Tag: retirement planning at 50

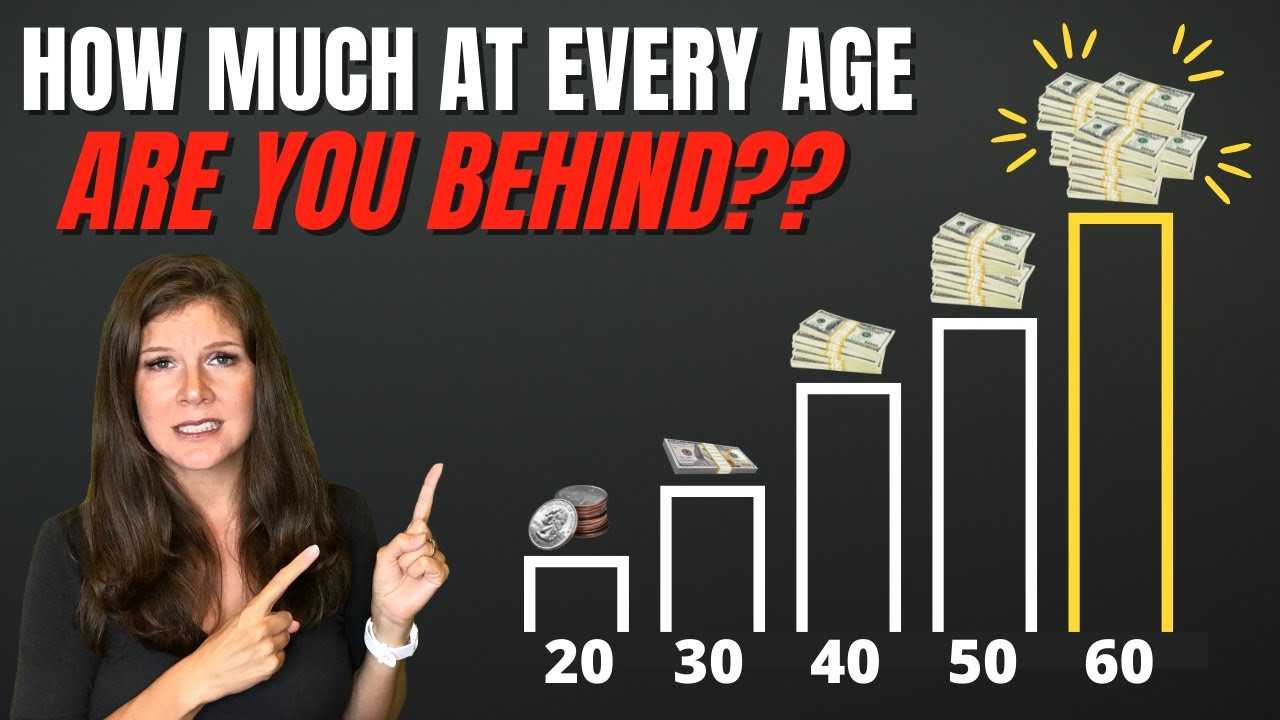

How Much Money You Should Have Saved At Every Age | Retirement Savings By Age

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

hey everyone this is lauren mack with hack in the rat race when it comes to retirement and strategies for saving for retirement people often ask how much money should i have saved at every age in order to reach my retirement goals this can be a very difficult question to answer because so much depends on one's lifestyle age in which they want to retire goals during retirement and so on in this video i'm going to talk about how much money you should have saved at every age for a typical american planning for retirement if you stay until the end of this video i am going to share with you a tip that you might be able to use in order to dramatically reduce the amount of savings you will need in retirement and possibly reduce the amount of time you'll have to work in order to get there additionally if you watch this video and think you're behind or maybe you haven't even started saving then i have created a workbook called from xero to retirement which walks you step by step through getting your finances in order and saving for retirement i'll put a link to it in the show notes below so let's jump right in the key to having enough money to live comfortably in retirement is to start saving as early as possible this means starting in your 20s most people in their 20s are just embarking on their careers whether that's freelancing in the digital economy starting a business entering a trade or finishing up college and starting a career either way people in their 20s usually have very little save for retirement and more often not can find themselves in debt due to school loans training startup costs or even entering the workforce and that is okay if you happen to be someone in your twenties who has managed to avoid debt and have money saved then congratulations you are ahead of the curve the best piece of financial advice i could give someone in their 20s is to start creating good financial habits while in your 20s because it will be a tremendous benefit throughout your life at this age there really is no specific amount that you should have saved although the more the better i usually recommend that if you're in your 20s you should at least have an emergency fund of one to two months worth of expenses saved up the reason having an emergency fund is that it can help you avoid falling into the debt trap i actually recommend that people of all ages have an emergency fund set aside that is easily accessible in cash so this is a good habit to begin early speaking of debt many people in their 20s are fresh out of school finally making some good money and it can be very tempting to rush out and finance and purchase a fancy car maybe some designer clothes or even a sweet bachelor pad but avoid the temptation to do that of course when you're just starting out there are necessities such as getting a car to get you to work or maybe suitable clothing for work however it's important to try not to live beyond your means or max out your credit cards many times when you do get your first job one of the benefits offered to employees is a company sponsored retirement account like a 401k oftentimes the company match meaning to a certain percentage the company will match the amount you put in so if the company match is 5 then if you put in 5 they will match your 5 i always recommend signing up for a corporate sponsor retirement account in my videos and i always suggest contributing at least up to what the company will match because this is like getting free money and it's considered part of your compensation package what if you work for yourself as a freelancer entrepreneur or work for a company that simply doesn't offer a retirement account then i recommend opening an ira or roth ira and contributing to the annual maximum limit ira stands for individual retirement account if you want to learn more about the difference between 401ks iras and raw diaries i created a video called roth ira versus traditional ira versus 401k i'll link to it above and in the show notes below to sum it up life in your 20s should be all about establishing good money habits make sure you have an emergency fund of at least one to two months of expenses three to six months would be ideal set up a retirement account either through an employer-sponsored 401k or your own ira or roth ira and lastly make sure to avoid the debt trap live within your means the more you can start investing early on as possible the sooner you'll be able to retire so now let's talk about your 30s by now you've most likely been in the workforce for a while and hopefully things are progressing well with your chosen occupation many experts recommend by the time you reach 30 years old you should have one year of salary saved up so for example if your annual salary is fifty thousand dollars a year then you should have fifty 000 saved up and invested this amount of savings should be in addition to the three to six months of savings that should be tucked away in your emergency fund in order to protect you from falling into the debt trap because of job loss medical bills car repair speaking of debt by the time you reach 30 you really should try to eliminate what i consider bad debt some examples of these are credit card debt car loans student loans etc paying on these types of debt each and every month prevents you from investing the difference and limits your ability to further invest and contribute to grow your nest egg as you saw in the earlier example in your 30s it can be tempting to keep up with joneses and live beyond your means many of your friends and acquaintances will take out large loans to buy an expensive home they'll borrow large sums of money in order to buy a luxury automobile in order to give the illusion of wealth avoid falling into this trap and feel tempted to compete with these people by making the same mistakes 98 of the time these wealthy people are actually highly leveraged and truly broke the best way to get out of the rat race meet your retirement goals and even retire early and wealthy is to live frugally and within your means okay so now you've reached 40 and you've managed to not succumb to the debt trap that so many people fall into in their 30s you should be more financially stable than you were in your 30s so how much should you have saved for retirement by now well most experts recommend that you have three times your annual salary saved up so for example if you make sixty thousand dollars a year you should have a hundred and eighty thousand dollars saved up and invested in addition to this should be maxing out your contributions to your retirement account that we've been talking about that is really important not only to help grow your investment but contributions to your retirement account can decrease your overall tax liability it is also a good idea at 40 to buy a house home ownership is really