How to Retire Solo & Smart: Retirement Planning for Single Millennials, Gen-X, and Baby Boomers

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

hello and welcome I'm Catherine Bowie from Pure financial advisors and thank you for joining us for this webinar on navigating retirement solo with Allison alley cfp professional Allison how are you I'm great Catherine how are you I'm doing really well and thank you for doing this for us of course well let's get into navigating a solo retirement all right we're going to talk about a few things today but first and foremost frankly whether you're single or not right planning for retirement um is important right and do you know what you would do if you were trying to build your wealth alone more people than effort more people than ever are navigating getting to retirement on their own so let's talk about what that entails first things first how do you plan to spend your retirement right you have to look and say do I have enough savings is and then is your plan on track currently 56 of single workers are confident that they're going to be able to retire comfortably have you thought about when to collect your Social Security did you remember that you might have to pay for Private health care insurance right even if you reach Medicare age there's usually additional costs associated with that have you built that into your planning to get you ready for retirement um the the numbers are actually pretty pretty staggering but a single retiree could pay anywhere close to two hundred thousand dollars over three decades in retirement for health care costs right so it can be a big expense if you aren't ready for it and have you thought about your emergency funds and your estate planning right all aspects that factor into getting ready for retirement fifty percent of U.S adults are actually single I think that's probably higher than a lot of people realize so there's a lot of people out there planning for retirement by themselves and that can have an impact on your ability to put away money for retirement sixty percent of people that have never been married actually have no retirement savings at all or any savings um 35 of people that have been married at least once have no savings so they're a little bit better off right that's still a large number of people with no savings but right people that have never been married there's a larger percentage of those so it's something to really want to you really want to factor in let's talk about retirement accounts right given the inability to save it's not that surprising that a lot of people aren't on course for retirement when we look at the different Generations right we're going to break things down by Millennials Gen X and Baby Boomers and we look at the ownership rates by generation 50 of Millennials have retirement accounts a little bit better the little bit older you get 56 of Gen X currently ages 43 to 58 I should say Millennials are currently 27 to 42.

56 percent of Gen X has retirement accounts and a little bit better a little bit older Baby Boomers currently age 59 to 77 58 of baby boomers have retirement accounts so people are making a little bit more progress the older they get which is good but the earlier the better and we're going to talk about some strategies for that when we look at average account balances by ages people currently 65 plus the average retirement account balance is approximately 87 000. ages 56 to 64. it's actually a little bit better 89 000 is the average retirement account balance but then it starts to drop off right currently people aged 45 to 54 retirement account balance on average of a little over sixty one thousand people 35 to 44 current retirement account balance is only about thirty six thousand and then 25 to 34 only about fourteen thousand dollars in on average in retirement accounts and people currently age 25 and under or under 25 I should say a very minimal amount right less than less than a couple thousand dollars so lots of work to be done here for everybody and let's get into that let's start off with Millennials so again Millennials are currently age 27 to 42 and most people in this age range are still kind of in that gearing up maybe a little bit past quite starting out but building right so there's some kind of initial things you want to pay attention to first and foremost putting a budget in place right a Target is to have savings built up of at least three times your salary and maybe not at 27 but as you get through that next decade of your 30s that being the target to get to a level where your savings is at least three times salary you want a man to make sure you're managing debt and also start to focus more heavily on retirement account funding creating a budget first and foremost right so things are kind of broken out here into needs and wants right and this is looking at a 50 30 20 strategy fifty percent of your budget focusing on those needs right housing food utilities the must pay for items right so ideally you're looking at spending no more than fifty percent of your budget on those items I'm going to skip over here to the the far right hand side because this is frankly the next most important thing um 20 of your budget going towards building emergency funds starting to build towards retirement and build towards other goals that might be a home purchase or something like that right and then that leaves the remaining 30 percent for those wants clothing dining out vacations Etc and even though that we've got this 30 in the middle right that 50 and 20 those are those are your needs right that's those are the priorities if you were to allocate 30 sent to this middle section first you probably find yourself without the excess to start funding these things right so needs first wants seconds to really get you along the right path let's talk student loans right Millennials have a lot of student loan debt um 15 million Millennials have student loan debt into I should say 15 million dollars in student loan debt by Millennials the average student loan balance is about thirty three thousand dollars so getting starting to get that reined in is going to help you start to fund retirement fund goals emergency funds Etc if you have 33 000 in loans at currently five percent if you were paying two 350 a month it's going to take you 10 years to pay off that student loan debt and the interest associated with that is going to create your total payback being 42 000 if you could accelerate that somewhat and instead of making 350 a month just bump that to 418 a month it's going to do a couple of things number one it's going to cut two years off your payback it's going to take it from 10 years to eight years and the total amount is going to be forty thousand one hundred So You're Gonna Save about two thousand dollars in interest just by accelerating those student loan payments then what you could do with that money right if you're finished paying off your student loans and you could then take that same amount 418 a month and start putting it away towards retirement towards goals Etc and you were to earn an average of six percent rate of return on those dollars over 30 years that what was a student loan payment could turn into four hundred and twenty two thousand dollars right so it's really looking at the opportunity that's lost by not trying to get those debts paid down as quickly as possible because you can turn that monthly payment into a significant Nest Egg for the future in addition there is the ability from some employers a one a new rule was passed allowing employers to give a matching contribution to your 401k based on you making student loan payments so if you were putting at least two percent of your annual salary towards student loan payments employers are now allowed to make a contribution worth up to five percent of your salary towards your 401k basically the equivalent of a company matching contribution but it doesn't even require you making 401K contributions it's based on you making student loan payments so this is a great opportunity if you are in a situation where you have student loan debt if you're making your payments and your employer offers this option it would be great to take advantage of it right because you're paying down debt but still getting funding into your 401k by your employer as one of the benefits that some employees are now able to offer so it's worth looking into see if your employer plan offers this choice in addition to that just knowing the funding limits for various retirement accounts is important right if you are working and you have an employer sponsored 401K the employee contribution limit for 2023 is 22 500.

In addition if you have the cash flow to fund an IRA or a Roth IRA the current contribution limit for 2023 was bumped up this year to sixty five hundred dollars so initial ways to start getting money set aside for retirement all right let's transition into Gen X right a little bit older Gen X workers are currently age 43 to 58 and slightly higher savings targets now right so goal being that you've got your retirement savings up to at least six percent of your current excuse me six times your current salary and again maybe not at 43 but as you're transitioning through your 40s and your 50s that being the goal of getting that savings balance up to six times you're in your annual salary you also really want to be paying attention to your emergency fund right if you haven't already built that assessing where you're at compared to your ongoing expenses you want to be really trying to focus on maxing out 401K contributions as well as trying to get as much of your employer match as they're willing to give you and then taking a look at your retirement plans and making sure that you're you're utilizing options available when we talk about emergency savings right general rule of thumb is a goal of six to 12 months of your ongoing living expenses set aside in emergency funds more than half of people don't even have three months of their expenses set aside in emergency funds right 53 percent of Gen X has less than three percent excuse me three months of their expenses set aside um and that's low right you want to be able to withstand unexpected things right if there's expenses that come up or you were to get laid off or any number of other things that might cause you to need additional funds right that's the benefit of the emergency fund so that you're not in a situation where you have no choice but to tap retirement accounts that might have a penalty associated with it things like that right that's the value of the emerge of emergency funds if you aren't in a position where you've built up adequate emergency funds different ways to do it right if you just start setting a little bit aside here's kind of what that could look like in a couple of short years if you're able to put 25 a week away you could build that up to twenty six hundred dollars over two years if you're able to do a little bit more and if you if you could get fifty dollars set aside on a weekly basis right you'd have a little over five thousand dollars in just two years you could do 75 dollars a month right you could have close to eight thousand dollars in a couple of years so little by little is going to get you to where you want to go it's just chipping away at those goals in a manageable manner all right retirement account limits so the base limits are the same but now Gen X is approaching 50 if not over 50 so there's catch-up contributions involved so same base limit on a 401K of 22 500 but people 50 and over can do an additional 7 500.

