Tag: index funds

Warren Buffett: How To Turn $10,000 Into Millions (Simple Investment Strategy)

Jason 0 Comments Retire Wealthy Retirement Planning

you can't really fail at it unless you buy the wrong stock or just get excited at the wrong time and i would like to just spend just a couple of minutes uh giving you a little perspective uh on how you might think about about uh investments as opposed to the uh tendency to focus on what's happening today or even this minute as you go through and to help me in doing that i'd like to go back through a little personal history and uh and we will start i have here up here in new york times of march 12 1942 and i'm a little behind on my reading and if you go back to that time it it was about what just about three months um since we got involved in a war which uh we were losing at that point uh the newspaper headlines were filled with bad news from the pacific and i've taken just a couple of the headlines from the days preceding march 11th which i'll explain it's kind of a momentous day for me and so you can see these headlines we've got slide 2 up there i believe and uh we were in trouble big trouble in the pacific uh it was only going to be a couple months later that the philippines fell but here we were getting bad news we might go to slide three for march 9th uh uh i hope you can read the headlines anyway the price of the paper is three cents incidentally um the uh and uh uh let's see we've got march 10th up there a slide i'm i want to get to where there's advanced technology of slides i want to make sure i'm showing you the same thing that i'm seeing in front of me so anyway on march 10th uh when again the news was bad full clearing path to australia and it was like it the stock market had been reflecting this and i'd been watching a stock called city service preferred stock which had sold at 84 dollars the previous year it had sold at 55 the year before early in the in january two months earlier and now it was down to forty dollars on march 10th so that night despite these headlines i said to my dad i said i think i'd like to pull the trigger and i'd like you to uh buy me three three shares of city certified the next day and that was all i had i mean that was my capital accumulated uh uh over the previous five years or thereabouts and so my dad the next morning um bought three shares well let's take a look at what happened the next day let's go to the next slide please and it was not a good day the stock market the dow jones industrials broke 100 on the downside now they were down 2.28 as you see but that was the equivalent of about a 500 point drop now so i'm in school wondering what is going on of course uh incidentally you'll see on the left side of the chart the new york times put the dow jones industrial average below all the averages they calculated they had their own averages which have since disappeared but the dow jones has continued so the next day uh we can go to the next slide and you will see what happened the stock that was in 39 my dad bought my stock right away in the morning because i'd asked him to my three shares and uh so i paid the high for the day that 38 and a quarter uh was my tick which is the high for day and by the end of the day it was down to 37 uh which was really kind of characteristic of my timing in stocks that was going to appear in future years uh um but uh uh it was on the what was then called the new york curb exchange then became the american stock exchange but things even though the war until the battle of midway looked very bad and if you'll turn to the next slide please you'll see that the stock did rather well you can see where i bought at 38 and a quarter and then the stock went on actually to eventually be called by the city service company for over 200 dollars a share but this is not a happy story because if you go to the next page you will see that i well as they always say it seemed like a good idea at the time you know uh so i sold those i made five dollars on it it was it was again typical of behavior but when you watch you go down to 27 uh you know it looked pretty good to get that profit well what's the point of all this well we can leave behind the city service story and i would like you to again imagine yourself back on march 11th of 1942 and as i say things were looking bad in the european theater as well as what was going on in in the pacific but everybody in this country knew uh america was going to win the war i mean it it was you know we'd gotten blindsided but but we were we were going to win the war and and we knew that the american system had been working well since 1776.

So if you'll turn to the next slide i'd like you to imagine that at that time uh you had invested ten thousand dollars and you put that money in an index fund we didn't have index funds then but but you in effect bought the s p 500 now i would like you to think a while and don't do not change the slide here for a minute i'd like you to think about how much that 10 000 would now be worth if you just had one basic premise just like in buying a farm you buy it to hold throughout your lifetime an independent and you look to the output of the farm to determine whether you made a wise investment you look to the output of the apartment house to decide whether you made a wise investment if you buy an apartment small apartment house to hold for your life and let's say instead you decided to put the ten thousand dollars in and hold a piece of american business uh and never look at another stock quote never listen to another person give you advice or anything of the sort i want you to think how much money you might have now and now that you've got a number in your head let's go to the next slide and we'll get the answer you'd have 51 million dollars and you wouldn't have had to do anything you wouldn't have to understand accounting you wouldn't have to look at your quotations every day like i did that first day i'd already lost 3.75 by the time i came home from school uh all you had to do was figure that america was going to do well over time that we would overcome the current difficulties and that if america did well american business would do well you didn't have to pick out winning stocks you didn't have to pick out a winning time or anything of the sort you basically just had to make one investment decision in your life and that wasn't the only time to do it i mean i could go back and pick other times that uh would work out even greater gains but as you listen to the questions and answers we give today just remember that the over the overriding question is how is american business going to do over your investing lifetime uh i would like to make one other comment because it's it's a little bit interesting let's let's say you're taking that ten thousand dollars and you listen to the profits of doom and gloom around you and and you'll get that constantly throughout your life and instead you use the ten thousand dollars to buy gold now for your ten thousand dollars you would have been able to buy about 300 ounces of gold and while the businesses were reinvesting uh in more plants and new inventions came along you would go down every year into your look in your safe deposit box and you'd have your three ounce 100 ounces of gold and you could look at it and you could fondle it and you could i mean whatever you wanted to do with it but it didn't produce anything it was never going to produce anything and what would you have today you would have 300 ounces of gold just like you had in march of 1942 and it would be worth approximately four hundred thousand dollars so if you decided to go with a non-productive asset goal instead of a productive asset which actually was earning more money and reinvesting and paying dividends and maybe purchasing stock whatever it might be you would now have over 100 times uh the value of what you would have had with a non-productive asset in other words for every dollar you have made in american business you'd have less than a penny by of gain by buying in the store value which people tell you to run to every time you get scared by the headlines or something disorder it's it's just remarkable uh to me that we have operated in this country with the greatest tailwind at our back that you can imagine it's an investor's i mean you can't really fail at it unless you buy the wrong stock or just get excited at the wrong time but if you if you owned a cross-section of america and you put your money in consistently over the years there's just there's no comparison against owning something that's going to produce nothing and there frankly there's no comparison with trying to jump in and out of stocks and and pay investment advisors if you'd followed my advice incidentally or this retrospective advice which is always so easy to give uh if you'd follow that of course you're there's one problem buddy your your friendly stock broker would have starved to death i mean you know and you could have gone to the funeral to atone for their fate but the truth is you would have been better off doing this than than a very very very high percentage of investment professionals have done or people have done that are active that it's it's very hard to move around successfully and beat really what can be done uh with a very relaxed philosophy and you do not have to be you do not have to be you do not have to know as much about accounting or stock market terminology or whatever else it may be or what the fed is going to do next time and whether it's going to raise rates three times or four times or two times none of that counts at all really in a lifetime of investing what what counts is is having a a philosophy that you've that you stick with that you understand why you're in it and then you forget about doing things that you don't know how to do

