Tag: vanguard index funds

This Is How To Become A Millionaire: Index Fund Investing for Beginners

Jason 0 Comments Retire Wealthy Retirement Planning

hi guys it's mark so did you know if you save two hundred dollars per month at an eight percent annual return then in 45 years you would have over wait for it one million dollars to be honest when someone first explained this was possible by investing in index funds i hardly understood a word they were saying it was like they would speak in a different language today i thought it was about time that i made the video that i wish i'd seen when i was younger and explain everything step by step and because i like people that actually practice what they preach i'm gonna be investing ten thousand dollars of my own money during this video so you can see exactly how it's done just a quick disclaimer though i'm not a financial advisor i'm a businessman and this is just some of the real life strategies that have worked for me personally i always thought of index funds as my backup plan if my businesses hadn't been successful then i would have become a millionaire anyway through these investments just remember if you like the video then smash the like button as it really helps push this video out to more people and also consider subscribing if you want to grow your wealth part one uncovering the lies so let's cut to the chase you've been put a major disadvantage people have been telling you lies about investing all of your life for instance at school when i was growing up i remember asking my teachers about investing and they always said it's just for rich people as they can afford to hire professionals to do it for them for the longest time i believed investing wasn't for me because i wasn't a pro and i didn't have much money and i thought i wouldn't stand a chance then we got friends one of mine said i'd have to look at all the financial newspapers learn how to read the charts and according to him it just wasn't worth my time and on top of this every time i mentioned investing to my family they seemed so scared because they thought it's the most risky thing in the world and not for normal people my dad even said if i started investing i'd lose all my money can you believe that these lies are exactly what the experts want you to believe as they know that index fund investing is extremely easy to do you don't need much money to start the risks are pretty low and on average it will make you more money in the long term the dark truth is that the average actively managed fund returns two percent less a year than the market in general this means that professionals on average are doing worse than index funds and even if they end up losing you money they still charge you fees no matter what now according to my favorite film the matrix you have now taken the red pill and you've woken up to the truth it's now time to move on to part two understanding the game i know when i first started investing i felt like i was going to make so many mistakes but once you understand their language it all becomes so much easier and that's what we're going to be talking about in this part so i've been banging on about index funds in many of my videos so i think it's about time i explained what they are and why they're so cool i'm a big football fan and if you have ever followed any sports you'll be familiar with a league table like this the better your team performs the higher up they'll be on the list but on the other hand if they do really badly they might be removed from the league entirely this is almost exactly the same as an index all you have to do is switch out the teams for companies let's take the s p 500 for example this is a list of the 500 best performing public companies in the usa the big dogs being amazon google apple and more recently tesla and just like a league table if a company doesn't perform well they're at risk of being removed from the list hasta la vista baby the idea of an index fund is to be a little bit sneaky as it allows you to invest in every single company on the list with just one click it's a bit like a friend of mine who picks a different football team each year he just wants to pick the winner every time so investing in index funds means that even if a few companies do terribly then it's balanced out by the companies that are doing extremely well the average return on the s p 500 over the last 10 years has been 13.6 now that is higher than usual but get this no one has ever lost any money if they've bought and held an s p 500 index fund for more than 20 years so if this is so foolproof then why do people still buy individual stocks well personally i like to do this just for a bit of fun i also think that some companies are currently working on awesome technology for the future but aren't making a lot of money at the moment so they won't make the cut into the popular index funds so now and again i like to invest some extra money into these up and coming companies so i don't miss out and that reminds me we bought currently giving away four free individual stocks if you want to pick them up i'll leave the link in the description and for everyone that's outside of the usa or china i'll leave a link where you can claim a free stock with trade in 212.