So for 2023 30 000 is the maximum 401k contribution amount Roth Ira's traditional IRAs also have an additional ketchup amount involved so again that base contribution amount is 6 500 but if you're over 50 or over you can add an additional thousand with Roth IRAs and traditional IRAs there are Income limitations involved so you want to check what you're eligible for but if you're eligible and 50 and up 7 500 for 2023 is what you could put aside into a Roth or a traditional IRA in addition you really want to pay attention to your available employer match so in this example somebody's salary here is eighty thousand dollars and their employer is willing to match 50 of their 401K contributions up to six percent of their salary which means if you were to put in six percent your employer is going to match three percent and it makes sense to try to put in at least the amount into your 401k that is going to give you the maximum match that your employer is willing to give you but here's a few examples so in the top example the employee making 80 000 is putting away four percent so that's thirty two hundred dollars annually into their 401K fifty percent is two right so the employer is going to match two percent or sixteen hundred dollars so this person's getting forty eight hundred dollars a year into their 401K keep in mind if they're 50 and over they're allowed to put up to thirty thousand of personal contributions so this is obviously well below that but at least they're getting a little bit of the company match next example this person's putting away five percent so five percent of their eighty thousand dollar salary four thousand dollar annual contribution half of that that the employer is willing to match two and a half percent gives them an additional two thousand dollars so six thousand dollars a year is going into their 401k last example down here this is how they get the maximum amount right so this person's doing six percent or forty eight hundred dollars into their 401K the employer is giving their maximum allowed match of three percent so a total of seventy two hundred dollars is what this person's getting into the 401K so again the more you're willing to do the more matching you're going to get um all of these examples are still obviously well below the maximum allowable but at a minimum you want to put into your 401k what's going to get you the maximum amount that your employer is willing to give you into the account as well otherwise you're just missing out on free money so you want to get those up um if you're finding yourself off course let's go through a little bit of math all right so in this example this person's 47 years old planning to retire in 20 years at 67.

They are anticipating that in retirement they'll have fixed income of about 55 000 so that might be their social security income or some pension income or a combination of both but they're currently spending about eighty thousand dollars so 47 today want to retire in 20 years spending 80 000 today do you have to factor in inflation to see what you're going to need in retirement 20 years from now right so in this example we took that eighty thousand dollars inflated it at three percent annual inflation assumption over 20 years and that brings the spending need at age 67 to 144 000 which means if they want to be able to spend 144 000 and they're going to have fifty five thousand dollars coming in from pension or social security or whatever the shortfall is eighty nine thousand so that's your starting point right now you can figure out well what do I need to accumulate by the time I get to age 67 so that I can comfortably withdraw this shortfall from your assets that you've accumulated okay so here's a couple scenarios scenario one this person that's 47 has already accumulated about three hundred thousand dollars in their retirement accounts but they need to get to the amount that's going to be able to provide for this shortfall in order to figure out what that is you there's something called the the rule of four percent right a safe distribution rate is widely assumed to be about four percent what that means is that if you could keep what you're pulling from your own assets to four percent of those assets or less you could be fairly confident that with a globally Diversified portfolio a reasonable rate of return over time those assets will then last you 25 to 30 years so once you've calculated your shortfall you just take that number and divide it by four percent or multiply it by 25 the math is the same so in this example this person's Target would be 2.2 million dollars by the time they're age 67.

So that's what they would need to accumulate to then be able to sustain withdrawals of 89 000 when added to their fixed income would give them the amount of income they want to live on so again back to our examples the target is 2.2 scenario one this person's got three hundred thousand dollars but they've got 20 more years to get the to the 2.2 so what they would need to start saving to get there is thirty four thousand dollars a year right so that's a big number but if you break it down it might be manageable this again is assuming a a reasonable rate of return in a diversified portfolio over time scenario number two assumes that this person also 47 20 years to retirement but they've already accumulated six hundred thousand dollars towards that goal so their savings need is significantly less eight thousand dollars a year for the next 20 years to get them to that same 2.2 and this just reinforces the benefit of starting earlier right the earlier you start the more you can put away the more manageable those savings goals become over time so again pretty straightforward example but the goal is to say hey here's how old I am here's my years to retirement map out what you're spending now what's going to be coming in so that you can calculate your shortfall again multiply that by 25 or divide by four percent same thing gives you that accumulation goal and then you can back into your additional savings need on an annual basis between now and then to get you to that targeted goal all right let's yeah I was just gonna say Catherine do we have now that it was before we move on to Baby questions I'm not that I'd give you just a couple so the first one is just when you're referring to saving a percentage of your salary are you referring to gross salary or net salary after taxes and retirement contributions gross salary and then also uh you might be getting into this in the next section section but someone has asked about uh can you talk about the death of a spouse so that's why someone is uh unfortunately single now and so resulting in a change in tax brackets and you know what affects their Roth conversion strategies yeah absolutely and we will talk a little bit about it in the baby boomer section but um yeah if you are if you were married and your spouse passed away there are a bunch of things that change right like for example the tax brackets they basically get cut in half so you hit higher tax brackets at essentially half the amount of income so the sooner you can build retirement accounts especially things like tax-free Roth accounts right once you get into retirement you'll have more flexibility on where to pull income from because if you're going to have social security income and you've built you know 401K funds you're going to be paying tax on those income streams so if you could then supplement by pulling from roths which then don't continue to increase your tax situation that's just going to give you more flexibility and choice so yeah and in addition to Social Security strategies which we will talk about in the next section um you know whether you were married and are divorced or are widowed that will also have an impact on your choices when it comes to Social Security income okay we have a couple more questions but I'm going to let you go through the next section and then we'll you'll probably answer some of them okay perfect um so next Generation Baby Boomers So currently um well and here's a quick one before we get into the ages right so one thing to do and this does sort of relate to what Catherine what you were just asking about um but whether you were always single or were married and are divorced or your spouse passed away you want to make sure that you're updating various accounts right so if you have insurance policies and retirement accounts updating beneficiaries to whoever right whether it's children or other family members or friends or whatever it may be if you did if you do have a spouse that passed away that's key to make sure that something happens to you your assets go where you want them to go I've um in addition if you were married and and are now divorced removing former spouses from bank accounts again investment accounts retirement accounts Etc and then um you know closing or updating any joint accounts that were titled whether it was jointly or community property or whatever the case may have been to your individual registration in addition we don't really talk too much about Estate Planning in this today but estate planning things like You're updating your trust updating your will right should you get divorced or have a spouse pass making sure that those documents now reflect the change in your situation and your current wishes big big things to make sure you follow up on okay so baby boomers are currently age 59 to 77 and lots of these people are either very close to retirement or obviously already in retirement and so that savings goal is even higher right 10 percent 10 10 10 times your annual salary is that Target savings goal so that you and are sure that you've got the assets needed to sustain you into retirement you are going to start paying attention to Social Security strategies really paying attention to those catch-up contributions on 401ks and IRAs that we were talking about previously as well as paying attention to your overall Investment Portfolio and your asset allocation let's talk Social Security so most people's full retirement age currently is somewhere between age 66 and 67 but you can take Social Security as early as 62 or you could delay it as late as age 70.