Read More

How to Have the Perfect Portfolio in Investment – John Bogle’s view

Jason 0 Comments Retire Wealthy Retirement Planning

But now this brings us to the main point of

our discussion with you which is to get your advice for our viewers about what you consider

to be the perfect portfolio now we know there's no such thing as perfect but i suspect that TIFs

will play some role in this what would you say to the typical investor now today looking forward how

should we be managing our wealth well let me um i tried to cover this you'd be surprised at some of

the what i've done in the asset allocation chapter of my book a little bit because i've come to

conclusion there's really not a very good answer and i've concluded that regular rebalancing is not

terrible but not necessary i've come to conclude that it's 60%, 40% portfolio is probably the best

option rather than going from 80 20 to 20 80 in a target retirement plan uh maybe right and i may

be wrong on that and i find it something very individual uh and and you know and clearly i mean

everybody knows this intuitively at the beginning there are no easy answers to this so i'll come

to exactly what i'm doing uh but what i was what i did i got a letter from clearly a young man

who was really worried about how he should be investing and what his allocation should be and he

said you know the dangerous risky world out there and he didn't mention it but of course he's right

you have potential nuclear war global warming much more than just potential and racial division in

the country uh right now uh threats to world trade and division of wealth all over the world but

most often very heavily in the us between the haves and the have-nots all those things

are worth worrying about but i said to him you don't know and i don't know what's going to

happen to any of them the market doesn't know nobody knows so you just have to put them out of

your mind and forget it what you want to think about is how much risk you can afford and that's

very much a personal thing and it has a little bit to do with whether you're investing regularly

and things like that and then i said to him if it's helpful to you i'll tell you what i'm doing

now i'm 88 years old and have an unusual kind of planning my estate and i said i'm 50 bonds and 50

stocks i don't happen to rebalance around that it just seems to come out that way particularly in

recent years and uh it's been higher than that and been lower than that but right

now i'm very comfortable at 50 50. although i spend half my time worrying that i have

too much in stocks and the other half of my time worrying that i have too little in stock and i

think that's the way most investors feel they don't know what the right number is and when the

market's going up they say god why don't i have more stocks when it's going down so your own worst

enemy in all this yes but having some stability without automatically rebalancing i don't think

you need to do that and and it's very clear you know and anybody understanding economist

certainly understands this that the more the less you rebalance the more you're going to

have because you're always selling the better performing asset and you don't know whether it

will do in the long run but i also look at it as as very importantly uh and this is this is kind

of an interesting thing i think the most important thing you need to know about the performance

of the stock market in the next 30 40 50 years is what is the GDP of the united states going to

do corporate profits are correlated at 96 percent s p dividends are correlated at 96 percent with

with the gdp of the united states the GDP doesn't grow quite as fast but not a big difference

6.7 compared to 7.5 or something like that and then they'd be nominal and uh i think so

what interests me is in peter lynch's book something about wall street uh one up on

wall street or something he says there's no number that could interest him less than the gdp

number is it going up or down and what that is is a statement that the short term is more

important than the long term and i don't believe this the short term is more important than

long term and then you even get in freakonomics those wise guys they did a nice interview with

me i'm heard all of it yet but i will someday um say pay no attention to the GDP well it's

everything right but it's not everything today and tomorrow right you know the gdp probably

rose today about two three hundred and sixty fifths of one percent or something whatever it

is uh and uh we don't pay any attention to it but it all comes down to for your you know the

best portfolio is are you an investor or are you a speculator and if you're going to keep changing

things you were speculating because we can't know if you're going to put commodities in there the

ultimate speculation it has nothing going for it no internal rate of return no dividend yield no

earnings growth no interest coupon nothing except the hope largely vain probably that you can sell

to somebody else for more than you paid for it how that could be even considered goals

let's say an investment uh i do not know so it's i'd like to take the mystery out of it and

say that the perfect portfolio first i think for a huge proportion over 90 percent certainly of

the investors should be limited to marketable securities they don't need the liquidity today but

and we may have you know too much marketability and that is too much sensitivity to prices as they

change day by day but you want to get out of the idea that you always have to do something and uh

i have said in my books and you know something happens and the federal reserve does something

and the traders all at the beginning of the day i think it's going to cause the market to go down so

they sell and everybody else says it has nothing to do with anything for you and when you hear news

and your broker calls up and says do something just tell them my rule is don't

do something just stand there and it's it's a lot of the rules that apply

to the investment are not rules that apply to ordinary life right and uh so don't do something

just stand there so get a rough idea of what you want to allocate your money to now i i do i'm

really entirely indexed at my 50 50.

Uh although oh my and i can't give you the proportions

because i don't remember them but my bonds that are in my retirement plan are

bond index funds and the bonds that are in my my uh personal account are municipal vanguard

missile bond short intermediate and so i'm reasonably comfortable with that so i think

i'm too conservative for the average investor so i'd say the perfect portfolio and it should

be well let me just mention one other issue and try a little bit differently uh blair academy i

have a scholarship fund that i'm allowed to manage and i don't i don't want to spend any time on

and i don't so here is exactly what i've done on the assumption that nobody will touch it for

a long time and when i'm gone i mean maybe they will maybe they won't but what i did this is

probably ten years ago um we say put half of it in Wellington Fund and have it balanced index

fund the idea was not all on balance index fund because there could be things that happen that a

manager needs to adjust to neither of them have an international component and that's fine with

me that's i believe that's the better strategy so that's and they would be together 90 of the fund

and then against two contingencies um just in case i put five percent in the emerging market index

and i hope you're sitting down five percent in gold really yeah in the event just a five percent

hedge against some kind of catastrophe now i wouldn't call that the perfect portfolio but

i i mentioned only because that's one there's distinctive meaning you cannot touch it and uh at

least theoretically can't touch it it's designed to be held through all extremes and so that's

going to give you with the two balanced funds uh roughly 62 percent in equities that's going to

be with wellington fund more corporate bonds than the index fund has i think the index is something

that we should be very very careful about because it has the one of a better expression too damn

much in governments right i don't think any individual would have a a bond account 70 in

governments and 30 corps right maybe it should be the reverse i think that makes more sense can

i prove that no i'm sorry i can't so it's looking at the long term looking at the numbers looking

at cost above all there's no there's no ideal portfolio perfect portfolio that ignores cost

now you know i've seen these articles saying well for example commodities no internal rate

of return silly including gold except that's the if nobody's gonna nobody's looking and we

have something explosive that will help and it probably shouldn't hurt you too much this

portfolio actually had done rather well in the last couple of years and it's fine in the long

run and uh so you know and actually it may be doing better than my own but i don't but i look at

my performance because i'm so conservative right uh i look at i look at the funds yeah but it's

almost all indexed and i do have wellington fund from those days with Mr Morgan and i wouldn't give