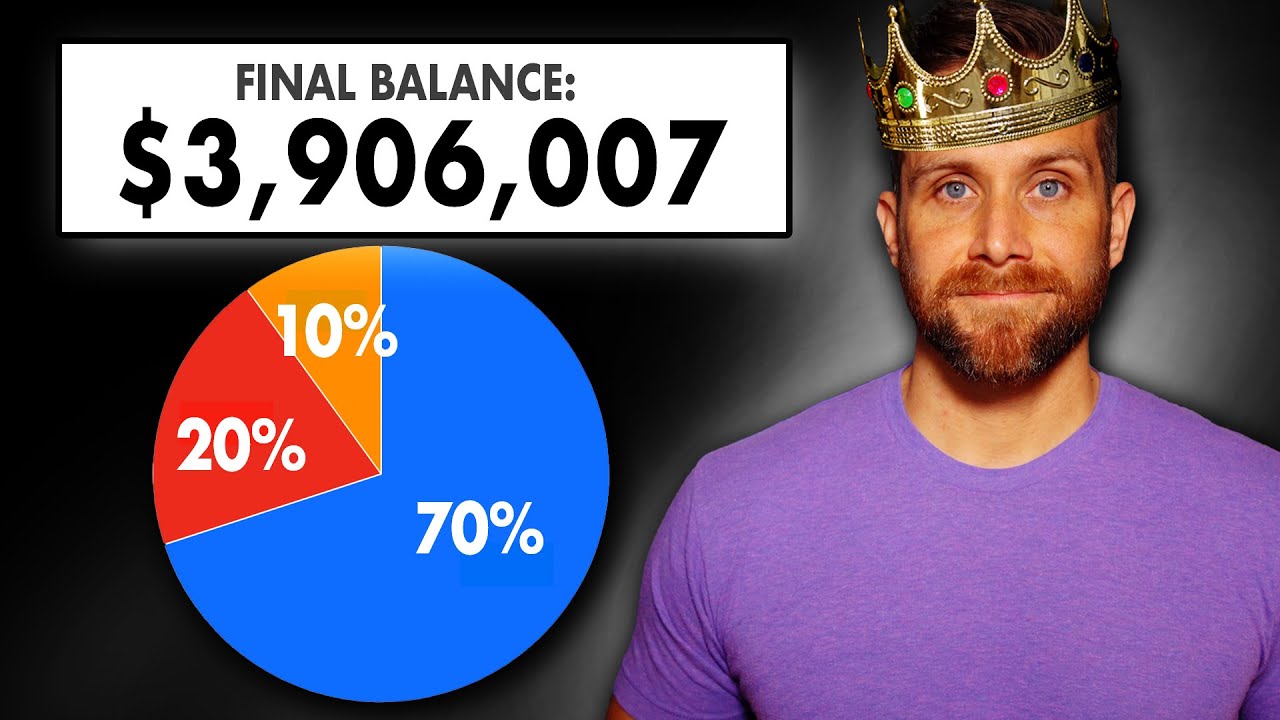

Hey that's pretty good you'll often hear people throwing around the terms roth ira in the usa stocks and shares isa in the uk tfsa in canada and supers in australia but what does it all mean well these are types of accounts that allow you to earn profits on your investments and you don't have to pay any taxes on them but they generally have limits because they're just so powerful these are kind of like captain america shield so let me explain if captain america just sat at home with his shield then he wouldn't ever get anything done but when he takes that shield into battle he has an advantage so these accounts are like your shield make sure to use them when you're investing a way you can do this is by using the money inside your shielded account to invest into index funds and all the profits will be yours because the government won't take a cut one of my biggest questions when i first started was should i invest all my money at the same time or do it gradually now this is something lots of investors argue about so i'm going to give you my view on things remember later i'm going to be investing this 10 000 in full so that kind of gives you an idea of what i believe investing all your money as a lump sum is certainly more risky however if i'm investing in something i know will increase over time like an s p 500 index fund then there is no point waiting the longer you wait the worse off on average you'll be however if you don't have the cash i wouldn't wait to save up the money i would just invest what i could every month as sometimes you're going to buy when the stocks high other times you're going to buy when the stock's low but overall this is going to balance out and this is known as dollar cost averaging when you log on to an investing website or app you'll see that there is something called etfs which are very similar to index funds and a lot of people get them confused both allow you to invest into a basket of stocks however the easy way to remember the difference is just to think of what etf stands for exchange traded fund if we break that down simply it just means that it can be traded on the stock market throughout the day whereas an index fund can only be bought and sold for a price that is set at the end of each trading day but let's cut to the chase you probably want to know which one's better on average if you're starting with little money then etfs may be a better option as they have lower minimum investment thresholds and many brokers don't charge a trading commission now if you're still watching this and you're younger than 18 then i am really impressed that you've been listening to a boomer like me for so long but seriously not many people learn this at such a young age as they don't teach it at school a way you can start investing under 18 is to open up a custodial account in the usa or a junior stocks and shares iso in the uk set up these accounts you just need to ask your parents the real secret ingredient to this millionaire formula is time and when you're younger you have so much of it that's because every year as you keep adding to your investments the interest starts to compound and grow at a rapid pace it's a snowball effect once you reach a certain tipping point the interest you're making is much more than the amount you're investing on a monthly basis it's a bit like when you see someone take ages to get to a hundred thousand subscribers on youtube and then within a few months they managed to hit the big million the sooner you get started the better as time will be on your side now i want to clear something up when people talk about index funds you will hear s p 500 again and again people just love it as i mentioned before this is a top 500 public companies in the usa but the cool thing is you don't actually have to be in the usa to invest in this i'm in the uk and it's one of my favorite investments i just love to think that i own a small part of all the biggest companies in the usa part three mastering the strategy so lots of people will teach you what to do but they won't actually say how to do it so i'm going to walk you through everything right now while i invest my own ten thousand dollars the first thing to really do is to work out your goals let's say you want to become a millionaire that was one of my goals i just had to work out how much i would actually need to invest per month to achieve this i love using these compound interest calculators you can find them online easily yourself if you want to have a go at this so if you're able to invest 250 dollars per month with an 8 annual return over 42 years you'll have over a million dollars in your account now if you're able to invest that for another 10 years you'll have over 2 million in your account of course if you wanted to invest even more then you're just going to speed up the whole process the next thing we need to do is pick the brokerage website we're using to set up our account and invest the ones that i love are charles swab fidelity and vanguard i call these the big three the founder of vanguard john bogle is often referred to as the father of index fund investing and if you think i'm a boomer he was even older than me his vanguard group gave birth to index funds so they're the oldest and most trusted let's jump onto their website to see what they have to offer so to get onto their full list of funds just go up to invest in and click on vanguard mutual funds at this point i'm going to have to ask you to strap in and brace yourself because if you haven't seen this page before it can look extremely overwhelming but in a minute you'll be able to impress all your friends when you know exactly how to read it see what i mean there are just so many options the main things to focus on are the expense ratio which is how much they're going to charge you per year you obviously want to keep these as low as possible and luckily with vanguard fees these are very low anyway the other thing to look at is the average returns and they break these down nicely on the right hand side of the screen but of course it's always good to remember that past performance doesn't always mean future returns my wife's a bit like vanguard she likes everything in order and nothing out of place so they have arranged all of their funds into different categories so everything is easy to find category one is bonds these are a type of contract that companies and governments sell when they need extra money if you invest in these they promise to pay you back in the future these are often seen as pretty low risk but also pretty low returns therefore the older you are the more bonds you should have in your portfolio number two is balance funds the idea of these is to pick the age at which you wish to retire and they'll do all the rest of the work for you and find the right mix of index funds as you can see these go up in five year intervals and you can pick whichever suits your plans best this could be a good option if you wanted to invest without thinking about it too much but personally i always prefer manually investing it's a bit like driving an automatic car that does all the work for you it just isn't as much fun as a stick shift number three is company location and size known as small medium and large cap here you can find v fix which tracks our old friend the s p 500 this little s means it's one of vanguard selected funds which they recommend if you click on it you're able to see exactly what companies you would be investing in and also the risk level vt sacs is another good one which is a total stock market index fund which has over 3586 different stocks this allows you to invest in the entire usa stock market in one click there is a minimum investment of three thousand dollars again but as before there's also an etf version with no minimum called vti then you have international stocks quite a cool one is emerging markets which invest in companies based in china taiwan india and many more but as you can see this is a five on the risk scale so i wouldn't personally invest a lot of money into this fund because look at me i'm a bit old to be taking too many risk and i need to sleep at night number four the last category is sector based so if you have a particular interest in energy healthcare or real estate you can invest into these sectors and there are also a lot more options for sector investing in the etf so now we've broken down what's on offer hopefully it all looks a bit more understandable now for the moment you've all been waiting for it's time to invest my ten thousand dollars i could split this between lots of different funds but personally i like to invest the majority of my money into american companies i would say probably about seventy percent american 20 in other countries including the uk and ten percent in some bonds i like to keep the bonds quite low as i don't mind this little extra bit of risk because i'm only 53 and i have a bit of time before i've got to rebalance my portfolio to secure my investments but that's a personal choice depending on your risk tolerance the funds that are available are different in every country but the indexes they track are very similar so you may need to invest in a different fund to me but obviously you can still use my percentages as a guide so i'm going to use the uk vanguard site to invest 5k straight into this etf that tracks the s p 500 so here we go all done two thousand dollars is going into an index fund that tracks the total american stock market so again we go on the screen click so far that's 70 invested in the biggest economy in the world which of course is the usa now i like to balance this out by investing in a different economy as i live back in my own country i'm going to be putting 2k into the ftse 100 index fund so looking good all done great now i've invested 90 of my 10k and i'd like a bit of security let's just put the remaining 1k into a global bonds index fund and let's just do that so just like that i've invested in the usa companies like apple amazon tesla and google i own a small piece of the biggest companies in the uk like hsbc bp and unilever and i have some bonds to balance out my portfolio it really is as easy as that so i'm going to leave the next video up here but don't click on it just yet remember to subscribe to the channel if you want to grow your wealth ring that notification bell and smash that like button okay i'll see you on the other side