There's trade-offs to all of this right the longer you wait to take it the more you get but the longer you go without taking your social security income and the more dependent you might be on your own assets depending on your retirement situation in this situation or in this example delaying from taking it early at 62 to 70 gives you a 77 percent increase in your benefit right so in this example this person's full retirement age is 67 and they are entitled to a thousand dollars a month of social security income if they were to start taking it at age 62 they would only get 700 a month right so that benefit gets reduced if they were to wait all the way from 67 to 70 that benefit would go from a thousand dollars to one thousand two hundred forty dollars so it's a pretty big increase and if you look at that entire eight year waiting period it's a 77 increase um so this is something that you want to factor in to that retirement planning right looking at well what other income sources do you have what's your asset level built to and when does it make the most sense for you to take social security income and it's going to be different for everybody in addition whether you were married before and are divorced or widowed there are some options here as well so Everyone's entitled to the higher of their own Social Security based on their own earnings record or 50 percent of their spouses whichever is higher that applies even if you get divorced as long as you were married at least 10 years you are at least 62 or older you're currently unmarried and your former spouse is entitled to Social Security if you have multiple ex spouses you would collect on again either your own benefit or the highest of your ex-spouses whichever of those amounts would be higher is what you'd be entitled to on the other side here if you are a Survivor so if your spouse passed away you're actually entitled to a hundred percent of their benefit if it's higher than your own benefit um but you have to either be not remarried or you remarried post age 60.

um you have to be at least 60 because survivor benefits can actually start as early as 60 whereas spousal benefits and your own benefits can't start any earlier than 62. this over here it's or it's 50 if you are disabled and you have to be entitled to your own benefits but again if they're less than your former spouse then you'd get the higher of those two benefits here's an example of Dave who's 62 and a widow so his wife passed away his spouse passed away and couple different strategies right he could start as early as 62 and just claim those survivor benefits now and in this example he would be entitled to 1237 a month the second strategy though is that he would take those survivor benefits now until age 70 and still get that same 12 37 a month but then at his age 70 he could switch to his own benefit which had the benefit of waiting those years to get that higher amount and at age 70 his own benefit would have grown to eighteen hundred dollars a month right so just by strategizing what's available to you he's increased his monthly benefits by 50 and a 35 percent increase over his lifetime just by strategizing and understanding that he's got a couple of options here right so that's important to pay attention to okay let's talk let's talk catch-up contributions we're already talking about how how people ages 50 and up can have additional contributions to their 401K plans however there's a few additional catch-ups for people even older than that and this is a new rule so that same 7 500 catch up on the 401K applies for people 50 and above and again from ages 59 58 to 59 however there's a change now an additional allowance that was put out there starting in year 2025 people ages 60 61 62 and 63 can actually make a ten thousand dollar catch-up contribution so again you've got that base level 22.5 that you can put into your 401k if you're 50 and above you can add the additional 7 500 to give you a total of 30 000 but starting in 2025 if your age is 60 to 63 that ketchup can actually be an additional ten thousand dollars so that would make your total 401K contributions for those four years as much much as thirty two thousand five hundred and then ages 64 to 70 it goes back to that 7 500.

So if you were if you if you're finding yourself behind right in your retirement plan in your accumulation goals and you get to these ages and you were able to Max Fund not only the basic amount but these catch-up contributions in all of these different age ranges right in these first couple of years that would be sixty thousand going into your 401k the next four years that would be 130 000 going into their your 401k and then these subsequent handful of years that would be an additional 210 000 going into your 401k add all that up that's getting a reasonable rate of return we're assuming six percent those contributions over that span of time would actually equate to almost six hundred and twenty thousand dollars of additional retirement account balances right so they they're basically giving people a way to kind of really jump start or accelerate kind of in these years as people are getting closer and closer to retirement to make a much larger impact on what they're able to put away towards retirement accounts all right last thing I want to talk about is making sure that you're paying attention to your asset allocation right as you're getting older as you're getting closer to needing the money from your retirement account you really want to make sure that you've built a portfolio that can withstand Market volatility it can withstand downturns a lot of people find and in fact the studies have been done in approximately 59 of baby boomers are actually over allocated to equities or stocks right and we've kind of got this little map here showing the different kind of rates of return versus risk levels when we compare various asset class right government treasuries so t-bills t-bonds Etc are going to be the lowest risk but also the lowest return and then these things just kind of Step Up corporate bonds still fairly low risk fairly low return but a little bit higher on that risk turn scale then we get into stocks right large companies mid-sized companies small size companies the risk level goes up so does the Target so does the projected returns but if you're in close to retirement in retirement right the volatility the potential for larger downturns is going to have a bigger impact on your ability to ensure that your assets are still sustainable and that you can still have the amount you need to last for your entire retirement so again it's you always want to pay attention to your asset allocation but it becomes even more important and more vital the closer you are to needing to start withdrawing from your funds right you want to ensure you've built a portfolio that can sustain those Market downturns I think Catherine's going to tell us about our free assessment but I'll also and let me know if there's any other questions at this point just had a couple that some are kind of detailed we've gotten several questions but some are very detailed so we might have to do those offline but um one is and I believe you you talked about it I just wanted to let Elaine know that um she asked if her husband and she just split up they're 64 and 58 respectively they've been married over 10 years they're both still working he's the higher income earner and will she be able to collect his social security benefits when she turns 62.

