Rethink Retirement – well-being beyond your bank account | Clare Davenport | TEDxBYU

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

Transcriber: Annet Johnson Reviewer: gaith Takrity Do you ever dream of retirement? What’s your retirement dream? Is it pure bliss and relaxation? Can you almost feel that warm wind? Taste those fruity umbrella drinks? Lounging by the pool, endless games of golf, walking on the beach? I’ve always loved vacations, haven’t you? So I think we’re really going to love this constant vacation space in retirement too, right? It actually reminds me of a couple I know.

Let’s call them, “Jeff and Jenny.” They’ve dreamt of retirement for years. Jeff had worked at the same company for over 30 years. He knew everybody. He was the life of the place. And Jenny, she’d often worked two jobs so they’d have enough. They finally did. They moved to sunny Florida, of course. But something strange started to happen. Jeff seemed lost, lonely. They started to nip at each other.

They started to quarrel. And Jenny, although she was beginning to make community, really didn’t like to golf. She’d never been that sporty. She missed her long-time book club. She missed her best friends, her kids, her soon-to-be grandchild. What was going on? Had they not done everything right? They’d moved to sunny Florida. They’d worked with a smart financial advisor. They’d saved enough. I ask you, if this is the dream vision for retirement – You see it in the adverts. Why is it that so many are dissatisfied at this age? Why is it that depression increases by 40%? Why is it [that] substance abuse, divorce rates are climbing? Why is everyone lonely? And people’s self-worth is low? Surely we can do better than this.

Look, I’ve spent many years consulting and coaching and researching the ideas, tools, and frameworks that best support us during times of transition, like retirement. Look, I’m not here to tell you whether you should or shouldn’t retire, because maybe you should or maybe you shouldn’t. It is up to you to design and discover. But I do want to share with you what I know about these life changes, these life quakes, these life disruptors so we don’t end up in a situation like Jeff and Jenny.

Look, we know that transitions are a regular part of life. They can be trying and triumphant. They can be predictable and unpredictable because life often doesn’t follow a straight line. But my research and others’ shows us that if we bring our intention and attention to them, we can improve our well-being. And we can improve our well-being in retirement too. I like to think of it as an ROI, a return on investment. But this time for our well-being. Think of it as the “ROI” beyond our bank account, an investment portfolio in human flourishing, your flourishing in retirement. Where “R” is where we reframe our current definition of retirement. “O” is where we optimize the well-being in retirement. And “I” is where we ignite our way forward. So let’s “ROI,” Reframe, Optimize, and Ignite, your retirement. Let’s start with “R”: reframe. Let’s reframe your current definition of retirement. Look, even the word retirement sends shivers down my spine. I really don’t like that word much. And when I look up the word “retire” in a thesaurus, I see the strangest words: retreat, remove, exit, my personal favorite, “go to bed.” And, although I get it – It is very, very tempting to go to bed sometimes, it does imply that we are fading from life when in fact these years can be some of our best years, some of our most flourishing years.

So then, how did it start? Well, historically, we never abruptly retired. We gently moved from one stage to another in life. And then rumor has it, this gentleman – I think he looks a bit scary, actually, German Chancellor, Otto Van Bismarck, in 1889, created this idea, this invention of retirement when he put in place disability insurance for those over 70. This idea was radical. But other countries followed suit, making retirement age between 65 and 70. But what’s interesting about this time period of 1889 was the life expectancy was less than 44 years. A far cry from our 80′ish years today. So to be clear, this definition or invention of retirement is over 100 years old and we have almost doubled our lifespan. So surely, can we not all agree that we need to reframe, rethink, redesign … our retirement definition? Next, let’s “O” of the ROI, let’s optimize. Let’s optimize our well-being in retirement. And it’s here we can learn from some great science and research. Edward Jones asked over 9,000 retirees, “What gives you fulfillment in retirement?” Their answers: being authentic, spending time with those they care for, they love, doing interesting things, things that help them grow, and being generous, giving back.

Interestingly, money was at the bottom of the list. And, look, we know that money can bring us freedom and flexibility. But research consistently shows us that above a base level, money is not the secret ingredient to happiness in life or in retirement. It’s also interesting to examine the disconnect between what retirees are thinking about – connection, contribution, community, and pre-retirees are thinking about, which is pretty much their bank accounts and this vacation view of retirement.

And when we look at this vacation view of retirement, we find that over time it becomes the norm and starts to lack the joy it once did. It’s probably why Berkeley researchers found that we have a sugar rush of well-being when we first retire and then a year or two later a fairly sharp decline. Behavioral economists might call it hedonic adaptation, where one more umbrella drink, one more golf game just loses its sparkle.

We can also look into the world of positive psychology as we continue to “O”, optimize. We can examine the science of what makes for a good life, a happy life, a life better than fine. And it goes by the acronym, PERMAV. I like to think of it as my well-being playbook where “P” is positive emotion, feeling good, hopeful, inspired, loving. It’s like a micro moment of joy: a good laugh, a good meal.

“E” is engagement. Having interests in pursuits that fully captivate us and take us away: help us grow, our relationships, having loving and authentic relationships with another, with groups, with communities. “M” is meaning, that sense of purpose, something beyond ourselves. “A” is accomplishment, having positive progress in life. And “V” is vitality, investing in our bodies, in our minds, because they both matter and they work together. Look, these elements collectively make up our well-being. They matter, they work together, and we have to bring our attention and intention to them because they can change.

So it’s super important in retirement to focus on these. We can also learn from the blue zones of the world, those zones where people fully embrace the PERMAV elements. They live flourishing lives and they live an extra 10 to 15 years than most of us. The word retirement doesn’t even exist. Take Marie, for example. She’s amazing. She's 101, has her own garden. walks over a mile a day, volunteers five days a week, and spends a lot of time with her great friends and her six great grandchildren. She is thriving. She is optimizing her retirement years. Next, “I” of the ROI. Let’s ignite our path forward. Let’s take action. Let’s explore ideas. Let's sneak up on the future. We know that life is not a fixed destination but rather a continual design project. There’s not one best option for us. There's many great options for us in retirement.

We also know to break down our ideas and our actions. We break them down small, so we feel comfortable taking action. We have a conversation, we explore an idea, we learn something new, but in a safe way. So we take some action. We adjust and edit and we take a little more action as we ignite our way forward. So in closing, I invite you, all of you, to have a conversation about your retirement. But maybe a little differently this time. It is never too early and it’s never too late. Let’s create a retirement canvas full of the colors and textures of well-being and ignited by our boundless designs and imaginations, like Jeff and Jenny did.

They moved back from Florida. They still vacation there sometimes. They bought a smaller condo, two doors down from their best friend. Jeff decided to go back to work part-time, and he’s taking improv classes twice a week. And Jenny, she’s enrolled in doing a Masters in English and still loving her long-time book club. They are prioritizing their friends, their family, and their new grandchild. They are thriving. So … what about you? Let’s begin to ROI your retirement chapter. Let’s start with “R”, refrain. What does retirement now mean to you? And what beliefs are no longer serving you? “O”, optimize.

Who and what will you prioritize and how will you use your many, many strengths and skills? And how does this compare with those you care for? And “I”, ignite. What is one small step you could take today to better understand your “retirement act,” knowing the best can be yet to come. Thank you. (Applause).

As found on YouTubeRead More

ZERO Savings at 50? Plan for Retirement NOW 💰

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

What are we doing here? What's going on? >>What are we doing here? >>This is a super-simple game. We're fishing for advice. Give me that. >>See, I chose the right outfit today. Yeah. [Fishing for Advice With Financial Advisers] I know you guys are probably thinking I'm a professional fisherman, but I'm not. I'm a financial coach. You are 50 years old and have not started saving for retirement. What is the first thing you do? Panic! No, I'm just kidding.

So, at 50 years old, that is a big wake-up call for a lot of people, and the very first thing you do is take stock of where your money is going today, because you are gonna need to seriously amp up your saving. So, not everybody needs to have some giant savings. You need to have enough to replace the amount of income you're gonna spend in retirement. I'm gonna just cheat a little, because I'm really embarrassed. So I would just take a minute to assess my full financial picture and actually sit down with the numbers to take financial inventory. So I think step 1 is just going through what are all the accounts I have, what is everything I own, what's the value of everything I own, and then making another list of everything that I owe. And then from there you can be like, "OK, well, this is the money that I actually do have, and so maybe there's a better way for me to maximize this for my retirement." I feel like 50 is the new 20 or 30, you know, still not too late.

Yeah, don't think that it's over. Consider it like a halftime. This is where you go into the locker room and you look at what you did in the first half and what can be done better for the second half. You come up with a new strategy, a new game plan, and then you go out into the second half, and you prepare to win the game. [Cheering] I have to say this is the weirdest game I've ever played at a FinCon.