Read More

This Is How To Become A Millionaire: Index Fund Investing for Beginners

Jason 0 Comments Retire Wealthy Retirement Planning

hi guys it's mark so did you know if you save two hundred dollars per month at an eight percent annual return then in 45 years you would have over wait for it one million dollars to be honest when someone first explained this was possible by investing in index funds i hardly understood a word they were saying it was like they would speak in a different language today i thought it was about time that i made the video that i wish i'd seen when i was younger and explain everything step by step and because i like people that actually practice what they preach i'm gonna be investing ten thousand dollars of my own money during this video so you can see exactly how it's done just a quick disclaimer though i'm not a financial advisor i'm a businessman and this is just some of the real life strategies that have worked for me personally i always thought of index funds as my backup plan if my businesses hadn't been successful then i would have become a millionaire anyway through these investments just remember if you like the video then smash the like button as it really helps push this video out to more people and also consider subscribing if you want to grow your wealth part one uncovering the lies so let's cut to the chase you've been put a major disadvantage people have been telling you lies about investing all of your life for instance at school when i was growing up i remember asking my teachers about investing and they always said it's just for rich people as they can afford to hire professionals to do it for them for the longest time i believed investing wasn't for me because i wasn't a pro and i didn't have much money and i thought i wouldn't stand a chance then we got friends one of mine said i'd have to look at all the financial newspapers learn how to read the charts and according to him it just wasn't worth my time and on top of this every time i mentioned investing to my family they seemed so scared because they thought it's the most risky thing in the world and not for normal people my dad even said if i started investing i'd lose all my money can you believe that these lies are exactly what the experts want you to believe as they know that index fund investing is extremely easy to do you don't need much money to start the risks are pretty low and on average it will make you more money in the long term the dark truth is that the average actively managed fund returns two percent less a year than the market in general this means that professionals on average are doing worse than index funds and even if they end up losing you money they still charge you fees no matter what now according to my favorite film the matrix you have now taken the red pill and you've woken up to the truth it's now time to move on to part two understanding the game i know when i first started investing i felt like i was going to make so many mistakes but once you understand their language it all becomes so much easier and that's what we're going to be talking about in this part so i've been banging on about index funds in many of my videos so i think it's about time i explained what they are and why they're so cool i'm a big football fan and if you have ever followed any sports you'll be familiar with a league table like this the better your team performs the higher up they'll be on the list but on the other hand if they do really badly they might be removed from the league entirely this is almost exactly the same as an index all you have to do is switch out the teams for companies let's take the s p 500 for example this is a list of the 500 best performing public companies in the usa the big dogs being amazon google apple and more recently tesla and just like a league table if a company doesn't perform well they're at risk of being removed from the list hasta la vista baby the idea of an index fund is to be a little bit sneaky as it allows you to invest in every single company on the list with just one click it's a bit like a friend of mine who picks a different football team each year he just wants to pick the winner every time so investing in index funds means that even if a few companies do terribly then it's balanced out by the companies that are doing extremely well the average return on the s p 500 over the last 10 years has been 13.6 now that is higher than usual but get this no one has ever lost any money if they've bought and held an s p 500 index fund for more than 20 years so if this is so foolproof then why do people still buy individual stocks well personally i like to do this just for a bit of fun i also think that some companies are currently working on awesome technology for the future but aren't making a lot of money at the moment so they won't make the cut into the popular index funds so now and again i like to invest some extra money into these up and coming companies so i don't miss out and that reminds me we bought currently giving away four free individual stocks if you want to pick them up i'll leave the link in the description and for everyone that's outside of the usa or china i'll leave a link where you can claim a free stock with trade in 212.

Hey that's pretty good you'll often hear people throwing around the terms roth ira in the usa stocks and shares isa in the uk tfsa in canada and supers in australia but what does it all mean well these are types of accounts that allow you to earn profits on your investments and you don't have to pay any taxes on them but they generally have limits because they're just so powerful these are kind of like captain america shield so let me explain if captain america just sat at home with his shield then he wouldn't ever get anything done but when he takes that shield into battle he has an advantage so these accounts are like your shield make sure to use them when you're investing a way you can do this is by using the money inside your shielded account to invest into index funds and all the profits will be yours because the government won't take a cut one of my biggest questions when i first started was should i invest all my money at the same time or do it gradually now this is something lots of investors argue about so i'm going to give you my view on things remember later i'm going to be investing this 10 000 in full so that kind of gives you an idea of what i believe investing all your money as a lump sum is certainly more risky however if i'm investing in something i know will increase over time like an s p 500 index fund then there is no point waiting the longer you wait the worse off on average you'll be however if you don't have the cash i wouldn't wait to save up the money i would just invest what i could every month as sometimes you're going to buy when the stocks high other times you're going to buy when the stock's low but overall this is going to balance out and this is known as dollar cost averaging when you log on to an investing website or app you'll see that there is something called etfs which are very similar to index funds and a lot of people get them confused both allow you to invest into a basket of stocks however the easy way to remember the difference is just to think of what etf stands for exchange traded fund if we break that down simply it just means that it can be traded on the stock market throughout the day whereas an index fund can only be bought and sold for a price that is set at the end of each trading day but let's cut to the chase you probably want to know which one's better on average if you're starting with little money then etfs may be a better option as they have lower minimum investment thresholds and many brokers don't charge a trading commission now if you're still watching this and you're younger than 18 then i am really impressed that you've been listening to a boomer like me for so long but seriously not many people learn this at such a young age as they don't teach it at school a way you can start investing under 18 is to open up a custodial account in the usa or a junior stocks and shares iso in the uk set up these accounts you just need to ask your parents the real secret ingredient to this millionaire formula is time and when you're younger you have so much of it that's because every year as you keep adding to your investments the interest starts to compound and grow at a rapid pace it's a snowball effect once you reach a certain tipping point the interest you're making is much more than the amount you're investing on a monthly basis it's a bit like when you see someone take ages to get to a hundred thousand subscribers on youtube and then within a few months they managed to hit the big million the sooner you get started the better as time will be on your side now i want to clear something up when people talk about index funds you will hear s p 500 again and again people just love it as i mentioned before this is a top 500 public companies in the usa but the cool thing is you don't actually have to be in the usa to invest in this i'm in the uk and it's one of my favorite investments i just love to think that i own a small part of all the biggest companies in the usa part three mastering the strategy so lots of people will teach you what to do but they won't actually say how to do it so i'm going to walk you through everything right now while i invest my own ten thousand dollars the first thing to really do is to work out your goals let's say you want to become a millionaire that was one of my goals i just had to work out how much i would actually need to invest per month to achieve this i love using these compound interest calculators you can find them online easily yourself if you want to have a go at this so if you're able to invest 250 dollars per month with an 8 annual return over 42 years you'll have over a million dollars in your account now if you're able to invest that for another 10 years you'll have over 2 million in your account of course if you wanted to invest even more then you're just going to speed up the whole process the next thing we need to do is pick the brokerage website we're using to set up our account and invest the ones that i love are charles swab fidelity and vanguard i call these the big three the founder of vanguard john bogle is often referred to as the father of index fund investing and if you think i'm a boomer he was even older than me his vanguard group gave birth to index funds so they're the oldest and most trusted let's jump onto their website to see what they have to offer so to get onto their full list of funds just go up to invest in and click on vanguard mutual funds at this point i'm going to have to ask you to strap in and brace yourself because if you haven't seen this page before it can look extremely overwhelming but in a minute you'll be able to impress all your friends when you know exactly how to read it see what i mean there are just so many options the main things to focus on are the expense ratio which is how much they're going to charge you per year you obviously want to keep these as low as possible and luckily with vanguard fees these are very low anyway the other thing to look at is the average returns and they break these down nicely on the right hand side of the screen but of course it's always good to remember that past performance doesn't always mean future returns my wife's a bit like vanguard she likes everything in order and nothing out of place so they have arranged all of their funds into different categories so everything is easy to find category one is bonds these are a type of contract that companies and governments sell when they need extra money if you invest in these they promise to pay you back in the future these are often seen as pretty low risk but also pretty low returns therefore the older you are the more bonds you should have in your portfolio number two is balance funds the idea of these is to pick the age at which you wish to retire and they'll do all the rest of the work for you and find the right mix of index funds as you can see these go up in five year intervals and you can pick whichever suits your plans best this could be a good option if you wanted to invest without thinking about it too much but personally i always prefer manually investing it's a bit like driving an automatic car that does all the work for you it just isn't as much fun as a stick shift number three is company location and size known as small medium and large cap here you can find v fix which tracks our old friend the s p 500 this little s means it's one of vanguard selected funds which they recommend if you click on it you're able to see exactly what companies you would be investing in and also the risk level vt sacs is another good one which is a total stock market index fund which has over 3586 different stocks this allows you to invest in the entire usa stock market in one click there is a minimum investment of three thousand dollars again but as before there's also an etf version with no minimum called vti then you have international stocks quite a cool one is emerging markets which invest in companies based in china taiwan india and many more but as you can see this is a five on the risk scale so i wouldn't personally invest a lot of money into this fund because look at me i'm a bit old to be taking too many risk and i need to sleep at night number four the last category is sector based so if you have a particular interest in energy healthcare or real estate you can invest into these sectors and there are also a lot more options for sector investing in the etf so now we've broken down what's on offer hopefully it all looks a bit more understandable now for the moment you've all been waiting for it's time to invest my ten thousand dollars i could split this between lots of different funds but personally i like to invest the majority of my money into american companies i would say probably about seventy percent american 20 in other countries including the uk and ten percent in some bonds i like to keep the bonds quite low as i don't mind this little extra bit of risk because i'm only 53 and i have a bit of time before i've got to rebalance my portfolio to secure my investments but that's a personal choice depending on your risk tolerance the funds that are available are different in every country but the indexes they track are very similar so you may need to invest in a different fund to me but obviously you can still use my percentages as a guide so i'm going to use the uk vanguard site to invest 5k straight into this etf that tracks the s p 500 so here we go all done two thousand dollars is going into an index fund that tracks the total american stock market so again we go on the screen click so far that's 70 invested in the biggest economy in the world which of course is the usa now i like to balance this out by investing in a different economy as i live back in my own country i'm going to be putting 2k into the ftse 100 index fund so looking good all done great now i've invested 90 of my 10k and i'd like a bit of security let's just put the remaining 1k into a global bonds index fund and let's just do that so just like that i've invested in the usa companies like apple amazon tesla and google i own a small piece of the biggest companies in the uk like hsbc bp and unilever and i have some bonds to balance out my portfolio it really is as easy as that so i'm going to leave the next video up here but don't click on it just yet remember to subscribe to the channel if you want to grow your wealth ring that notification bell and smash that like button okay i'll see you on the other side