You talked about it yeah so since they were married at least 10 years once they are divorced yes she would be entitled to frankly the same as if they were still married her own benefit or 50 of his whichever one's higher right and then uh there's another one that says they're in a long-term relationship they keep their finances separate they're 38 and 37 and they have no intention of ever getting married does this change how we should each invest for retirement uh that's definitely pretty specific so I don't know how much I could really uh give on that but I mean it sort of depends right even if they're Finance if they're never gonna get married and their finances are always going to be completely separate but do they like pay for joint goals together or like it's literally every single thing separate then you were just going to want to map out your goals individually to try to Target accumulating for those goals so it kind of depends on how separate it is right or if there's joint goals that they're accumulating towards together right that would probably have an impact also and then there was an uh one other question that I think we can get there's other questions but we'll probably have to get back to them but one was saying that in their in our slides it says that uh additional savings per year when we say additional savings per year and the name of the slide was getting off course are you talking about savings or investment savings like Investments it should be clear yeah like retirement savings so whether that's in your 401k or IRA your Roth a combination retirement savings exactly okay if you have more questions please schedule your free financial assessment with one of the experienced professionals here at pure financial advisors and they'll take a deep dive into your entire Financial picture and stress test your retirement portfolio you'll not only learn how to choose a retirement distribution plan that's right for you minimize risk and maximize return legally reduce taxes now and in retirement and maximize your Social Security you'll also learn how to protect yourself against Market volatility Rising inflation and Rising health care costs remember there's no cost no obligation this is a one-on-one comprehensive Financial assessment that's tailored especially for you to get your questions answered we would just like to thank you so much for being here thank you Allison I know there's so much information to get to so it's difficult but this is our you know we try to do these every month so that we can get specific topics and if you have other topics that you'd like to hear about please let us know that as well

Read More

Want to Simplify Your Retirement Income? Try Using a Dividend Portfolio…

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

One of the big challenges you will face leading into

retirement is what's called the permission to spend problem. The permission to spend problem occurs

when you've been a diligent saver and then you arrive at the point where you have to create retirement

income out of your assets. And you simply can't give yourself

permission either out of fear, anxiety or lack of knowledge to actually spend

the wealth of accumulated. In today's video,

we're going to be talking about how living off of dividend

income in retirement can help solve, or at least lubricate a portion

of that permission to spend problem. I've done a few videos recently about this permission to spend problem

and you can watch them. And there's many elements

that feed into this. But at the root,

the main reason that we see clients don't give themselves permission to spend when they've diligently saved

leading into retirement is because there's so many unanswered

questions with how we curate and craft retirement income.

See, when you are working

or if you own a business, you've had 20, 30, maybe 40 years

to gain comfort and familiarity with how your income will be crafted,

what day of the month it will hit your account,

how it will be taxed, what's going to be left over to spend.

Maybe you'll get a bonus, right? There's all these questions that

are nested that have already been answered with the situation you're familiar with,

but now you're navigating the retirement risk zone,

which is the ten years prior to retirement or the first ten years in retirement,

and you're trying to solve this problem, which is how do I give myself permission

to spend the wealth I've accumulated and how do I craft an income

out of my retirement portfolio? One of the big challenges here

that we're going to address today, and I think this is the challenge

that dividend income solves, is the predictability or the reliability

of income situation, right? So now you're crafting your

own retirement income or your planning for how to do that.

And you have what I call tons of decision

making friction. You have a checklist

of a whole bunch of things that you need answered, either

consciously or subconsciously about what's going to allow you to know

you're making the best decision for how you're crafting

your retirement income. And until you've knocked

those items off the checklist or at least improved your level of comprehension

about those different items, you're going to have significant decision

making friction, which will many cases disallow you or make it very difficult

for you to actually spend the money that may be appropriate to spend. And the last thing that you want

is to end up on your deathbed and regret having this huge pile of money,

but not having used it during the years in which you were most able to maximize

the value and the novelty and the benefit and pleasure of the wealth that

you spent so many years, of so much hard work saving.

So let's get right into this. There are really several problems

that characterize this, and I believe that dividend income

can at least help with each component. So I'm going to show this on the screen. We'll talk through this piece by piece. The first problem here

is very, very simple. So you really have two ways

of crafting income in retirement.

I mean, there's many, many ways. But at simplest form, the conventional

wisdom presents us two ways. We either have

what's called capital appreciation or pruning the principal value of

our investments, which basically you could consider that I have

a total pool of $1 million investments. I want to sell a portion

of those investments each year to create the income

I will need to live on. And then I simply have to ask myself

how much do I sell? What's the appropriate amount? Right? The second method is income, right? And that conventionally has been,

you know, through dividend portfolios or maybe buying bonds

or maybe having rental property or even a business in retirement

that kicks off a stream of income.

Now, what we're comparing

today is dividend income versus the more conventional wisdom,

which is principal reduction or selling a portion of your investments

in order to producer income. So problem number one

is up here on the screen. Let's say you start

with the million dollar portfolio. You have $1,000,000 portfolio

and now you have a set of nested decisions you need to make that could present

decision making friction and make it difficult for you to again

solve this permission to spend problem, if you've been a great saver. Let's say you have

this million dollar portfolio. Well, you have to answer a bunch of questions

before you can even decide what or when or how you're going to sell. You have to ask yourself

what's an appropriate amount of income to take from this

million dollar portfolio? You're going to produce this little,

you know, little ball of income. And you have to ask yourself, what is the absolute dollar

amount per year I'm comfortable taking? And then what is the percent

of the portfolio I'm willing to take? We're not talking about the 4% rule here.

We're not giving guidance

on any of that stuff. It's just understanding problem number one is you have

to ask yourself these questions. Problem number two, once you've addressed the question

of how much income will I take each year? Now you have to answer

a whole bunch of questions. Because on the screen, we're showing instead of just one portfolio,

that's $1 million what you really have is one pie chart

that is composed or comprised of many different investments. Maybe you follow an asset allocation,

maybe you have individual stocks, maybe it's both. It doesn't really matter. But your portfolio is not

$1 million bucket of money. It's many, many buckets of money

within that $1 million that are all have a different level of risk and different performance

characteristics and different elements that, you know, information that feed into

how each of those elements perform. Now, problem number two is once you've determined

how much you're willing to take each year and what percent of your portfolio, have to answer these questions.

What do you sell

in order to craft that income? How much of each thing do you

sell in order to craft that income? When do you sell it? What happens if you decide

to take your distributions annually? That's very different than taking your distributions quarterly

or very different than taking it monthly. And ultimately

you'll have to make decisions on your own about what frequency

you want your distributions. And that is simply another nested question

you have to answer for yourself that will undoubtedly provide

or present decision making friction and will make it difficult

for you to have permission or feel your own permission

to spend your money. So you have to answer all these questions,

and we call that problem number two, because it's not just determining

a distribution rate, it's also all the mechanics that go into

how you craft that income.

What about problem number three, which is

what if you have a one time expense, like a sudden expense? You've already decided

how much you're comfortable taking out each year for your annual

living costs or your annual spend. Well, what happens if your car dies

or you have a flood in a bathroom or something happens to your home or a kid

who needs some financial support? And what happens

if at the beginning of the year you have this million dollar

portfolio on the left here and you agreed on a 4% distribution,

which is $40,000. And now by July, middle of the year, you've taken your monthly

or quarterly distributions as planned. But all of a sudden you have a $30,000

one time expense that comes up and your portfolio has also gone down

slightly that year or it's just in the middle of the year doing,

you know, whatever choppy things it does. And now the portfolio is worth $972,000. And you need to take out this $30,000 sudden one time expense. You're going to have a ton of decision

making friction there and you're going to feel this gut

wrenching difficulty of how do I give myself permission

to spend that money? So these are the three problems that occur

when we use a principled reduction method.