important because home values tend to rise over time if you buy a home at age 40 with a 30-year mortgage and make all your payments your home will be paid off by the time you're 70 and you've reached retirement therefore reducing housing expenses in retirement once your home is paid off then it becomes an asset this also gives you the option of selling it once you reach retirement downsizing paying cash for a new property that's worth less than the value of your home therefore giving you the extra cash to help you pay for your retirement another benefit of owning a home or rental properties is leverage which is the mortgage if you put twenty thousand dollars down on two hundred fifty thousand dollar house and the value rises ten percent then your returns twenty 25 000 instead a 10 return on 20 000 is 2 000 as you reach 50 years old many people are well established in their career and hopefully have managed to get a few raises over the years and are now making even more money at this point you should save around five times your annual salary so if you make sixty thousand dollars a year then you should have three hundred thousand dollars saved for retirement you should really be noticing the compound interest effects now due to all that diligent savings over the years once you turn 50 years old the irs allows you to start making catch-up contributions to your retirement accounts which means you're allowed to contribute higher limits to the annual contributions so you should be taking advantage of this in order to grow your retirement account quicker and also reduce your overall tax liability another recommendation at this age is to continue to remain debt free live frugally and continue to pay down your mortgage by age 60 now you're getting close to retirement by this age it is recommended to have seven to eight times your annual salary saved up so if you make sixty thousand dollars a year then you should have four hundred and eighty thousand dollars saved for retirement you're probably debt free now and really enjoying watching your savings and investments grow at this point it might be tempting to start dipping into your retirement savings however avoid doing this keep up the study savings pace many people are still working and earning great incomes in their 60s and can really boost their retirement accounts if they have fallen behind in the early years hopefully by now your home is either paid off or close to being paid off which should give you peace of mind as of now you should be eligible for social security benefits but you might want to put that off as long as possible to be able to receive the maximum amount of money you can go to the social security website they have a form where you can enter your information and it will give you estimates of what to expect at different ages i'll put a link to it in the show notes below you'll be able to determine at what point it makes sense to take it out and how much will be added for waiting and if you're just starting out saving for retirement and you're still relatively young don't assume you will have social security benefits when you reach your 60s or 70s many experts debate whether they'll actually be enough money to pay out those benefits in the future now for the bonus tip like i said at the beginning of this video having enough money for retirement depends mostly on your lifestyle cost of living and retirement in america however these days more and more people are choosing to retire outside the united states where the cost of living is dramatically less and they can have a much better standard of living for substantially cheaper than the us the thought of retiring abroad might sound frightening to some people and i get it but i have traveled to over 58 countries and lived all over the world and i can tell you that you might be quite surprised retiring abroad is not unusual in fact many americans choose to either retire early to stretch their retirement savings even further by joining the ever growing list of american expats who are deciding to retire abroad many countries around the world entice retirees by offering retirement visas to come spend their golden years enjoying the beaches golf courses and laid-back lifestyle in their country i personally know so many people who have chosen this option and none of them have regretted it you're probably thinking oh lauren what about the health care overseas it cannot be as good as the u.s well my husband and i have received medical care in numerous countries all over the world including emergency surgeries from countries in southeast asia south america mexico europe and i can tell you that every time we receive medical care it has been as good or better than the care we received in america and the bill was certainly much less expensive if this sounds appealing to you then take a few scouting trips to some countries where you think you may want to live and spend some time checking it out and meeting up with some expats that live there to get their impression of what it's like to retire abroad in the country that you're considering now i want to hear from you in the comments section would you like me to do a video on retiring abroad have you been considering moving abroad to retire if so where let me know in the comments below if you're watching this video and you're thinking lauren i am so far behind or i haven't even started is it too late then watch this video right here

The Psychology Of Retirement: Transitioning Effectively

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

Okay, before we go anywhere in a discussion of moving from permanent employee to permanent retiree, allow'' s speak regarding these two words and define them a little bit extra, modifications and also transitions.Changes are external,

they ' re contextual, and also'they ' re public, whereas shifts are interior, they ' re private, and they ' re mental. We ' re going to have to discover methods to maintain our mind going, and also I ' m not just chatting about doing crossword problems. Several of us put on ' t recognize exactly how to do that so I ' ve produced this roadmap to lead you through.

Okay, prior to we go anywhere in a discussion of relocating from permanent employee to full time retiree, allow'' s speak regarding these two words and also define them a little bit much more, changes as well as transitions.Changes are outside,

they ' re contextual, as well as'they ' re public, whereas changes are interior, they ' re exclusive, and they ' re mental. Possibly there ' s an enthusiasm project you ' ve always desired to obtain to. You desire to take your career to the following degree and also not completely retire, however do some kind of work that ' s related to what you ' ve done previously, or perhaps also take up that interest job. Many of us put on ' t recognize exactly how to do that so I ' ve produced this roadmap to direct you via. The web link for that document, it ' s a PDF and also it ' s your own for the download, is appropriate beneath this video.