You're 50 years old — I am 50 years old — and have not started saving for retirement. What's the first thing you do? You breathe, and you don't panic, and you start now. What you should not do is think, "Well, it's too late now, so let's just see what happens in the next 20, 30 years." Because that is going to lead to disaster. You still have time to turn this around, but you have to get serious about this now. So you would talk to a financial planner, come up with a game plan of how you can reduce your spending, how you could put extra money into savings, and how you can kind of catch up. Once you've found the money, you are gonna automate the flows into those IRAs and 401(k)s, because if you don't automate it, you're gonna force yourself to go through this exercise again and again, but if you set it and forget it, you will continue to make headway.

All right, here we go. It’s why I got this net, man. The first thing I want you to do, I want you to take positive action. I want you to look around this minute, right now, and make a decision on some things you're gonna change. And it might be your attitude, it might be the way that you're spending money, it might be the way that you're even looking at money. Be positive. You know, it's not over till it's over. You can do it, you just have to start doing it right now. Whoops! All right, everyone, listen. Gaining information is absolutely imperative. It keeps you aware and it keeps you motivated. So be sure to subscribe to AARP's YouTube channel. OK, come on. All right. I'm just gonna pick these fish up. OK! [Laughter].

As found on YouTubeRead More

How To Save For Retirement: Suze Orman Shares Her Best Money Advice | TODAY

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

>>> AND WE’RE BACK WITH OUR >>> AND WE’RE BACK WITH OUR SPECIAL SERIES LIVING LONGER SPECIAL SERIES LIVING LONGER TODAY, EXPLORING WAYS TO LIVER TODAY, EXPLORING WAYS TO LIVER NOT ONLY LONGER BUT BETTER. NOT ONLY LONGER BUT BETTER. >> THIS MORNING WE’RE FOCUSING >> THIS MORNING WE’RE FOCUSING ON YOUR FINANCES AND THE NEW ON YOUR FINANCES AND THE NEW ADVICE EXPERTS ARE GIVING TO ADVICE EXPERTS ARE GIVING TO MAKE YOUR MONEY REALLY LAST. MAKE YOUR MONEY REALLY LAST. >> THE GOOD NEWS AMERICANS ARE >> THE GOOD NEWS AMERICANS ARE LIVING LONGER, WHAT THAT MEANS, LIVING LONGER, WHAT THAT MEANS, A NEW FOCUS ON MAKING YOUR MONEY A NEW FOCUS ON MAKING YOUR MONEY LAST. LAST. >> AS YOU’RE PLANNING FOR YOUR >> AS YOU’RE PLANNING FOR YOUR FUTURE, DON’T UNDERESTIMATE HOW FUTURE, DON’T UNDERESTIMATE HOW LONG YOU’RE GOING TO LIVE. LONG YOU’RE GOING TO LIVE. >> IN FACT, ABOUT ONE OUT OF >> IN FACT, ABOUT ONE OUT OF EVERY FOUR 65-YEAR-OLDS TODAY EVERY FOUR 65-YEAR-OLDS TODAY WILL LIVE PAST 90.

WILL LIVE PAST 90. >> THE OLD ADVICE USED TO BE >> THE OLD ADVICE USED TO BE THAT AS YOU’RE PLANNING FOR THAT AS YOU’RE PLANNING FOR RETIREMENT EXPECT TO LIVE INTO RETIREMENT EXPECT TO LIVE INTO YOUR 80s. YOUR 80s. NOW THE EXPECTATION IS THAT NOW THE EXPECTATION IS THAT YOU’LL HAVE A GOOD CHANCE OF YOU’LL HAVE A GOOD CHANCE OF LIVING INTO YOUR 90s, MAYBE EVEN LIVING INTO YOUR 90s, MAYBE EVEN CELEBRATING YOUR 100th BIRTHDAY. CELEBRATING YOUR 100th BIRTHDAY. >> WITH LONGEVITY CAN COME THE >> WITH LONGEVITY CAN COME THE ADDED STRESS TO SAVE MORE. ADDED STRESS TO SAVE MORE. >> PLANNING FOR THE FUTURE HAS >> PLANNING FOR THE FUTURE HAS BECOME A LOT MORE CHALLENGING BECOME A LOT MORE CHALLENGING AND REALLY THE ONUS IS NOW ON AND REALLY THE ONUS IS NOW ON THE INDIVIDUAL MORE THAN EVER.

THE INDIVIDUAL MORE THAN EVER. >> SO HOW DO WE MAKE SURE WE’RE >> SO HOW DO WE MAKE SURE WE’RE FINANCIALLY PREPARED FOR ALL FINANCIALLY PREPARED FOR ALL THOSE EXTRA YEARS? THOSE EXTRA YEARS? IT’S EASY. IT’S EASY. JUST CALL SUZE ORMAN, A PERSONAL JUST CALL SUZE ORMAN, A PERSONAL FINANCE EXPERT. FINANCE EXPERT. SHE HOSTS SUZE ORMAN’S WOMEN AND SHE HOSTS SUZE ORMAN’S WOMEN AND MANY PODCASTS. MANY PODCASTS. >> WE’RE LIVING LONGER. >> WE’RE LIVING LONGER. THAT’S GREAT, BUT THE BAD NEWS THAT’S GREAT, BUT THE BAD NEWS IS, WE SURVEYED OUR TODAY.COM IS, WE SURVEYED OUR TODAY.COM AUDIENCE.

AUDIENCE. THEY SAID 60% OF THEM FELT LIKE THEY SAID 60% OF THEM FELT LIKE THEY DON’T HAVE THE AMOUNT OF THEY DON’T HAVE THE AMOUNT OF MONEY THAT THEY’RE SAVING RIGHT MONEY THAT THEY’RE SAVING RIGHT NOW THAT, THAT IT WON’T LAST NOW THAT, THAT IT WON’T LAST THEM THROUGH THEIR RETIREMENT. THEM THROUGH THEIR RETIREMENT. >> IF YOU REALLY THINK ABOUT IT, >> IF YOU REALLY THINK ABOUT IT, YOU GUYS, MOST PEOPLE BARELY YOU GUYS, MOST PEOPLE BARELY HAVE THE MONEY TO PAY THEIR HAVE THE MONEY TO PAY THEIR BILLS TODAY LET ALONE SAVE IN BILLS TODAY LET ALONE SAVE IN THEIR MINDS FOR THE FUTURE.

THEIR MINDS FOR THE FUTURE. >> PEOPLE FEEL LIKE THEY CAN’T >> PEOPLE FEEL LIKE THEY CAN’T SAVE. SAVE. >> THEY JUST FEEL THAT WAY, AND >> THEY JUST FEEL THAT WAY, AND THEY HAVE TO CHANGE THAT BECAUSE THEY HAVE TO CHANGE THAT BECAUSE THEY ARE GOING TO SPEND MORE THEY ARE GOING TO SPEND MORE YEARS IN RETIREMENT THAN THEY YEARS IN RETIREMENT THAN THEY EVER DID WORKING IF YOU THINK EVER DID WORKING IF YOU THINK ABOUT IT BECAUSE MOST PEOPLE ABOUT IT BECAUSE MOST PEOPLE THINK THEY’RE GOING TO RETIRE AT THINK THEY’RE GOING TO RETIRE AT 65, MAYBE THEY WORK 30 YEARS, 65, MAYBE THEY WORK 30 YEARS, THEY’RE GOING TO LIVE TO 100 THEY’RE GOING TO LIVE TO 100 POSSIBLY. POSSIBLY.

>> OENGWNING A HOUSE WAS ALWAYS >> OENGWNING A HOUSE WAS ALWAYS THE PLAN, BUT FOR THESE THE PLAN, BUT FOR THESE MILLENNIALS, THEY’RE OPEN ABOUT MILLENNIALS, THEY’RE OPEN ABOUT THE FACT THEY THINK THEY’LL THE FACT THEY THINK THEY’LL NEVER BE ABLE TO AFFORD A HOUSE, NEVER BE ABLE TO AFFORD A HOUSE, NEVER MIND SOME LONGEVITY OR NEVER MIND SOME LONGEVITY OR 401(k).

401(k). >> THAT’S NOT SUCH A HORRIBLE >> THAT’S NOT SUCH A HORRIBLE THING. THING. I DON’T THINK THAT THE KEY TO I DON’T THINK THAT THE KEY TO YOUR RETIREMENT IS OWNING A YOUR RETIREMENT IS OWNING A HOME. HOME. I THINK THE KEY TO YOUR I THINK THE KEY TO YOUR RETIREMENT IS HAVING ENOUGH RETIREMENT IS HAVING ENOUGH MONEY TO PAY WHATEVER YOUR MONEY TO PAY WHATEVER YOUR EXPENSES HAPPEN TO BE SO THE KEY EXPENSES HAPPEN TO BE SO THE KEY IS TO GET RID OF AS MUCH IS TO GET RID OF AS MUCH EXPENSES AS YOU CAN, DON’T HAVE EXPENSES AS YOU CAN, DON’T HAVE DEBT. DEBT. IF YOU DO HAVE A HOME, MAKE SURE IF YOU DO HAVE A HOME, MAKE SURE YOUR MORTGAGE IS PAID OFF BY THE YOUR MORTGAGE IS PAID OFF BY THE TIME YOU RETIRE. TIME YOU RETIRE. THAT WOULD BE MY NUMBER ONE TIP THAT WOULD BE MY NUMBER ONE TIP TO TELL EVERYBODY THEY HAVE GOT TO TELL EVERYBODY THEY HAVE GOT TO DO IF THEY DO OWN A HOME.