Now, on the screen here,

I'm going to move to another visual here. The best way

I like to think about living off of dividend income in retirement is

it doesn't have to be all or nothing. You don't have to only live off

of dividend income or only live off of

principal reduction income. You can blend the two. But a really good analogy for how to think about dividend

income is if you have a portfolio that's only invested in stocks

that you don't get dividends from and you need to sell in order

to get access to money, it's like owning an investment home or a

investment property with no renter in it.

When you have a dividend portfolio, it's like owning an investment

property with renters in it. The comparison here is if you have an investment property

worth $1 million, you can't just sell one

corner of the house or one part of the house

in order to get access to the money. Now, with stock portfolio, you can,

but you're going to feel that same amount, that same decision making friction,

that same lack of permission to spend, because you actually have to sell

at different unpredictable values of the portfolio, especially when it comes

to one time expenses. But having a dividend portfolio

or at least partial amount of your retirement portfolio in dividend

producing investments is like owning an investment property with renters,

at least you're getting that rental income payment.

Right. And that can be very, very helpful in lubricating and relieving

some of that decision making friction. So couple elements

to kind of bring this to a close. The main objective of the dividend

income is not about maximizing or squeezing out every single dollar

or drop of profit. It's about giving you some element of predictability

or stability to your retirement income, right? You come from this place in your life where you may be at a salary

and you need to replace it. A stream of dividend income can be a very,

very similar feel to having a salary. It boosts your predictable

or stable sources of income. Maybe you have Social Security

or an annuity or a pension. Those are going to feel really good

because they're predictable, they're reliable, they come

with the regular frequency.

You know what day, what amount,

how they're taxed and when they hit. Dividend income can function

very similarly. You can set up automatic dividend sweeps

so that you get this dividends. The dividend income

swept to your account on a monthly or quarterly or an annual basis,

whatever is comfortable for you. But the benefit is you don't have

all this decision making friction where you have to decide, what do I sell,

How much do I sell, when do I sell it? What if the portfolio is down?

What if it's up? Which stocks do I sell? Right. Huge questions that need to be answered. The dividend income

is so frictionless because you don't have to answer

all those questions. It's also very simple to understand

how it will be taxed.

We can do a whole nother video on how dividend income is taxed,

but it's pretty straightforward. Most dividend income

that is what's called qualified dividends, will be taxed at long term

capital gains tax rates. So that as well can be favorable,

assuming that the dividend income is in a taxable brokerage account. If it's in a retirement account,

that's a different case. And we'll do a longer video on that. But without getting

into the weeds of that, the idea here is dividend income can be a super helpful, lubricating tool

if you're suffering from the permission to spend problem. And we have a whole playlist dedicated to some videos that go through

how to understand dividend income versus capital gains or appreciation

or principal pruning income sources in retirement.

You can watch that playlist up here, right up here, above my finger,

if you're interested. I highly recommend

at least understanding it. The idea of this video, in summary, is there's many ways to skin the cat

and create a retirement income. And one of the primary objectives

and you know, it is really important that we try to figure out how to maximize

or optimize your income in retirement. But also very important

is creating a similar feel, a comfort, a level of comfort and predictability to your income in retirement

so that you don't have this latent anxiety about how you're going

to get your money in retirement. So I hope you find this helpful. Again, I highly recommend

watching the longer, more robust video series

we've done on dividend income. It's also tied into concepts

about asset allocation and other things. Very interesting. We're giving away a

ree six part video series. It's our proprietary retirement

planning process that we call Navigating the Retirement

Risk Zone. In that video series,

we talk about everything from your distribution rate

required portfolio income, how you craft that income, what you track, how you measure your

financial plan success, and how you monitor

your plan on going.

It's a very long 90 minute video series. We're giving that away in

conjunction with our free, free access to our retirement

planning tool, right capital. You can get all of that for free by clicking

any form on our website, submitting your email address, and

we'll send you the entire series for free. No strings attached. If you're also feel called,

you're more than welcome to schedule a free consultation

with our Fee Only Fiduciary Financial Planning Team,

and we'll be very privileged to speak to you about your retirement

planning needs.

As always,

thank you for your time and attention. We hope you enjoyed the video

and see you in the next video..

How To Retire At 30 Living Off Investments

Jason 0 Comments Retire Wealthy Retirement Planning

in order to live off of

your investments completely. And I know that the title of this video may sound crazy about retiring by 30, and there are a lot of people

out there selling a pipe dream of you can retire by 30

as long as you invest in this course, or go buy real estate and while that may work for some people I'm not here to sell you guys a course or to pitch you on any

kind of product like that. What we're going to

simply talk about here is how much money you need to have invested in order to live off of your investments and essentially not have

to work to earn your money.

And believe it or not, there's

actually countless people out there who have in fact

retired as early as 30 years old, by following this exact strategy

that I'm going to outline. So if this idea of retiring early and not having to work for your money is something that interests you. What I want to ask you

guys to do is go ahead and drop a like on this

video just show your support. I really do appreciate

that as it helps out with the algorithm and allows this video to get shared with more people. But what we're going to look

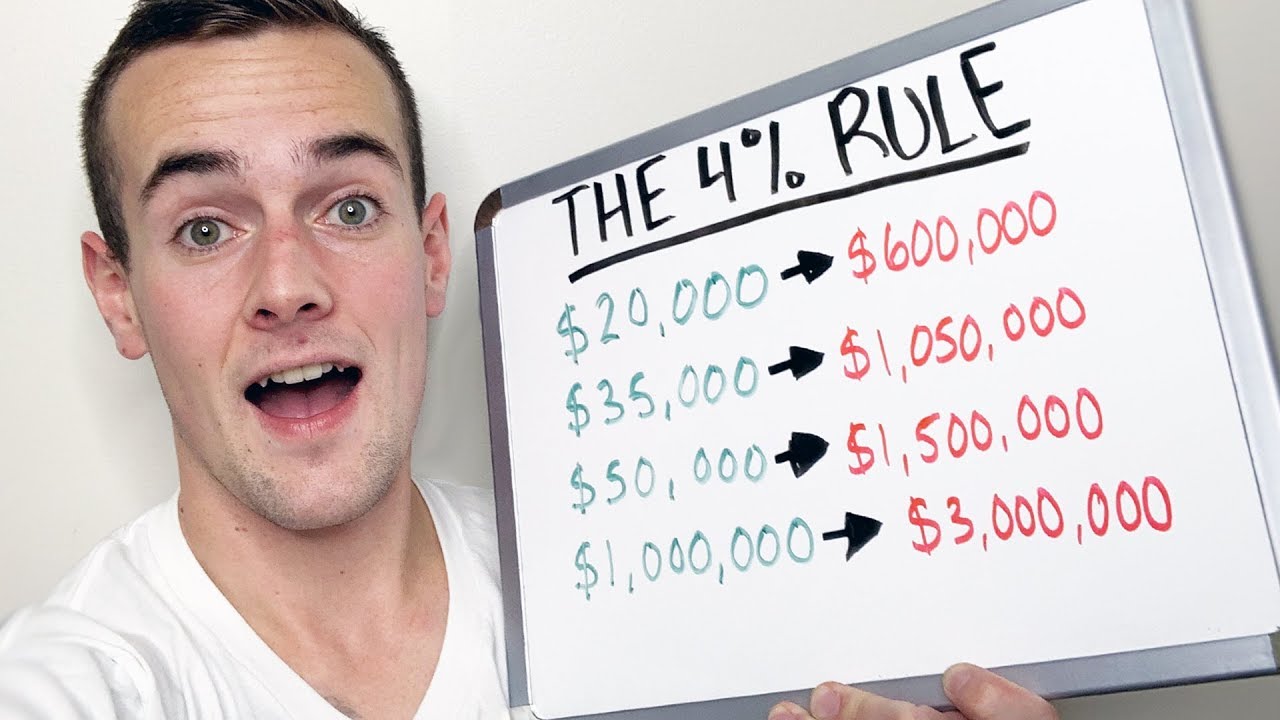

at in particular in this video is something called the 4% rule, and that essentially

