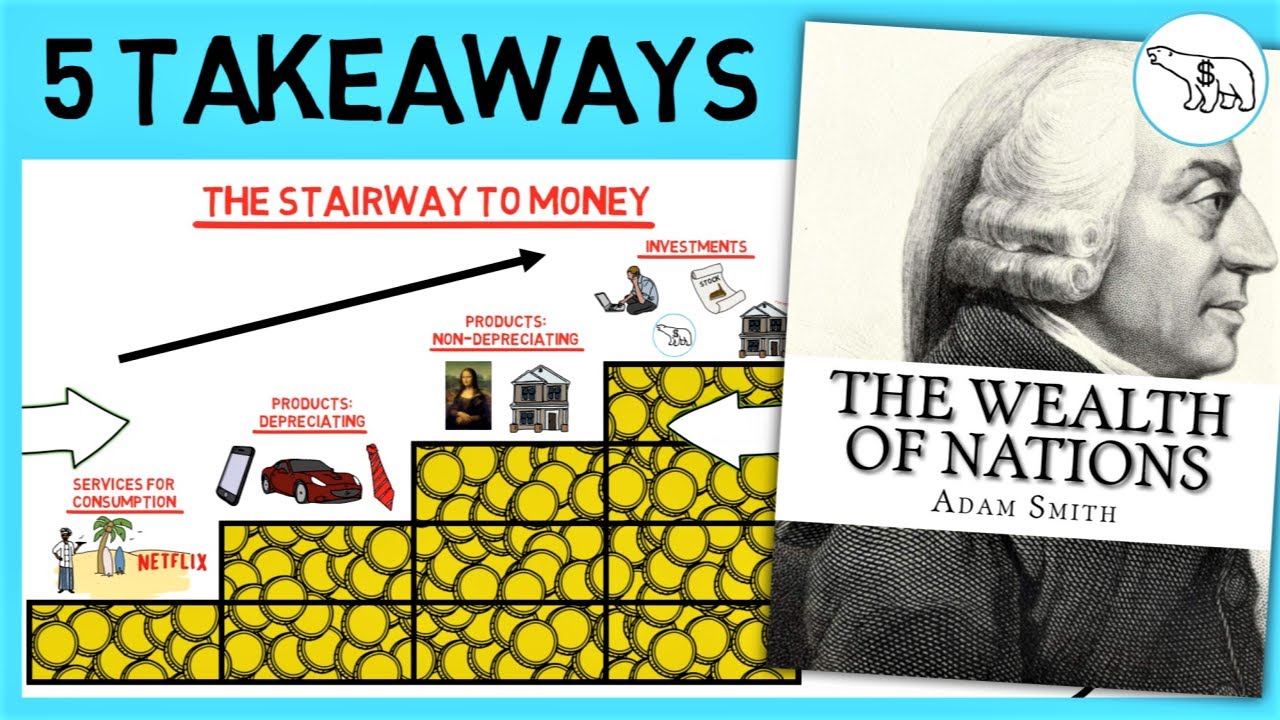

THE WEALTH OF NATIONS | PART 2 (BY ADAM SMITH)