TO DO IF THEY DO OWN A HOME. >> WE’RE GOING TO GET INTO THAT. >> WE’RE GOING TO GET INTO THAT. WE HAVE THE THREE W’S. WE HAVE THE THREE W’S. THE FIRST IS WHERE. THE FIRST IS WHERE. WHERE IS THE BEST PLACE TO WHERE IS THE BEST PLACE TO INVEST YOUR MONEY SO IF YOU DO INVEST YOUR MONEY SO IF YOU DO HAVE 30ISH YEARS OF RETIREMENT HAVE 30ISH YEARS OF RETIREMENT YOU’RE SET? YOU’RE SET? >> I’VE SAID FOR A LONG TIME, >> I’VE SAID FOR A LONG TIME, JUST FORGET THE TAX WRITE OFFS JUST FORGET THE TAX WRITE OFFS OF YOUR PRETAX 401(k) OR IRA. OF YOUR PRETAX 401(k) OR IRA. FORGET THOSE NOW, AND IF YOUR FORGET THOSE NOW, AND IF YOUR CORPORATION OFFERS IT, CAN YOU CORPORATION OFFERS IT, CAN YOU CO CO DO A ROTH 401(k) OR A ROTH IRA DO A ROTH 401(k) OR A ROTH IRA WHICH ARE AFTER TAX WHICH ARE AFTER TAX CONTRIBUTIONS.

CONTRIBUTIONS. WHY? WHY? YOU DON’T HAVE TO WORRY WHAT THE YOU DON’T HAVE TO WORRY WHAT THE TAX BRACKETS ARE GOING TO BE 20, TAX BRACKETS ARE GOING TO BE 20, 30, AND 40 YEARS FROM NOW. 30, AND 40 YEARS FROM NOW. I PERSONALLY THINK THEY’RE GOING I PERSONALLY THINK THEY’RE GOING TO SKYROCKET OVER THE YEARS, SO TO SKYROCKET OVER THE YEARS, SO THEREFORE WHAT YOU SEE IS WHAT THEREFORE WHAT YOU SEE IS WHAT YOU GET IN A ROTH IRA OR A ROTH YOU GET IN A ROTH IRA OR A ROTH 401(k). 401(k). AGAIN, IT’S PRETAX VERSUS AFTER AGAIN, IT’S PRETAX VERSUS AFTER TAX, BUT AFTER THAT IT’S TAX TAX, BUT AFTER THAT IT’S TAX DEFERRED VERSUS TAX FREE. DEFERRED VERSUS TAX FREE. IT’S FOR YOUR BENEFICIARIES IN A IT’S FOR YOUR BENEFICIARIES IN A PRETAX ACCOUNT THEY’RE GOING TO PRETAX ACCOUNT THEY’RE GOING TO PAY TOTAL TAXES ON IT. PAY TOTAL TAXES ON IT.

>> LET’S GO BACK TO DEBT FOR A >> LET’S GO BACK TO DEBT FOR A SECOND. SECOND. FOR PEOPLE WHO HAVE STUDENT FOR PEOPLE WHO HAVE STUDENT LOANS, THEY’VE GOT CREDIT CARDS, LOANS, THEY’VE GOT CREDIT CARDS, THEY’VE GOT THAT MORTGAGE. THEY’VE GOT THAT MORTGAGE. HOW DO YOU PRIORITIZE THE DEBT? HOW DO YOU PRIORITIZE THE DEBT? WHAT DO YOU PAY AND WHEN? WHAT DO YOU PAY AND WHEN? >> STUDENT LOAN DEBT IS THE MOST >> STUDENT LOAN DEBT IS THE MOST DANGEROUS DEBT YOU CAN HAVE BAR DANGEROUS DEBT YOU CAN HAVE BAR NONE BECAUSE IN 90% OF THE NONE BECAUSE IN 90% OF THE CASES, 99%, IT IS NOT CASES, 99%, IT IS NOT DISCHARGEABLE IN BANKRUPTCY. DISCHARGEABLE IN BANKRUPTCY. SO THEY HAVE THE LEGAL AUTHORITY SO THEY HAVE THE LEGAL AUTHORITY TO GARNISH YOUR WAGES AND TO TO GARNISH YOUR WAGES AND TO REALLY THEN DECREASE YOUR INCOME REALLY THEN DECREASE YOUR INCOME SO STUDENT LOAN — SO STUDENT LOAN — >> TAKE CARE OF THAT FIRST.

>> TAKE CARE OF THAT FIRST. >> FIRST THAT. >> FIRST THAT. THEN IF YOU HAVE CREDIT CARD THEN IF YOU HAVE CREDIT CARD DEBT THAT NEEDS TO GO BECAUSE DEBT THAT NEEDS TO GO BECAUSE DEBT IS BONDAGE. DEBT IS BONDAGE. YOU GOT TO GET OUT OF THAT. YOU GOT TO GET OUT OF THAT. AND THEN YOU START WORKING, IF AND THEN YOU START WORKING, IF YOU’RE GOING TO STAY IN YOUR YOU’RE GOING TO STAY IN YOUR HOME FOR THE REST OF YOUR LIFE, HOME FOR THE REST OF YOUR LIFE, GET RID OF YOUR MORTGAGE GET RID OF YOUR MORTGAGE PAYMENT.

PAYMENT. >> I WANT TO FOLLOW UP ON THAT. >> I WANT TO FOLLOW UP ON THAT. YOU DON’T WANT TO HAVE A YOU DON’T WANT TO HAVE A MORTGAGE, A LIVE MORTGAGE STILL MORTGAGE, A LIVE MORTGAGE STILL GOING BY THE TIME YOU RETIRE. GOING BY THE TIME YOU RETIRE. WHY? WHY? >> BECAUSE YOUR MORTGAGE PAYMENT >> BECAUSE YOUR MORTGAGE PAYMENT IS YOUR HIGHEST MONTHLY EXPENSE IS YOUR HIGHEST MONTHLY EXPENSE THAT YOU’RE GOING TO HAVE BAR THAT YOU’RE GOING TO HAVE BAR NONE.

NONE. >> WHEN YOU RETIRE. >> WHEN YOU RETIRE. >> IT’S FAR EASIER TO PAY OFF >> IT’S FAR EASIER TO PAY OFF YOUR MORTGAGE THAN TO SAVER THE YOUR MORTGAGE THAN TO SAVER THE MONEY TO GENERATE THE INCOME TO MONEY TO GENERATE THE INCOME TO PAY OFF YOUR MORTGAGE. PAY OFF YOUR MORTGAGE. YOUR GOAL IN RETIREMENT IS TO BE YOUR GOAL IN RETIREMENT IS TO BE TOTALLY DEBT FREE 100% IN TOTALLY DEBT FREE 100% IN RETIREMENT. RETIREMENT. IF YOU DON’T HAVE ENOUGH MONEY, IF YOU DON’T HAVE ENOUGH MONEY, DECREASE YOUR EXPENSES, AND THEN DECREASE YOUR EXPENSES, AND THEN YOUR MONEY WILL GO FURTHER. YOUR MONEY WILL GO FURTHER. >> GOT YOU. >> GOT YOU. >> WHAT ABOUT WHEN, WHEN DO YOU >> WHAT ABOUT WHEN, WHEN DO YOU START? START? I KNOW, WHEN WE’RE BORN WE I KNOW, WHEN WE’RE BORN WE SHOULD START SAVING.

SHOULD START SAVING. >> YOU HAVE THE 200 BUCKS WHEN >> YOU HAVE THE 200 BUCKS WHEN YOU’RE 30. YOU’RE 30. >> PEOPLE ALWAYS THINK THEY HAVE >> PEOPLE ALWAYS THINK THEY HAVE TIME, TIME IS THE MOST IMPORTANT TIME, TIME IS THE MOST IMPORTANT INGREDIENT IN YOUR RETIREMENT INGREDIENT IN YOUR RETIREMENT RECIPE. RECIPE. LET’S JUST SAY YOU HAVE 40 LET’S JUST SAY YOU HAVE 40 YEARS. YEARS. YOU’RE YOUNG. YOU’RE YOUNG. YOU HAVE 40 YEARS UNTIL YOU’RE YOU HAVE 40 YEARS UNTIL YOU’RE GOING TO BE 70. GOING TO BE 70. YOU PUT $200 A MONTH AWAY INTO A YOU PUT $200 A MONTH AWAY INTO A ROTH IRA OR ROTH 401(k).