Read More

This Is How To Become A Millionaire: Index Fund Investing for Beginners

Jason 0 Comments Retire Wealthy Retirement Planning

hi guys it's mark so did you know if you save two hundred dollars per month at an eight percent annual return then in 45 years you would have over wait for it one million dollars to be honest when someone first explained this was possible by investing in index funds i hardly understood a word they were saying it was like they would speak in a different language today i thought it was about time that i made the video that i wish i'd seen when i was younger and explain everything step by step and because i like people that actually practice what they preach i'm gonna be investing ten thousand dollars of my own money during this video so you can see exactly how it's done just a quick disclaimer though i'm not a financial advisor i'm a businessman and this is just some of the real life strategies that have worked for me personally i always thought of index funds as my backup plan if my businesses hadn't been successful then i would have become a millionaire anyway through these investments just remember if you like the video then smash the like button as it really helps push this video out to more people and also consider subscribing if you want to grow your wealth part one uncovering the lies so let's cut to the chase you've been put a major disadvantage people have been telling you lies about investing all of your life for instance at school when i was growing up i remember asking my teachers about investing and they always said it's just for rich people as they can afford to hire professionals to do it for them for the longest time i believed investing wasn't for me because i wasn't a pro and i didn't have much money and i thought i wouldn't stand a chance then we got friends one of mine said i'd have to look at all the financial newspapers learn how to read the charts and according to him it just wasn't worth my time and on top of this every time i mentioned investing to my family they seemed so scared because they thought it's the most risky thing in the world and not for normal people my dad even said if i started investing i'd lose all my money can you believe that these lies are exactly what the experts want you to believe as they know that index fund investing is extremely easy to do you don't need much money to start the risks are pretty low and on average it will make you more money in the long term the dark truth is that the average actively managed fund returns two percent less a year than the market in general this means that professionals on average are doing worse than index funds and even if they end up losing you money they still charge you fees no matter what now according to my favorite film the matrix you have now taken the red pill and you've woken up to the truth it's now time to move on to part two understanding the game i know when i first started investing i felt like i was going to make so many mistakes but once you understand their language it all becomes so much easier and that's what we're going to be talking about in this part so i've been banging on about index funds in many of my videos so i think it's about time i explained what they are and why they're so cool i'm a big football fan and if you have ever followed any sports you'll be familiar with a league table like this the better your team performs the higher up they'll be on the list but on the other hand if they do really badly they might be removed from the league entirely this is almost exactly the same as an index all you have to do is switch out the teams for companies let's take the s p 500 for example this is a list of the 500 best performing public companies in the usa the big dogs being amazon google apple and more recently tesla and just like a league table if a company doesn't perform well they're at risk of being removed from the list hasta la vista baby the idea of an index fund is to be a little bit sneaky as it allows you to invest in every single company on the list with just one click it's a bit like a friend of mine who picks a different football team each year he just wants to pick the winner every time so investing in index funds means that even if a few companies do terribly then it's balanced out by the companies that are doing extremely well the average return on the s p 500 over the last 10 years has been 13.6 now that is higher than usual but get this no one has ever lost any money if they've bought and held an s p 500 index fund for more than 20 years so if this is so foolproof then why do people still buy individual stocks well personally i like to do this just for a bit of fun i also think that some companies are currently working on awesome technology for the future but aren't making a lot of money at the moment so they won't make the cut into the popular index funds so now and again i like to invest some extra money into these up and coming companies so i don't miss out and that reminds me we bought currently giving away four free individual stocks if you want to pick them up i'll leave the link in the description and for everyone that's outside of the usa or china i'll leave a link where you can claim a free stock with trade in 212.