Read MoreHow Much Money You Should Have Saved At Every Age | Retirement Savings By Age

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

hi everybody this is lauren mack with hack in the daily grind when it pertains to retirement and also methods for conserving for retired life individuals usually ask just how much cash ought to i have conserved at every age in order to reach my retired life objectives this can be a really difficult question to respond to due to the fact that a lot depends upon one'' s lifestyle age in which they intend to retire goals during retirement as well as so on in this video i'' m going to chat regarding just how much money you should have conserved at every age for a common american planning for retirement if you stay till completion of this video clip i am going to share with you a tip that you may be able to utilize in order to substantially decrease the quantity of cost savings you will certainly require in retired life and possibly decrease the amount of time you'' ll have to work in order to get there additionally if you view this video clip and assume you'' re behind or maybe you haven'' t also began conserving then i have developed a workbook called from xero to retirement which walks you step by step via obtaining your financial resources in order and also conserving for retirement i'' ll placed a web link to it in the show keeps in mind listed below so allow'' s jump right in the trick to having enough cash to live easily in retirement is to start conserving as early as possible this means starting in your 20s lots of people in their 20s are simply starting their jobs whether that'' s freelancing in the electronic economic situation starting a company going into a trade or finishing up university as well as starting a career either means people in their 20s usually have very little save for retirement and regularly not can discover themselves in debt due to institution loans educating start-up costs and even going into the workforce which is okay if you happen to be somebody in your twenties who has managed to avoid financial debt and also have cash saved after that congratulations you lead the curve the very best item of economic suggestions i could provide someone in their 20s is to start developing good financial behaviors while in your 20s due to the fact that it will be an incredible advantage throughout your life at this age there actually is no specific amount that you ought to have saved although the much more the much better i normally advise that if you'' re in your 20s you should at the very least have an emergency fund of one to two months well worth of expenses conserved up the reason having a reserve is that it can help you avoid falling into the debt trap i in fact recommend that individuals of every ages have a reserve reserved that is quickly obtainable in cash so this is a great habit to begin very early talking financial obligation several people in their 20s are fresh out of school finally making some great money and also it can be very alluring to hurry out as well as finance and buy an expensive automobile possibly some designer clothing or also a sweet bachelor pad but prevent the temptation to do that of course when you'' re simply starting out there are requirements such as getting a cars and truck to get you to function or possibly appropriate apparel for work nonetheless it'' s important to attempt not to live past your methods or max out your credit score cards lot of times when you do get your initial task among the benefits used to staff members is a company sponsored pension like a 401k often the business match suggesting to a specific percent the company will match the amount you place in so if the firm suit is 5 then if you place in 5 they will match your 5 i always recommend enrolling in a company enroller retirement account in my videos as well as i always recommend adding at the very least approximately what the firm will match because this is like getting totally free cash and it'' s considered part of your payment bundle what happens if you function for yourself as a consultant entrepreneur or help a firm that just doesn'' t supply a pension after that i suggest opening up an ira or roth ira and adding to the annual maximum restriction individual retirement account represents specific retirement account if you wish to find out more about the difference between 401ks iras and raw diaries i developed a video called roth ira versus typical ira versus 401k i'' ll link to it above and also in the show notes listed below to sum it up life in your 20s ought to be all regarding developing great money behaviors see to it you have an emergency situation fund of at the very least one to 2 months of costs three to 6 months would certainly be perfect established a retirement account either through an employer-sponsored 401k or your very own individual retirement account or roth individual retirement account and finally ensure to stay clear of the financial obligation trap live within your ways the more you can start investing early on as feasible the faster you'' ll be able to retire so currently let ' s discuss your 30s now you'' ve more than likely remained in the workforce for some time and also with any luck points are proceeding well with your picked profession lots of experts suggest by the time you reach thirty years old you must have one year of salary saved up so for example if your yearly income is fifty thousand bucks a year then you must have fifty 000 saved up as well as invested this amount of financial savings should remain in addition to the 3 to 6 months of savings that need to be stashed in your reserve in order to safeguard you from dropping into the financial debt catch since of job loss clinical costs automobile repair service talking financial debt by the time you reach 30 you really ought to attempt to eliminate what i think about uncollectable loan some instances of these are credit report card financial obligation cars and truck loans student finances and so on paying on these kinds of debt every month stops you from spending the difference and limits your capability to additional invest and add to expand your nest egg as you saw in the earlier instance in your 30s it can be tempting to stay up to date with joneses and also live past your methods most of your friends and acquaintances will secure huge lendings to get an expensive home they'' ll obtain large amounts of money in order to purchase a luxury automobile in order to give the illusion of riches stay clear of falling into this catch and also feel attracted to take on these individuals by making the same blunders 98 of the time these rich people are in fact highly leveraged and truly damaged the very best method to obtain out of the daily grind fulfill your retired life objectives as well as also retire early and rich is to live frugally and within your methods fine so currently you'' ve got to 40 and also you ' ve handled to not surrender to the debt catch that many people fall right into in their 30s you must be extra monetarily secure than you remained in your 30s so just how much ought to you have saved for retirement now well most professionals advise that you have three times your yearly wage conserved up so for instance if you make sixty thousand dollars a year you should have a hundred and eighty thousand dollars conserved up and purchased addition to this must be maxing out your payments to your pension that we'' ve been chatting regarding that is truly crucial not just to assist grow your financial investment but payments to your pension can lower your general tax obligation obligation it is also a great concept at 40 to acquire a house residence possession is actually vital since house values tend to increase in time if you purchase a house at age 40 with a 30-year home loan as well as make all your payments your residence will be settled by the time you'' re 70 as well as you ' ve reached retirement therefore reducing real estate costs in retired life as soon as your residence is settled then it becomes a possession this also gives you the alternative of marketing it once you reach retirement downsizing paying money for a brand-new residential or commercial property that'' s worth much less than the value of your residence for that reason offering you the extra cash to help you pay for your retired life an additional benefit of having a residence or rental residential properties is leverage which is the mortgage if you place twenty thousand dollars down on 2 hundred fifty thousand buck home as well as the value increases ten percent after that your returns twenty 25 000 instead a 10 return on 20 000 is 2 000 as you reach half a century old many individuals are well established in their job as well as ideally have procured a few elevates throughout the years and also are currently making also more money at this moment you must save around five times your yearly wage so if you make sixty thousand bucks a year after that you need to have three hundred thousand dollars saved for retirement you ought to truly be noticing the substance passion effects now because of all that persistent cost savings throughout the years when you turn 50 years old the irs allows you to start making catch-up contributions to your retirement accounts which implies you'' re enabled to contribute greater limitations to the yearly contributions so you must be making use of this in order to grow your retirement account quicker and likewise minimize your general tax obligation liability one more suggestion at this age is to remain to continue to be financial debt free real-time frugally and also remain to pay down your mortgage by age 60 now you'' re obtaining near retired life by this age it is suggested to have seven to 8 times your annual salary saved up so if you make sixty thousand bucks a year then you should have 4 hundred and also eighty thousand dollars saved for retirement you'' re most likely financial obligation complimentary currently and actually appreciating viewing your cost savings as well as financial investments expand at this factor it could be alluring to begin dipping right into your retirement cost savings nonetheless avoid doing this maintain up the research study savings pace many individuals are still working as well as gaining excellent earnings in their 60s and can truly improve their pension if they have actually fallen back in the early years with any luck now your home is either settled or near to being paid off which should give you peace of mind as of currently you ought to be qualified for social security advantages however you could intend to place that off as long as possible to be able to get the maximum amount of cash you can go to the social security website they have a kind where you can enter your details as well as it will certainly provide you estimates of what to expect at different ages i'' ll put a link to it in the program keeps in mind listed below you'' ll be able to establish at what factor it makes sense to take it out as well as just how much will be added for waiting as well as if you'' re just starting saving for retired life and also you'' re still reasonably young don'' t assume you will have social protection advantages when you reach your 60s or 70s numerous experts dispute whether they'' ll in fact be sufficient cash to pay out those benefits in the future now for the benefit pointer like i stated at the beginning of this video having sufficient cash for retirement depends mostly on your way of living cost of living and also retirement in america nonetheless these days a growing number of individuals are selecting to retire outside the united states where the expense of living is considerably much less as well as they can have a better criterion of living for considerably more affordable than the us the idea of retiring abroad could appear frightening to some people and also i obtain it however i have traveled to over 58 countries and also lived throughout the globe and i can tell you that you may be fairly stunned retiring abroad is not uncommon in reality many americans choose to either retire very early to stretch their retired life savings even further by joining the ever before expanding list of american expats who are deciding to retire abroad lots of countries worldwide tempt senior citizens by providing retired life visas to come invest their gold years delighting in the beaches golf links and also laid-back way of life in their nation i directly know many people that have actually selected this option as well as none of them have actually regretted it you'' re most likely assuming oh lauren what about the healthcare overseas it can not be just as good as the u.s well my spouse as well as i have received treatment in numerous countries all over the world consisting of emergency situation surgeries from countries in southeast asia south america mexico europe as well as i can tell you that every time we receive healthcare it has actually been as good or much better than the care we received in america as well as the costs was definitely much more economical if this seems enticing to you after that take a couple of hunting journeys to some nations where you think you may intend to live as well as invest time inspecting it out and fulfilling up with some expats that live there to obtain their perception of what it'' s like to retire abroad in the nation that you'' re taking into consideration currently i want to learn through you in the remarks section would you like me to do a video on retiring abroad have you been considering moving abroad to retire if so where let me know in the comments listed below if you'' re watching this video clip as well as you'' re assuming lauren i am so much behind or i haven'' t even started is it too late after that watch this video clip right here