ROTH IRA OR ROTH 401(k). AVERAGE MARKET RETURNS, DO YOU AVERAGE MARKET RETURNS, DO YOU KNOW THAT YOU WOULD HAVE KNOW THAT YOU WOULD HAVE $1.1 MILLION AT 70, WHICH I $1.1 MILLION AT 70, WHICH I THINK SHOULD BE THE NEW THINK SHOULD BE THE NEW RETIREMENT AGE, BUT YOU WAIT TEN RETIREMENT AGE, BUT YOU WAIT TEN YEARS. YEARS. >> YOU’RE TALKING ABOUT HAVING A >> YOU’RE TALKING ABOUT HAVING A SURPLUS OF 200 BUCK WHEN IS SURPLUS OF 200 BUCK WHEN IS YOU’RE 30. YOU’RE 30. SHOULD YOU TAKE THAT 200 AND SHOULD YOU TAKE THAT 200 AND APPLY IT TO ONE OF THESE OTHER APPLY IT TO ONE OF THESE OTHER THINGS. THINGS. >> YOU NEED TO BE SAVING >> YOU NEED TO BE SAVING ESPECIALLY IN A 401(k), ESPECIALLY IN A 401(k), ESPECIALLY IF THEY MATCH YOUR ESPECIALLY IF THEY MATCH YOUR CONTRIBUTION. CONTRIBUTION. YOU PUT IN A DOLLAR, THEY GIVE YOU PUT IN A DOLLAR, THEY GIVE YOU $0.50. YOU $0.50. I DON’T CARE IF YOU HAVE ANY I DON’T CARE IF YOU HAVE ANY MONEY. MONEY. YOU CAN’T PASS UP FREE MONEY.

YOU CAN’T PASS UP FREE MONEY. IF YOU STARTED PUTTING, JUST IF YOU STARTED PUTTING, JUST LET’S SAY $200 A MONTH AWAY, AND LET’S SAY $200 A MONTH AWAY, AND YOU NOW ONLY HAVE 30 YEARS LEFT YOU NOW ONLY HAVE 30 YEARS LEFT VERSUS 40, YOU’D ONLY HAVE LIKE VERSUS 40, YOU’D ONLY HAVE LIKE $400,000. $400,000. YOU JUST BLEW $700,000 BECAUSE YOU JUST BLEW $700,000 BECAUSE YOU WAITED TEN YEARS. YOU WAITED TEN YEARS. IT WAS ONLY A $24,000 DIFFERENCE IT WAS ONLY A $24,000 DIFFERENCE IN THOSE TEN YEARS. IN THOSE TEN YEARS. BUT THE TEN YEARS, THE SOONER BUT THE TEN YEARS, THE SOONER YOU BEGIN, THE BETTER YOU’LL BE. YOU BEGIN, THE BETTER YOU’LL BE. >> JUST TO CARSON’S POINT. >> JUST TO CARSON’S POINT. IF I HAVE 200 BUCKS TO SPARE,KY IF I HAVE 200 BUCKS TO SPARE,KY CAN EITHER PAY OFF MY CREDIT CAN EITHER PAY OFF MY CREDIT CARD DEBT AND START SAVING IN A CARD DEBT AND START SAVING IN A ROTH IRA, WHAT WOULD MY CHOICE ROTH IRA, WHAT WOULD MY CHOICE BE? BE? >> YOUR CHOICE THERE IS TO PAY >> YOUR CHOICE THERE IS TO PAY OFF YOUR CREDIT CARD DEBT.

OFF YOUR CREDIT CARD DEBT. >> IF YOU DON’T HAVE MUCH MONEY >> IF YOU DON’T HAVE MUCH MONEY YOU MAY BE BEHIND ON YOUR CREDIT YOU MAY BE BEHIND ON YOUR CREDIT CARD PAYMENTS, AND YOUR INTEREST CARD PAYMENTS, AND YOUR INTEREST RATES ARE 15, 18%. RATES ARE 15, 18%. THAT’S A GUARANTEED RETURN. THAT’S A GUARANTEED RETURN. WHEN YOU PAY OFF YOUR CREDIT WHEN YOU PAY OFF YOUR CREDIT CARD DEBT, YOU’RE GUARANTEEING A CARD DEBT, YOU’RE GUARANTEEING A FANTASTIC RETURN. FANTASTIC RETURN. >> WHAT IS THE ONE SMALL THING >> WHAT IS THE ONE SMALL THING YOU WOULD TELL OUR VIEWERS YOU WOULD TELL OUR VIEWERS BEFORE WE GO? BEFORE WE GO? >> HERE’S WHAT’S REALLY >> HERE’S WHAT’S REALLY IMPORTANT. IMPORTANT. MANY PEOPLE HAVE ADVICE FOR ALL MANY PEOPLE HAVE ADVICE FOR ALL OF YOU. OF YOU. SOMETIMES THAT ADVICE IS GOOD SOMETIMES THAT ADVICE IS GOOD FOR THE PERSON GIVING THE FOR THE PERSON GIVING THE ADVICE, AND SOMETIMES IT’S GOOD ADVICE, AND SOMETIMES IT’S GOOD FOR THE PERSON RECEIVING IT.

FOR THE PERSON RECEIVING IT. MY ADVICE IS THIS, PLEASE DON’T MY ADVICE IS THIS, PLEASE DON’T DO ANYTHING THAT YOU DON’T DO ANYTHING THAT YOU DON’T UNDERSTAND. UNDERSTAND. IT IS BETTER TO DO NOTHING THAN IT IS BETTER TO DO NOTHING THAN TO DO SOMETHING YOU DO NOT TO DO SOMETHING YOU DO NOT UNDERSTAND BECAUSE SOMETIMES YOU UNDERSTAND BECAUSE SOMETIMES YOU CAN DO SOMETHING AND IT BLOWS CAN DO SOMETHING AND IT BLOWS ALL YOUR MONEY, AND SO IF IT ALL YOUR MONEY, AND SO IF IT DOESN’T FEEL RIGHT TO YOU, YOU DOESN’T FEEL RIGHT TO YOU, YOU HAVE TO TRUST YOURSELF MORE THAN HAVE TO TRUST YOURSELF MORE THAN YOU TRUST OTHERS.

YOU TRUST OTHERS. IT’S YOUR MONEY, AND WHAT IT’S YOUR MONEY, AND WHAT HAPPENS TO YOUR MONEY IS GOING HAPPENS TO YOUR MONEY IS GOING TO DIRECTLY AFFECT THE QUALITY TO DIRECTLY AFFECT THE QUALITY OF YOUR LIFE, NOT MY LIFE. OF YOUR LIFE, NOT MY LIFE. NOT ANYBODY ELSE’S LIFE, SO IF NOT ANYBODY ELSE’S LIFE, SO IF YOU REALLY WANT TO BE POWERFUL YOU REALLY WANT TO BE POWERFUL IN LIFE, YOU HAVE TO BE POWERFUL IN LIFE, YOU HAVE TO BE POWERFUL OVER YOUR OWN MONEY.

OVER YOUR OWN MONEY. >> THAT’S GOOD ADVICE. >> THAT’S GOOD ADVICE. IN SOME CASES FINANCIALLY DOING IN SOME CASES FINANCIALLY DOING NOTHING IS BETTER THAN MAKING A NOTHING IS BETTER THAN MAKING A CHOICE TO YOUR DETRIMENT. CHOICE TO YOUR DETRIMENT. >> NEVER TALK YOURSELF INTO >> NEVER TALK YOURSELF INTO TRUSTING ANYONE. TRUSTING ANYONE. YOU WALK INTO A FINANCIAL YOU WALK INTO A FINANCIAL ADVISER’S OFFICE AND THEY FEEL ADVISER’S OFFICE AND THEY FEEL LIKE THEY KNOW WHAT YOU’RE LIKE THEY KNOW WHAT YOU’RE DOING. DOING. THEY MUST KNOW, YOU DON’T KNOW THEY MUST KNOW, YOU DON’T KNOW AND YOU BELIEVE THEM. AND YOU BELIEVE THEM. SOMETIMES THEY GIVE GREAT AED SOMETIMES THEY GIVE GREAT AED VICE AND SOMETIMES THEY GIVE VICE AND SOMETIMES THEY GIVE ADVICE THAT’S NOT SO MUCH. ADVICE THAT’S NOT SO MUCH.