Hey that's pretty good you'll often hear people throwing around the terms roth ira in the usa stocks and shares isa in the uk tfsa in canada and supers in australia but what does it all mean well these are types of accounts that allow you to earn profits on your investments and you don't have to pay any taxes on them but they generally have limits because they're just so powerful these are kind of like captain america shield so let me explain if captain america just sat at home with his shield then he wouldn't ever get anything done but when he takes that shield into battle he has an advantage so these accounts are like your shield make sure to use them when you're investing a way you can do this is by using the money inside your shielded account to invest into index funds and all the profits will be yours because the government won't take a cut one of my biggest questions when i first started was should i invest all my money at the same time or do it gradually now this is something lots of investors argue about so i'm going to give you my view on things remember later i'm going to be investing this 10 000 in full so that kind of gives you an idea of what i believe investing all your money as a lump sum is certainly more risky however if i'm investing in something i know will increase over time like an s p 500 index fund then there is no point waiting the longer you wait the worse off on average you'll be however if you don't have the cash i wouldn't wait to save up the money i would just invest what i could every month as sometimes you're going to buy when the stocks high other times you're going to buy when the stock's low but overall this is going to balance out and this is known as dollar cost averaging when you log on to an investing website or app you'll see that there is something called etfs which are very similar to index funds and a lot of people get them confused both allow you to invest into a basket of stocks however the easy way to remember the difference is just to think of what etf stands for exchange traded fund if we break that down simply it just means that it can be traded on the stock market throughout the day whereas an index fund can only be bought and sold for a price that is set at the end of each trading day but let's cut to the chase you probably want to know which one's better on average if you're starting with little money then etfs may be a better option as they have lower minimum investment thresholds and many brokers don't charge a trading commission now if you're still watching this and you're younger than 18 then i am really impressed that you've been listening to a boomer like me for so long but seriously not many people learn this at such a young age as they don't teach it at school a way you can start investing under 18 is to open up a custodial account in the usa or a junior stocks and shares iso in the uk set up these accounts you just need to ask your parents the real secret ingredient to this millionaire formula is time and when you're younger you have so much of it that's because every year as you keep adding to your investments the interest starts to compound and grow at a rapid pace it's a snowball effect once you reach a certain tipping point the interest you're making is much more than the amount you're investing on a monthly basis it's a bit like when you see someone take ages to get to a hundred thousand subscribers on youtube and then within a few months they managed to hit the big million the sooner you get started the better as time will be on your side now i want to clear something up when people talk about index funds you will hear s p 500 again and again people just love it as i mentioned before this is a top 500 public companies in the usa but the cool thing is you don't actually have to be in the usa to invest in this i'm in the uk and it's one of my favorite investments i just love to think that i own a small part of all the biggest companies in the usa part three mastering the strategy so lots of people will teach you what to do but they won't actually say how to do it so i'm going to walk you through everything right now while i invest my own ten thousand dollars the first thing to really do is to work out your goals let's say you want to become a millionaire that was one of my goals i just had to work out how much i would actually need to invest per month to achieve this i love using these compound interest calculators you can find them online easily yourself if you want to have a go at this so if you're able to invest 250 dollars per month with an 8 annual return over 42 years you'll have over a million dollars in your account now if you're able to invest that for another 10 years you'll have over 2 million in your account of course if you wanted to invest even more then you're just going to speed up the whole process the next thing we need to do is pick the brokerage website we're using to set up our account and invest the ones that i love are charles swab fidelity and vanguard i call these the big three the founder of vanguard john bogle is often referred to as the father of index fund investing and if you think i'm a boomer he was even older than me his vanguard group gave birth to index funds so they're the oldest and most trusted let's jump onto their website to see what they have to offer so to get onto their full list of funds just go up to invest in and click on vanguard mutual funds at this point i'm going to have to ask you to strap in and brace yourself because if you haven't seen this page before it can look extremely overwhelming but in a minute you'll be able to impress all your friends when you know exactly how to read it see what i mean there are just so many options the main things to focus on are the expense ratio which is how much they're going to charge you per year you obviously want to keep these as low as possible and luckily with vanguard fees these are very low anyway the other thing to look at is the average returns and they break these down nicely on the right hand side of the screen but of course it's always good to remember that past performance doesn't always mean future returns my wife's a bit like vanguard she likes everything in order and nothing out of place so they have arranged all of their funds into different categories so everything is easy to find category one is bonds these are a type of contract that companies and governments sell when they need extra money if you invest in these they promise to pay you back in the future these are often seen as pretty low risk but also pretty low returns therefore the older you are the more bonds you should have in your portfolio number two is balance funds the idea of these is to pick the age at which you wish to retire and they'll do all the rest of the work for you and find the right mix of index funds as you can see these go up in five year intervals and you can pick whichever suits your plans best this could be a good option if you wanted to invest without thinking about it too much but personally i always prefer manually investing it's a bit like driving an automatic car that does all the work for you it just isn't as much fun as a stick shift number three is company location and size known as small medium and large cap here you can find v fix which tracks our old friend the s p 500 this little s means it's one of vanguard selected funds which they recommend if you click on it you're able to see exactly what companies you would be investing in and also the risk level vt sacs is another good one which is a total stock market index fund which has over 3586 different stocks this allows you to invest in the entire usa stock market in one click there is a minimum investment of three thousand dollars again but as before there's also an etf version with no minimum called vti then you have international stocks quite a cool one is emerging markets which invest in companies based in china taiwan india and many more but as you can see this is a five on the risk scale so i wouldn't personally invest a lot of money into this fund because look at me i'm a bit old to be taking too many risk and i need to sleep at night number four the last category is sector based so if you have a particular interest in energy healthcare or real estate you can invest into these sectors and there are also a lot more options for sector investing in the etf so now we've broken down what's on offer hopefully it all looks a bit more understandable now for the moment you've all been waiting for it's time to invest my ten thousand dollars i could split this between lots of different funds but personally i like to invest the majority of my money into american companies i would say probably about seventy percent american 20 in other countries including the uk and ten percent in some bonds i like to keep the bonds quite low as i don't mind this little extra bit of risk because i'm only 53 and i have a bit of time before i've got to rebalance my portfolio to secure my investments but that's a personal choice depending on your risk tolerance the funds that are available are different in every country but the indexes they track are very similar so you may need to invest in a different fund to me but obviously you can still use my percentages as a guide so i'm going to use the uk vanguard site to invest 5k straight into this etf that tracks the s p 500 so here we go all done two thousand dollars is going into an index fund that tracks the total american stock market so again we go on the screen click so far that's 70 invested in the biggest economy in the world which of course is the usa now i like to balance this out by investing in a different economy as i live back in my own country i'm going to be putting 2k into the ftse 100 index fund so looking good all done great now i've invested 90 of my 10k and i'd like a bit of security let's just put the remaining 1k into a global bonds index fund and let's just do that so just like that i've invested in the usa companies like apple amazon tesla and google i own a small piece of the biggest companies in the uk like hsbc bp and unilever and i have some bonds to balance out my portfolio it really is as easy as that so i'm going to leave the next video up here but don't click on it just yet remember to subscribe to the channel if you want to grow your wealth ring that notification bell and smash that like button okay i'll see you on the other side

Read More

How To Invest For Beginners (Full Guide)

Jason 0 Comments Retire Wealthy Retirement Planning

– Hello, it's Mark. In this video, I'll reveal the investment strategies I used to go from novice investor with very little money to millionaire by age 35 and how you can do the exact same thing. I have a simple question for you. Do you want to be here rich and enjoy the freedom that comes with financial stability? Many people do that. Why do you think there are so many get-rich-quick schemes out there? Most people, unfortunately, have a lottery mentality. They're just waiting for the magic fairy to come down and hand them a million dollars. Do I look like a magical fairy to you? If the answer is no, and I really hope it is no, then smash the like button and subscribe to the channel. The truth is, as many people believe, winning a chunk of money will make your problems go away, but there will be an absolute shock. Without the right investment and mindset strategies , it will all be gone , and in no time, you will be back to square one. You need a solid, consistent investment plan that gradually builds your wealth over time.

Long-term investment will give great returns. When I was younger, I always wanted to be a race car driver. I loved everything about cars but I didn't have enough money to pursue my dreams. But as I started building my investments, it allowed me to race in multiple championships and win countless trophies like this. I even got my helmet here, you sometimes sit in the back of the shots. How cool is that? My investments allow me to spend time having fun creating YouTube videos, like the one you're watching. I'm not currently making any money from this channel and you can sit back and relax because I won't end up trying to sell you something either. There are many different investments out there. It's very easy to get distracted by the next shiny object. It's also confusing when someone tells you this is the best thing, the latest and greatest , and if you don't invest, you could end up losing thousands.