Retirement Planning During Bear Markets – Especially if It’s Your First One In Retirement

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

bearish market can really feel a whole lot different when you'' re retired and also you ' re no longer earning revenue from work especially if this is your first bearish market considering that you stopped functioning when you were younger you recognize you had time on your side you understand you may have even seen declines in the market as an opportunity since it offered you added time as well as you got to acquire more shares well points got on sale in a manner of speaking today probably that'' s not the situation the relationship in between our money and also our accounts currently are of money going out versus cash entering to put it just and plus you may have seen that there'' s this psychological component now around cash and not wanting to mess things up due to the fact that the decisions we make really lugged far more weight now when we'' re close to or in retirement as well as it ' s actually that ' s not only psychological or emotional it'' s real since preparing the distributions is far more complex than the the planning around around saving and putting cash right into the investment accounts what resulted in our financial investment success the last thirty years is a lot different than what'' s going to lead to success the next 20 or three decades or finally that'' s at the very least what we ' ve been seeing at simplify Monetary since 1998 given that we ' ve been around so I want to share just how to withstand with bad markets if you'' re near to retired life or you ' re already retired and after that what you can do to in fact make use of of this even if you'' re currently retired and also you'' re no more saving cash as well as we'' re mosting likely to do that due to the fact that we understand an universal regulation of physics that can'' t be disproven and we can in fact use it to our retired life and make it a bit better if you'' re thinking Dave what the heck are you speaking about below'' s a short description so Newton'' s third regulation of motion is that every activity there'' s an equal as well as opposite response right you'' ve heard that in the past so the manner in which I see it exists'' s a favorable to every unfavorable and also the exact same point there'' s an adverse to every favorable it'' s the regulation of polarity so I intend to share what the positive is to benefit from during negative markets and incidentally if I sanctuary'' t satisfied you yet I ' m Dave zoller and also Tim and also Luke as well as I and Sean we run enhance Financial it'' s a retirement planning firm and also we ' ve been around like I had actually stated considering that 98 so we'' ve seen clients actually go through it all the.com bust the financial situation and also then wish for and after that all things in between all those uh you know those mini worries that we'' ve had so we produced this channel to share what'' s working and also what has actually benefited them therefore that you can hopefully glean some wisdom from them and after that apply it to your your very own life so the initial point we require to be knowledgeable about is that the previous thirty years there were four bear Market Modifications to make sure that'' s a decrease of 20 or more and afterwards the three decades before that there was an overall of 5 bearish market Adjustments so the main takeaway is we require to anticipate these bear markets to take place throughout our retirement throughout that following 20 thirty years right the 2nd thing is we don'' t wish to make a modification only on a feeling right as well as it'' s not not simply making an extreme modification like selling every little thing as well as putting every little thing under the mattress right it'' s we were simply speaking with someone yesterday and also feelings can create us not to take an action when we recognize doing so is really the Smart Financial thing to do as an example throughout March of 2020 when it wasn'' t very easy to rebalance your accounts it was extremely hard to do however if you did follow through and also as well as do the right rebalancing system or technique if you were recalling now it can have made a great deal of sense the 3rd thing is upgrade your revenue plan since that helps assist us and make truly excellent preparation choices around our financial investment strategy so it'' s really start with the revenue plan you ' ve heard that before which aids us make the investment choices versus the various other means around as well as upgrading your revenue strategy during bad markets that can additionally offer you some confidence in addition to you'' re checking out where we are today and afterwards considering over the next couple of years and as well as seeing that points possibly aren'' t as negative as it might seem at least when you ' ve got those two points of the unidentified and also then the known updating the plan is the well-known as well as you can obtain a little better image on what the future might appear like for you currently to the 2 things that perhaps might offer us a benefit throughout a time such as this this is back to the regulation of polarity so the feasible points that we could be able to make use of right here are well very first prior to I say it as always this is general advice to you so we'' re not looking at your your plan together so before you do anything simply speak with an economic professional yet idea top to think of is tax loss gathering that might be a way to cross out some of the losses while still maintaining your investment approach undamaged as well as I speak about this principle a whole lot much more in other videos so I'' m not going to go into information on it today however simply maintain that in mind the one point to to really take notice of though when we'' re we ' re speaking about the law or chatting regarding tax loss harvesting is that clean sale rule right so seek the various other videos or talk to that Monetary expert before thinking of doing that the second point that can be a possible chance for truly the very first time in an extremely long time is that capacity or choice to secure higher returns in that conservative container as you recognize the the bucket technique you'' ve seen that before where we'' ve obtained the feasible 3 pails as well as having that conventional container here is a fantastic means to plan and prepare for for bad markets as well as currently at the time of this recording a few of those historically traditional possession courses are paying a higher passion a higher yield than what we'' ve seen truly over the last decade which could be a silver cellular lining during this time period so those are just 2 points feasible points to consider which perhaps could be capitalized on by you for for your advantage so those are simply 2 points to consider during this time period that we'' re in now if that short video clip was handy please such as this and after that share it with others if you think it might assist them as well as well as if you'' d like to chat more regarding your plan feel complimentary to connect to me in the in the description below or go to our web site streamlinedplanning.com for get you click the get going button we put on'' t constantly have space readily available however you'' ll hear back from me in either case so I really hope that was handy and afterwards I'' ll see you in the following video clip