>> THAT STUFF’S TRUE IN >> THAT STUFF’S TRUE IN ANYTHING, RIGHT? ANYTHING, RIGHT? >> WHEN YOU THINK ABOUT IT, >> WHEN YOU THINK ABOUT IT, SAVANNAH, YOUR MONEY AND YOUR SAVANNAH, YOUR MONEY AND YOUR LIFE ARE ONE. LIFE ARE ONE. WHO YOU ARE AND WHAT YOU HAVE IS WHO YOU ARE AND WHAT YOU HAVE IS ONE. ONE. IT’S YOU’RE THE ONE WHO EARNS IT’S YOU’RE THE ONE WHO EARNS IT.

IT. YOU’RE THE ONE WHO INVESTS IT. YOU’RE THE ONE WHO INVESTS IT. YOU’RE THE ONE WHO SAVES IT, AND YOU’RE THE ONE WHO SAVES IT, AND YOU’RE THE ONE WHO’S GOING TO YOU’RE THE ONE WHO’S GOING TO LIVE. LIVE. >> WE’LL JUST GO TO YOU. >> WE’LL JUST GO TO YOU. YOU’RE OUR TRUSTED SOURCE. YOU’RE OUR TRUSTED SOURCE. >> COME ON, EVERYBODY, COME JOIN.

As found on YouTubeRead More

Brian Tracy | The 80/20 Rule for Wealth Growth #shrots

Jason 0 Comments Retire Wealthy

the 80/20 rule the bottom 80% of people the ones who struggle for money and worry about money all their lives these people when they take their first job will work to a certain level and then they will level off and never improve for the rest of their lives unless they're forced to and so therefore 10 years after starting work the average person today is no more productive at getting results than they were after one year but they find that the people in the top 20% are very different the people in the bottom 80% increase their income about 2 or 3 % per year people in the top 20% increase their income at an average of about 11% per year.

As found on YouTubeRead More

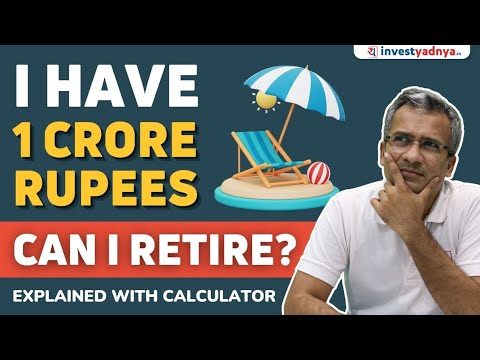

Is 1 Crore Enough To Retire? How to plan your retirement?

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

Hi friends, welcome to Yadnya investment academy. We are going to talk about a topic of financial planning on Friday. And today's topic is very interesting. Because this question is asked regularly on many social media channels and workshops. That people have an amount in their mind that is 1 crore rupees. We think that if we have 1 crore rupees, our life will be good. So this question remains in the mind that if I have 1 crore rupees, can I retire now? Am I financially free? I don't have any tension of retirement now. Now whatever work I am doing is extra. So that 1 crore rupees is enough. And if you have retired now and got EPF money and total is 1 crore is it enough for you? And if it is enough or not, how much can you spend in both questions, when is enough and when is not. We will touch on all those things in this video. I will explain everything through a calculator. You can check that calculator on our website investyadnya.in as well. We cover many topics of financial planning in this session. If you want to make your own financial plan, then go to investyadnya.in website There are many products related to financial planning.

There are 1 to 1 sessions as well. You can check that out. Now I am going to my website and I am sure you can see my screen. If you go to the tool and calculator, here you can see the retirement calculator. I don't think you will get this anywhere else. Now the question is, suppose I have 1 crore rupees, is it enough for me to retire? First of all, I will be asked what is my age? I am just giving an example, 50.

Suppose I am 50 years old, what is my life expectancy? It is important to know when you will be retiring. I think we should keep it around 90. I am keeping it at 90. How much is the expense now? If you are retiring and you have 1 crore rupees, how much do you want to spend? What is your monthly or annual expense? Suppose I am thinking that I have 6 lakh rupees. I have put 6 lakh rupees here. How much inflation are you assuming? How much will my expenses increase every year? If India's inflation is around 6-7%, then you can assume that. Suppose 7% inflation till the end of life. Current asset, how much money do I have? I will put 1 crore rupees here. I have 1 crore rupees here. I will put that here.

How do you invest this 1 crore rupees? How much return will you be able to earn? This is a very important question. What type of investment do you want to put? Do you want to put it in PPF? Do you want to put it in Senior Citizen Savings Scheme? Or do you want to put it in FDs? Or do you want to create a portfolio of Mutual Funds like Hybrid Equity Funds? This is very important. Let's take all the scenarios. Suppose I want to put it in FDs. I don't want to do anything special.

I will get 7% return in FDs. Whatever is the post tax. Or whatever you think. You get 7.5% but let's keep 7% for calculation. Let's keep 7.5%. Let's keep 8%. We have put it in bonds, Senior Citizen Savings Scheme. And there is some money in EPF. So, we have kept some money in equity. So, my 8% will earn 1 crore rupees corpus. Which is 1% over inflation. I have taken 7% inflation and 8% returns.

I have to put these 6 fields first. If I submit this, My retirement corpus is in deficit of 1 crore. This means that I need 1 crore more to develop this scenario. If I am 50 years old and I have 6 lakhs per month. And 7% inflation. And 8% growth. I need 2 crores. 1 crore is not enough. Now, let's change the scenario. What should I do if I am not able to do it.

I can either reduce it. I don't spend Rs 50,000 per month. I can do 30,000. Then we can change the amount. We have done 36,000. And then we have put this change. So, 21 lakhs is still less. So, basically it will come to 3 lakhs. So, now our retirement corpus is only 67,000 less. So, I can spend 3 lakhs per year. If I can spend Rs 25,000 per month. And if I take 7% inflation. And 8% growth. Then 1 crore is enough in 50. If I spend 25,000. If I spend 50,000 with same scenario. Then I will need 1 crore. Now, you will say that I invest in mutual funds. I know investing well. And I think that my corpus can earn 10%. If 7% is inflation. Then I think that my corpus can earn 10% per annum.

Like our approach. You must have seen many videos on retirement. If you want to understand anything. Then put it in the comment section. If I think that I can do 10%. So, let's try it on 6% after spending 3 lakhs. So, now our corpus will be 47 lakhs. So, it means that I can spend 4 lakhs or 4.5 lakhs. So, 4.2 or 4.3. Means I can spend around Rs 35,000 per month. If I can earn 10% return. Now, you will say that I have already retired. I am 60 years old. And now tell me what is this scenario. So, in that I can spend 50,000 per month. So, in 60 years also if you are earning 10% return. Then there is a deficit of 24 lakhs. If this scenario plays. You say that I have inflation. I don't spend much.

50,000 per month. Next year, I will grow according to 5%. Then it is good. 5% inflation, 10% rate of return, 1 crore rupees. You have enough. You have just enough. So, you can spend 50,000 per month. If you are 60 years old, you will get that money for 90 years. Now, there is one more thing. Many people think that I have a pension. I have a house. He is giving rental. Or I am getting pension. Suppose you are getting pension of Rs 10,000 per month. Means it comes more than that. But I think 10,000 per month. So, I am getting a pension of 1,20,000. And we will make it 7 again.

Is there any growth of pension? It seems that 2-3% growth is there. So, let's grow it by 3%. Till when will the pension come? Will it come till 90? Will it come till life expectancy or will it come soon? Many times, for limited time, money is going to come. So, we sell those things. Rental is going to come. I have to sell that house after 10 years. So, you can put that also. So, I have to get pension till last. Till 90. So, then in 6 lakhs, 7% inflation, 1 crore, 10% and all. So, then almost I am there. Means 3 lakhs is the only deficit left. So, in this way, you can find out that the money you have, is it enough for your retirement? So, now you can change the amount.

If you have 2 crore, 3 crore or 50 lakhs, then you can change the amount. Accordingly, you can find out how much expense I will have after retirement, my work will go smoothly till life expectancy which I have planned. So, this will be very very helpful for you. So, if you like Calculator, then do share this video with everyone. I think this will be very helpful to many people in retirement planning. And from the perspective of financial freedom also. And if you want our financial plans and personalized approach, if you want to understand how to get 10% rate of return, or what all I can do after retirement, then you can go to our website and call our customer service, sales team or relationship team. You can WhatsApp or call or email. And then we will reach out to you and we will surely try to help you on those things.

That is all I have. I hope, do subscribe more. Because the topics of financial planning are not going on much. So, do subscribe and like the video if you like it. Have a great time, friends. Jai Hind..