that up as a sentimental matter but but i should

This Is How To Become A Millionaire: Index Fund Investing for Beginners

Jason 0 Comments Retire Wealthy Retirement Planning

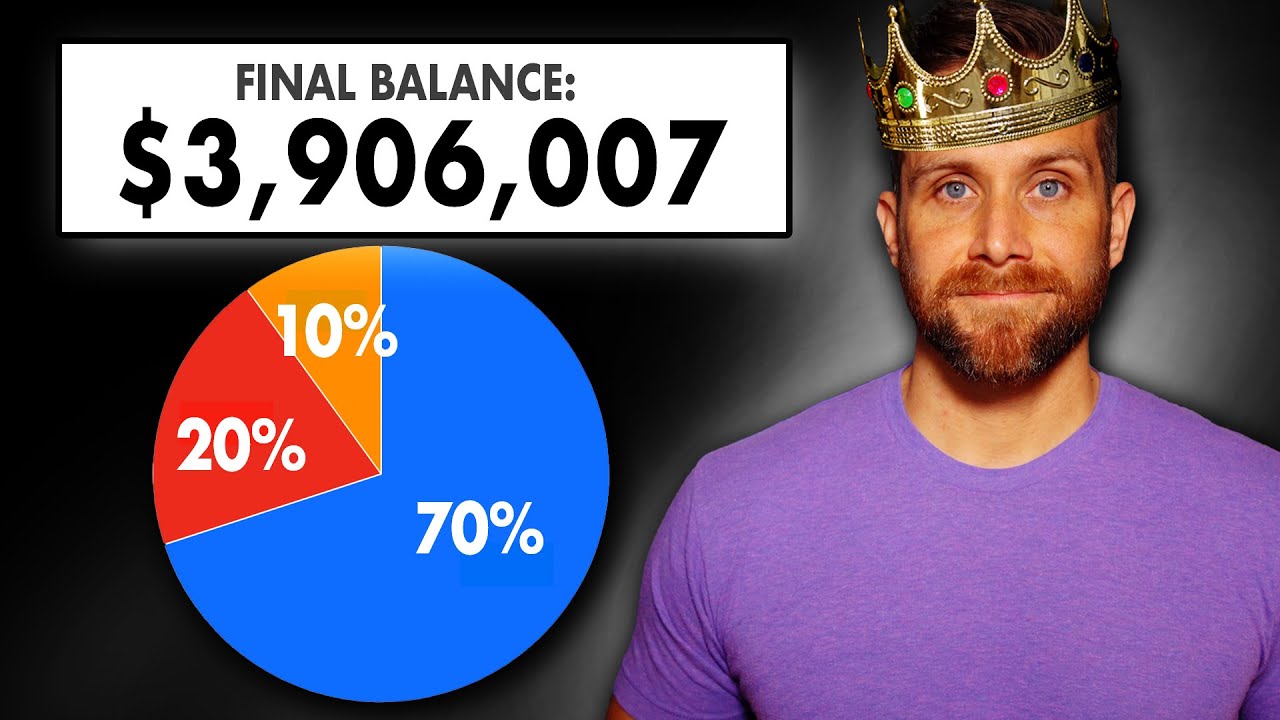

hi guys it's mark so did you know if you save two hundred dollars per month at an eight percent annual return then in 45 years you would have over wait for it one million dollars to be honest when someone first explained this was possible by investing in index funds i hardly understood a word they were saying it was like they would speak in a different language today i thought it was about time that i made the video that i wish i'd seen when i was younger and explain everything step by step and because i like people that actually practice what they preach i'm gonna be investing ten thousand dollars of my own money during this video so you can see exactly how it's done just a quick disclaimer though i'm not a financial advisor i'm a businessman and this is just some of the real life strategies that have worked for me personally i always thought of index funds as my backup plan if my businesses hadn't been successful then i would have become a millionaire anyway through these investments just remember if you like the video then smash the like button as it really helps push this video out to more people and also consider subscribing if you want to grow your wealth part one uncovering the lies so let's cut to the chase you've been put a major disadvantage people have been telling you lies about investing all of your life for instance at school when i was growing up i remember asking my teachers about investing and they always said it's just for rich people as they can afford to hire professionals to do it for them for the longest time i believed investing wasn't for me because i wasn't a pro and i didn't have much money and i thought i wouldn't stand a chance then we got friends one of mine said i'd have to look at all the financial newspapers learn how to read the charts and according to him it just wasn't worth my time and on top of this every time i mentioned investing to my family they seemed so scared because they thought it's the most risky thing in the world and not for normal people my dad even said if i started investing i'd lose all my money can you believe that these lies are exactly what the experts want you to believe as they know that index fund investing is extremely easy to do you don't need much money to start the risks are pretty low and on average it will make you more money in the long term the dark truth is that the average actively managed fund returns two percent less a year than the market in general this means that professionals on average are doing worse than index funds and even if they end up losing you money they still charge you fees no matter what now according to my favorite film the matrix you have now taken the red pill and you've woken up to the truth it's now time to move on to part two understanding the game i know when i first started investing i felt like i was going to make so many mistakes but once you understand their language it all becomes so much easier and that's what we're going to be talking about in this part so i've been banging on about index funds in many of my videos so i think it's about time i explained what they are and why they're so cool i'm a big football fan and if you have ever followed any sports you'll be familiar with a league table like this the better your team performs the higher up they'll be on the list but on the other hand if they do really badly they might be removed from the league entirely this is almost exactly the same as an index all you have to do is switch out the teams for companies let's take the s p 500 for example this is a list of the 500 best performing public companies in the usa the big dogs being amazon google apple and more recently tesla and just like a league table if a company doesn't perform well they're at risk of being removed from the list hasta la vista baby the idea of an index fund is to be a little bit sneaky as it allows you to invest in every single company on the list with just one click it's a bit like a friend of mine who picks a different football team each year he just wants to pick the winner every time so investing in index funds means that even if a few companies do terribly then it's balanced out by the companies that are doing extremely well the average return on the s p 500 over the last 10 years has been 13.6 now that is higher than usual but get this no one has ever lost any money if they've bought and held an s p 500 index fund for more than 20 years so if this is so foolproof then why do people still buy individual stocks well personally i like to do this just for a bit of fun i also think that some companies are currently working on awesome technology for the future but aren't making a lot of money at the moment so they won't make the cut into the popular index funds so now and again i like to invest some extra money into these up and coming companies so i don't miss out and that reminds me we bought currently giving away four free individual stocks if you want to pick them up i'll leave the link in the description and for everyone that's outside of the usa or china i'll leave a link where you can claim a free stock with trade in 212.