Retirement Planning in Your 50s and Beyond

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

Your 50s are an outstanding time to buckle down

regarding retired life planning, as well as that'' s because now in your life, you may have figured

a number of points out. You may have a decent idea of where you

invest cash, what your preferences are, the points you don'' t look after so much, and also you

Possibly you'' ve paid off a whole lot of financial debt possibly.

your knees didn'' t hurt as much.For typical as well as Roth IRAs, for 2022 that. number is a thousand bucks of added catch-up contributions. Certainly, this is thinking that you have.

the cash money circulation to make the maximum contribution and also put the catch-up contribution in addition to.

that, and also if you don'' t', that ' s alright, it ' s not feasible for everyone, just do what you. can. If you are truly attempting to maximize your.

account equilibriums at retired life, those catch ups are a powerful device. The next thing to do is to check out your Social.

It'' s an excellent time to begin obtaining

a realisticReasonable If you'' re eligible for Social Protection, you ' ll. You may be able to obtain some.

be able to get income on your partner'' s incomes record if you are still wed as well as there,.

are some approaches you'' ll intend to look at as you go via that procedure. By the means, I'' m Justin Pritchard, and i aid.

individuals prepare for retirement as well as invest for the future. There will certainly be some resources down in the.

summary below that cover this in even more detail and also offer you some other pointers. An additional wise step is to handle your financial debts.

or make a technique for them.So, if you have consumer debts like credit rating.

cards for example, you most definitely wish to intend to remove those financial obligations and also make certain.

that your spending stays within your earnings limitations to ensure that you'' re not digging yourself.

A mortgage. There'' s a whole lot of advantage to being debt-free.

and also not having a home mortgage settlement when you'' re in retired life a great deal of individuals really concentrate. on getting rid of that financing prior to their retirement date however it'' s not always the end of the. globe to have a mortgage in retirement, as well as paying it off swiftly out of your retirement.

funds can create some troubles. As long as you can fit that month-to-month payment.

right into your earnings possibly that'' s your Social Protection, pensions, and also some withdrawals from.

interest-bearing accounts, as well as you can handle that financial obligation pleasantly, however, it'' s not

the. end of the globe, and keep in mind that that car loan settlement will at some point disappear sooner or later which.

Well, that ' s something to begin figuring out.

above will certainly provide you some reminders on that particular yet essentially you can consider your costs.

today as well as perhaps adjust that for rising cost of living or you could look at an earnings substitute.

ratio and also claim possibly I simply need 80 percent of what I'' m gaining now that may or might. not be appropriate for you or you can target a particular level of investing such as $50 or $100,000.

whatever the instance might be, and also with those numbers you can establish a goal to begin heading for when.

you have a concept of your investing and also your retired life income sources and also your assets.

then you can run some estimations and also once more we'' re establishing your expectations to ensure that you.

understand if you'' re on course or otherwise as well as this can inform you to some possible deficiencies or.

possibly let you recognize if you might retire earlier than possibly you anticipated there are a great deal of.

valuable on-line calculators available they can do a respectable work of obtaining you in the.

ballpark however ensure you comprehend what their constraints may be so they put on'' t necessarily. get extremely thorough as well as you might not have the ability to adjust all of the assumptions yet once more.

you can get some fundamental suggestions of if you'' re kind of close or if you'' re way off on what.

you anticipated an additional excellent relocate your 50s is to fine-tune your financial investment strategy so up.

to this factor you may have been doing some fantastic points to obtain you to the factor where.

you are you'' ve accumulated some wonderful properties yet if you'' ve been utilizing high risk techniques.

maybe hypothesizing perhaps day trading that type of point it'' s time to ask on your own if that ' s. something that you want to continue doing at this stage in life it is difficult to continually.

get excellent results with those high risk approaches and also you may have even more to lose now than you.

did previously.I ' m not stating

you can ' t do it or absolutely. don ' t do it but I would certainly claim wage extreme caution and also possibly simply claim hey I'' ve done a.

excellent task as much as this factor possibly I'' ll reevaluate what I'' m going to do moving forward.'At 50 it ' s time to start believing regarding long-term.

care if you sanctuary'' t currently been believing about it there'' s a 70 percent chance that.

you might require some sort of long-term treatment which may include everything from someone.

aiding you out in your home possibly this is a loved one presuming you have someone at residence that.

wants and able and remember maybe literally as well as psychologically tough and also.

it might call for competence but it could consist of somebody aiding you out at house who you recognize.

or you entering into a knowledgeable nursing center and also paying those greater costs that are associated.

with that said greater degree of treatment there are a number of means to handle the expenses and also that might.

include a long-term treatment insurance plan yet those are type of troublesome so absolutely.

explore them however consider some other options also possibly rather than perhaps to supplement.

or perhaps you simply choose insurance policy yet some various other options consist of conserving up assets as well as.

setting aside those for a long-lasting treatment occasion or perhaps checking out your house equity as a.

security net to cover several of those big expenses that'' s not necessarily a fun method to spend.

your time so among the other points you can do is imagine how you desire your retirement.

to unravel and this is a really important step that a great deal of individuals miss it'' s important to.

have something to do with yourself when you stop functioning you might have obtained a great deal of.

your social interaction a great deal of your meaning and some of your identity out of your job.

and you could wish to not always confess that but also for a great deal of individuals that'' s the case. it ' s simple to claim that the main thing you'' re looking onward to in retired life is not going.

to work however you possibly intend to have some ideas on just how you'' re going to load your time.

which method you'' re mosting likely to top enjoy it more and second there may be some.

actual benefits in regards to your psychological and also physical health and wellness if you are retiring to something.

in contrast to simply retiring from job, so ask yourself how will you load your days? What are you most thrilled regarding and also interested.

in? What can you do to find some meaning and some.

objective during that time? And also who might you invest time with, and also what.

are your prepare for maintaining your physical health and wellness like you can possibly maintain it? So, I hope you found that helpful.If you did, please leave a quick thumbs up,.

thanks, and take treatment.