You may have heard of bitcoins, penny stocks, and shorting stocks, but I've found that the key for me, is to not get overwhelmed and distracted by the latest trends. Now you have to face it. You will never be an expert at everything , and by constantly changing your investment strategy, you will end up with less money and at some point, you will make a big mistake. I have nothing against experimentation, but I have kept my major investments very consistent over the years and make sure to only invest large amounts in things I completely understand.

I won't pretend to have all the answers, but I will be completely transparent about everything I did that helped me have a multi-million dollar net worth. I am a businessman, not a financial advisor. So I do not consider this financial advice. It's just what I did and it worked for me. First of all, you need to create more disposable income. At the end of the day, you need money to invest and the more money you have, the better especially during your 20s and 30s. Now many people will say: save and save, don't go out with your friends, don't drink that expensive coffee, don't buy that nice car. I completely disagree. Of course, saving is a big part of this but you have to enjoy your life. There's no point in making yourself miserable just to save a few extra bucks. You should focus most of your time on energy to increase your income. You can do this by learning valuable new skills, having a side hustle or building a scalable business.

You don't have to settle for the money you make from your nine-to-five job. You should focus your time on finding ways to supplement or replace it. When I was in my early 20s, I realized that to make my way as a sculptor, earning less than $3 an hour wouldn't give me enough money to invest. It barely paid my bills. I needed to find a way to increase this significantly and that's when my journey into the business world began. Investment and business, really go hand in hand. The sign is very correct. The more you learn, the more you gain. Most importantly, you can invest more. Be really aware of your lifestyle and make sure you keep it in check.

Just because you earn more, does n't mean you should spend more. Think of someone like saying, I know Ed Sheeran. He has a huge amount of money. Yes, he keeps his lifestyle under control. He still enjoys life's little pleasures. If you're happy with the profit, let's say $40,000 a year, and you manage to grow your income up to a hundred thousand a year, that means you have an extra $60,000. This should go directly into a high-interest savings account. Then in your investments. You know, you don't need to spend it. Well, there is one slight exception and that's stage two. Pay off all your high-interest debts. If you have student loans, credit card bills, or even a payday loan, the needs are pulling you. They destroy your credit score which destroys your ability to take advantage of good loans. By paying off these high-interest debts first, you'll actually save more money than you could ever hope to achieve elsewhere. The next stage is the creation of the Freedom Fund.

This is my name for an emergency fund that puts power back in your hands. This Freedom Fund consists of three to five months of living expenses. It protects you if you decide to leave your job, as well as a lot of other situations like recessions, depressions or even pandemics around the world. Well, you've increased your income by learning a valuable skill or perhaps you've invested in your own business.

You have kept your lifestyle under control. You've paid off all your loans and established your Freedom Fund, now it's time to start looking for other options. Let's start with the lowest risk option. Index funds. An index fund is a collection of investments that you can invest your money in and own a percentage of everything. This gives you great diversification and protects you from bad stock choices. For example, let's say you got a thousand dollars and you invested in, I don't, let's say Apple stock. Is there a big company, right? They will be safe. Once your money is in, the company takes a turn for the worse causing the stock price to collapse.

The result may be that you lose the majority of your investment. This is where index funds come in. Instead of just owning Apple Stock, you can take $1,000 and invest it in something like the S and P 500, which gives you penny shares in Apple as well as Microsoft, Amazon, Facebook, Visa, Disney and many more. You're a shareholder in all these big companies. Now if something happens to Apple, it will be balanced out by other investments in your index funds. Now a lot of people will try to convince you that a mutual fund is better.

A mutual fund is very similar to an index fund except that it is controlled by a very smart person whose job is to pick the stocks in the fund. The purpose of a mutual fund is to try to beat the market and get better results for the investor. However, in the vast majority of cases, you would be better off putting your money in a simple index fund with less risk and an often brighter return. This is because index funds charge very low fees. S and P 500 fees, 0.07% per annum. Mutual funds charge high fees, ranging from one to 2% of your account balance annually. If you invest $10,000 in a mutual fund, $200 will go directly into the fund managers' wallet each year. Even if it causes you to lose money through bad stock options. On the flip side, if you had the same amount invested in an S and P 500 index fund, only $7, yes only $7 would leave your account annually. This is because index funds are passively managed , so you don't have to pay a manager who may or may not be doing their job.

For long-term investments, I like to use Vanguard index funds, which I love. It's easy to use. I am not affiliated with Vanguard in any way. I just love the way it works. I also like to mix it up a bit with some international funds and bonds to diversify my portfolio further. As you get older, I recommend you invest in more bonds.

And I don't mean the James Bond singer, although he's pretty cool. The investment method I put the majority of my money into is real estate. I'm much more of a real estate guy than a stock guy. I love real investments that I can feel and touch, but I appreciate that it can be difficult to buy real estate with little money, but it's definitely something you should save up for. My first place was a one bedroom apartment and I loved it. it was mine. It cost me about $50,000 , and when I moved out I decided to rent it for $500 a month.

I owned this property for about 10 years and when I sold it, I sold it for 150k and after that, I was obsessed with the money we could make from real estate. Now, this is a good time to determine what type of investor you are. The first type is the capital gains investor. This is the person who likes to buy low, sell high and pocket the difference. These are investors who are interested in buying auction houses or you may have seen outdoor advertising signs that we are buying your house for cash. They like to take advantage of situations where people want quick sales. They have them move into the house, and they do it and flip it for a profit. They have to keep repeating this process. This can work very well but is subject to market fluctuations on an annual basis. The second type is the cash flow investor. That's the kind of investor I like to think I am. I will never buy a property if the rent doesn't cover the mortgage. I like to follow the 1% rule which means if I buy a property for a hundred thousand dollars, then I at least want it to bring me a thousand dollars a month.

Otherwise, to be honest, I don't buy it. Now, let's talk about one of the riskiest options, individual stocks. I get asked about this type of investing every day and I understand why. Individual stocks are a very attractive option for many people. This is because with a small investment you can buy in the market and sell whenever you want. Unlike real estate where you have to find a buyer and do the entire selling process, with the click of a button, you have full access to your funds. When I was in my early 20s, I looked at a few different companies and invested $5,000 in stocks and individual stocks.

I'll tell you what, that was a lot of money for me in those days and in just six months though I made a profit of a hundred thousand dollars and with that , I could buy a huge warehouse that really pushed my business forward. Make sure you understand what you are investing in. I see a lot of people investing in stocks because their friends said they should. If you don't understand it, it's very simple, don't invest. I use two methods to value inventory. The first method is called quantitative analysis. Something that might surprise you is when you Google the stock price which is not the actual real value, it is more appreciative. I like to look at a company's quarterly earnings reports which include things like balance sheets, income and cash flows, to get a real kind of sense of the company's value. You can easily find this information on the Internet. The second method is called qualitative analysis. It's less about the actual numbers and more about the more abstract qualities that make a company great. A good example of this is Tesla.

There was something special about Tesla from CEO Elon Musk, to the raving fans who are his customers. I would also consider the future value of a company based on how its technology lives up to the modern world. I believe the transition to electric is inevitable and Tesla is at the forefront of this industry with the largest Supercharger network and product availability. If you decide to go the individual stock route, make sure you create a diversified portfolio, and don't use just one sector. You have to use different things like healthcare and technology and various different things.