As found on YouTubeRead More

Step 1 to Putting Together a Good Retirement Plan

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

[Music] what do you think is the first step in putting together a good retirement plan a lot of people start by looking at how much they have saved and thinking about how they're going to get that money out but that is not the first step to a good retirement plan your first step is to think about what you want your retirement to look like what is your retirement going to look like what are you going to spend money on what are you going to be doing in retirement how long is your retirement going to last that's your first step and you want to think about three different phases of retirement number one is the go- go years this is when you're first retired and you're active and you're going so you want to consider what do you want to be doing during that period of time do you want to travel do you want to travel over seas or get an RV do you want to travel to see grandkids that live in different places of the country how do you want to be spending your time the second phase is going to be the slowo years so once you've done and gone and and enjoyed a lot of retirement you'll just move into those slowo years and you'll be going and doing less probably spending less but you need to consider what is that going to look like for you are you going to still be living in the same house or do you want to downsize do you want to be closer to family what is that period of time going to look like and what will you be spending your money on and then the last phase is the no-o years and this is when you've reached the end of your retirement years and you're not going and doing because you can't go and do as much as you did before you may even need help you might need help with assisted activities of daily living you might need some assistance uh with Mobility with grocery shopping a lot of different areas that you could need more help with you may even need to be in a facility because of some Dementia or some other health issues so you want to think about that and think about where you would be living at that point in time and what that would cost so that you know what your retirement savings needs to cover so you take the total of all of those the early years where you're going and going and going those go- go years the middle years where you're not going as much you're probably not spending as much and then those later years where you may need more help you may be spending more money where you going to be how long are those going to last and what might you spend and putting that together that allows you to build the foundation of your plan now we're going to talk about that more in the next video so please subscribe to this channel if you don't want to miss it I don't want you to miss it because I want you to be on your best path for your retirement [Music]

As found on YouTubeRead More

RATE OF RETURN: What To Expect in Retirement.

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

Rate of return is a function of risk. It's kind of unique to each individual. We have a metric or a gauge that we think certain retirees should be at. The level of risk is really unique. There is a balance to not wanting to take too much risk because it's great to make a greater return, but in markets like this, it's a lot harder to stomach the losses. Whereas, if you have a well-balanced portfolio you may not make as much in the up markets but it certainly softens these down markets. So, as much as we want to say there's one specific rate of return like, five percent should be my rate of return or seven percent should be my rate of return.

It really is a function of someone's risk and unique to them as an investor. As far as the ranges of rates of return and retirement, it should be somewhere between four and a half to eight percent. Again, the more aggressive you are you could target that eight percent rate of return you just have to expect more volatility and more price change in your portfolio. The lower the rate of return expectation, the less volatility someone should experience. Which is again a smoother path into retirement it just might mean you don't make as much.

As found on YouTubeRead More

Noble Gold Investments IRA Reviews| Worth the Fees? #goldinvestmentreviews

Jason 0 Comments Retire Wealthy Retirement Planning

Noble gold Investments Ira reviews worth the fees I strongly believe that there is a perfect fit for every type of investor not only that but Noble gold is among the best and unique among precious metals Ira companies you can invest in with just five thousand dollars and in today's Noble gold review I'll share with you everything I've learned in my personal interactions with them so you can make an educated decision before you potentially invest not only do I have a personal relationship with Noble gold Investments which I'll share here but if you dive into other Noble gold reviews like I did you'll learn that their education process helps people understand the basics of investing in gold silver platinum and Palladium Investments Noble gold offers five minute individual retirement portfolio gold and silver retirement account transfers and gold Ira rollovers still unsure about whether to choose Noble gold Investments or not continue reading my Noble gold Ira review to find out the exact reasons why I feel this is a top-ranked precious metals company who owns Noble gold is Noble gold legit Noble gold reviews are incredible pros and cons why choose Noble gold Investments precious metals Ira approved one gold coins and bars two silver Ira coins and bars three Platinum coins and bars four Palladium coins and bars frequently asked questions about Noble gold the primary founders of noble gold are Charles thorngren and Colin plume in a world where anyone can speak up loudly about a bad experience that says a lot about the service and customer care provided by Noble gold Investments under the guidance of noble gold you can protect your retirement by Investing in Gold and Silver Platinum and Palladium and other precious metals Ira approved the Canadian gold Maple Leaf coins are known to have a purity of about 99.999999 this proofs coin is one of the two American Gold Eagle coins versions when it comes to Purity only a few coins are present in the world that can beat Canadian gold Maple Leaf coins the Canadian gold Maple Leaf coins are known to have a purity of about 99.99999 Noble gold offers popular silver coins investment among coin collectors which are given below these are America's official silver bullion coins which increases their worth in Precious Metals investment the popularity of these coins explains well that these coins are Ira approved for investing the dominations of these coins include one tenth of an ounce one quarter of an ounce half an ounce and one ounce it was first issued by Royal Canadian Mint in 1988 and is known as Canada's official Platinum bullion coin it contains bullion coins of gold and silver that can easily be liquidated in case of a stock market crash because the survival pack is eligible for home delivery of physical precious metals as discussed earlier the unique and Flawless Noble Gold's customer service has acquired almost five star reviews if you want to try your luck in Precious Metals investment you can get a consultation from Noble gold Ira there are various ways to invest in gold or other metals Noble gold is the top precious metals company that will help you throughout the process if not you can also consider investing in gold jewelry