shows you just how much money you need to have set aside, in order to live

off of your investments. Now you can in fact live off of different types of investments like real estate or the stock market for

example or a business that's providing income for you. But what we're going to use in this video as an example is a passive

stock market investment, and we'll show you exactly

how much money you need to have invested in order

to live off of that income.

So the goal here with this

strategy is to simply invest your money and have a large

amount of money invested and then you would

essentially be living off of the interest income or

the growth of that money without touching the principle. And as I'm sure you guys can imagine if you're not touching the principle or your initial investment, then your money could

foreseeably last forever. Now, the sooner you're able to retire is all based on how much

money you're able to save up and how little money you are

spending each and every month, and there's actually a

whole movement of people that are following this

exact strategy, and it's something out there called FIRE, and FIRE stands for financial

independence retire early. And there's a lot of

people who are doing blogs and videos and all kinds of

stuff about this concept, and there are countless

examples out there, of people who have retired

as early as 30 or even less.

By following these strategies. Alright guys so there's

basically three steps you have to follow in order to do this, and as I'm sure you can imagine, step number one is to be frugal or to spend as little money as possible, because ultimately what

you're looking to do is save and invest enough

money that the interest or the dividends, or

whatever the growth is pays for your monthly living expenses.

And as I'm sure you guys can guess if your monthly expenses

are $6,000 versus $3,000, you're going to need a

lot more money invested to cover those expenses. So being frugal and saving

as much money as possible is actually going to serve

two different purposes here. Well, number one, the

less that you're living on the more of your paycheck

you're able to save up, and the more of your paycheck

you're able to save up, the more you're able to

contribute to that freedom fund, which will eventually be paying for all of your living expenses. And then second of all by spending as little money as possible

every single month, you actually don't need

to save up as much money to potentially live off of the interest or the growth of your money.

And we're going to go over

those exact numbers right now. Alright guys so step number two

that you have to follow here is going to be a tough one, but that is going to be saving 50 to 70% of your take home income and again, if you're looking to

retire by 30 years old, let's say you want to work from 20 to 30, and then not work for

the rest of your life, you're going to have to take

some drastic actions here. And that is why you need to live off of a microscopic amount of money. And that's why step number

one is so important, by cutting down as much as possible on those monthly expenses. So people who are trying to do this, you're not going to see

them driving brand new cars, you're not going to see

them going on vacations, they're probably going to be,

you know, eating canned beans and doing campfires in the

backyard as summer entertainment. Not that there's anything wrong with that, but they are literally spending

as little money as possible, because they're focusing

on the long term picture of what they are trying to do.

So people who are following

this FIRE movement are often aiming to save 30

times their annual expenses, and that will allow them to

withdraw about 4% per year without basically touching that principle and that is where that

4% rule comes into play. And that is basically where you're able to draw from an account about 4% per year, and over a long period of

time based on the growth of that account and those investments, it shouldn't be chipping

away at the principle which should in theory

give you unlimited money. So what you're aiming

to do here is to lower your monthly expenses as much as possible. Figure out what it costs

you to live per year, multiply that by 30, and then

save up that amount of money by saving 50 to 70% of your

paycheck every single week or month, or however often

you are getting paid. Alright so now the question

you guys have been waiting for, just how much money do

you need to have saved up and invested to live off of that money following the 4% rule. Well if your annual expenses

are $20,000 per year, they would recommend having 30 times that amount of money saved and

invested, so $600,000.

If your annual expenses were $35,000, that number becomes 1.05 million. If you're somebody

spending $50,000 per year on your living expenses

you would need to have $1.5 million saved and invested,

and for the final figure here, if you spent $100,000 per

year on cars and housing and food and all of that,

you would need to have about $3 million to successfully

follow this strategy. So I'm sure this goes without saying guys, the best way to follow the strategy and to reach that retirement as quickly as possible is going to be

to keep your monthly expenses as low as possible. And just to put it in

perspective for you guys, every additional $100

that you spend per month, if you follow this is

an additional $36,000 you need to have set

aside in that freedom fund to support that $100 of monthly spending. So if you're serious

about this and you want to retire at 30, or even younger, you are spending literally as little money as humanly possible. Alright so the final step

to following this strategy is going to be passively

investing in the stock market. So most people following this strategy are actually following

the Warren Buffett style of passively investing in index funds.

And if you're not familiar,

index funds are basically a way for you to have diversified

exposure to the stock market. Where you're not essentially

picking what stocks are going to outperform,

you're just passively owning the entire market. So people following this strategy are not out there trying

to beat the market, they are not stock

traders or stock pickers they simply passively invest

in these low fee index funds, one of the most popular ones being VOO or the vanguard 500 fund. And essentially what you are doing, is buying a small piece of the 500 largest publicly traded companies out there, and all the different

dividends those companies pay are all collectively put together, and then you earn a quarterly

dividend from that ETF. And over the last hundred

years or so the stock market, on average, has returned

about eight to 10% per year. So if you were only drawing

4% from that account, based on historical data, you should never be

touching that principle over a long period of time.

And that is how you would

be able to live off of 30 times your annual income, if you save that money and invest it. Now that being said that

is the perfect segue into the sponsor for this

video which is Webull. So if you guys are

interested in getting started with investing in the stock market, this is a totally commission

free broker out there, meaning you're not paying

any fees to please trades with them and you can

purchase the Vanguard 500 ETF that we're talking about in this video right on that Webull platform, and not only that, they're

willing to give you up to two completely free stocks just for opening up an account with them. Number one, if you open the account, you're going to get a free

stock worth up to $250, and then when you fund the account, you'll get an additional

stock worth up to 1000.

So if you do the math there, that is two completely free stocks worth up to $1,250. Now I am affiliated with Webull, so I do earn a commission in the process if you use my link, but

if you guys are interested in grabbing two completely free stocks that is going to be down

in the description below. So finally, the last

thing I want to do here is to put all of this together, and go through a real

example of how you could in fact follow this strategy and even retire by 30. Now again, this is going to

require some very drastic saving because essentially you're trying to work for about 10 years of your life and then not have to work

for the rest of your life. So most people will never

be able to accomplish this, because of the amount of

sacrifice that is required, with that being said, let's go ahead and run

through the numbers now. So let's say you're earning

a salary of $75,000 per year from your job, and ideally,

you don't have any, you know school loans,

student loans, medical bills, or anything like that.