You really don't want to leave yourself vulnerable to huge losses. If you're interested in this, I'll put some links below where you can find some really great books. You can do this on some great apps like M1 Finance, Robinhood, and if you're in the UK, you can use Freetrade. Personally, I like to have control over my investments and add value to them. I want to be able to see how my money is being spent and use my experience, and my contacts so I can sway the odds in my favor. This finally brings me to my own business investments. This allows me to blend stock buying with my own trading experience. Think Shark Tank and Dragon's Den, but on a much smaller scale.

I regularly receive messages about investment opportunities, and in exchange for my money and knowledge, they give me a stake in their business. Recently, one of my connections in China contacted me because he wanted to give me input on his new hotel business. This is me and him at the UK's largest independent hotel exhibition. He needed someone he could trust who understood business and also spoke English. He wanted me to help open doors and opportunities for him in the English speaking market. He flew me to China so we could inspect some of the supply chain and give me a good idea of what we could offer our potential customers. Now the nice thing is that I am expanding my house at the moment. So I was able to get all kinds of building materials and even a nice hot tub. She must be in her nice way. We'll have to make a video of there someday but I'm not sure you'll want to see that video.

It may be rated It can sometimes lead to free shares in another company. You will love this next video. I'll just leave it here but don't click on it now. You guessed it, destroy that like button. I really appreciate it. Finally, consider subscribing to the channel. If you are interested in increasing your income, I hope to see you in the next video. what are you waiting for? Just there. I'll see you later..

Read More

Why The 3 Fund Portfolio Is King

Jason 0 Comments Retire Wealthy Retirement Planning

– There's a very easy do it

yourself method to investing that not only out

performs the vast majority of retail and professional investors, but it also saves you a ton of time, energy and money along the way, and that investing method

is called, wait for it, the three fund portfolio. In this video I'll show you

what makes this way of investing so successful, the steps to properly create this portfolio in your account, which aren't always so obvious. I'll give you a list of the funds needed to create the portfolio, and then I'll show you the

actual historical returns based on a few back tested

three fund portfolios that I put together. If you get some value from this video, then please hit that thumbs up button. If not for me, then please

do it for my dog, Molly, because she's starring at me right now waiting for me to get done filming so that we can go outside and play. The three fund portfolio is made up of, you guessed it, three different funds. Nothing more and nothing less.

As with anything, you can

of course customize it beyond those three if you want, but the results may vary

based on how many shares of speculative investments that you decide to add beyond those three. The three types of funds consist of number one, a total U.S.

stock market index fund, which essentially holds every single stock traded on the stock market. We're talking small cap, mid cap, and large cap stocks, which makes up around

4,000 U.S.

Based companies. Number two, a total

international stock index fund that excludes stocks

that are headquartered within the United States. These are stocks that make up developed and emerging international economies, and are equal to roughly

7600 different stocks. And finally, a total U.S.

bond market index fund, which consists of a

mixture between maturities that are short,

intermediate and long term. In total, there's a little

over 10,000 of these.

When you own a total market index fund, you basically have money invested in essentially every single stock and bond traded on the stock market. Between these three funds, you'd hold a little more

than 21,500 different stocks and bonds across the world at the lowest cost possible. You're instantly diversifying your money by only having to worry about purchasing three different funds. As Jack Bogel, the guy

who introduced the first index fund to retail

investors like us once said "Why look for the needle," meaning those individual winning stocks, "when you can just buy

the whole haystack." By investing in these

three types of funds, there is zero overlap when it comes to stocks and bonds. Portfolio overlap happens when you invest in multiple funds that hold the exact same stocks, which in turn makes you less diversified than you might think you are. An easy way to remember this is when diversification decreases, your risk will increase.

Only having to own three

different investments sounds pretty simple, right? – Yep. – Like so simple that you

don't even need to pay one of those expensive

professional advisors- – What? – To pick your investments that will most likely underperform the market

in the long run, right? – Yep. – Did we just become best friends? – Do you wanna go do karate in the garage? – It's no secret that advisors

make money off of you, because that's how they get paid. And the amount that

they're paid comes directly from the returns of your investments. There's two main ways that

they make money off of you. Number one, by charging you

either an ongoing percentage based on your account balance, which I've seen on average is about 1%, or a flat fee no matter

the size of your account.

And/or number two, by

getting a cash kickback from the company that manages the fund they're having you invest in. I don't know if you caught that, but it sounds like there might be a little bit of a conflict of

interest for that one, right? Of course there is, but naturally they're gonna

try to hide that from you. If an investment advisor

told you to invest in the same three low cost

funds for the rest of your life, would you be willing to

pay them an ongoing 1% fee every single year? Would it be worth paying

them $20,000 in fees? Because if you invested $10,000 today, and paid them 1% per year for 30 years, then the total fees that you would pay from the annual fees plus

the opportunity cost, would add up to $19,800.

Now, let me put that in terms

that we can all understand. That equals $2,475 Chipotle burritos. Yes, you heard me correctly. You would pay more in fees

than that initial $10,000 that you invested. I don't know about you, but I wouldn't be willing to give up over 6.5 years worth of

daily Chipotle burritos for them to do something as simple as put me into a three fund portfolio. They wanna make it as

complicated as possible to make it appear like they're doing something

productive with your money by constantly fiddling with your portfolio to justify charging you 1%. If they knew that you knew that it was as easy as buying

three low cost index funds, then they'd be out of a job, which is why you most likely only hear this sort of good advice from a fiduciary financial advisor because they are legally obligated to act in your best interest. And the trust worthy ones

usually only charge a flat fee as opposed to an ongoing yearly fee. Not all non-fiduciary financial advisors are professional scumbags, but we do have to acknowledge the fact that their incentives aren't aligned with helping you make the

best investment decisions.

Investing in a three fund portfolio reduces the amount of time that you need to spend with

and pay a financial advisor whose goals aren't aligned with yours. But avoiding a shotty advisor isn't the only reason to

use a three fund portfolio. It's also a good way to avoid the risk that comes from an active fund manager that's handling how money's invested within a mutual fund that you invest in. Low cost total stock market index funds held within a three fund portfolio are passively managed funds, which means that they funds managers aren't choosing what

to buy, sell and hold.

Actively managed funds on the other hand, are run by people who

are choosing which stocks to buy, sell and hold. To successfully pick the right stock combo to outperform a basic total

stock market index fund, these fund managers need

to have some level of skill to achieve that out performance. But time after time the data shows that it's nearly impossible

to successfully do this over long periods of time. The hot fund manager

everyone talks about today turns out to be the loser of tomorrow that everyone eventually forgets about. In a paper published in

the journal of finance called luck versus skill in the cross section

of mutual fund returns, Fama and French found

that "On a practical level "our results on long term performance "say that true out performance "and net returns to investors "is negative for most if

not all active funds." In the paper they did admit that when returns are

measured before costs and expense ratios there

is stronger evidence of manager skill, but this is irrelevant though because you're not

getting into these funds without paying a fee.

It's like saying I have this

awesome new electric car but there's nowhere for

me to charge the thing so I can't really turn it on and drive it. All I can do is look at it. – Look at that, that's nice and shiny. – Which brings up another advantage that the three fund portfolio has. The three index funds

that make up the portfolio are extremely low cost. The price for each can

vary from fund to fund, which we'll cover in just a minute, but compared to most

other funds out there, they're the lowest since

they're passively managed. For example, the Vanguard ETF versions have an expense ratio of 0.03%, 0.08% and 0.035%.