As found on YouTubeRead More

Inequality – how wealth becomes power (1/3) | DW Documentary

Jason 0 Comments Retire Wealthy

this is the airfield for private jets at düsseldorf Airport entrepreneur Christoph gröna is one of Germany's super-rich people who have a lot of say in this country but a rarely heard in public corner is worth millions and private assets and company shares all of it and self-made [Music] let's say you have 250 million you could throw it out the window and it'll come back in through the door you can't destroy it you can buy cars and they go up in value you buy houses and real estate is worth more you buy gold and the gold prices go up you can't destroy money by consuming we've been following coasts of Kona for six months through him and many others this film takes a look at inequality in Germany a first glance Germany is a rich and powerful country full of opportunities but if you look closely you'll see wealth is more unevenly distributed here than in just about any other industrialized country success often depends on your background [Music] why is that do the differences threaten social cohesion and democracy to find some answers we go around the world and speak to a Nobel Prize winner and other experts who have looked deeply into the issue of inequality the world is at a crossroads today people sense that the control of their nation is being stolen from inequality is the most pressing social problem facing us today welcome to the land of inequality [Music] it's almost 8:00 in the morning in Berlin good longer my house the driver is already waiting when the boss comes he has to get moving right away Christophe Colonna a teacher son has made his way to the top often working 20 hours a day he's what's called a high achiever I don't have a driver because I'm lazier I think I'm too good for that on the contrary I like driving I'm a passionate motorist but the question is what does my company pay me for for sitting behind the steering wheel or for working corner earns his money with real estate hardly any company in Germany builds as much as his cg group does and in the housing market the prices only go in one direction upwards his company has just bought a very special building the developer wants to turn their Stieglitz a Keisel office block into the tallest residential tower in the city custom governor is always up for a challenge he wants to run all the way to the top in less than five minutes a race against himself 30 floors 120 meters 600 steps an employee times him with a stopwatch it's half a minute faster than the last time angry well it was pretty perfect but I could still do it better I could still remember back when I was finishing high school I watched Boris Becker when in Wimbledon and I thought just you wait I'll be right up there with you you know today's an apartment here will cost between five and ten thousand euros a square metre from up here corner can look down on many of his construction projects you can actually follow the trail of the last 20 years here in Berlin nearly 4,000 apartments and another 3,000 are under construction we've played a big role in housing construction here one stop this is Coronas headquarters in Berlin every company like this is a realm with the boss at the top and the staff beneath him corners company now employs 500 people they all have good contracts he says the 2015 tax statement from your brother there's a lot to pay one of his most important employees is his personal assistant Angelique Lisa you still in Dusseldorf then he'll be going on to Zurich then tomorrow he'll be back in Berlin Friday and Leipzig and then he'll be away over the long weekend and what about sleep not a lot there are rumors of between four and six hours I also don't think it'll be much more depending on how busy he is or whether he's traveling you can tell from when his emails arrive I'm an assistant like her has at least the same level of stress I have the boss is only as good as his assistant you don't notice it with her she's only been in the job for a few months so she's still fresh but she also has the Constitution for it Mario Lauterbach guards the door downstairs he's had a permanent contract as a security guard for half a year benzine outside gets in yeah but I went to school for 14 years I speak two or three foreign languages so if I ever got the opportunity again and had the initiative I could imagine becoming a lawyer or a judge that's something that interests me a lot latter Bach earns about 2,000 euros a month gross that's enough for a modest life but not much more his boss on the other hand has been able to build up millions of euros and assets can the guard live on what he earns from me that's what counts if he can then I've done my job as an employer if I pay a guard so little that he can't live off a salary then I've done something wrong so you think comparing him with you is nonsense of course it's nonsense I've stayed home from work due to sickness three times in 30 years ask my guard how many times he's been out sick if I have a slipped disc I come to work if I have a 40 degree fever I come to work if my wife quarrels with me and keeps me up all night I still come to work ask my security guard comparing us isn't fair or correct justification is miscarriage dismissed fish dish will he ever be able to afford a house with a pool of course not but he does not want that I know my security guards I know my caretakers would you like to trade places with her groaner didn't say yes right away I guess if I had to answer spontaneously my first answer would be no and I believe if I thought about it for a long time it would still be no that's actually got a lot less to do with him as a person or what he does it's just a question of my own attitude I wouldn't want to have that much responsibility would you like to have a house with the pool yes but then maybe not here in Germany where in Greece so whereas the one can only dream of a house with a pool the other can afford several properties Kristoff corner has a villa in Berlin and a penthouse in Cologne with a view of the cathedral but little time off how much distance should there be between those in the middle and those at the top and how big is the gap in reality there's a lot of data about poverty in the poor but very little about the rich estate asset registry would help but there isn't one and so a team from the German Institute for Economic Research is trying to find out more if you try to represent the wealth distribution in Germany in a graphic way you can do it quite simply on an a4 sheet of paper and a few look you can imagine a coordinate system like at school with an x-axis and a y-axis and with the y-axis this here I show the amount of wealth you can easily display ninety-five percent of the population on this sheet here in the – area because a part of the population is in debt or even insolvent and then there's a relatively broad area where assets are virtually zero until it finally starts to increase exponentially at the outer edge instructors this describes 95 percent of the population but the question is of course how far away is the richest person from this manager magazine puts the Reimann family business at the top of its rich list for Germany the family's estimated worth thirty three billion euros so if 95 percent of Germans are graphed on an a4 sheet that aemon's would be a whopping six point six kilometers further away every era has its mother lode in the past car makers made big money earlier still the families who owned the big trading houses became hugely wealthy now real estate developers have joined them gustaf corners rice began here in leipzig 20 years ago he invested when prices below it was all ruins or scrap [Music] I love everything you see to the left and right has been redeveloped built and rented out by us his company says it now builds one in three new apartments in the city but coast of Cavanaugh's Korea has been unusual he was not born a boss he used to work on construction sites himself every other stone has been replaced here with expertise with a sense of proportion to create an entirety and it helps if you have worked on scaffolding like this yourself I can do masonry I can lay concrete I can lay steel I can plaster walls lay tiles put up the sods that was my career the company started out as christophe grew nabokov Steen's to building services then we took on specialized construction then contractor work and project development until we became the company that we are today Kona has also invested in this former industrial district this is the class family Thomas and Kirkland with their two children they live in a rented apartment around the corner they wouldn't mind having one more room well you have to say it's an oasis in a built-up environment each building has nine classic apartments and two penthouses one large and one small at the top I'd like to show you all the floor plans in the trailer so we're about where the woman is right no the house is next to that the houses themselves or at least 20 meters further back to the penthouse apartments there we have a four room 123 square metre apartment with a 60 square meter roof terrace I think we need to be realistic the penthouse isn't what we need or what we can afford I take a classic four-room apartment with a balcony or shared garden I think that's what we'd be looking for that would interest us then let's take a look at a floor plan parents would practically have a separate wing here a sandpit playground and recreation area so in general the target group is young families yes typical young families give me some idea of the scale I'd be interested in a four-room apartment first floor would come at three thousand four hundred fifty euros the foreign apartment would cost four hundred and fifty thousand euros to buy the classes are a typical middle-class family they both have good jobs buying property used to be the way to start building up assets was a Matthias tarbush at the spoke we were 30 before we could even start to think about our old age and accumulating wealth to date now I'm almost 40 and we still haven't managed to put away much in terms of reserves I even come up with the minimum amount of capital so that banks will be able to give us a loan a sticking point the screens not food the other fueled 94 percent of buyers here aren't from Saxony that means this is currently a market where normal Saxons can't participate even each Michi encode the class family isn't the only one with little chance of owning their own place in all the richest 5% of Germans own half the apartments and houses every second person owns no property at all most Germans rent and are having to pay more and more for living space the purchase price of an 80 square metre apartment has soared in the last 10 years leipzig is an extreme case only 10% of the people here own real estate 60% of all new buildings and 94% of refurbished all buildings have gone to bias from out of town [Music] don't you want to get your shoes dirty mister I can feel pretty fastidious while the Klaus family hesitates others are snapping up the houses on the market did he make a killing again he did did he get another bargain we keep getting repeat offenders here they buy one house after another this is the third right it's his second his second complete one and the apartments before we went for a meal and I said it won't cost less than 4.5 and he got it for 3 well I'm crazy right today the time is ripe for us to make money here with the standard and my company urgently needs it that's not a crime no I don't think it is such a bad thing the real estate market is symptomatic it enables those on top to make more profits while others can hardly afford to live in their own city anymore behind this is the more basic question does profit for the one mean loss for the others today's typical property buyers are rich people well-off retirees yes and investors the others like Thomas Klaus and his colleagues can only look on [Music] honestly when I look at what's being built in the sluicey district I need a practical apartment to live in and I don't think they're building them to be lived in they're building them as investments and I can't join in that game none of my colleagues can't either that probably also creates housing that doesn't meet the needs of the city and most of the population scary because many people are being left behind banks digna there are many parts of life see who are nowadays you find one place with high priced apartments and another where the people who just couldn't afford to live in them anymore had to move to it's a crappy situation when you say that for whatever reason you have to get out of your apartment but you'd like to stay in your neighborhood but that's not possible [Music] in a neighborhood in the eastern part of Berlin bigger schlosser has been the scene of an escalating conflict between residents who are afraid of losing out economically and the man they accused of making the deal of his life here Gustov kkona arrives and his security guard stays close by when he's here he usually gets police protection I'm going to be disturbing your lunch break today so let me at least say good morning Korea has been the focus of an angry backlash his opponents filmed the first encounter with residents and protesters let me ask you is this a dialogue it was nice whether they were meeting me for the first time we could call it the birth of the boogeyman they got to see an entrepreneur who has arguments on his side and won't back down and it's precisely this stupid thinking that prevails in society there's always a direct connection he makes money and he's become wealthy so we must have stolen it from someone it's all about politics he's charging 12 euros a square metre nobody can afford that well we have smaller apartments 35 40 50 square meters which any nurse can afford even at 14 euros a square metre as long as it's well made has great light she'd love to live there instead of in 60 square meters over there for 8 euros a square metre Clara knows that many of his workmen or the police officers who protect him had difficulties finding affordable housing but he says his millions of square meters are not the cause of the problem but part of the solution [Music] how do you strike the right balance between rewarding achievement and letting everyone share in it what consequences does inequality have for society the real general finding is that inequality being a way of making people feel more distance from one another stretches the social fabric it phrased the social fabric it pulls us apart from one another physically experientially and psychologically there's nothing necessarily wrong with inequality of course people have an unequal endowments of intelligence and beauty and they have different parents and where I start to worry as a sociologist is when people accumulate dynastic wealth and dynastic wealth means a lot of money that gets transferred down through generations because that starts to stabilize systems of inequality across society and that constricts the opportunities available to everybody else coast of Ghana may have worked his way to the top but even for him there's still a glass ceiling you can't buy your way into the world of dynastic wealth you can only be born into it Kirsti on fly – best all-time traces his family tree back to the year 1135 he's a descendant of the fogers one of the richest families of the Middle Ages you can always use a winch to pull in the deer and you've killed a stag which normally weighs well over 100 kilos then you need mechanical help to get it into the vehicle would look a bit odd when you drive around towing a dead deer in a trailer people sometimes find that a little strange the car he's is to transport dead stags as an old Austrian military vehicle when bechtolsheim uses it in the 300 hectares of forest he owns somewhere in central Germany we're not allowed to say exactly where back was his condition for letting us film him discretion is everything why had some visits in the morning a forest is a wonderful feeling because you have the run of it so to speak Keltie I think it was the publisher of deed site countess den Hoff who once said you always have to own everything you love I can comprehend the question philosophically but if I answer according to my natural instincts I'd say yes I like owning things that I find beautiful man rush to gardenia demonize Shirin imprinted by citizens not Eagles it had the great inequality that exists room on your folks is wanted for the economy and it's unavoidable obviously if you're an entrepreneur and you have inherited something and keep it running properly you will have more than someone who's just an employee do you think that things are by and large fair in Germany yes by and large I do I don't sense any real feeling of injustice and the part of most people on the street lights Lord after stars it can be not having during the week from best Hawthorne works with a view of the main river in Frankfurt he heads what he calls the family office this exclusive establishment is essentially what used to be known as a private bank perhaps you should add that this is one of the few old Frankfurt patrician houses that survived the Second World War intact this old terrazzo floor or this handle this banister you don't often find them in Frankfort today these display cases you can see the remnants of what once made patrician dining culture so special Oscar Moffitt you have to imagine a family office as just that an office that takes care of the interests and all the financial needs of a single family or an individual that ranges from let's say five or ten million to several hundred million not even the employees know all the names of the bank's clientele the wealthy come via personal recommendations they know that from battle time will offer them something that normal savers can't get from a bank these days interest and returns on their money we've done work together to create an asset structure one for the future let's say you want to invest so and so much in real estate and with real estate you also have apartments and commercial buildings and maybe even logistics stick stocks it's maybe thirty percent you might put 10% into pensions and 10% in cash the rest is invested in other things private equity forestry and so on we help families to maintain their fortunes for generations that is what we aspire to the legend surrounding germany's post-war economic recovery sometimes and evokes the notion of a kind of monetary zero-hour when everyone supposedly had to start from scratch if you wanted to get rich you had to work your way up according to the myth what's photomask Noveck shortly before the first world war a former interior ministry official published an almanac of millionaires in buda Shanda in these books you still find numerous names that look very familiar today if you look at the lists of the wealthy you get the impression that old money plays a huge role among the big fortunes today I'm hiding guns awesome for moving our biases line the ups transition dean dean the gap between those who only have work do you and those who belong to the upper class has increased enormously if i took for clue such i think if people understood how how deeply unfair economic competition was in the modern global economy they really would be up in arms [Music] it's the end of Thomas class's shift after visiting the construction site he and his wife considered the real estate agents offer at the moment the family lives essentially from his income his wife has reduced her workers to take care of the children [Music] the children are eager to tell their father about the events of the day they visited their grandmother once the children go to bed the parents talk about buying the apartment in the middle of the city when this dish walked on join us mommy first you are all enthusiastic and a bit dazzled by the idea and the beautiful project and by the question about whom the project is aimed at well at young families like you on the one hand that's flattering but on the other hand when you then hear the price and think about it again these are dimensions where I say that a family like us are out of it we aren't expecting an inheritance or any other sources of outside money we have to earn it on a monthly basis four hundred fifty thousand euros I don't even know how many annual incomes that would be as I income in the severan so at some point you start to worry that the step downwards into the lower middle class is much closer than the step up into the upper middle class I think everyone has the same feeling I'm lucky I have a big employer I feel like I have won the jackpot in Leipzig but that doesn't mean that we can keep up with the developments in the real estate market being mauled the classes are not poor but they belong to a group that has come under pressure in recent years the middle class the people who have no fortunes but have to work for prosperity in recent months thousands have sent in comments online for this film project under the hashtag on Graceland for example they've reported their salaries an industrial clerk in the car industry 1600 euros net a social worker in a rehab clinic 1648 net a civil engineer nearly 2000 net a medical specialist work 12 years of training 2768 net a net income of 3500 euros puts a single person in Germany's top 10% of earners accumulated wealth is particularly unequal half the population has less than 17 thousand euros in reserve that would let them buy a base-model VW Golf all shoes and clothing for 1.6 children from birth to the age of 18 or just 3.3 square meters of a newly built apartment in Frankfurt the vast majority of the gains and income have gone to people at the very top of the income distribution in the top 1% of the income distribution and incomes for people in the middle class and below the middle class have essentially not increased or have even fallen at the bottom very large middle class is necessary for peaceful and democratic societies and if you now have polarization in rich countries and if you have shrinkage of the middle classes then you really have a problem or you are really moving to a new territory that is just unexplored yet in u.s.