Jason 0 Comments Retire Wealthy

As promised, here is the second part of The Wealth of Nations, one of the most influential books ever written about economics If you haven't watched the first part yet I'd advise you to do that now, as some of the takeaways here build on those from the previous part Let's continue where we left last time … Takeaway number 6: Accumulation and employment of capital What's the similarity between Michael and a country like the US, China or Sweden? It is that they get wealthy in the same way Allow me to introduce The Swedish Investor's "Stairway to Money" All copyrighted and original content, of course Each different step represents a category that an individual can spend money on To become wealthy a person wants to spend money on the higher steps and not the lower ones At the bottom, we have services meant for consumption These are the worst things that you can spend your money on, as you'll consume them instantly Vacations, dinners and video on demand all belong to this category The next worst thing to direct your money towards is products meant for consumption Products depreciating value from the time of purchase, but at least they're not as bad as services because you will still be able to sell them at a later stage, even though it may only be at a fraction of their original value Cars, clothes and phones belong to this category Then we have products that do not depreciate in value and that often keep their value through inflation Important entries in this category are collectibles and a house to live in And at the top, we have investments This is a very broad category indeed, and anything which is expected to generate more cash in the future than the outlay of money is today, plus a reasonable return, belongs here Therefore – starting a business, educating yourself, investing in the stock market, or renting out properties all belong here It's the same with countries If a country buys services from another country, money flows right out from it without being replaced with something else that is valuable If a country buys products from another country, at least some of the value is still preserved as products can be sold again at a later stage It is similar with a third step in our Stairway to Money A country gets rich by increasing its own productivity by starting businesses there, by educating its people so that their skill and dexterity increases, or by buying productive assets from other countries BUT …

… and this is unimportant but Neither people nor nations should be afraid of having expenses just because of this Both people and nations, if they want to acquire wealth, should focus on what they are naturally good at and then outsource the rest This is what we shall focus on next Takeaway number 7: Globalization – the shortcut to increased wealth Here we have. Michael Lewis, a 32 years old engineer He's working at a job where he's paid a base monthly salary, but he's also compensated for overtime For overtime hours, he nets approximately $30 per hour Given this, here comes a few questions for you: Should michael cook his own food? Should michael clean his own house? And, sorry now i'm getting a bit silly just to prove a point here, should michael build his own phone instead of buying one from apple? From a wealth standpoint the answer is no to all of these questions It makes sense for Michael to do what he is best at, earning money from that and then hire other people to do what they are best at for everything else that he demands Perhaps Michael can cook his own food, but it takes him about an hour to prep a single meal, which means that he does so at a cost of $30, because he could have spent that time working as an engineer Therefore, it doesn't make sense for him to do it as he can just buy a meal outside for $15 Similarly, he can clean his own house, but it takes him 2 hours to do So that's $60 for Michael, while he can hire someone to do it for $40 And as an engineer, he is capable of building his own phone, but it might take him something like 200 hours plus $200 in materials That's a $6,200 phone! Why not just go buy the latest IPhone for $1,000? If it doesn't make sense to do something at 6 times the price it doesn't make sense to do so at 2 times the price, and probably not at 1.5 times the price either It is the same with nations For nations to increase their wealth, they should be focusing on the things that they are really good at, and then hire other nations to do what they are best at For example ..

The US is obviously a leader in many different businesses, but among others, in the fast food and entertainment industry China is incredible at producing most products at very low prices And in Sweden, we are quite good at producing furniture … … sorry, I mean at making everyone else produce furniture for themselves, of course Now, should Sweden try to produce the same products that China can produce much cheaper? No. Should China compete head-to-head with Hollywood? Probably not. Should the US have everyone produce furniture for themselves? Definitely not! All these countries can be more productive, and in that increase their wealth, by simply doing what they are best at, and then trade goods with each other Also, to make another comparison between individuals and countries in their quest for wealth: Both of them will earn more by having rich neighbors or acquaintances People know that if they want to be rich, they should move where other people are rich And probably even more importantly – they should acquire rich friends It's the same with nations A country should want their neighbors and trading partners to be wealthy, because eventually that wealth will spill over to them, too Just look at this map But we've been getting this backwards for centuries now In the 18th century, Great Britain and France, probably the two wealthiest countries in Europe at that time, did everything they could to make business miserable for each other instead of cooperating They even went to war with each other! Today, let's hope that the two most important economies of our time, the US and China, don't make that same mistake Takeaway number 8: Why free trade is superior, and why governments shouldn't interfere As we talked about in the previous video – in a capitalistic society, money will naturally flow where the returns are higher and disappear from where their returns are lower In a society where the government does not interfere, two rules will guide capital – Capital is naturally employed where it can produce the greatest returns This is actually a good thing, because businesses like these are more sustainable than anything else They will employ people where there is demand and a real competitive advantage – Capital is also naturally employed in the home market, as this comes with less risk This is also good, because it creates working opportunities in the own country For these two reasons, it is totally unproductive when governments interfere with the market Just as an imaginary example: Say that we, in Sweden, would do something as silly as setting up a ban on movies created in Hollywood What would happen when such a ban is introduced? Excluding potential retaliation, it will yield higher profits for the film industry in Sweden than what would naturally be the case Therefore, more capital will be incentivized to flow to this industry But this business still isn't competitive on a global scale.