Hey that's pretty good you'll often hear people throwing around the terms roth ira in the usa stocks and shares isa in the uk tfsa in canada and supers in australia but what does it all mean well these are types of accounts that allow you to earn profits on your investments and you don't have to pay any taxes on them but they generally have limits because they're just so powerful these are kind of like captain america shield so let me explain if captain america just sat at home with his shield then he wouldn't ever get anything done but when he takes that shield into battle he has an advantage so these accounts are like your shield make sure to use them when you're investing a way you can do this is by using the money inside your shielded account to invest into index funds and all the profits will be yours because the government won't take a cut one of my biggest questions when i first started was should i invest all my money at the same time or do it gradually now this is something lots of investors argue about so i'm going to give you my view on things remember later i'm going to be investing this 10 000 in full so that kind of gives you an idea of what i believe investing all your money as a lump sum is certainly more risky however if i'm investing in something i know will increase over time like an s p 500 index fund then there is no point waiting the longer you wait the worse off on average you'll be however if you don't have the cash i wouldn't wait to save up the money i would just invest what i could every month as sometimes you're going to buy when the stocks high other times you're going to buy when the stock's low but overall this is going to balance out and this is known as dollar cost averaging when you log on to an investing website or app you'll see that there is something called etfs which are very similar to index funds and a lot of people get them confused both allow you to invest into a basket of stocks however the easy way to remember the difference is just to think of what etf stands for exchange traded fund if we break that down simply it just means that it can be traded on the stock market throughout the day whereas an index fund can only be bought and sold for a price that is set at the end of each trading day but let's cut to the chase you probably want to know which one's better on average if you're starting with little money then etfs may be a better option as they have lower minimum investment thresholds and many brokers don't charge a trading commission now if you're still watching this and you're younger than 18 then i am really impressed that you've been listening to a boomer like me for so long but seriously not many people learn this at such a young age as they don't teach it at school a way you can start investing under 18 is to open up a custodial account in the usa or a junior stocks and shares iso in the uk set up these accounts you just need to ask your parents the real secret ingredient to this millionaire formula is time and when you're younger you have so much of it that's because every year as you keep adding to your investments the interest starts to compound and grow at a rapid pace it's a snowball effect once you reach a certain tipping point the interest you're making is much more than the amount you're investing on a monthly basis it's a bit like when you see someone take ages to get to a hundred thousand subscribers on youtube and then within a few months they managed to hit the big million the sooner you get started the better as time will be on your side now i want to clear something up when people talk about index funds you will hear s p 500 again and again people just love it as i mentioned before this is a top 500 public companies in the usa but the cool thing is you don't actually have to be in the usa to invest in this i'm in the uk and it's one of my favorite investments i just love to think that i own a small part of all the biggest companies in the usa part three mastering the strategy so lots of people will teach you what to do but they won't actually say how to do it so i'm going to walk you through everything right now while i invest my own ten thousand dollars the first thing to really do is to work out your goals let's say you want to become a millionaire that was one of my goals i just had to work out how much i would actually need to invest per month to achieve this i love using these compound interest calculators you can find them online easily yourself if you want to have a go at this so if you're able to invest 250 dollars per month with an 8 annual return over 42 years you'll have over a million dollars in your account now if you're able to invest that for another 10 years you'll have over 2 million in your account of course if you wanted to invest even more then you're just going to speed up the whole process the next thing we need to do is pick the brokerage website we're using to set up our account and invest the ones that i love are charles swab fidelity and vanguard i call these the big three the founder of vanguard john bogle is often referred to as the father of index fund investing and if you think i'm a boomer he was even older than me his vanguard group gave birth to index funds so they're the oldest and most trusted let's jump onto their website to see what they have to offer so to get onto their full list of funds just go up to invest in and click on vanguard mutual funds at this point i'm going to have to ask you to strap in and brace yourself because if you haven't seen this page before it can look extremely overwhelming but in a minute you'll be able to impress all your friends when you know exactly how to read it see what i mean there are just so many options the main things to focus on are the expense ratio which is how much they're going to charge you per year you obviously want to keep these as low as possible and luckily with vanguard fees these are very low anyway the other thing to look at is the average returns and they break these down nicely on the right hand side of the screen but of course it's always good to remember that past performance doesn't always mean future returns my wife's a bit like vanguard she likes everything in order and nothing out of place so they have arranged all of their funds into different categories so everything is easy to find category one is bonds these are a type of contract that companies and governments sell when they need extra money if you invest in these they promise to pay you back in the future these are often seen as pretty low risk but also pretty low returns therefore the older you are the more bonds you should have in your portfolio number two is balance funds the idea of these is to pick the age at which you wish to retire and they'll do all the rest of the work for you and find the right mix of index funds as you can see these go up in five year intervals and you can pick whichever suits your plans best this could be a good option if you wanted to invest without thinking about it too much but personally i always prefer manually investing it's a bit like driving an automatic car that does all the work for you it just isn't as much fun as a stick shift number three is company location and size known as small medium and large cap here you can find v fix which tracks our old friend the s p 500 this little s means it's one of vanguard selected funds which they recommend if you click on it you're able to see exactly what companies you would be investing in and also the risk level vt sacs is another good one which is a total stock market index fund which has over 3586 different stocks this allows you to invest in the entire usa stock market in one click there is a minimum investment of three thousand dollars again but as before there's also an etf version with no minimum called vti then you have international stocks quite a cool one is emerging markets which invest in companies based in china taiwan india and many more but as you can see this is a five on the risk scale so i wouldn't personally invest a lot of money into this fund because look at me i'm a bit old to be taking too many risk and i need to sleep at night number four the last category is sector based so if you have a particular interest in energy healthcare or real estate you can invest into these sectors and there are also a lot more options for sector investing in the etf so now we've broken down what's on offer hopefully it all looks a bit more understandable now for the moment you've all been waiting for it's time to invest my ten thousand dollars i could split this between lots of different funds but personally i like to invest the majority of my money into american companies i would say probably about seventy percent american 20 in other countries including the uk and ten percent in some bonds i like to keep the bonds quite low as i don't mind this little extra bit of risk because i'm only 53 and i have a bit of time before i've got to rebalance my portfolio to secure my investments but that's a personal choice depending on your risk tolerance the funds that are available are different in every country but the indexes they track are very similar so you may need to invest in a different fund to me but obviously you can still use my percentages as a guide so i'm going to use the uk vanguard site to invest 5k straight into this etf that tracks the s p 500 so here we go all done two thousand dollars is going into an index fund that tracks the total american stock market so again we go on the screen click so far that's 70 invested in the biggest economy in the world which of course is the usa now i like to balance this out by investing in a different economy as i live back in my own country i'm going to be putting 2k into the ftse 100 index fund so looking good all done great now i've invested 90 of my 10k and i'd like a bit of security let's just put the remaining 1k into a global bonds index fund and let's just do that so just like that i've invested in the usa companies like apple amazon tesla and google i own a small piece of the biggest companies in the uk like hsbc bp and unilever and i have some bonds to balance out my portfolio it really is as easy as that so i'm going to leave the next video up here but don't click on it just yet remember to subscribe to the channel if you want to grow your wealth ring that notification bell and smash that like button okay i'll see you on the other side

Read More

Big Problem With Fidelity Index Funds – Zero Fee Funds Explained

Jason 0 Comments Retire Wealthy Retirement Planning

– Fidelity offers zero fee index funds. Can you believe it? They're such a kind,

privately held company that's willing to give

up a bunch of profit to help out the little guy

investor like you and me. – So you're telling me

there's a chance? Yeah. – Ah, not so fast. – What?!

– As with most things, there's a bit of a catch, and the Fidelity zero fee

index funds are no different. So, let's go through what you need to know about these things, then we'll stack up each one

to its fee based competitor. Before we get too deep into it, I need to say that I am by no means implying that you should

sell these index funds if you currently hold them. You could be investing in

much worse financial products, like anything that Cathie

Wood has her name attached to. I'm basically going to be giving you a peak behind the curtain of

these zero fee index funds to show you what isn't so

obvious on the surface, In 2018, Fidelity started offering four different index funds where they charge you $0 to own them.

These four funds consist of

a large cap, total US market, extended market and

international index fund. At first glance, this seems

like an odd thing to do, because they already offer

an S&P 500, total US market, extended market and

international index fund where they charge you to own them. Yes, the fees for these funds

are extremely cheap as it is. But by offering these zero fee funds, they're in direct

competition with themselves.

I can promise you they're not doing this out of

the goodness of their hearts. To help uncover why they're doing this we just have to follow the money, but not the money that they

don't make from these funds, the potential money that they could make in other areas of their business by offering you these zero fee funds. These funds are what you would consider to be a loss leader for Fidelity. Kind of like how Costco sells their rotisserie chickens for a loss to the tune of being out $30,000,000 to $40,000,000 per year. The goal for Costco, and

Fidelity in this case, is to get you into their ecosystem so that they can sell you on more profitable products and services. If you are already through

the doors of Costco to buy your unhealthy, corn-fed,

GMO, rotisserie chicken, then you're more likely

to buy additional items. If you are already investing

in Fidelity's zero fee funds, then you're more likely to use them first if you are looking for

a financial advisor, annuity, life insurance

or more expensive funds. This of course won't

work for every customer.