So you haven't gotten

sucked into the consumerism and you don't have like a brand new car so your expenses are as low as possible. And I know this sounds like

you know theoretical situation, but this was actually

about the same situation I was in, when I graduated

college I was 20 years old, now I was making about $68,000, so a little bit less, but I had no debts, I had no car payment,

and so I was somebody who could have potentially

followed this strategy. So after you pay your

taxes, your take home pay is going to be around $56,250. Now we know already in

order to pull this off, you need to save 50 to

70% of that take home pay in order to actually build up enough money to live off of that income. So we're going to assume

you are saving 70% of that take home pay. So you would need to live off of 30% of that post tax income, which

amounts to just over $16,000, or around $1400 per month. Now, is that possible? It absolutely is.

Is it easy? Absolutely not, you're certainly not going to be going out to the

bar and buying beers or going out to dinner,

you're probably going to be living in a tiny apartment driving an old car and eating at home for breakfast, lunch, and dinner. But if that type of

sacrifice is worth it to you for the long term picture, it is something you may

be willing to do yourself. So each year you would

be saving and investing a staggering amount of money, which is 70% of your take home pay

or just over a $39,000. And that is how you would

be able to pull this off, and assuming you kept that

cost of living the same at around $16,000, just over 16,000.

Your freedom number, or 30

times your annual expenses, would be just over $506,000. So, how long would it take

you to save up that money? Let's go ahead and answer that now. Well if you took that

$39,375 per year of money that you are saving and

invested in the stock market, earning 8% return, and

as we said, historically, it's an eight to 10% so we're going to go on the conservative side, well in 10 years at 8%

return career you would have $570,408.40, meaning you could then, if you kept those living

expenses the same, following that 4% rule, not have to work for your

money past that point. And just to circle back

guys what this really comes down to is the level

of sacrifice involved. Are you really willing to live

off of about $1400 per month, or do you want to have vacations and going out to get dinner

and things like that? So it's not people who are doing this that are out there traveling and dining it's people that are living

as frugal as possible and finding enjoyment

in other areas of life other than just, you know,

spending money on dining and things like that.

Now, is this a strategy I

would personally follow? Probably not because I

am one of those people that enjoys traveling, I enjoy dining, and I do spend a little bit

more than the average person, so my freedom number would be

multiple millions of dollars, but instead I follow the

strategy of earning as much as possible and saving a

lot of that earned money, and then eventually allowing

that to supplement my income by having that interest

or the growth of my money paying for a lot of

those things that I want. And believe it or not,

guys, there are honestly countless people out

there that have followed this exact strategy and

retired at 30 or less. One of the most well known people being Mr. Money Mustache, he has a whole blog where he documented this whole journey of becoming financially

independent and retiring early with both him and his wife.

So I'm going to link up his blog down in the description below

as well as a couple of other stories about

people who have followed this exact strategy and

retired at 30 or less. So that's going to wrap

up this video guys, thanks so much for watching. If you're new to this channel, make sure you subscribe and

hit that bell for notifications so you don't miss future videos, and I hope to see you in the next one..

The Difference Between Wealth Management and Asset Management

Jason 0 Comments Retire Wealthy

OK so now you've been at JP Morgan for about 25 years. Yes. So

and now you run one of the most important parts of JP Morgan which as I say is the asset and wealth management business for

people that aren't that familiar with wealth management. What actually is wealth management and how is that different than

asset management. Great question. The two are often used interchangeably. But but but there they have distinctions. Asset

management business is where we manage money on behalf of individuals institutions sovereign wealth funds pension funds.

We manage them in mutual funds. We manage them an ETF. We manage them in single stock single bonds hedge funds private equity and

the like. And that is the heart of the fiduciary business that we run here at JP Morgan.

Wealth management is that plus

understanding someone's entire balance sheet. So for the individuals where we manage money we also help them with their

mortgage. We help them with a loan that they might need. We help them with their basic credit card. And so wealth management is

trying to help someone with their entire life both their assets and their liabilities their planning their gifting the legacy

that they want to leave for their families.

The 529 plans they need to prepare to get their kids to go through college. And

it's a great it's a great insight into people's you know entire journey. Now many organizations like J.P. Morgan to have wealth

management businesses some are bigger than some are smaller. But basically you're managing money for and doing other things for

wealthy people more or less.

Is that fairly right for wealthy people. Although you know many of the successful wealth

management firms today have figured out how to take all of those great learnings for what they do with very wealthy people and

also package them for people who are have their first paycheck. And they want to be able to save a little bit of money or want

to have access to things that maybe they wouldn't normally have. And so we've been able to take things like what we do for a

super wealthy family package it into a bite size where you walk into a chase branch and you're able to get some of that some of

the same advice. And so it's it's I think it's opening up the world to be able to help people. And you know the most important

thing is to be able to save early. And if someone can be there to help you through that you know that's that's one of the most

important things. If you look at an average investment in the world if you just look over the past 20 years take a balanced

portfolio.

It's about six point four percent average annual return for people that generally manage money. The problem is

most individuals actual return is less than 3 percent. So it's less than half of that. Why. Because they make emotional

decisions when markets are one way or another and they get caught up in the hype of things. And so it's super important to

have that advice as early on as we can give it. And I think you know that that's the rewarding part about about this business is

being able to try to help people through all of those different journeys that they have..

Retirement Planning Checklist

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

Presenter 1>> Welcome to the CalPERS video Retirement Planning Checklist. In this session, we’re going to discuss a list of things you should be taking care of as you get ready for retirement. Before we get to the main presentation, let’s take care of some housekeeping items. To provide you with a future reference, and make your note taking easier, we’ve provided a presentation learning guide. You’ll see the link to the learning guide in the YouTube description box. Please note that due the large number of participants, although the chat feature is active, we won’t be able to respond to member questions during this presentation. If you have any questions, please contact us directly. Here’s the agenda for today’s presentation. We’ll start with things you’ll want to do one or more years away from retirement, and gradually work our way up to retirement and beyond. As we go through today’s presentation, we will reference several CalPERS forms and publications that you may be interested in, so here’s where you can find them. On our homepage at CalPERS.ca.gov, you’ll find the Forms & Publications column. Select the View All link at the bottom of the list to access a complete list of forms and publications which are shown in alphabetical order.

You can also filter by whether you’re an active member or a retiree. One of the publications you’ll want to review as you prepare for your retirement is Planning Your Service Retirement, Publication 1. It has a great deal of good information, including a checklist similar to what we’ll be reviewing here today. There is also a Retirement Planning Checklist on our website. Select the Active Members tab, then find the Resources column and select the Retirement Planning Checklist link.

Let’s start by looking at what you need to do about one or more years prior to your retirement. We encourage you to watch our Planning Your Financial Future video series available on the CalPERS YouTube channel. Financial security helps ensure you have enough money for the retirement lifestyle you want. Use our Planning Your Financial Future Checklist as a guide through this video series. For those who qualify for Social Security, visit our Social Security and Your CalPERS Pension page to learn how your Social Security benefits may be affected by your CalPERS retirement. If you haven’t already done so, sign up for a mySocial Security account at www.ssa.gov/myaccount. Here you can access your statement, review estimates of future Social Security retirement benefits, and more.