It'' s a great time to start getting

a realisticReasonable If you'' re eligible for Social Security, you ' ll. There'' s a whole lot of advantage to being debt-free.

Well, that ' s something to start figuring out. At 50 it ' s time to begin thinking concerning lasting.

Investing For Retirement – 4 Tips (I Learned Over 30 Years As A Financial Advisor)

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

are you bothered with exactly how you'' re mosting likely to pay for retirement you ' re not the only one lots of people are concerned about their retirement financial savings specifically with the volatility in the stock exchange in recent times in this video I'' m going to show you 4 pointers that can help you to invest for retirement these tips are based on my 30 years experience as a financial advisor and I function with hundreds of customers tip top make the most of your employer'' s retirement match several employers provide a retirement with a coordinating payment for instance if your company offers a 50 pair up to 6 percent of your salary as well as you gain fifty thousand dollars per year you must contribute at the very least three thousand dollars to your retirement your company will certainly then match your contribution with fifteen hundred bucks for a total amount of forty 5 hundred bucks in your pension not benefiting from your company'' s matches leaving cash on the table so make sure you contribute a minimum of adequate to your retirement plan to maximize your employer'' s match idea two purchase a diversified portfolio this implies investing in a selection of Investments like supplies and also bonds this should aid you to lower your threat and enhance your opportunities of reaching your retired life goals tip 3 rebalance your profile periodically to make certain that it remains in line with your risk profile if you'' re a person that suches as to handle your profile yourself even more power to you as well as sign up for our network to maintain learning if you'' re the sort of individual who likes assistance selecting and also managing your profile well that'' s the service we provide to our clients I'' ll leave a link in the summary you can click if you'' d like to establish a time to talk to us now on to our following pointer idea 4 Don'' t Panic sell the stock market will certainly fluctuate yet it'' s important to remain tranquil as well as not offer your Investments when the markets take a slump panic marketing can cost you a great deal of cash in the future if you'' re concerned regarding the marketplaces being down when you retire enjoy this video following [Songs]