But the lost leader business model doesn't need to have a 100% success rate. They just need a small portion of people to buy these more expensive

products and services. Once Fidelity has you in the doors and investing into their funds, they lock you into

their umbrella even more by penalizing you if you wanna move to a

different investment platform. These Fidelity zero

fee funds are exclusive to their investing platform and cannot be bought on or transferred to any other platform. With their other fee based index funds, you can transfer those out of Fidelity and onto any other platform like Vanguard, Charles

Schwab or any of the others. They'll usually come with a transfer fee, but this is par for the

course no matter where you go and which fund you decide to move.

With these zero fee funds,

you have to sell them if you wanna move your

investment somewhere else, which means that you might

have to pay capital gains taxes if they're held within a

taxable investment account. It might not be a big

deal to you right now, but if for some reason

at a point in the future you become unhappy with

Fidelity, then you're screwed. Before I tell you my biggest issue with these zero fee funds, please help and support this channel, and my dog, Molly, who

actually just tore up her leg and had to get stitches, by

hitting that thumbs up button.

The word index fund

gets thrown around a lot by these large investment

institutions nowadays because of how successful

they've been over the years. At this point, a lot of people understand the power of investing in index funds. But not all index funds

are created equally, and it's not so obvious unless

you know what to look for. Technically, you could create your own custom stock market index. And if I wanted to create a

fund that tracks your index, then I could call it an index fund. The problem is that you are

most likely an unknown person with an unknown track record

and an unproven process. There's a couple levels of trust that need to exist

within this whole process between the financial index provider, the index fund and the investor. My fund needs to trust

your indexing process, and the potential investors within my fund needs to have some level of trust in how my fund attracts your index. There's a few different well-known and trusted

financial index providers that index fund creators like Fidelity, Vanguard and Charles Schwab pay a licensing fee to to create their fee based index funds.

The Fidelity zero fee index

funds are a lot different in that they don't want to

have to pay the licensing fee to these trusted index providers because they need to cut corners to reduce the cost to run their funds. Because if they're still

doing a bunch of work and you are not paying

them to do that work, they're gonna cut corners

wherever they can. But they still need to

track some sort of index to be able to call

themselves an index fund. To do that, Fidelity has created

their own internal index, which is what their zero fee funds track.

This might not seem like a big deal, but their indexing methods haven't been around for very long, which means that they are unproven. I'm also not sure how

I feel about Fidelity creating the index that

their zero fee funds track. Having an unassociated

third party index provider at least gives a little

bit of separation of power within the whole process. To show you why I'd prefer 75% of the fee based Fidelity index funds over the zero fee index funds, let's compare them against each other so I can show you the biggest differences. For the total market index we have the zero fee index fund FZROX and the comparable fee

based index fund FSKAX. The stock style for both are pretty close so there's really no issue there. Next, we can look at the

total holdings for each one. The zero fee fund holds 2,655 stocks, while the fee based fund holds 3,998. For me, I want my index funds, especially my total market index funds, to hold as many stocks as possible.

The zero fee fund fails to do this. Lastly, the portfolio turnover

for each is different. This is important to know because the higher portfolio turnover means more stocks are

being bought and sold which is going to cost you money. The zero fee fund is at 4%, while the fee based fund is at 3%. Not a huge difference, but for me, I prefer to keep

this as low as possible. I also like the option

of investing in the fund that charges 0.015% to track

a larger number of stocks, instead of only sampling 2,600 stocks like the zero fee fund does. For the large cap index, we have these zero fee index fund FNILX, and the comparable fee

based index fund FXAIX. The stock style for both of these are pretty darn close as well so there's nothing too concerning here. Since both of these are large cap only we see that the total

holdings are about the same, which it should be. For the portfolio turnover, we see that the Fidelity

S&P 500 index fund is at 2%, while the zero fee

large cap fund is at 5%.

I personally choose to

pay the extra 0.015% to hold the true S&P 500 index fund. We see the biggest divergence with the extended market index funds. For this comparison we have these zero fee index fund FZIPX and the fee based index fund FSMAX. As you can see, the stock

styles are way different. The stock style for FSMAX is more in the mid and small cap range with a tilt towards growth. FZIPX is more in these small cap stocks with a tilt towards value. The sector breakdown

for the fee based fund has more money going into technology, while the zero fee fund has more money going into

everything else except tech. Once again, the fee based

fund holds more stocks, which I like, at 3,703 of them, while the zero fee fund

only holds 2,143 stocks. The turnover ratios make me

sick just looking at them. 18% for the fee based fund

and 25% for the zero fund. I am not a huge fan of

any extended market funds, so I prefer to stay

away from both of these. The last zero fee fund that we have is the international index fund FZILX. We'd wanna compare it to the fee based international

index fund FSPSX.

Stock style for both

are basically identical. The sector exposure between them both are all over the place. So, I'll throw up a screenshot so you can pause the video

to see it for yourself. The holdings are a lot

different than you'd think. The zero fee fund holds 2,377 stocks, while the fee based fund

only holds 832 of them. One of the big reasons the

zero fee fund holds more stocks is because it encompasses both developed and emerging markets, while the fee based fund

excludes emerging market stocks and only focuses on developed market. Believe it or not, I kind of like the zero fee

international index fund a little bit more because I prefer developed

and emerging market stocks to get more diverse exposure. The only things I don't like about it is the 8% turnover ratio, as well as the fact that you're kind of stuck

in the Fidelity ecosystem if you hold these zero fee fund. Make sure to hit that thumbs up button to support the channel before you go. If you wanna see my preferred

Fidelity index funds or Vanguard ETFs that you can purchase on the Fidelity platform, then watch these videos to your left next.

I'll see you in the

next one, friends. Done..