The service credit you earn is part of the calculation for your retirement benefit. Review your most recent account information in myCalPERS to make sure your service credit is accurate. You can also find a link to your most recent Annual Member Statement here. If you are a year or more away from retirement, use the Retirement Estimate Calculator in your myCalPERS account to estimate the amount of your pension and begin determining when you want to retire. It’s important to be prepared when you decide to take the big step into retirement. To get answers to most of your retirement questions, the Planning Your Retirement class is a great one to take if you are a year or even further from retirement.

Sign into myCalPERS and select Classes under the Education tab to enroll. If you think you may be eligible to purchase service credit, the first thing you should do is review the appropriate publication which provides the types of service credit available, eligibility for each type, and what is needed to submit the request. The publications are A Guide to Your CalPERS Service Credit Purchase Options, or for military time, the Military Service Credit Options publication. The publications can be found on our website. To find the cost of any available service credit purchases. First, log in to myCalPERS, go to the Retirement tab, select Service Credit Purchase, followed by the Search for Purchase Options button. You can also find the Service Credit Purchase link in the service credit box on the myCalPERS home page. Next, complete a series of questions to help determine which service credit purchase types you may be eligible for. Finally, the system will return the cost for any available service credit purchase options, at which point you can begin the purchase process if you choose to.

If you have a community property claim on your retirement account because of a legal separation or divorce, you must provide us with a copy of an acceptable court order that resolves the claim. It’s important to understand that a hold is placed on your account and retirement benefits cannot be paid until your community property issue is resolved. However, you shouldn’t wait to submit your application to retire. Waiting may affect the retirement date and other benefits. If you’ve been awarded a separate nonmember account, you may be eligible to retire and receive a monthly benefit for this as well. For more information, review our publication A Guide to CalPERS Community Property. You also may want to contact a financial planner for assistance with coordinating your CalPERS benefits with you overall retirement planning. Please remember that CalPERS does not provide financial planning services. Next is nine months prior to retirement.

If you're also a member of another California retirement system other than CalPERS, there are steps you need to take to ensure you receive all the benefits you’ve earned from each system. Reciprocity refers to an agreement between CalPERS and many other California public retirement systems that allow members to move from one retirement system to another within a specified time limit and possibly retain some valuable benefit rights such as your highest average pay in the calculation of your retirement.

Read our publication, When You Change Retirement Systems, for more information. If you have Social Security or other non-CalPERS income coming later after retirement, you might want to temporarily increase your monthly CalPERS income until those benefits begin. See if a temporary annuity is right for you by reviewing our temporary annuity publication. Moving on to five to six months before you retire. You should become familiar with the information needed to apply for retirement in the publication A Guide to Completing Your CalPERS Service Retirement Election Application, which is Publication 43. Begin to gather and make copies of the required documents you’ll need, such as a marriage license, or a birth certificate for a lifetime beneficiary. Refer to the Service Retirement Election Application for a complete list of required documents. If you apply for retirement online, you’ll be able to upload your documents into the system. If you choose to mail in the documents, only send us copies, never send originals. Always include your Social Security number or CalPERS ID on every document you submit. If you don’t know your CalPERS ID number, you can find it in your myCalPERS account under the My Account tab in the Profile section. Although an appointment isn’t required, if after taking the Planning Your Retirement class, you have specific questions about your own situation that weren’t answered during the class, you can schedule an appointment by logging on to your myCalPERS account.

You’ll find the Appointments link under the Education Resources tab. You determine how you want your taxes withheld. We can’t offer tax advice so you should check with your tax consultant or attorney to find out about the taxability of your overall retirement income. You can also find more information about your federal taxes on the Internal Revenue Service website at www.irs.gov. For your California taxes, you can go to the Franchise Tax Board website at www.ftb.ca.gov. If you plan on moving out of state, you are not required to pay California State taxes. However, you should check with the state you’re moving to find out what taxes they require and how they are to be paid. You cannot have out-of-state taxes taken out of your retirement check. And then three to four months prior to retirement. You can apply for service retirement online, in person, or by mail.

You can submit your retirement application no more than 120 days prior to your retirement. To file electronically, log in to myCalPERS. Go to the Retirement tab, select Apply for Retirement, and follow the steps for submitting your application and required documents online to CalPERS. We also have a video on our YouTube channel titled Your Online Service Retirement Application that will take you through the steps for completing and submitting your retirement application online.

There are a number of benefits to filing for retirement electronically. Easily and securely submit your application at your convenience, 24 hours a day. You can leave the online application and return at any point to complete it. Prior to submission, you can review and edit your information. You’ll receive confirmation that your application has been successfully submitted. You can upload additional required documents online. And, you can use the Electronic Signature to eliminate the notary requirement for the member signature. If you are unable or do not wish to complete your Service Retirement application online, you can submit the paper application at one of our regional office or by mail. If you bring your application to one of our Regional Offices, both you and your spouse’s or domestic partner's signatures can be witnessed by one of our representatives. If you choose to mail it in, you must have you and your spouse or domestic partners signatures notarized.

If you’d like assistance filling out your application, you can enroll in our class Your Retirement Application and Beyond. This class is available online through your myCalPERS account and is also taught by our regional office team members in virtual classes, and also in-person throughout the state. Find the next available instructor-led class in your area by logging in to your myCalPERS account or by calling us. Be sure you keep a copy of all forms and supporting documents for your records and future reference. Apply timely. Any delay in submitting your application could result in a delay of your first retirement check. If you have a deferred compensation plan such as a 401K, 457, or 403b, check with your plan administrator regarding distribution of your funds. Contact your health benefits officer or personnel office to determine your eligibility for continuation of health, dental or vision coverage into retirement. If applicable, check with your credit union, employee organization, insurance plan, or others to see if certain types of payroll deductions can be continued into retirement. So the next question is, what happens after you retire? As soon as your service retirement application is received, CalPERS will generate an Acknowledgment of Service Retirement letter.

This letter will confirm the retirement date you selected, your date of birth, your beneficiary’s date of birth, if applicable, the retirement option you selected, age at retirement, and the retirement formula along with other valuable information. About two weeks prior to your first check being issued, we’ll send you a First Payment Acknowledgement letter providing you with the date of your first retirement check, the gross amount you can expect to receive, and important income tax information. You’ll also receive an Account Detail Information sheet that provides what was included in your retirement calculation based on the payroll and service credit information posted in your account at the time your retirement was calculated. Finally, if you have CalPERS health coverage, you’ll receive two letters. The first letter will notify you that your health benefits as an active employee have been cancelled, and the second letter notifies you that your health coverage as a retiree has been established. You should keep all these letters, along with other CalPERS information you may have, with your important financial papers.

If you expect to have any adjustments to your retirement payment, you should allow four to six months for all final payroll to be processed for adjustments. An example of an adjustment would be a change in service credit or final compensation that was reported after your initial benefit was calculated. If after six months you haven’t received an adjustment that you think you’re due, you should send us a message through your myCalPERS account or give us a call at 888 CalPERS, which is 888-225-7377. You can find a list of mailing and direct deposit dates on our website.