Why Some Retirees Succeed and Others Live in Worry – 5 Retirement Truths

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

I intend to share one of the most important items of retirement advice that I'' ve ever before heard if you ' re considering your retired life and you'' re asking yourself if you ' re doing the best thing or assume that you need to be doing something different or if you'' re just bothered with all the important things taking place today whether it'' s the economic situation or the marketplaces or the value of your accounts make certain to view this video clip due to the fact that I'' m mosting likely to share the retired life realities that every retired person experiences and it'' s these things right here we'' re mosting likely to cover today and also every senior citizen undergoes it and it they experience this in retired life so it'' s going to look at this and afterwards also what to anticipate in retirement and afterwards exactly how to offer yourself the best possibilities of maintaining your way of life in retirement as well now the adverse of these retirement facts that we'' re mosting likely to consider is that a lot of them cause raised uncertainty or worry regarding your retirement one of our objectives though as we'' re assuming regarding it is truly the reverse of uncertainty or worry in retirement it actually should be more concerning self-confidence right the following years really right up till you pass away wait these are the the magic ears these could be the most effective years of your life as well as I understand that because there'' s an actual research study a research study uh confirming this so allow me pull that up really fast and reveal you the outcomes as well as I'' ll web link to it below individuals were asked to score their life complete satisfaction from absolutely no to 10 where 10 is the very best possible life and then no is the most awful possible life as well as this is really just the typical rating by age and I assumed it was encouraging to see that life fulfillment has a tendency to increase as you can view as we grow older and afterwards it has a tendency to Path off as we age but really the area the the duration of time we intend to concentrate on is that this is the magic time and we recognize this to be real as well due to the fact that we'' ve helped numerous pre-retirees move right into retired life with confidence and enjoyment and also these were the people who were pertaining to us that were feeling somewhat unsure or otherwise 100 confident with their cash strategy and also our company improve Financial has actually been around for 24 years as well as we'' ve made it through numerous bad Market durations with our clients and incidentally if I haven'' t fulfilled you yet I ' m Dave zoller as well as I own streamline Financial with Tim and Luke and also Sean and also if you ' re working with an advisor now that'' s mostly concentrated on investments and also investment preparation however doesn'' t speak about these crucial retirement strategies like the tax obligation effective withdrawal planning as well as income preparation or just tax decrease general really feel free to connect to us with the site currently we don'' t constantly have time yet I ' ll return to you regardless so allow ' s enter into this very first fact in retired life it will certainly be usual to have that thought of maybe I ought to be be making a modification or must I be doing something various it'' ll be normal to feel this way in retirement particularly when you see the information or you'' re paying attention to buddies talk concerning their funds there'' s this sensation or this idea of really making us question our present plan which triggers some people to make even more psychological choices rather of making smart economic choices and also an excellent way to avoid this is really to avoid this feeling is by having an understanding of your plan which really leads to more confidence with what you'' re doing as well as having a prepare for both the great times and likewise the demerit of times so that you understand that you'' re gotten ready for either among those as well as I'' ll provide you some means to accomplish this turning up in this video clip currently on the 2nd point that turns up in retirement that we simply need to be prepared for is we need to anticipate bearish market right you'' ve most likely endured a great deal of them already and also really in retirement though they really feel a little various usually worse however as a result of the frequency creating a plan with bearish market in mind as well as really huge Corrections developed right into the strategy is a wise point to do in this way you wear'' t have to fret when they eventually come now if you'' re uncertain how to design out these various what-if situations or negative Market scenarios for your strategy then you may wish to speak to a cfp or have a look at my preferred retired life earnings organizer below this video you should see a link to it it'' s among the ideal customer encountering coordinators that I'' ve seen and it doesn ' t cost thousands of dollars like the ones that we make use of for our customers the next thing to bring up is for pre-retirees that are close to stopping their wage especially if that'' s throughout bad markets they may assume need to I function a bit much longer maybe simply another year to kind of make it through this this challenging period we really had a client call us up concerning 5 months back and uh no she was five months right into retired life as well as she stated something like it looks like so much problem is out there as well as what'' s going on with the marketplaces I'' m questioning if I it would certainly have been better if I must have just maintained working so we reviewed her plan and also since we constructed in to her plan this assumption of bad markets whatever looked great and as well as actually the only reason to maintain functioning would be if she really appreciated this kind of job that she was doing as well as it brought her some some purpose however she didn'' t so it was fantastic it was wonderful confirmation that she was still on the appropriate track so if this seems like you have a look at another video clip I recorded I'' m gon na either link on this screen or it'' ll be below as well as it gives a few actual examples of what functioning an additional year may look like in an economic plan the following thing to know is that nobody truly recognizes what'' s mosting likely to take place next it appears like everybody has a prediction on television or YouTube or at the dinner table with family or with pals and nobody really understands what is certainly mosting likely to happen we understand this uh in a logical way because you understand there'' s that stating if you placed 10 financial experts in the area together and also they show up they need ahead up with a conclusion they'' ll come up with 12 of different solutions when they stroll out knowing that it'' s essential to prepare your investment prepare for that 4 financial Seasons that we might undergo in the future because we don'' t recognize which one we ' re going to undergo next so simply as as an example you'' ve seen it prior to the four financial seasons are higher than anticipated financial development or less than anticipated economic development as well as after that greater than anticipated inflation or less than expected rising cost of living and there'' s possession classes that can do well in every one of those now once again we wear ' t understand which method we'' re headed but having possession courses and every one of those potential Seasons that can be advantageous currently that'' s simply my point of view and actually it'' s for all of this talk to your very own Financial professionals before doing anything similar to this now on to the next one which truly has more to do with human psychology than financial investment method and after that after that I'' ll share the the actually one of the most handy piece of guidance that I ' ve heard pertaining to retirement planning yet if you ' d similar to this thus far please click the the like button as well as as well as maybe this video clip can aid somebody else experiencing the exact same points that that you'' re eagerly anticipating so the following reality remains in retirement we might tend to compare ourselves to others the turf is constantly greener on the other side of the fencing truly throughout life that'' s we ' ve obtained that tendency to contrast it to others yet it can hurt us in retirement also if we do a video clip on this network that states a buck quantity as an instance we don'' t want that to actually make you feel far better or really feel worse concerning your existing scenario since you understand we assist high total assets family members at enhance Financial we in some cases point out big numbers however we don'' t desire it to be concerning the numbers we really intend to communicate just the concepts as well as the strategies that can can truly be applied to to any person'' s financial resources and there'' s constantly going to be people with greater than us and after that there'' s constantly mosting likely to be people with less than us as well as the one who wins is the one that'' s web content and also tranquil most at peace with their current circumstance you recognize that claiming if I desire to be able to exercise being material with a little and also I wish to have the ability to practice being material with a whole lot and as well as you recognize healthy and balanced competitors that'' s alright but contrasting ourselves to somebody else since uh you understand if it triggers us a feel of absence or less than that can hurt our retirement because that leads really back to that first factor that we spoke around in uh in this checklist of sensation like we should be doing something different as an example if we see a guy on the web and he'' s investing a certain means or he'' s choosing he ' s altering his whole method um as a result of what'' s happening with the economy then that might trigger us to really feel like we should be doing something various and also after that begin to increase the emotional degree of uh of our decision making as opposed to remaining to purely sensible or monetary degrees however again it'' s a regular feeling to really feel that concern or fear or stress and anxiety with what'' s taking place during throughout present durations yet among one of the most useful pieces of guidance that I'' ve heard that we can put on retired life preparation is truly the difference in between those two words fear and also stress and anxiety knowing the distinction in between those two is really extremely extremely valuable as we'' re preparation retirement and also speaking about money that is if we want to really feel far better about what we'' re doing today when we believe regarding fear as well as stress and anxiety we could think about them as being the exact same point however in fact they'' re completely different points as well as allow me just bring up these 2 definitions if I can actually swiftly anxiety is a caution over a real as well as existing risk and after that anxiousness is a worry over an envisioned future risk currently fear if we'' ve obtained something right before us then it'' s clearly a really practical tool for us as people stress and anxiety however is not always a helpful device as as we'' re attempting to process things partially because these anxiousness there'' s absolutely nothing we can do to regulate or influence them you might have seen this drawing from Carl Richards prior to regarding things that matter as well as then things I can regulate here'' s an area to focus and then one more way to check out it is we in fact sent this to clients not too lengthy back on a video clip of what you can'' t control and also what you can regulate so we can'' t control the marketplaces as well as rising cost of living'as well as what they ' re making with interest prices or what ' s happening current or the world or tax obligation legislations or the political elections however a whole lot of these things in fact do connect to things that we can regulate as an example you know markets are rising cost of living or rate of interest prices your portfolio allotment you can control that you can control when to pay tax obligations when it'' s associated to in investing you referred to as we'' re speaking about Roth conversions or the the expenses the tax expense tax drag on several of the profile and not to obtain as well nerdy regarding these things however two of the largest points that we'' ve seen is this suggestion of not regulating the news but what we can manage is information consumption we'' ve seen a large change with uh some people who as opposed to a person that wishes to consume the information they switch from television information to reviewing news where you have a little extra control of what'' s coming with you versus television is simply the following thing is coming with you if you understand what I suggest I wear'' t know if that ' s if I if I ' m describing that the ideal method but back to the this video clip all the points that we mentioned in the past earlier below um a great deal of these can be anxiety-inducing points as well right the intensity of a bearishness or otherwise having the ability to anticipate what'' s going to occur following on the planet or comparing ourselves and also doubting our plan or assuming that we don'' t have as high as as we desire we had when it comes to to money or the you know suppose this happens and what if this happens just how is that mosting likely to affect my strategy which can lead that kind of reasoning can bring about paralysis as well as actually no activity being taken yet what happens if you had a strategy that was constructed in to reveal those different what-if circumstances so rather than the unidentified future threat you'' re able to obtain more concrete circumstances in the strategy as a result that'' s what I would certainly suggest once you obtain obtain it out in the open then it comes to be a lot much less scary we both understand that so either find a wonderful certified monetary planner that can reveal you that and show you the what-if scenarios or examine out the the DIY planner or a different organizer that aids you place in those what-if scenarios also so it becomes less scary so don'' t fail to remember anxiety is it can be the burglar of Desires it takes you far from enjoying the the here and now minute as well as it stops you from even taking the right action to make things far better in the future because it actually just makes you only concentrated on on the unfavorable as you'' re you ' re relocating with life that video clip that I pointed out earlier is called why postponing retired life could not be a good suggestion if you'' re pre-retirement as well as you'' re believing you want to function a little bit longer since of what'' s going on have a look at that one turning up next or below and afterwards I'' ll see you in the next video clip take care international [Songs]