This Is How To Become A Millionaire: Index Fund Investing for Beginners

Jason 0 Comments Retire Wealthy Retirement Planning

hi guys it's mark so did you know if you save two hundred dollars per month at an eight percent annual return then in 45 years you would have over wait for it one million dollars to be honest when someone first explained this was possible by investing in index funds i hardly understood a word they were saying it was like they would speak in a different language today i thought it was about time that i made the video that i wish i'd seen when i was younger and explain everything step by step and because i like people that actually practice what they preach i'm gonna be investing ten thousand dollars of my own money during this video so you can see exactly how it's done just a quick disclaimer though i'm not a financial advisor i'm a businessman and this is just some of the real life strategies that have worked for me personally i always thought of index funds as my backup plan if my businesses hadn't been successful then i would have become a millionaire anyway through these investments just remember if you like the video then smash the like button as it really helps push this video out to more people and also consider subscribing if you want to grow your wealth part one uncovering the lies so let's cut to the chase you've been put a major disadvantage people have been telling you lies about investing all of your life for instance at school when i was growing up i remember asking my teachers about investing and they always said it's just for rich people as they can afford to hire professionals to do it for them for the longest time i believed investing wasn't for me because i wasn't a pro and i didn't have much money and i thought i wouldn't stand a chance then we got friends one of mine said i'd have to look at all the financial newspapers learn how to read the charts and according to him it just wasn't worth my time and on top of this every time i mentioned investing to my family they seemed so scared because they thought it's the most risky thing in the world and not for normal people my dad even said if i started investing i'd lose all my money can you believe that these lies are exactly what the experts want you to believe as they know that index fund investing is extremely easy to do you don't need much money to start the risks are pretty low and on average it will make you more money in the long term the dark truth is that the average actively managed fund returns two percent less a year than the market in general this means that professionals on average are doing worse than index funds and even if they end up losing you money they still charge you fees no matter what now according to my favorite film the matrix you have now taken the red pill and you've woken up to the truth it's now time to move on to part two understanding the game i know when i first started investing i felt like i was going to make so many mistakes but once you understand their language it all becomes so much easier and that's what we're going to be talking about in this part so i've been banging on about index funds in many of my videos so i think it's about time i explained what they are and why they're so cool i'm a big football fan and if you have ever followed any sports you'll be familiar with a league table like this the better your team performs the higher up they'll be on the list but on the other hand if they do really badly they might be removed from the league entirely this is almost exactly the same as an index all you have to do is switch out the teams for companies let's take the s p 500 for example this is a list of the 500 best performing public companies in the usa the big dogs being amazon google apple and more recently tesla and just like a league table if a company doesn't perform well they're at risk of being removed from the list hasta la vista baby the idea of an index fund is to be a little bit sneaky as it allows you to invest in every single company on the list with just one click it's a bit like a friend of mine who picks a different football team each year he just wants to pick the winner every time so investing in index funds means that even if a few companies do terribly then it's balanced out by the companies that are doing extremely well the average return on the s p 500 over the last 10 years has been 13.6 now that is higher than usual but get this no one has ever lost any money if they've bought and held an s p 500 index fund for more than 20 years so if this is so foolproof then why do people still buy individual stocks well personally i like to do this just for a bit of fun i also think that some companies are currently working on awesome technology for the future but aren't making a lot of money at the moment so they won't make the cut into the popular index funds so now and again i like to invest some extra money into these up and coming companies so i don't miss out and that reminds me we bought currently giving away four free individual stocks if you want to pick them up i'll leave the link in the description and for everyone that's outside of the usa or china i'll leave a link where you can claim a free stock with trade in 212.

Hey that's pretty good you'll often hear people throwing around the terms roth ira in the usa stocks and shares isa in the uk tfsa in canada and supers in australia but what does it all mean well these are types of accounts that allow you to earn profits on your investments and you don't have to pay any taxes on them but they generally have limits because they're just so powerful these are kind of like captain america shield so let me explain if captain america just sat at home with his shield then he wouldn't ever get anything done but when he takes that shield into battle he has an advantage so these accounts are like your shield make sure to use them when you're investing a way you can do this is by using the money inside your shielded account to invest into index funds and all the profits will be yours because the government won't take a cut one of my biggest questions when i first started was should i invest all my money at the same time or do it gradually now this is something lots of investors argue about so i'm going to give you my view on things remember later i'm going to be investing this 10 000 in full so that kind of gives you an idea of what i believe investing all your money as a lump sum is certainly more risky however if i'm investing in something i know will increase over time like an s p 500 index fund then there is no point waiting the longer you wait the worse off on average you'll be however if you don't have the cash i wouldn't wait to save up the money i would just invest what i could every month as sometimes you're going to buy when the stocks high other times you're going to buy when the stock's low but overall this is going to balance out and this is known as dollar cost averaging when you log on to an investing website or app you'll see that there is something called etfs which are very similar to index funds and a lot of people get them confused both allow you to invest into a basket of stocks however the easy way to remember the difference is just to think of what etf stands for exchange traded fund if we break that down simply it just means that it can be traded on the stock market throughout the day whereas an index fund can only be bought and sold for a price that is set at the end of each trading day but let's cut to the chase you probably want to know which one's better on average if you're starting with little money then etfs may be a better option as they have lower minimum investment thresholds and many brokers don't charge a trading commission now if you're still watching this and you're younger than 18 then i am really impressed that you've been listening to a boomer like me for so long but seriously not many people learn this at such a young age as they don't teach it at school a way you can start investing under 18 is to open up a custodial account in the usa or a junior stocks and shares iso in the uk set up these accounts you just need to ask your parents the real secret ingredient to this millionaire formula is time and when you're younger you have so much of it that's because every year as you keep adding to your investments the interest starts to compound and grow at a rapid pace it's a snowball effect once you reach a certain tipping point the interest you're making is much more than the amount you're investing on a monthly basis it's a bit like when you see someone take ages to get to a hundred thousand subscribers on youtube and then within a few months they managed to hit the big million the sooner you get started the better as time will be on your side now i want to clear something up when people talk about index funds you will hear s p 500 again and again people just love it as i mentioned before this is a top 500 public companies in the usa but the cool thing is you don't actually have to be in the usa to invest in this i'm in the uk and it's one of my favorite investments i just love to think that i own a small part of all the biggest companies in the usa part three mastering the strategy so lots of people will teach you what to do but they won't actually say how to do it so i'm going to walk you through everything right now while i invest my own ten thousand dollars the first thing to really do is to work out your goals let's say you want to become a millionaire that was one of my goals i just had to work out how much i would actually need to invest per month to achieve this i love using these compound interest calculators you can find them online easily yourself if you want to have a go at this so if you're able to invest 250 dollars per month with an 8 annual return over 42 years you'll have over a million dollars in your account now if you're able to invest that for another 10 years you'll have over 2 million in your account of course if you wanted to invest even more then you're just going to speed up the whole process the next thing we need to do is pick the brokerage website we're using to set up our account and invest the ones that i love are charles swab fidelity and vanguard i call these the big three the founder of vanguard john bogle is often referred to as the father of index fund investing and if you think i'm a boomer he was even older than me his vanguard group gave birth to index funds so they're the oldest and most trusted let's jump onto their website to see what they have to offer so to get onto their full list of funds just go up to invest in and click on vanguard mutual funds at this point i'm going to have to ask you to strap in and brace yourself because if you haven't seen this page before it can look extremely overwhelming but in a minute you'll be able to impress all your friends when you know exactly how to read it see what i mean there are just so many options the main things to focus on are the expense ratio which is how much they're going to charge you per year you obviously want to keep these as low as possible and luckily with vanguard fees these are very low anyway the other thing to look at is the average returns and they break these down nicely on the right hand side of the screen but of course it's always good to remember that past performance doesn't always mean future returns my wife's a bit like vanguard she likes everything in order and nothing out of place so they have arranged all of their funds into different categories so everything is easy to find category one is bonds these are a type of contract that companies and governments sell when they need extra money if you invest in these they promise to pay you back in the future these are often seen as pretty low risk but also pretty low returns therefore the older you are the more bonds you should have in your portfolio number two is balance funds the idea of these is to pick the age at which you wish to retire and they'll do all the rest of the work for you and find the right mix of index funds as you can see these go up in five year intervals and you can pick whichever suits your plans best this could be a good option if you wanted to invest without thinking about it too much but personally i always prefer manually investing it's a bit like driving an automatic car that does all the work for you it just isn't as much fun as a stick shift number three is company location and size known as small medium and large cap here you can find v fix which tracks our old friend the s p 500 this little s means it's one of vanguard selected funds which they recommend if you click on it you're able to see exactly what companies you would be investing in and also the risk level vt sacs is another good one which is a total stock market index fund which has over 3586 different stocks this allows you to invest in the entire usa stock market in one click there is a minimum investment of three thousand dollars again but as before there's also an etf version with no minimum called vti then you have international stocks quite a cool one is emerging markets which invest in companies based in china taiwan india and many more but as you can see this is a five on the risk scale so i wouldn't personally invest a lot of money into this fund because look at me i'm a bit old to be taking too many risk and i need to sleep at night number four the last category is sector based so if you have a particular interest in energy healthcare or real estate you can invest into these sectors and there are also a lot more options for sector investing in the etf so now we've broken down what's on offer hopefully it all looks a bit more understandable now for the moment you've all been waiting for it's time to invest my ten thousand dollars i could split this between lots of different funds but personally i like to invest the majority of my money into american companies i would say probably about seventy percent american 20 in other countries including the uk and ten percent in some bonds i like to keep the bonds quite low as i don't mind this little extra bit of risk because i'm only 53 and i have a bit of time before i've got to rebalance my portfolio to secure my investments but that's a personal choice depending on your risk tolerance the funds that are available are different in every country but the indexes they track are very similar so you may need to invest in a different fund to me but obviously you can still use my percentages as a guide so i'm going to use the uk vanguard site to invest 5k straight into this etf that tracks the s p 500 so here we go all done two thousand dollars is going into an index fund that tracks the total american stock market so again we go on the screen click so far that's 70 invested in the biggest economy in the world which of course is the usa now i like to balance this out by investing in a different economy as i live back in my own country i'm going to be putting 2k into the ftse 100 index fund so looking good all done great now i've invested 90 of my 10k and i'd like a bit of security let's just put the remaining 1k into a global bonds index fund and let's just do that so just like that i've invested in the usa companies like apple amazon tesla and google i own a small piece of the biggest companies in the uk like hsbc bp and unilever and i have some bonds to balance out my portfolio it really is as easy as that so i'm going to leave the next video up here but don't click on it just yet remember to subscribe to the channel if you want to grow your wealth ring that notification bell and smash that like button okay i'll see you on the other side