That means for every $10,000 invested you're paying an expense of $3, $8 and $3.50 per year. A study from the Financial

Research Corporation called Predicting Mutual Fund Performance set out to determine

if there were any ways to predict the future

performance of a mutual fund. They tested 10 different predictors like past performance,

morning star ratings, expenses, turn over, manager tenure, asset size and a few more things. They came to the conclusion

that the best way to reliably predict the

future performance of funds was by looking at the expense ratio and nothing else.

They call a favorable expense ratio an exceptional predictor for bonds, and a good predictor for stock funds. Based on this research, if you wanna pick a successful fund, then ignore everything else, and just look for the one with the lowest expense ratio. And lucky for the three fund portfolio, those three total stock market index funds are about as low cost as they get. Hang tight because I did

all of the legwork for you by putting together a list of the exact tickers

that you might wanna use. I'll cover those in just a minute. It was cold in here, and now it's hot, so the jacket had to come off. When it's all said and done, the biggest selling point of a three fund portfolio

is that it's just easy.

Literally dummy proof. Contributing money to

your investment account on a regular basis, and spreading that money among

only three funds is easy. Rebalancing once per year

across only three funds is easy. When it comes to withdrawing

money when you're older, you only have to pick between

three funds to sell off, which is easy. When choosing what to invest in, you only have three funds to worry about, which is easy. Investing isn't complicated at all, but for some reason we

like to make it out to be more than it actually is. There is zero correlation between spending a bunch of time trying to pick stocks or mutual funds, or spending a bunch of

money on an advisor, and an increase in your

investment returns. Successful investing has more

to do with your psychology than anything. Stick with the three

fund portfolio process, and get on with living your life because the returns will

take care of themselves. The first step in building

your three fund portfolio will be to choose the three

funds that you'd wanna use. Here's a list of the exact

funds that you'd wanna hold deponing on which investing

platform that you use.

All you do is choose one

from the total U.S. funds, one of the total international funds, and one of the total U.S. bond funds. Side note, if you're

building this portfolio within a 401k, then you might not have access to a total

U.S. stock market fund. Now if that's the case, then you should have access to some sort of S&P 500 fund, which you can substitute in its place. You don't have to, but I'd suggest choosing

funds from the same row just to make things a lot easier for you.

As you can see, all

the funds are exclusive to their respective investing platforms except for the Vanguard ETF versions. Those Vanguard ETF's can be purchased on any investment platform, which is why they're my number one choice. To the far left, you can also see that I've ranked each three fund mix. I did that because the more

that I looked into each one, the more I realized that they

are not all created equally. Even though the expense

ratios for each fund within a category is

going to be different, they're not far off enough

to where I'd steer you away from any of them.

The issue I have is that

when the name of a fund says total U.S. stock market index, I would assume that the fund would hold literally every

single stock on the U.S. market. The same goes for the total international and total bond index as well. But the more I started

to look into each one, the more I realized that

that's far from accurate. Most of these funds do not actually hold, quote, unquote, everything. Here's the same list, and next to each ticker symbol I have how many stocks or bonds are held within each one. Based on this info, the only true U.S.

Stock,

international stock, and bond funds are the

ones offered by Vanguard. That's not to say that you

should avoid any of the others, but it's something to be aware of. The returns will most likely be pretty close between all of them, but if you wanna get the closest return to the market as possible, then go with the Vanguard funds. Once again, the good news is

that with the Vanguard ETFs, they can be purchased on any

investment platform out there. The next step will be to

choose an asset allocation. Meaning out of 100%, how

much should go towards each of the three funds. This is quite possibly the

most important decision that you'll have to

make, so pay attention, because it's going to have a direct impact on your expected return and risk level. The more risk you wanna take, for example, the more stocks and less bonds that you wanna hold, the higher expected return. The inverse is also true. So the less risk that you wanna take, i.e., the more bonds and less stocks, the lower expected return. Here's a chart I put together showing you how different stock and bond allocations would have performed over the past 34 years.

On the first line, the 0% stock and 100% bond allocation would have only netted you an average of 5.73% annual return. During the worst year, you would have only lost 2.66%, with a max draw down of 5.96%. On the last line, I tested a 100% stock and 0% bond allocation for 34 years. It gave us an average annual return of basically 10%. But, and this is a big but, you would have had to been able to handle a worst year

return of negative 38%, and a max draw down of negative 52%. That means that if you had

a million dollar portfolio, and you were 100% in stocks, that at one point you would have been down $520,000, and your three fund portfolio

would be worth $480,000. Yes, of course your investments

eventually recovered, but you need to ask yourself if you could handle that kind

of draw down on your portfolio and not panic sell. That point when the portfolio was down 52% was the housing market crash, which started towards the end of 2007. There were a lot of

unknowns during that time. And looking back on it now, we know how things played out. But if you were in the middle of it, then you had zero clue if the whole financial

system was going to crash.

To make things even worse, your portfolio during that time would have been under water for a little over five

years and two months. Let me say that again in a different way. It would have taken your portfolio 1,885 days to fully recover from that $520,000 loss. So you need to ask yourself

could you handle not selling and continuing to invest during that time if you were invested in 100% stocks, because to get that 10%

average annual return over those 34 years, you would have had to of not sold, and continued to invest

money every single month, even when it looked like

there wasn't any light at the end of that tunnel.

That's one of the prices

that you have to pay for that higher average annual return. Always keep that in mind. And I didn't even put in here data of other times it crashed too because that wasn't the only time. There was another time

where I think it was down 43% or 48% as well. Based on the odds and history, we know that it's likely

your portfolio will tank, potentially like that, at some point between now and when you disappear from this earth.

If you want your money to

grow in a meaningful way, then you have to have a decent amount of your money invested into stocks, which means that times like these are going to hurt no matter what. If you don't think that you can handle huge swings like that, but still wanna give your money a fighting chance to grow, then start with a five,

10 or 20% bond allocation within your three fund portfolio. You're also going to

wanna continue investing even when times look really, really ugly in the economy and the stock market. When it comes to how much to put towards international stocks, this is a tricky one that's been debated so many times. And because of that I

refer back to Jack Bogel, the founder of Vanguard on this one. For a long time he was completely against allocating any money towards

international stocks. His thought process was

that if you already own a total U.S. stock market index, then you naturally have exposure

to international markets because a lot of those corporations do a ton of business overseas. But as time went on he changed

his stance a little bit.

He ended up saying that he would be fine if someone held anywhere between 0% and 20% of their portfolio in international stocks. So do what you want with that info. If you're really not sure, then start out with something

like 10% in international, and then adjust it up or down from there. When it comes to

rebalancing your portfolio to get your allocations back

to where they should be, I would only plan on

doing that once per year. Don't worry about doing

it any more than that. One of my favorite investing

platforms that I use, and I love that makes the whole three fund portfolio investing a lot easier is M1 Finance.

I'll have a link in the description of this video to check them out, and also get a free $30 from them. Now it's time to implement

this strategy for yourself. If you have any additional questions beyond what I've covered so far, please leave them down

in the comments below, and I will try to answer every

single one of them for you. But there's two things that I really need to

stress to you though.

Number one, it is extremely important to invest money into