Everywhere else than in Sweden, people will still watch movies from Hollywood! Moreover – the capital in Sweden which goes towards the creation of film is capital that could have been directed towards something where Sweden is competitive on a global scale, like the previously mentioned furniture Generally, politicians must have a small dose of God Complex if they think that they are smarter than the aggregated thinking of the market when it comes to capital allocation decisions in businesses There are two examples when it might be necessary to introduce duties, bans and tariffs though: – For goods that are important for the defense or survival of the country – And when a tax is imposed even on such domestically produced goods You don't want to shift the favor to the foreign goods, at the very least Apart from that, governments should probably stay away from using duties, bans and tariffs on foreign goods They should not incentivize certain industries or disincentivize others, because the market is likely to do this very well on its own, thanks to the before mention two There are a few areas where a government is absolutely necessary for the wealth of a nation though, and that is what we shall cover in the next takeaway Takeaway number 9: What is the purpose of a government? According to Adam Smith, there are some tasks in a society that the market and private people have little or no interest in solving The four that Smith discusses are: – The defense of a country – The justice system – Some type of infrastructure – And basic education The defense of a country is absolutely necessary for its wealth to increase Interestingly enough, a country is more and more likely to be invaded the richer it is Or so it was in the old days at least ..

Consider the raids of Genghis Khan and his Mongolian savages of the much wealthiest cities of China Or how the vikings invaded many much more established societies in Europe The savages actually had the advantage at this time, as they were much more skilled fighters But that all changed with the invention of the firearms Firearms were expensive to make, and no matter how skilled an army of spears and bows were, it couldn't beat one equipped with firearms And so, the odds changed in the favor of the wealthy nations, who could afford these supreme weapons Anyways … A nation must be able to defend itself to sustain its wealth And as this benefits everyone in a society, it does make sense that a government has the responsibility of this task Justice, is similarly an expense that benefits everyone in a society In the old days, justice was often exercised by those in power, but one can easily understand how such a system can be very corrupt It is essential that justice and power are separated.

Otherwise – who should bring justice to those in command? Similarly, a justice system that is based on profits tend to be very corrupt too, so it doesn't lend itself well to the free markets It used to be like this too, everyone that wanted justice had to bring a gift to the judges As you can probably imagine, the person who brought the greatest gift tended to get a little bit more "justice" than everyone else … So to speak. Therefore, the task of bringing justice to its people should be paid for by a government But those that use the justice system often should probably pay extra for that Infrastructure, such as the most important roads and docks used for commerce of a country, is something that benefits everyone too But it doesn't invite the same conflict of interest as the justice system does, and should thereby often be held privately Infrastructure should be financed with revenue from the commerce which can be carried by means of it. Because in this way, money will much more seldom be wasted on infrastructure projects Some infrastructure projects can be important without being profitable, but in that case they should often come with a local tax, not a national one Without some type of basic education being free and probably also mandatory, some of the country's inhabitants, those that are born into poverty, will most likely never learn how to read write or count Such inhabitants are unlikely to increase the productivity of a nation Therefore, we want to avoid that this happens A benefit such as learning to read, write and count benefits everyone and it should be one of the purposes of the government of making sure that this is done Takeaway number 10: How should a government be financed? So ..