Read More

This Is How To Become A Millionaire: Index Fund Investing for Beginners

Jason 0 Comments Retire Wealthy Retirement Planning

hi guys it's mark so did you know if you save two hundred dollars per month at an eight percent annual return then in 45 years you would have over wait for it one million dollars to be honest when someone first explained this was possible by investing in index funds i hardly understood a word they were saying it was like they would speak in a different language today i thought it was about time that i made the video that i wish i'd seen when i was younger and explain everything step by step and because i like people that actually practice what they preach i'm gonna be investing ten thousand dollars of my own money during this video so you can see exactly how it's done just a quick disclaimer though i'm not a financial advisor i'm a businessman and this is just some of the real life strategies that have worked for me personally i always thought of index funds as my backup plan if my businesses hadn't been successful then i would have become a millionaire anyway through these investments just remember if you like the video then smash the like button as it really helps push this video out to more people and also consider subscribing if you want to grow your wealth part one uncovering the lies so let's cut to the chase you've been put a major disadvantage people have been telling you lies about investing all of your life for instance at school when i was growing up i remember asking my teachers about investing and they always said it's just for rich people as they can afford to hire professionals to do it for them for the longest time i believed investing wasn't for me because i wasn't a pro and i didn't have much money and i thought i wouldn't stand a chance then we got friends one of mine said i'd have to look at all the financial newspapers learn how to read the charts and according to him it just wasn't worth my time and on top of this every time i mentioned investing to my family they seemed so scared because they thought it's the most risky thing in the world and not for normal people my dad even said if i started investing i'd lose all my money can you believe that these lies are exactly what the experts want you to believe as they know that index fund investing is extremely easy to do you don't need much money to start the risks are pretty low and on average it will make you more money in the long term the dark truth is that the average actively managed fund returns two percent less a year than the market in general this means that professionals on average are doing worse than index funds and even if they end up losing you money they still charge you fees no matter what now according to my favorite film the matrix you have now taken the red pill and you've woken up to the truth it's now time to move on to part two understanding the game i know when i first started investing i felt like i was going to make so many mistakes but once you understand their language it all becomes so much easier and that's what we're going to be talking about in this part so i've been banging on about index funds in many of my videos so i think it's about time i explained what they are and why they're so cool i'm a big football fan and if you have ever followed any sports you'll be familiar with a league table like this the better your team performs the higher up they'll be on the list but on the other hand if they do really badly they might be removed from the league entirely this is almost exactly the same as an index all you have to do is switch out the teams for companies let's take the s p 500 for example this is a list of the 500 best performing public companies in the usa the big dogs being amazon google apple and more recently tesla and just like a league table if a company doesn't perform well they're at risk of being removed from the list hasta la vista baby the idea of an index fund is to be a little bit sneaky as it allows you to invest in every single company on the list with just one click it's a bit like a friend of mine who picks a different football team each year he just wants to pick the winner every time so investing in index funds means that even if a few companies do terribly then it's balanced out by the companies that are doing extremely well the average return on the s p 500 over the last 10 years has been 13.6 now that is higher than usual but get this no one has ever lost any money if they've bought and held an s p 500 index fund for more than 20 years so if this is so foolproof then why do people still buy individual stocks well personally i like to do this just for a bit of fun i also think that some companies are currently working on awesome technology for the future but aren't making a lot of money at the moment so they won't make the cut into the popular index funds so now and again i like to invest some extra money into these up and coming companies so i don't miss out and that reminds me we bought currently giving away four free individual stocks if you want to pick them up i'll leave the link in the description and for everyone that's outside of the usa or china i'll leave a link where you can claim a free stock with trade in 212.