Average Net Worth in Retirement | Age 65, 70, 75

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

in this video clip i discuss the typical total assets of retirees at age 65 70 as well as 75 turning up following on holy schmidt divine schmidt the majority of the videos on youtube go over funds internet well worth cost savings earnings for individuals in their 40s 50s and even 60s not unsurprisingly these numbers have a tendency to increase the older a person gets anymore that they make as well as conserve during their lifetime this is the first video clip i'' ve carried out in truth that i'' ve seen below on youtube that discusses what occurs to individuals'' s internet worth after they go into retirement and also it talks regarding what their net worth is at age 65 age 70 and also 8.75 it'' s an essential video since there'' s not a whole lot of openness around on what takes place to somebody'' s funds once they enter retirement it ' s nearly like a black box where the information just goes away which is a shame due to the fact that for a lot of individuals they wish to know what happens after they obtain into retirement and also there simply isn'' t a whole lot of details available and also that ' s why i created this video for you in this video i discuss the mean and the typical internet well worth of people at 65 70 and also 75 and also the outcomes are a lot various than you would expect before we start please ensure you click subscribe as well as notifications there'' s a great deal taking place around in the globe as well as retired life for folks is transforming day-to-day often in terms of the policies and the information and also i job really difficult to obtain what'' s taking place out there in below for you when somebody enters retirement the video game modifications they had simply invested the last 30 or 40 years adding to their retirement savings as well as currently they'' re really attracting down on their retirement nest egg they'' re living off the return on their investments a pension social safety and security maybe also some part-time work it is this vibrant which causes a great deal of issue for individuals in retired life since the message that they had obtained up until that factor had to do with preparing for retired life not what to do following with the security of full-time employment gone and also the experience of living off of the returns from your retirement savings the road in advance is both interesting and also a little bit demanding allow'' s begin with age 65 since this is the following stop for a great deal of you as well as certainly you'' re naturally curious about those numbers first the data i'' m going to make use of originates from the 2020 study of consumer finances from the federal get board so it'' s fairly precise the very first number we'' re going to discuss is the mean which is just the standard of every one of the respondents that the federal get board spoke to this data comes from both ends of the spectrum on the low end individuals that have a lot more liabilities than they do properties this suggests that they'' re financially troubled and also at the high-end people that have so lots of possessions that they couldn'' t perhaps spend their means via them during their lifetime and those are going to most likely to their relative when they pass at age 65 the mean net worth is 1 million ninety 6 thousand 8 hundred bucks now i can inform you now that the majority of the people watching this video clip don'' t have that amount a much better number is the typical mean just implies there are an equal number of respondents with a greater total assets as well as an equivalent number with a reduced net well worth so it'' s the individual right in the middle that individual has a total assets of 239 450 so simply put much less than quarter of the ordinary total assets of the mean of that team what do you assume the typical total assets of a 70-year-old would be well if you ask most individuals they would believe that the 70-year-old would have attracted down on their pensions their 401ks their cost savings and so on and also their web well worth would have gone down interestingly that'' s not really the case though at age 70 the typical total assets really enhances to one million 2 hundred seventeen thousand 7 hundred bucks up one point 7 percent the average goes up to two hundred sixty six thousand four hundred dollars to put it simply it rises by 11 so why did both increase well there are a lot of concepts however the one that'' s more than likely is that individuals are adjusting during the initial few years of retired life they'' re intentionally not spending as a lot as they might since they wear'' t desire to obtain it incorrect so if that'' s the situation you ' d anticipate the following five years to actually go down as well as that'' s precisely what takes place at age 75 the mean web worth goes down to 977 thousand 7 hundred bucks down 19.7 percent from the net worth at age 70.

the typical goes down to 254 thousand eight hundred bucks down 4 point 4 percent from age seventy so why does the mean net well worth go faster downward from 70 to 75 than the average throughout both period there are a whole lot of reasons one of the most likely factor for the increase between 65 and 70 is that those retirees at that age at the very least at the high-end more than likely possess their very own services and aren'' t totally retired yet but by the time they hit 70 and also they move in the direction of 75 not just are they out of business yet they'' re establishing up trusts and also arranging their lives to ensure that their assets are relocating right into various pockets for their heirs if you such as this video and also you'' d like to see more of me please see to it you click subscribe notifications to make sure that you obtain alerted the following time i publish a video clip i article concerning twice a week additionally have a look at this video on the average social safety and security settlement in this nation this is jeff schmidt many thanks for seeing.

Read More11 Tips To Plan Your Retirement Overseas | Live and Invest Overseas

Jason 0 Comments Retire Wealthy Retirement Planning Tips for Retiree's

Here are 11 points you should know.

when intending your abroad retirement: # 1. The initial step to any emigrate is to set.

your top priorities as well as to be honest at the same time What matters to you most? Nights at.

the cinema? English-speaking good friends? An inexpensive of living? A.

trusted internet connection? Don’t child yourself. If you can’t think of life.

without a Maytag washing machine as well as clothes dryer, for instance, or Sunday afternoons seeing the huge game, you.

may require to reconsider the whole suggestion. # 2. Make all choices jointly with.

whomever you will make the action Your spouse’s ideas about what she or he wants.

Recognize that no place is excellent No environment is suitable. No city is 100%. Understand That No Other Country On Planet.

And also only a handful of real estate markets outside. the States operate with Multiple Listing Services, implying the look for your new residence in. paradise will certainly mishandle at finest. # 5. Do not leave your good

feeling at the border That is, do not blend alcohol and residential property buying … You need to do more due persistance when purchasing an item of residential or commercial property in. another country, not much less. # 6. There’s no such point as the globe’s top. retired life place

, no one-size-fits-all

Paradise The just one who can identify the.

There are dozens of lovely, budget friendly, friendly, secure, lovely areas where you. # 7. Rent initially Do not buy a new home in paradise until.

Even if the nation transforms out. # 9. Anticipate it, prepare for it, as well as recognize that it will pass.

Whatever you made the action for is waiting on you. You just require to offer your. perspective a little time to adjust. # 10. Obtain regional tax suggestions in the. nation where you’re preparing to stay before you settle. # 11. Take notice of your intestine A

area either feels right … or it does n’t. All your study and figuring in advance is essential, however nothing replacement for the. feeling you obtain when you struck the ground. What else do you think you should. take into consideration prior to retiring overseas? Let us know in the remarks !

Recognize that no place is best No climate is optimal. Understand That No Various Other Nation On Planet. Do not leave your great

sense feeling the border That is, don’t do not blend and property residential or commercial property Purchasing You need require do more even more diligence persistance investing spending a piece item property residential or commercial property. There are lots of lovely, cost effective, pleasant, safe, captivating areas where you. Also if the nation turns out.

Recent Comments