The question can really a successful democracy exist with very polarized of citizenship with lots of people who are rich but also lots of people who are below the middle-class level the world is at a crossroads today that if it doesn't try to write a new social contract those who have been hurt the many many people who have been hurt will repel [Applause] there are a few places where all social strata come together but even where they do exist it doesn't mean that the pool the rich and the middle classes actually meet how are they doing they're playing tactically Costa Fiona has paid for a place in a luxury suite in Leipzig main soccer stadium we in the luxury area of paying for their cheaper tickets through our high contributions everyone makes their own contribution maybe that guy pays 20 years for a ticket I'm actually paying 2,000 for mine there's a certain justice there now at the family office in Frankfort the bank's own Forester has come to call I brought all the figures let's start with Finland Christian fund bechtolsheim has been using his clients money to buy up forests in Finland New Zealand and Uruguay what's benefited us you can see it here in the timber prices in Finland the development last year spruce and pine have seen a huge increase since 2016 and that works to our advantage the Sweden solution copy mm-hmm authorities German forests are just insanely expensive there are very few areas available and when an area opens up people jump on it like crazy surprises a double tripled quadrupled over the past 10 or 15 years of course this is also due to the low interest rates that we currently have people are looking for everything they can find where can you invest money where can you safely invested or invested very profitably it's an intrinsic conflict can we briefly talked about Uruguay how does the return look relative to our plans we're doing quite well Uruguay is our most conservative projects this is a new global form of capitalism financial capitalism to find out how the system works sociology stat Brooke Harrington first trained as an asset manager it's a global profession and that's why I had to go to 18 different countries you know from the Cayman Islands and the BVI all the way out to the Cook Islands in the middle of the South Pacific to the Seychelles and Mauritius to New York and London and Switzerland all over one of the things you learn in wealth management school is to regard the world as kind of a legal financial shopping mall and you go to each different state in the world the way you would go to shops in a mall picking out the laws and the conditions that are most favorable for what you want to do or what your client wants to do with a particular asset so what you have to know is a wealth manager is where's the best place to get the laws that you need to do what you want to do with the art collection or the yacht or the family business the family office is the starting point of a global investment chain the wealthy entrust from best all time with their money among other things he invests with these fund managers they send it all around the world ensuring it earns much more interest than say a normal savings account I'm glad that you're here to say it at the outset we are really satisfied with the performance you have achieved so far currently we are at nine point three percent since the beginning of the year they say the secret of their fund is automated investment they have an algorithm that scans the global economic situation and converts it into traffic light signals green means the computer buys a lot of shares and when the signal jumps to yellow will read fewer yeah the curve is flat and you can see it because the signal isn't dark green we do the market timing we are the ones who ensure that a customer can re-enter the market because we operate without emotion we have no emotions our entire set up our entire algorithm is purely quantitative normal geopolitical upheavals such as those in Syria or Ukraine none of them has such a global economic dimension that it could really knock the world economy out of sync and that's our benchmark where we would intervene in the traffic light it has to be an event that knocks the world economy off-balance and at least in history no conventional war has done that many people would now say here are six well-to-do people sitting at the table and all they're doing is trying to increase their wealth for many you are kind of an economic bloat what would you say to them frankly nothing because no one ever asks net I think it's pretty tricky in Germany everyone thinks he can join Deutsche Bank as a trainee at 18 then become an authorised signatory and then eventually a department head and then retire at the age of 65 as a class-b director with a palm tree in the office and a chair with arm rests that world is definitely over that's for sure in the context of modern investor capitalism there's been this massive shift of power from labor to investment it's called financialization dissonance cloud these are very clear elements of an artificial world for which only an abstract amount of money counts a vanished but not the quality of life locally among the peoples in the markets in society now you can get rich from being a rentier capitalist that is not from your work not from the sweat of your brow as they say but from putting your money at the right place and at the right time the right things Tomasz class has been working as an engineer for siemens for nine years he sits on the works council and could imagine staying here until he retires with or without a palm tree we have employees who have been trained here they've worked here all their lives it's like a family it's not just work it's a bit of family and a bit of life the staff and I are very attached to what we do here together during the day good mind some – just recently Siemens posted six billion euros in annual profits but then worrying rumors began circulating investors were reportedly putting pressure on the company saying this plant wasn't fit for the future actually nothing is secure even everyday life living in a rented apartment is insecure we're currently secured by a single income and that is now on very very shaky legs you suddenly realize that when you get a situation like the one we're in now students really insist [Music] a few streets away from the Siemens plant cassava corner has invited all his staff to the company Christmas party he just bought this old post office railway station his wife Anna and his youngest daughter are the first to show up then the boss arrives a lot is riding on him his employees are also worried for much the same reasons as Thomas Klaus in recent weeks the financial Press reported that investors have taken over 50% of the company's shares [Applause] before though dear friends family it's amazing to be able to stand among you you are my motivation seasoned minam will to pursue is easy where my strength yeah I think you have been convinced by a letter from the management perhaps signed by me that we are still the same family no matter who owns the shares no matter who will have a say and so forth yes we do Capital Markets yes we have to refinance ourselves yes we have to reposition ourselves I will also be doing that no matter in what post I will be available to you in the future what we have achieved so far as to be a truly great and big family have a nice evening and thank you at some point every company reaches a certain size where its banking and financing structures are no longer sufficient I have to deal with the financial institutions and all that if I have that under control then I will remain in my post but if I don't then I'll be voted out faster than you can possibly imagine [Music] it looks like the whole world is being shaken up by big money it's a game that few can play and even fewer can win but when those at the top stopped a jump ship and those below have to worry about a crash what effect does that have on a country today and in the future [Applause] [Music] [Applause] [Music]

As found on YouTubeRead More