Hey that's pretty good you'll often hear people throwing around the terms roth ira in the usa stocks and shares isa in the uk tfsa in canada and supers in australia but what does it all mean well these are types of accounts that allow you to earn profits on your investments and you don't have to pay any taxes on them but they generally have limits because they're just so powerful these are kind of like captain america shield so let me explain if captain america just sat at home with his shield then he wouldn't ever get anything done but when he takes that shield into battle he has an advantage so these accounts are like your shield make sure to use them when you're investing a way you can do this is by using the money inside your shielded account to invest into index funds and all the profits will be yours because the government won't take a cut one of my biggest questions when i first started was should i invest all my money at the same time or do it gradually now this is something lots of investors argue about so i'm going to give you my view on things remember later i'm going to be investing this 10 000 in full so that kind of gives you an idea of what i believe investing all your money as a lump sum is certainly more risky however if i'm investing in something i know will increase over time like an s p 500 index fund then there is no point waiting the longer you wait the worse off on average you'll be however if you don't have the cash i wouldn't wait to save up the money i would just invest what i could every month as sometimes you're going to buy when the stocks high other times you're going to buy when the stock's low but overall this is going to balance out and this is known as dollar cost averaging when you log on to an investing website or app you'll see that there is something called etfs which are very similar to index funds and a lot of people get them confused both allow you to invest into a basket of stocks however the easy way to remember the difference is just to think of what etf stands for exchange traded fund if we break that down simply it just means that it can be traded on the stock market throughout the day whereas an index fund can only be bought and sold for a price that is set at the end of each trading day but let's cut to the chase you probably want to know which one's better on average if you're starting with little money then etfs may be a better option as they have lower minimum investment thresholds and many brokers don't charge a trading commission now if you're still watching this and you're younger than 18 then i am really impressed that you've been listening to a boomer like me for so long but seriously not many people learn this at such a young age as they don't teach it at school a way you can start investing under 18 is to open up a custodial account in the usa or a junior stocks and shares iso in the uk set up these accounts you just need to ask your parents the real secret ingredient to this millionaire formula is time and when you're younger you have so much of it that's because every year as you keep adding to your investments the interest starts to compound and grow at a rapid pace it's a snowball effect once you reach a certain tipping point the interest you're making is much more than the amount you're investing on a monthly basis it's a bit like when you see someone take ages to get to a hundred thousand subscribers on youtube and then within a few months they managed to hit the big million the sooner you get started the better as time will be on your side now i want to clear something up when people talk about index funds you will hear s p 500 again and again people just love it as i mentioned before this is a top 500 public companies in the usa but the cool thing is you don't actually have to be in the usa to invest in this i'm in the uk and it's one of my favorite investments i just love to think that i own a small part of all the biggest companies in the usa part three mastering the strategy so lots of people will teach you what to do but they won't actually say how to do it so i'm going to walk you through everything right now while i invest my own ten thousand dollars the first thing to really do is to work out your goals let's say you want to become a millionaire that was one of my goals i just had to work out how much i would actually need to invest per month to achieve this i love using these compound interest calculators you can find them online easily yourself if you want to have a go at this so if you're able to invest 250 dollars per month with an 8 annual return over 42 years you'll have over a million dollars in your account now if you're able to invest that for another 10 years you'll have over 2 million in your account of course if you wanted to invest even more then you're just going to speed up the whole process the next thing we need to do is pick the brokerage website we're using to set up our account and invest the ones that i love are charles swab fidelity and vanguard i call these the big three the founder of vanguard john bogle is often referred to as the father of index fund investing and if you think i'm a boomer he was even older than me his vanguard group gave birth to index funds so they're the oldest and most trusted let's jump onto their website to see what they have to offer so to get onto their full list of funds just go up to invest in and click on vanguard mutual funds at this point i'm going to have to ask you to strap in and brace yourself because if you haven't seen this page before it can look extremely overwhelming but in a minute you'll be able to impress all your friends when you know exactly how to read it see what i mean there are just so many options the main things to focus on are the expense ratio which is how much they're going to charge you per year you obviously want to keep these as low as possible and luckily with vanguard fees these are very low anyway the other thing to look at is the average returns and they break these down nicely on the right hand side of the screen but of course it's always good to remember that past performance doesn't always mean future returns my wife's a bit like vanguard she likes everything in order and nothing out of place so they have arranged all of their funds into different categories so everything is easy to find category one is bonds these are a type of contract that companies and governments sell when they need extra money if you invest in these they promise to pay you back in the future these are often seen as pretty low risk but also pretty low returns therefore the older you are the more bonds you should have in your portfolio number two is balance funds the idea of these is to pick the age at which you wish to retire and they'll do all the rest of the work for you and find the right mix of index funds as you can see these go up in five year intervals and you can pick whichever suits your plans best this could be a good option if you wanted to invest without thinking about it too much but personally i always prefer manually investing it's a bit like driving an automatic car that does all the work for you it just isn't as much fun as a stick shift number three is company location and size known as small medium and large cap here you can find v fix which tracks our old friend the s p 500 this little s means it's one of vanguard selected funds which they recommend if you click on it you're able to see exactly what companies you would be investing in and also the risk level vt sacs is another good one which is a total stock market index fund which has over 3586 different stocks this allows you to invest in the entire usa stock market in one click there is a minimum investment of three thousand dollars again but as before there's also an etf version with no minimum called vti then you have international stocks quite a cool one is emerging markets which invest in companies based in china taiwan india and many more but as you can see this is a five on the risk scale so i wouldn't personally invest a lot of money into this fund because look at me i'm a bit old to be taking too many risk and i need to sleep at night number four the last category is sector based so if you have a particular interest in energy healthcare or real estate you can invest into these sectors and there are also a lot more options for sector investing in the etf so now we've broken down what's on offer hopefully it all looks a bit more understandable now for the moment you've all been waiting for it's time to invest my ten thousand dollars i could split this between lots of different funds but personally i like to invest the majority of my money into american companies i would say probably about seventy percent american 20 in other countries including the uk and ten percent in some bonds i like to keep the bonds quite low as i don't mind this little extra bit of risk because i'm only 53 and i have a bit of time before i've got to rebalance my portfolio to secure my investments but that's a personal choice depending on your risk tolerance the funds that are available are different in every country but the indexes they track are very similar so you may need to invest in a different fund to me but obviously you can still use my percentages as a guide so i'm going to use the uk vanguard site to invest 5k straight into this etf that tracks the s p 500 so here we go all done two thousand dollars is going into an index fund that tracks the total american stock market so again we go on the screen click so far that's 70 invested in the biggest economy in the world which of course is the usa now i like to balance this out by investing in a different economy as i live back in my own country i'm going to be putting 2k into the ftse 100 index fund so looking good all done great now i've invested 90 of my 10k and i'd like a bit of security let's just put the remaining 1k into a global bonds index fund and let's just do that so just like that i've invested in the usa companies like apple amazon tesla and google i own a small piece of the biggest companies in the uk like hsbc bp and unilever and i have some bonds to balance out my portfolio it really is as easy as that so i'm going to leave the next video up here but don't click on it just yet remember to subscribe to the channel if you want to grow your wealth ring that notification bell and smash that like button okay i'll see you on the other side

Read More

5 Best Fidelity Index Funds To Buy and Hold Forever

Jason 0 Comments Retire Wealthy Retirement Planning

– In this video, I'm gonna go through the five best Fidelity funds to buy and hold forever. Now you're going to notice that all of the Fidelity zero index funds are missing from this top five, because they aren't really what they appear to be on the surface. Later in the video, I'll send you to another video I made uncovering their dirty little secret. First up is the Fidelity

500 Index Fund, FXIAX. There's only a few funds that I would consider foundational fund that most people should hold.

And if you prefer Fidelity funds, then this would be one of them. FXAIX tracks the S&P 500, which is made up of the

500 largest U.S. stocks, based on market cap. All a market cap is is the total number of outstanding shares multiplied by the price of the stock. These 500 stocks represent about 80% of the U.S. market cap. So these companies are what really moves the price of the overall stock market. To put it into perspective, there's about 4,300

publicly traded U.S. stocks. That means once we remove the largest 500, the remaining 3,800 only account for 20% of the total U.S. market cap. Everyone loves to talk

about the upside potential, and we'll cover that in just a minute. But I personally like to call out the downsides as well, because what you do during those times will have the biggest impact on your future returns.

Because the Fidelity 500 Fund has only been around since 2011, we'll be looking at the S&P 500 drawdowns to get a larger sample size. The largest drawdown started in 2007, due to the financial crisis. This fund would've seen a 51% drawdown, which means that if you

had $1 million invested, then at one point, it would've

been down to $490,000. This portion of your portfolio would've taken about three

and a half years to recover. The next largest drawdown was in 2000, where it had a drawdown of 45%, and took a little over

four years to recover. The third largest drawdown was in 2020, due to the health crisis, where that drawdown was 20%, and took four months to recover. A four-month recovery period is comical, so do not expect that